Select Language

By Stella Qiu and Wayne Cole

SYDNEY (Reuters) - Asian shares were hammered on Thursday as a slump in global tech stocks sent investors fleeing into less risky assets, including short-dated bonds, the yen and Swiss franc.

Chinese stocks were given little support after the country's central bank sprang a surprise cut in longer-term rates, adding to a recent rush of stimulus measures.

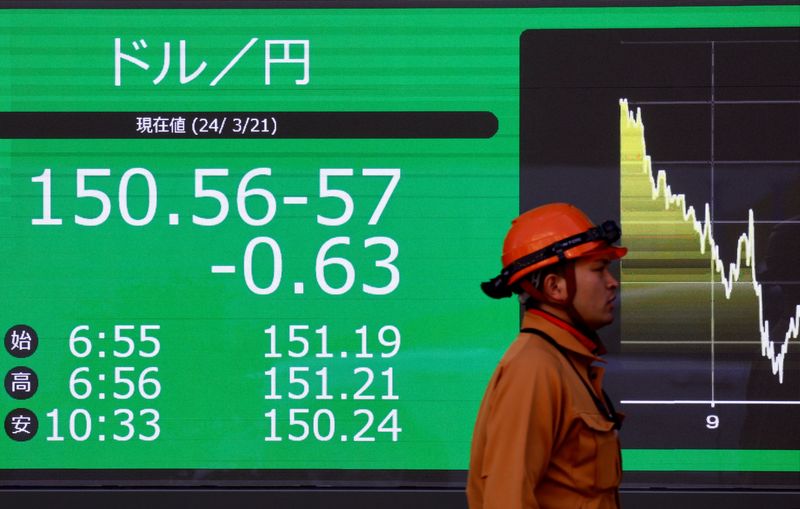

The sell-off in stocks saw investors ramp up bets on rate cuts globally, with futures implying a 100% chance of a Federal Reserve easing in September. A spike in market volatility fuelled a vicious squeeze on carry trades which saw the dollar sink another 0.6% to 152.85 yen on Thursday.

MSCI's broadest index of Asia-Pacific shares outside Japan lost 0.7%, while Japan's Nikkei tumbled 2.9% and South Korea's KOSPI dropped 2%. Taiwan's markets were closed for a second day due to a typhoon.

Chinese blue-chips pared earlier losses to be down 0.1%, although the Shanghai Composite index was still off 0.3%, hitting five-month lows.

Hong Kong's Hang Seng dropped 0.6%, finding little support from Beijing's latest easing step.

On Wall Street, the Nasdaq lost almost 4% - the worst one-day fall since 2022 - as lacklustre Alphabet (NASDAQ:GOOGL) and Tesla (NASDAQ:TSLA) earnings undermined investor confidence in the already lofty valuations of the "Magnificent Seven" stocks. [.N]

That added to recent market volatility, with Wall Street's fear gauge jumping to a three-month high. Investors looked for the safety of cash and super-liquid short term debt, with U.S. two-year yields hitting their lowest in almost six months on Wednesday.

In early Asian trade, Nasdaq futures rebounded 0.4% and S&P 500 stock futures rose 0.3%.

"Traders have played outright defence, as the saturated and well-owned tech position continues to be unwound," said Chris Weston, head of research at Pepperstone.

"We can also add an ongoing unease around China's growth trajectory, very poor PMIs in Europe and a bearish opinion piece from ex-New York Fed member Bill Dudley, and investors and traders derisked and de-grossed portfolios."

The other big mover in Asia was the safe-haven yen, up 0.6% to the strongest in 2-1/2 months. It surged 1.1% overnight, with the upward momentum intact ahead of the Bank of Japan's meeting next week where policymakers will debate whether or not to raise interest rates.

The Swiss franc also rose 0.7% overnight.

Short-dated bonds rallied overnight, supported by comments from Bill Dudley, a former president at the New York Fed that the central bank should cut rates, preferably at its policy meeting next week.

The yield on two-year Treasuries fell 4 basis points overnight and was last steady at 4.4121%.

Markets are fully pricing in a quarter-point rate cut from the Fed in September, with even some risk for a 50 basis point cut. For all of 2024, a total easing of 65 basis points has been priced in.

"The rate cut expectations are getting very elevated the same way as they were last year," said Andrew Lilley, chief rates strategist at Barreyjoey in Sydney.

"My worry is that the market is getting ahead of the economic data because we have seen previously that these short-term dips in inflation haven't been sustained."

