Select Language

By Rae Wee and Sameer Manekar

SINGAPORE (Reuters) - Asian stocks edged marginally lower on Wednesday after Federal Reserve Chair Jerome Powell offered little hints on the timing of U.S. rate cuts expected later this year, even as he signalled greater confidence that inflation was coming to heel.

MSCI's broadest index of Asia-Pacific shares outside Japan eased 0.27% in early Asia trade, losing some steam after surging to an over two-year high at the start of the week.

In New Zealand, the kiwi rose 0.05% to $0.6128 ahead of a rate decision by the country's central bank later in the day, where focus will be on any guidance for its rate outlook.

Expectations are for the Reserve Bank of New Zealand (RBNZ) to maintain its hawkish bias at the conclusion of its monetary policy meeting, with bets for the central bank to cut rates just once before year-end.

"I think the RBNZ should be easing sooner - a lot sooner than what they expect," said Jarrod Kerr, chief economist at Kiwibank.

"I think we've seen enough in the local data to expect inflation to fall back to 2%... we think they should be cutting in August but they probably will start cutting in November."

Stocks have rallied globally on the back of growing expectations of a Fed easing cycle likely to commence in September, with Powell saying on Tuesday that the U.S. is "no longer an overheated economy".

However, Powell provided little clues on how soon those rate cuts could come.

"He suggested that the Fed's reaction function is shifting to an easing bias given the significantly cooling labour market, but he nonetheless declined to offer a clear timeline on rate cuts," said Alvin Tan, head of Asia FX strategy at RBC Capital Markets.

"In any event, the market has been pricing in almost two full Fed rate cuts this year, and Powell's statements didn't shift those expectations much."

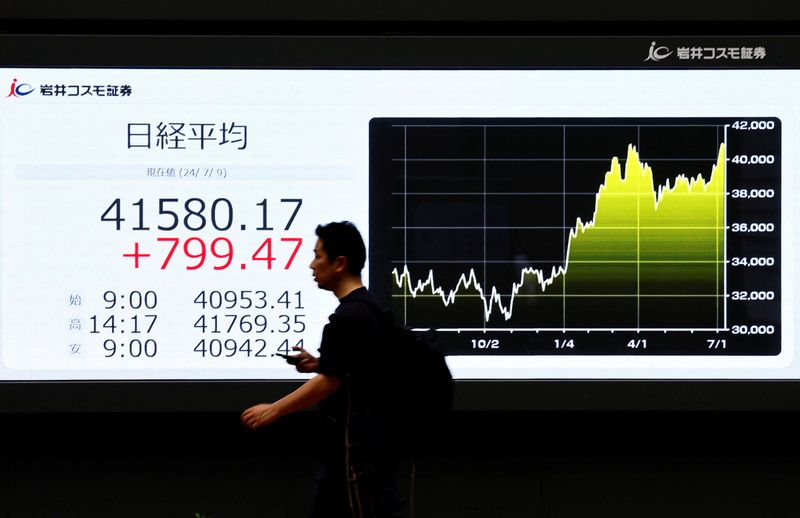

Japan's Nikkei rose 0.08%, helped by a weaker yen which last stood at 161.47 per dollar.

Data on Wednesday showed Japan's wholesale inflation accelerated in June as the yen's declines pushed up the cost of raw material imports, keeping alive market expectations for a near-term interest rate hike by the central bank.

The Bank of Japan said on Tuesday that some market players called on the central bank to slow its bond buying to roughly half the current pace under a scheduled tapering plan due this month.

In other currencies, the dollar held broadly steady, with sterling little changed at $1.2787 while the euro dipped 0.01% to $1.0813.

Oil prices rebounded following three days of declines after an industry report showed U.S. crude and fuel stockpiles fell last week, indicating steady demand, and as the outlook for interest rate cuts improved. [O/R]

Brent futures rose 0.24% to $84.86 a barrel, while U.S. West Texas Intermediate (WTI) crude ticked 0.29% higher to $81.65 per barrel.

Gold gained 0.07% to $2,365.09 an ounce. [GOL/]