Select Language

Most Asian stocks rose marginally on Thursday as investors second-guessed recent optimism over a deescalation in the U.S.-China trade war, although Japanese markets outperformed on reports of more U.S. trade dialogue.

South Korean markets were an exception, with the KOSPI lagging its peers after gross domestic product data showed an unexpected contraction for the first quarter. This largely offset positive earnings from memory chip major and Nvidia (NASDAQ:NVDA) supplier SK Hynix.

Broader Asian markets tracked overnight gains on Wall Street, as investors were encouraged by U.S. President Donald Trump flagging an eventual, albeit unspecified reduction in trade tariffs on China. Trump’s cooling rhetoric against the Federal Reserve also aided sentiment.

U.S. stock index futures trickled higher in Asian trade. But optimism over Trump’s comments was seen cooling, given that Trump signaled any deal with China will require Beijing to approach Washington- a scenario that Chinese officials have shown little indication will play out.

Comments from other U.S. officials also raised some doubts over a U.S.-China deescalation.

Japan shares lead gains on trade talk reports

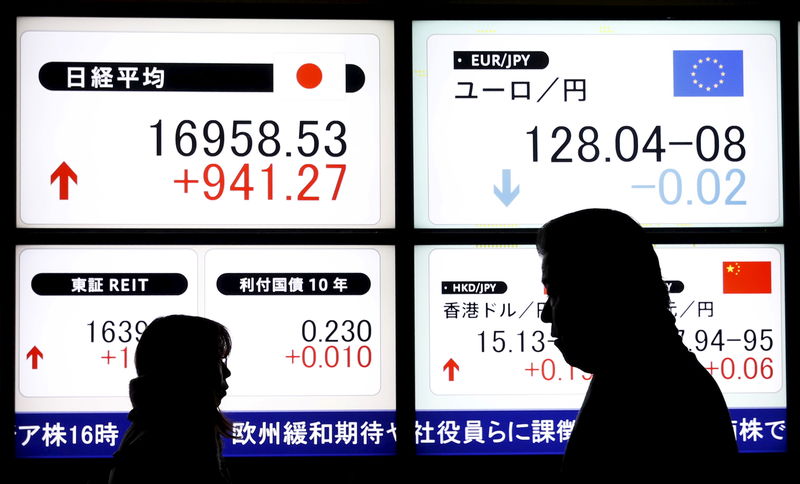

Japanese markets were the best performers on Thursday, with the Nikkei 225 adding nearly 1%, while the TOPIX rose 0.8%.

A slew of media reports said Japan’s Economic Revitalization Minister Ryosei Akazawa will visit the U.S. later this month for a second round of trade negotiations.

A separate report on Wednesday showed U.S. officials stating that they will not offer Japan special treatment from Trump’s trade tariffs. But Japanese ministers were seen maintaining their calls for smaller tariffs and more transparent trade agreements.