Indeed, advance U.S. gross domestic product data is due later on Thursday and is forecast to show growth picking up to an annualised 2% in the second quarter. The closely watched Atlanta Fed GDPNow indicator points to growth of 2.6%, suggesting some risk to the upside.

In commodity markets, gold fell 0.9% to $2,375.92 an ounce. [GOL/]

Oil prices ticked lower and held near six-week lows on worries about a slowing Chinese economy crimping demand. [O/R]

Brent futures fell 0.4% to $81.81 a barrel, while U.S. West Texas Intermediate (WTI) crude also dropped 0.3% to $77.33.

By Emma Farge

GENEVA (Reuters) - Countries and environmental groups voiced concern and disappointment on Tuesday after a draft treaty to cut fishing subsidies failed to pass, with China calling for major changes in how countries negotiate at the World Trade Organization.

The talks, seen as critical to helping over-fished stocks recover, have been going on for more than 20 years at the WTO with an initial package approved in 2022.

The second phase tackling some of the toughest remaining issues had been drafted for approval at a WTO meeting this week but was blocked by India which criticised what it called the treaty's "significant shortcomings" while seeking deeper carve-outs for developing countries.

As a result, the talks were downgraded from being up for adoption to merely being "discussed" by the WTO's 166 members, any one of which can block a deal under the body's rules.

"We are deeply concerned for our future work here in the WTO on these negotiations," said U.S. Ambassador Maria Pagan. On India's proposals, she said: "We find it difficult to understand the objectives of these papers when they re-introduce topics that have been debated and discussed repeatedly...," she said.

China, a major subsidiser, voiced deep disappointment that it had not been adopted. "The fish and this planet cannot wait any longer," said Ambassador Li Chenggang, who did not name India but referred to multiple failures of these talks "due to the same or similar reasons".

"We need to think about how to get out of this dilemma ... Let's change. No reform, no success," he said.

Environmental groups also expressed regret.

"The longer we wait, the more fishers are hurt by damaging subsidies that deplete the fish populations that coastal communities depend on," said The Pew Charitable Trusts's Ernesto Fernández Monge.

By Marcela Ayres and David Lawder

RIO DE JANEIRO (Reuters) - G20 finance leaders meeting in Brazil are preparing a joint statement for Thursday in support of progressive taxation that will stop short of endorsing the hosts' proposal for a global "billionaire tax," two G20 officials told Reuters.

Brazil's presidency of the Group of 20 major economies this year has drummed up initial support from some countries for a joint effort to tax ultra-high-net-worth individuals, although debate has been preliminary.

France, Spain, Colombia, Belgium and the African Union have backed the idea, along with South Africa, which will assume the G20 presidency next year. However, the idea has hit high-profile resistance, including from U.S. Treasury Secretary Janet Yellen.

Sources at the German finance ministry, which came out against the idea in April, said that a tax on the super-rich was off the table at this week's G20 meetings. Tax discussions would focus on other ideas, such as combating tax avoidance and wealth concealment, the sources said.

One of the G20 officials familiar with talks, who requested anonymity to discuss ongoing negotiations, said Thursday's joint statement is expected to include a call for cooperation to reduce tax evasion by the super-rich through greater exchange of information and best practices.

A broader G20 joint communique is expected on Friday, when finance ministers and central bankers conclude this week's meetings in Rio de Janeiro.

Despite skepticism, the G20 discussions of a global billionaire tax have garnered praise from former world leaders including 19 members of the Club de Madrid, a forum of more than 100 former presidents and prime ministers.

At a seminar in Brasilia last month, officials discussed the proposal from the independent EU Tax Observatory to levy a 2% wealth tax on fortunes over $1 billion, raising estimated revenue of up to $250 billion annually from 3,000 individuals.

BANGKOK (Reuters) - Thailand's 500 billion baht ($13.85 billion) "digital wallet" handout scheme is a necessary stimulus measure to boost a lagging economy held back by low income and high household debt, its finance minister said Wednesday.

Projected economic growth of 2.4% this year is low and a result of structural issues, Pichai Chunhavajira said, adding those problems were being fixed in parallel to stimulus measures to jumpstart the economy, Southeast Asia's second-biggest.

The scheme is the ruling Pheu Thai party's flagship policy and was a key vote-winner, but the government has suffered delays in rolling it out due to challenges over funding it.

Some experts, including former central bankers, have called it fiscally irresponsible due to potential impacts on public debt, while the Bank of Thailand has recommended it be targeted more towards vulnerable sectors, rather than a mass handout that will provide only a short-term remedy.

