Select Language

By Tom Westbrook

SINGAPORE (Reuters) - Stocks rose on Thursday, with markets from Tokyo to New York at record highs, while traders counted down to U.S. data that is expected to show inflation easing and pave the way for rate cuts in September.

Bonds and the dollar were steady, keeping the yen on the weak side of 161 per dollar and near its lowest levels in decades.

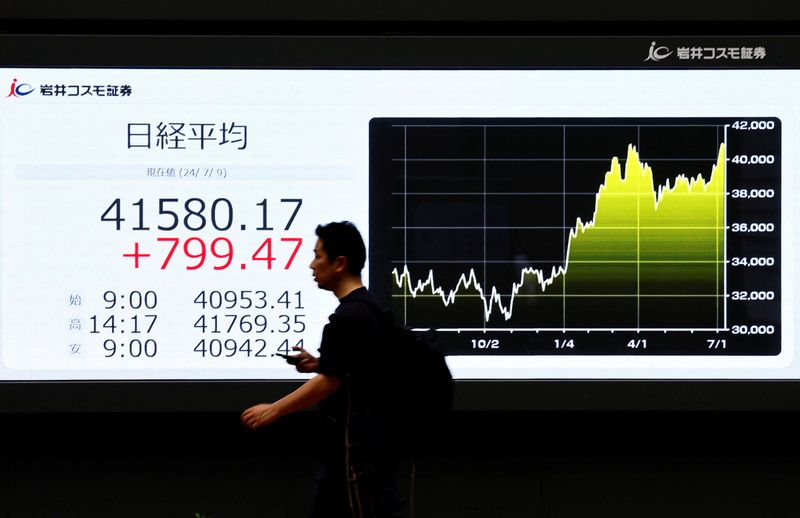

Gains in heavyweight technology shares sent the S&P 500 up 1% overnight to a sixth consecutive record closing high, and in Asia, Japan's Nikkei rose 1% to a record high at 42,426. (T)

MSCI's broadest index of Asia-Pacific shares outside Japan also gained 1% to a two-year high. Taiwan stocks hit a record peak and Australia's ASX 200 was within a whisker of its all-time top.

"The main driver is really the prospect of interest rate cuts," said Shane Oliver, chief economist and head of investment strategy at AMP (OTC:AMLTF) in Sydney. "If we get a good inflation read, it will tick one of Powell's boxes."

U.S. Federal Reserve Chair Jerome Powell told lawmakers on Capitol Hill overnight that "more good data" would build the case for the U.S. central bank to cut interest rates. Futures pricing implies about a 75% chance of a cut in September.

Economists forecast annual U.S. CPI slowed to 3.1% in June from 3.3% in May.

The Bank of Korea stood pat on interest rates and Governor Rhee Chang-yong told reporters that it was time to prepare to pivot to rate cuts.

A shift in tone at the Reserve Bank of New Zealand on Wednesday led to a sharp re-pricing in rate-cut expectations, with the benchmark two-year swap rate diving 18 basis points and the currency sliding.

Malaysia is expected to hold rates steady later in the day, and the U.S. earnings season will also begin with results from Delta Air Lines (NYSE:DAL) and consumer bellwether PepsiCo (NASDAQ:PEP), followed by bank results on Friday.

CHINA LAGGING

China stocks chimed with the market momentum on Thursday, but a drumbeat of disappointing data and talk of tariffs in its major export markets have made rallies hard to sustain. China GDP print is due on Monday.

Hong Kong's Hang Seng rose 1%, and on the mainland, the blue-chip CSI300 climbed 0.4% although it remains huddled pretty close to Tuesday's four-and-a-half-month low. [.HK][.SS]

China's yuan steadied at 7.2738 per dollar, barely stronger than an almost eight-month low made on Wednesday. [CNY/]

Elsewhere, moves were modest ahead of the U.S. CPI release.

The euro ticked higher to $1.0835. Sterling made a one-month high of $1.2854 as Bank of England's chief economist had, overnight, sounded vaguer about the timing of rate cuts than many traders had expected. [FRX/]

The yen hovered at 161.58 per dollar. Data showed Japan core machinery orders unexpectedly down for a second month running, challenging expectations for interest rates to rise.

