Select Language

By Rae Wee

SINGAPORE (Reuters) -Asian shares are set to end the week on a sour note, as uncertainty across major economies added to headwinds for investors even as the global rate easing cycle gets under way.

It has been a turbulent week in markets, with a tech sell-off sparked by deepening Sino-U.S. trade tensions, uncertainty over U.S. President Joe Biden's fate in the presidential race, disappointing Chinese economic data and a lacklustre third plenum outcome casting a shadow over the global mood.

In the foreign exchange market, Tokyo's recent bouts of intervention also kept traders on edge.

"We could just be getting a taste of things to come. And that is more turbulence," said Matt Simpson, senior market analyst at City Index.

MSCI's broadest index of Asia-Pacific shares outside Japan slid 1.56% and was headed for its worst week in three months with a nearly 3% loss.

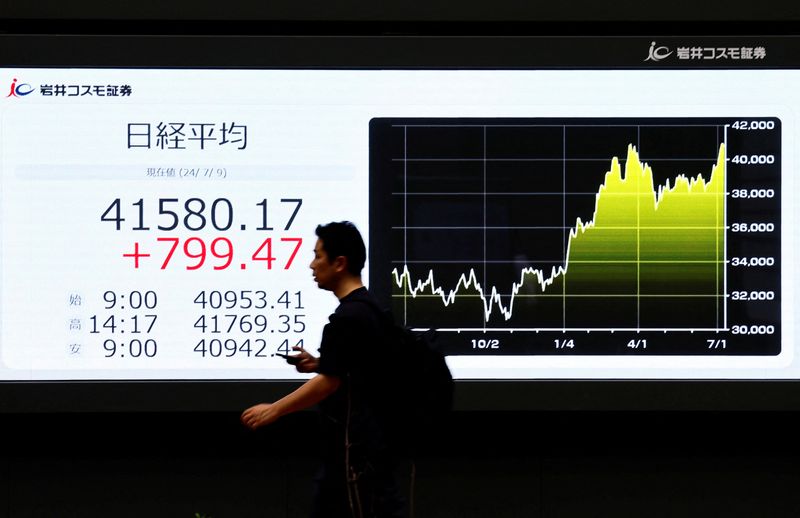

Japan's Nikkei fell to a more than two-week low and was last down 0.09%, extending its sharp 2.4% fall from the previous session.

The Nikkei was on track to lose 2.7% for the week, also its steepest weekly decline in three months.

European shares looked set for a mixed start, with EUROSTOXX 50 futures up 0.08%, while FTSE futures fell 0.4%.

S&P 500 futures tacked on 0.16%, while Nasdaq futures gained 0.3%.

Technology stocks continued to struggle, with South Korea's tech-heavy KOSPI index and Taiwan stocks both falling 1.5% and 2%, respectively.

South Korean chipmaker SK Hynix slid more than 1%, though Japan's Tokyo Electron, a chipmaking equipment manufacturer, rebounded some 2.5%, after an 8.75% tumble on Thursday.

Shares of Taiwan's TSMC, the world's largest contract chipmaker, fell 2.7%, even after the company posted better-than-expected earnings on Thursday and raised its full-year revenue forecast.

In China, investors were left disappointed over the lack of details provided on the implementation steps for achieving economic policy goals at the conclusion of its closely watched plenum on Thursday.

Chinese officials on Friday acknowledged that the sweeping list of economic goals contained "many complex contradictions", pointing to a bumpy road ahead for policy implementation.

Chinese blue-chips were last a touch higher, though the CSI300 Real Estate index slid more than 2%, as an anaemic property sector continued to weigh on China's growth outlook.

The Shanghai Composite Index edged 0.08% lower, while Hong Kong's Hang Seng index fell 2.1%.

"Apart from very broad-brush platitudes devoid of stimulus, economic policy references of quality over quantity may also imply willingness to stomach slower overall growth," said Vishnu Varathan, chief economist for Asia ex-Japan at Mizuho Bank.

The onshore yuan was weaker on the day at 7.2666 per dollar.

RATES VIEW

The euro was last 0.08% lower at $1.0887, having fallen 0.4% in the previous session after the European Central Bank (ECB) kept rates on hold as expected but left the door open to a September cut as it downgraded its view of the euro zone's economic prospects.

"The policy statement gives little away, offering no meaningful changes from June - continuing to stress a data-dependent approach to policy setting," said Nick Rees, FX market analyst at MonFX.