The government denies this and said it would closely adhere to fiscal discipline.

The government was due to announce details on Wednesday how the digital wallet scheme will work ahead of its implementation in the fourth quarter.

It entails transferring credit of 10,000 baht ($277) to 50 million recipients via a smartphone application, to spend in their localities within a six-month period.

($1 = 36.0700 baht)

Investing.com-- Concerns over a second Donald Trump presidency have weighed on Asian markets, specifically China, on what new headwinds they could bring for the region through increased protectionist policies.

Analysts at ANZ said that while tariff increases appeared likely if Trump did win the November elections, they would not be as severe as he had foreshadowed.

ANZ said that Trump would be likely to rein-in more extreme policy positions, given that he also holds an agenda for boosting U.S. economic growth and equity markets.

Tax cuts and looser regulations were likely to be positive for U.S. growth, but any more expansionary fiscal policy and checks on immigration were likely to increase inflation, ANZ said.

China faces more tariffs in Trump presidency

ANZ said that while a Trump presidency was likely to broaden protectionist U.S. policies to other economies, China will still remain exposed to tighter trade regulations. Such a scenario bodes poorly for the country, which is already struggling with a slowing economic recovery.

“(China’s) current dependence on production and exports to fuel GDP-growth suggests any tariffs, even if substantially less than the 60% Trump has mentioned, will be costly,” ANZ analysts wrote in a note.

Trump could also apply more trade pressure on China by revoking the country’s Most Favored Nation status, further cutting off the country from the U.S. economy and pressuring domestic growth.

China's blue-chip CSI300 index was nursing an over 1% loss in the past week. Trump has so far maintained a largely hawkish stance towards China, and has called for stricter policies against Beijing to offset the country's trade dominance.

Dollar likely to firm under Trump, but not overwhelmingly

ANZ expects the dollar to firm and Asian currencies to weaken under a Trump presidency, likely driven by more protectionist policies and improved economic growth.

Among Asian currencies, the Chinese yuan and the Japanese yen are most likely to be impacted by stricter U.S. policies.

A renewed trade war with China, coupled with tighter U.S. policies, could spark an “across-the-board 10% depreciation in most Asian currencies,” ANZ said, with potentially worse conditions for the Chinese yuan.

But strength in the dollar is expected to be limited, especially given that Trump and his running mate, Ohio Senator J.D. Vance, have been calling for a weaker dollar to support U.S. exports.

But while concerns over a Trump presidency have dented Asian markets in recent weeks, it still remains unclear if such a scenario will come to pass. Trump is set to square off against presumed Democratic Presidential candidate Kamala Harris in the 2024 race.

By Ankur Banerjee

SINGAPORE (Reuters) - Asian stocks were subdued on Wednesday after lacklustre earnings from U.S. tech behemoths Tesla (NASDAQ:TSLA) and Alphabet (NASDAQ:GOOGL) dented sentiment, while the yen hit a six-week high ahead of a central bank meeting next week where a rate hike remains on the table.

The U.S. dollar was broadly firm, with traders watching out for an inflation reading on Friday and Federal Reserve meeting next week. The Bank of Japan is also due to meet next week, where a 10 basis point hike is priced at a 44% chance. [FRX/]

MSCI's broadest index of Asia-Pacific shares outside Japan was 0.08% lower at 566.26, not far from the one-month low of 562.43 it touched on Monday.

Japan's Nikkei fell 0.23% while Taiwan financial markets are closed due to a typhoon.

Nasdaq futures fell 0.5%, while S&P 500 futures eased 0.36% after Tesla reported its smallest profit margin in more than five years. Shares of Google-parent Alphabet slipped in after-hours trade even after the firm beat revenue and profit targets.

"The bar was set so high for Alphabet that a modest earnings beat couldn't push the stock higher. So, the market has no news to buy into," said Kyle Rodda, senior financial market analyst at Capital.com.

"It also speaks to concerns that tech stocks are too richly valued here. We will have to see how the other tech giants report and how the markets react."

Chinese stocks were lower in choppy trading, with the Shanghai Composite index down 0.18%, while the blue-chip CSI300 index was 0.19% lower after recording its largest one-day decline since mid-January on Tuesday.

Investor sentiment remained fragile in the world's second-biggest economy despite stimulation efforts.

On the macro side, investors await the U.S. GDP data on Thursday and PCE data - the Fed's favoured measure of inflation - on Friday to gauge the expectations of interest rate cuts this year.