The New Zealand dollar found support at its 200-day moving average and traded at $0.6095. The Australian dollar rose 0.2% to a six-month high of $0.6763. [AUD/]

Treasuries were steady overnight and in Asia, with U.S. two-year yields holding at 4.62% and benchmark 10-year yields at 4.29%. [US/]

In commodity trade, oil prices edged higher on signals of strong U.S. gasoline demand. Brent futures rose 35 cents, or 0.4%, to $85.43 a barrel. U.S. crude climbed 36 cents, or 0.5%, to $82.47 a barrel. [O/R]

Favourable U.S. weather has wheat futures pressured near two-and-a-half month lows. [GRA/]

Gold crept 0.2% higher to $2,373 an ounce. After a selloff last week, bitcoin has steadied around $58,900.

By Cynthia Kim and Jihoon Lee

SEOUL (Reuters) - The Bank of Korea extended a pause on interest rate for the 12th straight meeting on Thursday, as it continues efforts to tame inflation amid expectations policymakers will soon agree to lower the highest borrowing costs in 15 years.

The benchmark interest rate was held at 3.50% at its policy review, as widely expected by all 40 economists surveyed by Reuters.

Expectations the BOK could cut interest rates in the coming months gained momentum after headline consumer price readings for June released last week showed inflation slowed to an 11-month low of 2.4%, close to its target of 2%.

South Korea's economy is confronting sticky inflation and policymakers are waiting for sufficient evidence that prices are cooling to begin lowering borrowing costs from restrictive levels.

The focus is on Governor Rhee Chang-yong's press conference at 0210 GMT, where the names of any dissenters could be announced. Dissenting votes typically lead to policy changes in subsequent months.

Governor Rhee said on Tuesday the central bank will now consider trade-offs between inflation and financial stability, given that price rises are easing amid a weaker won and rising household debt.

Economists say a wobbly won, down about 7% this year against the dollar, can potentially push back the timetable for interest rate relief, even as political pressure for early rate cuts grows.

"Sluggish economic growth and lower inflation support a near-term rate cut, although policymakers are likely to have concerns about FX and housing market," Oh Suk-tae, an economist at Societe Generale (OTC:SCGLY) said.

"The rise in USD/KRW towards 1,400 and the rebound in Seoul apartment prices should support a wait-and-see stance in monetary policy."

By Noel Randewich and Ankika Biswas

NEW YORK (Reuters) -The Nasdaq and S&P 500 hit record highs on Wednesday fueled by gains in Nvidia (NASDAQ:NVDA) and other Wall Street heavyweights ahead of inflation data and quarterly earnings reports due this week.

It was the fifth straight day of intraday record highs for the S&P 500 and the Nasdaq. The S&P 500 crossed 5,600 for the first time as expectations of an interest-rate cut in September climbed following comments this week by Federal Reserve Chair Jerome Powell.

Powell said in his second day of Congressional testimony that he was not ready to conclude that inflation was moving sustainably down to 2%, although he expressed "some confidence of that".

The Philadelphia semiconductor index jumped 2% to a record high after contract manufacturer Taiwan Semiconductor Manufacturing Co posted strong quarterly revenue.

"TSMC's report supported the AI narrative, so that more than anything else today is a pretty important data point," said Thomas Martin, senior portfolio manager at Globalt Investments in Atlanta.

Micron Technology (NASDAQ:MU) rallied almost 4%, while Nvidia rose 2.3% to a three-week high.

Apple (NASDAQ:AAPL) climbed 1.4% to a record high, lifting its stock market value to almost $3.6 trillion.

Of the 11 S&P 500 sector indexes, 10 rose, led by information technology, up 1.24%, followed by a 0.97% gain in materials.

With just a handful of large-cap stocks fueling Wall Street's rally this year, some investors worry about a potential selloff if those companies' earnings fail to meet high expectations.

The S&P 500 was up 0.69% at 5,615.50 points.

The Nasdaq gained 0.99% to 18,610.88 points, while the Dow Jones Industrial Average was up 0.48% at 39,482.11 points.

U.S. inflation data due this week include the Consumer Price Index on Thursday and the Producer Price Index report on Friday.

Expectations of a 25-basis-point rate cut by September ticked up to 74% from around 70% on Tuesday and 45% a month ago, according to CME's FedWatch.

Second-quarter earnings season, which kicks off this week with major banks reporting on Friday, will test whether high-flying megacaps can justify expensive valuations and extend their strong runs.

Intuit (NASDAQ:INTU) dropped 3% after the TurboTax owner said it plans to lay off about 10% of its workforce.

Gene-sequencing equipment maker Illumina (NASDAQ:ILMN) jumped 6.5% on plans to acquire privately held Fluent (NASDAQ:FLNT) BioSciences.

Advancing issues outnumbered falling ones within the S&P 500 by a 2.3-to-one ratio.

