Select Language

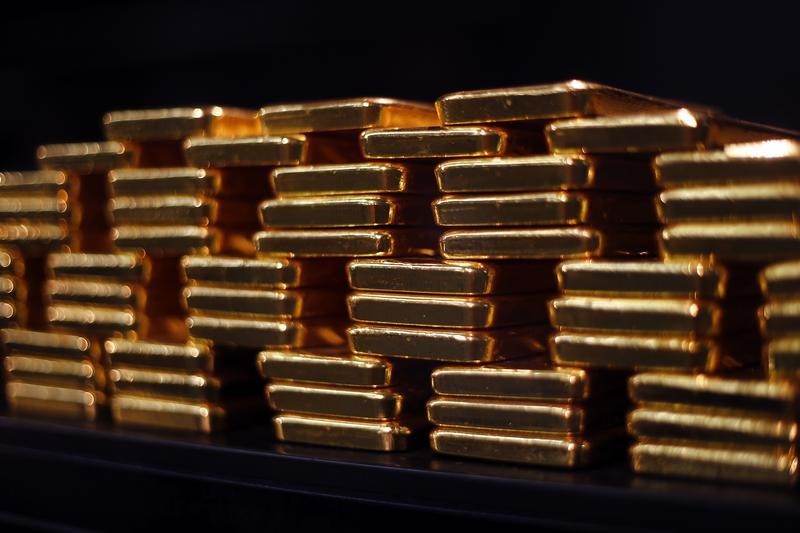

Gold prices held largely steady in Asian trade on Thursday after sliding from record highs, as a stronger dollar and cautious Federal Reserve signals weighed on the metal’s appeal.

Spot gold was last up 0.2% at $3,713.42 an ounce by 03:01 ET (07:01 GMT), after retreating from Tuesday’s all-time peak of $3,790.82/oz. U.S. Gold Futures for December edged up 0.1% to $3,773.02.

The yellow metal settled 0.7% lower on Wednesday as the dollar rebounded overnight, making gold more expensive for buyers using other currencies.

Gold slips from near record levels ahead of key US data

Fed Chair Jerome Powell said on Tuesday there was “no risk-free path” for policy, warning of the risks of cutting too quickly or too slowly.

San Francisco Fed President Mary Daly and other officials echoed the cautious tone, underscoring that easing would hinge on incoming data.

Investors are awaiting a string of U.S. economic reports this week, expected to provide clearer signals on whether the central bank will move ahead with further rate cuts this year.

Lower interest rates reduce the opportunity cost of holding non-yielding assets such as bullion, making gold more attractive to investors.

Weekly jobless claims due later on Thursday are expected to come in around 230,000. The government’s second estimate of second-quarter GDP will also be released on Thursday.

The August core Personal Consumption Expenditures (PCE) price index, due Friday, is expected to rise about 2.7% from a year earlier, remaining above the Fed’s 2% target.

Bullion has been constantly reaching fresh peaks, driven by expectations of monetary easing, geopolitical uncertainty and strong central bank purchases.

Other metal markets subdued

Other precious and industrial metals also traded in narrow ranges on Thursday amid broader caution.

Silver Futures edged 0.2% higher to $44.29 per ounce, while Platinum Futures were largely steady at $1,484.35/oz.

Benchmark Copper Futures on the London Metal Exchange slipped 0.5% to $10,313.65 a ton, while U.S. Copper Futures gained 0.4% to $4.85 a pound.