Markets are pricing in 62 basis points of easing this year, with a cut in September priced in at 95%, the CME FedWatch tool showed.

A growing majority of economists in a Reuters poll said the Fed will likely cut rates just twice this year, in September and December, as resilient U.S. consumer demand warrants a cautious approach despite easing inflation.

"The U.S. consumer has remained extremely strong ... but you're starting to see a degree of fragility underlying some of the data," said Luke Browne, head of asset allocation for Asia at Manulife Investment Management.

"We are expecting probably two cuts from the Fed now, there is of course a high degree of uncertainty. We watch closely the data as it evolves and whilst inflation has been easing somewhat, there remain pressures underlying that."

YEN RIDE

The Japanese yen rose to touch 155.25 per dollar in Asian hours, its highest since June 7 after surging nearly 1% on Tuesday, having languished near a 38-year low of 161.96 at the start of the month.

Traders suspect Tokyo intervened in the currency market in early July to yank the yen away from those lows, with estimates from BOJ data indicating authorities may have spent roughly 6 trillion yen ($38.62 billion) to prop up the frail currency.

The bouts of intervention have led speculators to unwound popular and profitable carry trades, in which traders borrow the yen at low rates to invest in dollar-priced assets for a higher return.

The yen was broadly higher, with the Japanese unit touching a one-month high against the pound, the euro and a two-month high against the Australian dollar

The dollar index, which measures the U.S. currency against six rivals, was little changed at 104.47. The index is down 1.3% this month.

Investor focus on Wednesday will also be on purchasing managers' index figures across the globe to gauge the health of economies.

In commodities, oil prices rose on falling U.S. crude inventories. Brent crude futures for September rose 0.25% to $81.21 a barrel, while U.S. West Texas Intermediate crude for September gained 0.26% to $77.16 per barrel.

($1 = 155.3600 yen)

By David Milliken

LONDON (Reuters) - British consumers and businesses used cash in just 12% of transactions last year, a record low, although there was a rise in the small percentage of people who use cash for most day-to-day purchases, industry data showed on Wednesday.

Cash usage in Britain, like in most countries, has fallen sharply over the past decade, accelerated by the COVID-19 pandemic which encouraged contactless payments and also by reduced costs for smaller retailers to accept cards.

Last year 39% of British adults - 22.1 million people - used cash no more than once a month, banking trade body UK Finance said in its annual payments report.

However, Jana Mackintosh, UK Finance's managing director for payments, said Britain was not on its way to becoming a cashless society and forecast that cash would continue to account for 6% of transactions in 2033.

"Cash is still the second most frequently used method of payment in the UK, although we are using it less and more people are leading largely cashless lives," she said.

Cash accounted for more than half of transactions 10 years ago, but since then it has been supplanted by debit cards which were used for 51% of transactions last year. Credit card usage has stayed fairly stable at around 10%.

In the United States, a Federal Reserve survey showed cash made up 16% of payments last year, down from 31% in 2016, while a European Central Bank study found cash was still used for 59% of face-to-face transactions in the euro zone in 2022.

Around 60% of British card payments were contactless, and 42% of British adults were registered for mobile phone contactless payments such as Apple (NASDAQ:AAPL) Pay or Google (NASDAQ:GOOGL) Pay last year, up sharply from 30% in 2022.

However, UK Finance estimated that 1.5 million adults - 2.6% of the total - still mainly used cash for day-to-day spending, though most used electronic payments for monthly bills.

This represented a big jump from 0.9 million in 2022 and was the highest total since 2019.

Cash users tended to be poorer and to prefer using cash as a way to budget, although the sample size was small and UK Finance said it was hard to make reliable generalisations or to be certain that the increase was not a blip.

SEOUL (Reuters) - South Korea's consumer sentiment in July was the most optimistic in 27 months, with a brighter spending outlook due to easing inflation concerns, a central bank survey showed on Wednesday.

The Bank of Korea's consumer sentiment index was 103.6 in July, up from 100.9 in June, marking its highest reading since April 2022.

The sub-index for the consumer spending outlook contributed the most to the rise in the headline figure, followed by those for current economic conditions and the future economic outlook.

The median of consumers' expectations for inflation in the next 12 months fell to 2.9% in July, from 3.0% in June. It was the lowest since March 2022.

The BOK said earlier this month it was time to prepare to pivot towards interest rate cuts, although more evidence was still needed, after inflation slowed to an 11-month low of 2.4% in June.