The S&P 500 posted 27 new highs and 10 new lows; the Nasdaq recorded 54 new highs and 104 new lows.

By Shivangi Acharya and Swati Bhat

NEW DELHI/MUMBAI (Reuters) - India's growing employment stems largely from self-employed individuals, unpaid workers and temporary farm hires, whose jobs are not equivalent to formal positions with regular wages, private sector economists said on Wednesday.

The comments follow labour department figures released this week showing 20 million new employment opportunities generated each year since 2017/18, countering a Citibank report that said only 8.8 million jobs were added each year since 2012.

"What is clear is that there is a large increase coming from agriculture and from self-employment, which includes own account work or unpaid family work," said Amit Basole, head of the Centre for Sustainable Employment at the Azim Premji University.

The jump in employment cannot be equated to the creation of formal jobs with regular wages, Basole said, going by detailed data available up to the financial year 2022/23.

In the fiscal year that ended in March 2024, employment in the economy rose by 46.7 million for a total of 643.3 million, up from 596.7 million a year ago, the central bank said in a statement on Monday.

The Reserve Bank of India database showed agricultural work opportunities contributed 48 million of the 100 million jobs generated between financial years 2017/18 and 2022/23, Basole said.

"I wouldn't call them jobs," he added. "They're just people working in agriculture or in non-farm self-employment because of lack of adequate demand for workers from businesses."

While the central bank gave a provisional estimate of the increase in employment in 2023/24, it did not detail the sectors that saw these additions. That data was only available up to the previous year.

The central bank and government did not respond to emails from Reuters seeking comment.

Prime Minister Narendra Modi, whose party lost its absolute parliamentary majority in elections last month, having to turn to allied parties to retain power, first won power in 2014, on a promise of creating 20 million jobs a year.

However, he has since faced criticism from analysts and political rivals for failing to deliver.

"The Modi government's only mission is to make sure youth are jobless," Mallikarjun Kharge, president of the main opposition party Congress said this week, after the Citibank report reignited the jobs debate in India.

Modi's party manifesto for this year's general election promised to create jobs through investments in sectors such as infrastructure, pharmaceuticals and green energy.

But the party's failure to win an absolute majority on its own was blamed on voters' disenchantment with lack of jobs and high inflation.

"Yes, there has been an enormous increase in the number of people who are, quote-unquote, employed," said India's former chief statistician, Pronab Sen. "But the bulk of this increase has come in agriculture and in casual work."

Growing farm employment was "extremely regressive" as it went against the nation's goal of moving more Indians away from agricultural work, he added.

"Look, the question is, do you really believe there's so much employment happening?" Sen said. "It seems unlikely."

The debate over India's employment data was "muddying the water," he added.

Government data shows just 20.9% of India's overall workforce earned regular wages in the form of salary, as of 2022/23.

Economists have pointed to weak consumption in the economy, which grew by just 4% in 2023/24, or half the pace of gross domestic product (GDP) which expanded at a world-beating 8.2%.

"We can have disputes on the numbers but ultimately, what we should go by is the outcome," said Rupa Rege Nitsure, an independent economist.

"If enough employment is being generated, then enough income should get generated and that should get translated into higher consumption at a broad-based level. Why are we seeing so much unevenness in consumption spending?"

By Joe Cash

BEIJING (Reuters) - China's exports likely grew at the fastest pace in fifteen months in June, as manufacturers front-load shipments in anticipation of tariffs from a growing number of the country's major export markets.

Trade data on Friday is expected to show exports grew 8.0% year-on-year by value, according to the median forecast of 31 economists in a Reuters poll, up from the 7.6% increase in May and the best pace since a 10.9% gain in March last year.

Imports likely grew 2.8% last month, faster than the 1.8% gain seen in May, suggesting factory owners are buying more parts to be turned into finished goods for export.

Stronger-than-expected exports have been one of the few bright spots for an economy that is otherwise still struggling for momentum despite officials' efforts to stimulate domestic demand following the pandemic. A prolonged property slump and worries about jobs and wages are weighing heavily on consumer confidence.

The $18.6 trillion dollar economy is so overwhelmingly competitive across so many sectors, including steel, solar and consumer goods, that even new trade restrictions wouldn't really slow the export juggernaut, analysts say.

Still, as the number of countries considering stepping up curbs on Chinese goods increases, so too does the pressure on its exports to prop up progress towards the government's economic growth target for this year of around 5%.

Washington in May hiked tariffs on an array of Chinese imports, including a quadrupling of duties on Chinese electric vehicles to 100%, while Brussels last week confirmed it would also impose tariffs, but only up to 37.6%.

Exporters are also on edge heading into U.S. elections in November in case either major party tips fresh trade restrictions.

Turkey last month also announced it would impose a 40% additional tariff on Chinese-made EVs, while Canada said it was considering curbs.

Meanwhile, Indonesia plans to impose import duties of up to 200% on textile products, which China is its biggest supplier of, India is monitoring cheap Chinese steel, and talks with Saudi Arabia over a free trade agreement have reportedly stalled over dumping concerns.

A global cyclical upturn in the electronics sector should also help exporters in the world's No.2 economy, which is investing heavily in expanding production of older chips, known as legacy chips, that can be found in everything from smartphones to fighter jets.

South Korean exports to China - a leading indicator of China's tech imports - jumped 16.8% last month.

The European Commission has reportedly began canvassing the bloc's semiconductor industry for its views on China's expanded production of legacy chips, which could constrain the Asian giant's strong export performance in electronics.

The median estimate in the poll predicted China's trade surplus will come in at $85.0 billion, up from 82.62 billion in May.

By Howard Schneider and Ann Saphir

WASHINGTON (Reuters) -The U.S. is "no longer an overheated economy" with a job market that has cooled from its pandemic-era extremes and in many ways is back where it was before the health crisis, Fed Chair Jerome Powell said in remarks to Congress that suggested the case for interest rate cuts is becoming stronger.

"We are well aware that we now face two-sided risks," and can no longer focus solely on inflation, Powell told the Senate Banking Committee on Tuesday. "The labor market appears to be fully back in balance."

Powell told lawmakers that he did not want "to be sending any signals about the timing of any future actions" on interest rates, a stance consistent with the chair's recent efforts to focus attention more on the evolution of economic data - and the possible choices the Fed might make in response - and less on firm guidance about what might happen on what timetable.

Still, with a Nov. 5 presidential election on the horizon and just two scheduled Fed meetings before it, Powell was quizzed by Democrats about the risks to the job market of not cutting rates soon, and by Republicans about the pain to households of inflation that remains above the central bank's 2% target.

"Any move to lower rates before Nov. 5 would be a bad perception," Senator Kevin Cramer, Republican of North Dakota, said to Powell, said in remarks that went on to pledge support for central bank independence.

By Rae Wee and Sameer Manekar

SINGAPORE (Reuters) - Asian stocks edged marginally lower on Wednesday after Federal Reserve Chair Jerome Powell offered little hints on the timing of U.S. rate cuts expected later this year, even as he signalled greater confidence that inflation was coming to heel.

MSCI's broadest index of Asia-Pacific shares outside Japan eased 0.27% in early Asia trade, losing some steam after surging to an over two-year high at the start of the week.

In New Zealand, the kiwi rose 0.05% to $0.6128 ahead of a rate decision by the country's central bank later in the day, where focus will be on any guidance for its rate outlook.

Expectations are for the Reserve Bank of New Zealand (RBNZ) to maintain its hawkish bias at the conclusion of its monetary policy meeting, with bets for the central bank to cut rates just once before year-end.

"I think the RBNZ should be easing sooner - a lot sooner than what they expect," said Jarrod Kerr, chief economist at Kiwibank.

"I think we've seen enough in the local data to expect inflation to fall back to 2%... we think they should be cutting in August but they probably will start cutting in November."

Stocks have rallied globally on the back of growing expectations of a Fed easing cycle likely to commence in September, with Powell saying on Tuesday that the U.S. is "no longer an overheated economy".

However, Powell provided little clues on how soon those rate cuts could come.

"He suggested that the Fed's reaction function is shifting to an easing bias given the significantly cooling labour market, but he nonetheless declined to offer a clear timeline on rate cuts," said Alvin Tan, head of Asia FX strategy at RBC Capital Markets.

"In any event, the market has been pricing in almost two full Fed rate cuts this year, and Powell's statements didn't shift those expectations much."

Japan's Nikkei rose 0.08%, helped by a weaker yen which last stood at 161.47 per dollar.

Data on Wednesday showed Japan's wholesale inflation accelerated in June as the yen's declines pushed up the cost of raw material imports, keeping alive market expectations for a near-term interest rate hike by the central bank.

The Bank of Japan said on Tuesday that some market players called on the central bank to slow its bond buying to roughly half the current pace under a scheduled tapering plan due this month.

In other currencies, the dollar held broadly steady, with sterling little changed at $1.2787 while the euro dipped 0.01% to $1.0813.