(Reuters) -India will spend $24 billion in job-spurring efforts over the next five years and boost rural spending, Finance Minister Nirmala Sitharaman said on Tuesday in the 2024/25 budget, unveiled after last month's election setback for the government.

COMMENTARY:

SANDEEP NAYAK, ED & CEO OF CENTRUM BROKING, RETAIL, MUMBAI

"The triad of welfare spends, capital expenditure and fiscal discipline has been beautifully balanced by the government in this budget. There is a good amount of welfare spend on women-led development, the MSME sector and the agriculture sector covering a large part of the populace."

"Augmenting the welfare spends with an adequate thrust on capital expenditure while containing the fiscal deficit at 4.9% of GDP is a fine balancing act. However, the increase in capital gains tax and securities transaction tax is a dampener for capital markets."

KIRANG GANDHI, FOUNDER OF FP INDIA, PUNE

"The hike in short- and long-term capital gains tax has caused instability in markets."

"While the goal is to raise more revenue, these changes might discourage short-term trading, potentially hurting investor sentiment."

SAKSHI GUPTA, PRINCIPAL ECONOMIST, HDFC BANK, GURUGRAM

"The budget successfully engineered a fine balance between supporting job creation and skilling, rural development and agriculture along with continued focus on infrastructure spending without compromising on fiscal consolidation."

"The reduction in the fiscal deficit and commitment to achieving a fiscal deficit below 4.5% by FY26 is positive for India's debt sustainability. The budget announcements are broadly positive for consumption and overall growth."

ANAND RAMANATHAN, PARTNER AND CONSUMER PRODUCTS AND RETAIL SECTOR LEADER, DELOITTE INDIA, BENGALURU

"The budget focuses on important areas such as climate-resistant seed variety distribution, scaling digital public infrastructure and natural farming which will improve farm level productivity."

"Mission for self sufficiency in pulses, encouraging shrimp production and focus on vegetable production clusters will help in aligning production to emerging changes in consumption of fresh produce and proteins."

ANAND RAMANATHAN, PARTNER AND CONSUMER PRODUCTS & RETAIL LEADER, DELOITTE INDIA, BENGALURU

"Focus on e-commerce hubs will help the D2C ecosystem including small vendors and aggregators to bring in greater efficiency in their operations and improve accessibility to markets including exports."

RAJAT MAHAJAN, PARTNER, DELOITTE INDIA, MUMBAI

"Government is incentivising job creation in the manufacturing sector which is likely to impact 30 lakh youth."

"We expect that these additional skilled workers with disposable income in hand will help in driving growth in the automotive industry in the 2 wheeler segment."

NITESH MEHTA, PARTNER, M&A TAX AND REGULATORY SERVICES, BDO INDIA, MUMBAI

"The introduction of Variable Capital Company (VCC) structure for Private Equity could be a game changer for the fund community."

"This structure is prevalent in countries like Singapore and the introduction of VCC coupled with the existing GIFT city structure could certainly bring India a step closer to becoming a financial hub like Singapore."

MADHAVI ARORA, LEAD ECONOMIST, EMKAY GLOBAL, MUMBAI

"As expected, Centre has not let go of the consolidation journey ahead (as the debt management remains tricky), despite the challenges of the political economy."

"The fiscal deficit target has been lower at 4.9% of GDP from 5.1% in the interim budget. The policy direction/prerogatives may remain largely similar, focusing on a credible and clearly communicated consolidation, anchored on stronger revenue mobilization and spending efficiency."

HARSH PARIKH, PARTNER AT KHAITAN & CO, MUMBAI

"Government's plan to implement a policy for rental housing market is a big step to streamline residential renting market and can open doors to many large real estate players including foreign investors to establish large residential complexes and ensure smooth renting."

"Guidance to all states to rationalize stamp duty and to give more benefit for women buyers is also a huge welcome step".

UPASNA BHARDWAJ, CHIEF ECONOMIST KOTAK MAHINDRA BANK, MUMBAI

"The current budget has extended the broad themes from the interim budget focusing on infrastructure, fiscal consolidation, jobs, MSME, rural and agricultural support."

"We expect the bond markets to maintain their euphoria as demand supply dynamics remains very comfortable."

MOIN LADHA, PARTNER AT KHAITAN & CO, MUMBAI

"The budget promises to prioritise strengthening and aiding the MSME sector by introducing credit guarantee schemes, continuing guarantee covers during stress period and developing e-commerce hubs for MSMEs to compete in the global market."

"With India being the hub of global trade, empowering small and medium businesses will be a step towards our mission of continued growth."

SAMIR SHETH, PARTNER & HEAD, DEAL ADVISORY SERVICES, BDO INDIA, MUMBAI

"One of the hindrances to the success of IBC (Insolvency and Bankruptcy Code) was the delays from the judiciary system. Setting up additional tribunals to deal with IBC cases is a welcome step, which will expedite the resolution process."

"While the details are yet to be released, an integrated technology platform will also help in the timely dissemination of information and bring in efficiencies in the IBC process."

ARPIT MEHROTRA, MANAGING DIRECTOR, OFFICE SERVICES, COLLIERS INDIA, BENGALURU

"Lower stamp duties make purchasing property more affordable for women, potentially leading to a rise in the number of female homeowners."

"The reduction in costs associated with buying property can stimulate more real estate transactions, as women and families take advantage of the savings."

VIMAL NADAR, HEAD OF RESEARCH AT COLLIERS INDIA, MUMBAI

"Provision for multilateral financial aid to develop the new capital city (of Andhra Pradesh) will drive significant momentum in construction and real estate over the next few years across asset classes mainly commercial and residential."

"The announcement of 12 industrial parks under the National Industrial Corridor with a focus on creating integrated zones will propel supply of Grade A industrial spaces. This will also aid in increasing the proportion of organized superior quality stock within the industrial segment."

By David Lawder

RIO DE JANEIRO (Reuters) - Talks over a global tax deal are continuing well past a June 30 deadline and governments are now looking to a Group of 20 finance leaders meeting this week for progress on a stalled plan to reallocate taxing rights on large multinational companies.

The so-called "Pillar 1" arrangement, part of a 2021 global two-part tax deal, aims to replace unilateral digital services taxes (DSTs) on U.S. tech giants including Alphabet (NASDAQ:GOOGL)'s Google, Amazon.com (NASDAQ:AMZN) and Apple (NASDAQ:AAPL) through a new mechanism to share taxing rights on a broader, global group of companies.

The stakes in the negotiations are high. A failure to reach agreement on final terms could prompt several countries to reinstate their taxes on U.S. tech giants and risk punitive duties on billions of dollars in exports to the U.S.

Standstill agreements under which Washington has suspended threatened trade retaliation against seven countries -- Austria, Britain, France, India, Italy, Spain and Turkey -- expired on June 30, but the U.S. has not taken steps to impose tariffs.

Discussions on the matter are continuing. An Italian government source said that European countries were seeking assurances that the U.S. tariffs on some $2 billion worth of annual imports from French Champagne to Italian handbags and optical lenses remained frozen while the talks continue, including at the G20 meeting in Rio de Janeiro.

TOP PRIORITY

A European Union document prepared for the G20 meeting lists finalizing the international tax deal as a "top priority."

It said the G20 should urge countries and jurisdictions participating in the tax deal "to finalize discussions on all aspects of Pillar 1, with a view to signing the Multilateral Convention (MLC) by summer end and ratifying it as soon as possible."

Meanwhile, Canada in July became the eighth country to impose a unilateral digital services tax, with Finance Minister Chrystia Freeland saying it was "simply not reasonable, not fair for Canada to indefinitely put our own measures on hold" after the June 30 deadline passed without a Pillar 1 agreement.

The U.S. maintains that such taxes are discriminatory because they specifically target the local revenues of U.S. technology firms that dominate the sector.

"Treasury continues to oppose all tax measures that discriminate against U.S. businesses," a U.S. Treasury spokesperson said in response to Canada's move. "We encourage all countries to finalize the work on the Pillar 1 agreement. We are in active discussions on next steps related to the existing DST joint statements."

A spokesperson for the U.S. Trade Representative's office added that the OECD/G20 negotiations "offer the best path to address challenges that digitalization of the economy poses to the international tax system."

SMALLER FIRMS AFFECTED

Treasury Secretary Janet Yellen told Reuters at a G7 finance meeting in May that India and China were hindering agreement on the alternative transfer-pricing mechanism known as "Amount B."

This mechanism would apply to thousands of companies below the $20 billion annual revenue threshold for "Amount A", and is aimed at delivering tax certainty to these firms through an objective way of calculating tax liability, said Danielle Rolfes, head of KPMG's Washington National Tax Practice.

"It's in the interest of all the countries around the table to try to keep it alive," Rolfes said.

At the G20 meeting in Rio de Janeiro, Yellen will also face questions from counterparts over the continuity of U.S. policy commitments in the wake of President Joe Biden's decision to end his re-election bid and growing international angst over a potential return of Donald Trump to the White House.