Oil prices rebounded following three days of declines after an industry report showed U.S. crude and fuel stockpiles fell last week, indicating steady demand, and as the outlook for interest rate cuts improved. [O/R]

Brent futures rose 0.24% to $84.86 a barrel, while U.S. West Texas Intermediate (WTI) crude ticked 0.29% higher to $81.65 per barrel.

Gold gained 0.07% to $2,365.09 an ounce. [GOL/]

(Reuters) - The S&P 500 and Nasdaq notched record-high closes on Tuesday, fueled by gains in Nvidia (NASDAQ:NVDA) after U.S. Federal Reserve Chair Jerome Powell told lawmakers that more "good" economic data would strengthen the case for rate cuts.

AI chipmaker Nvidia climbed 2.5%, offsetting declines in other chip stocks.

Microsoft (NASDAQ:MSFT) dipped 1.4%, while Tesla (NASDAQ:TSLA) added 3.7%, bringing its gain in 2024 to 5%.

It was the Nasdaq's sixth straight record-high close and the S&P 500's fifth straight as optimism about the growth of AI across the U.S. corporate landscape offset uncertainty around the Fed's rate-cut path.

In testimony before Congress, Powell said that while inflation "remains above" the 2% soft-landing target, it has been improving in recent months and "more good data would strengthen" the case for interest-rate cuts.

However, the central bank chief insisted he was not "sending any signals about the timing of any future actions."

Markets have stuck to pricing in 50 basis points of easing for the year, seeing a nearly 72% chance for a 25 bps cut by the Fed's September meeting, according to CME's FedWatch. Those bets were at under 50% a month ago.

"The U.S. economy, and currently the U.S. labor market, have been surprisingly resilient through the course of 2024 and our base case is that a recession is not the highest probability outcome, but rather we should continue to expect moderate growth through the balance of this year and into next," said Bill Northey, senior investment director at U.S. Bank Wealth Management.

Inflation data is also due this week, including Thursday's consumer price index and the producer price index reading on Friday.

Shares of JPMorgan and Wells Fargo climbed over 1% and Citi rose 2.8%. The three banks will release quarterly results on Friday, marking the start of second-quarter earnings season.

Reuters reported that the Fed was considering a rule change that could save big banks billions of dollars in capital.

Analysts on average see S&P 500 companies increasing their aggregate earnings per share by 10.1% in the second quarter, up from an 8.2% increase in the first quarter, according to LSEG I/B/E/S data.

The S&P 500 climbed 0.07% to end the session at 5,576.98 points.

The Nasdaq gained 0.14% to 18,429.29 points, while the Dow Jones Industrial Average declined 0.13% to 39,291.97 points.

Even as the S&P 500 rose, declining stocks outnumbered rising ones within the index by a 1.5-to-one ratio.

Tempus AI rose almost 4% after JPMorgan, Morgan Stanley and other brokerages initiated coverage of the stock with bullish ratings. The genetics testing firm, which receives "immaterial" revenue from its AI business, is down around 7% from the $37 price set in its June IPO.

Volume on U.S. exchanges was relatively light, with 9.6 billion shares traded, compared with an average of 11.6 billion shares over the previous 20 sessions. (This story has been refiled to add a dropped letter in the advisory line)

By Yoruk Bahceli and Samuel Indyk

(Reuters) -A shock election win for France's leftist alliance has reinforced wariness among investors who had already braced for the risk of political deadlock and a policy paralysis that's unlikely to improve the country's creaking public finances.

The left-wing New Popular Front (NFP) alliance won the most seats in Sunday's election, but fell far short of an absolute majority, a big surprise after Marine Le Pen's far-right National Rally (RN) led opinion polls.

France, at the centre of the euro project and the bloc's second biggest economy, still faces a hung parliament and taxing negotiations to form a government as markets had already anticipated - just with the left in pole position, rather than the far-right.

The risk premium, or spread, for holding France's debt over Germany's was at 65 basis points on Monday, a touch lower from Friday. It remains below the 12-year high hit in June at 85 bps.

Still, that gap is not expected to tighten again rapidly with concern fixed on what France's new political climate means for its stretched public finances that have left it facing European Union disciplinary measures.

Debt stood at 110.6% of output in 2023.

"For any budget to be passed in the new assembly, probably at the margin some fiscal loosening is required to get a compromise," said Kevin Zhao, head of global sovereign and currency at UBS Asset Management, which manages $1.7 trillion in assets.

Market relief proved tentative on Monday. France's main CAC 40 stocks index, down 3.7% since Macron called the election, rose as much as 0.8% on Monday then gave up all its gain.

Shares in France's three biggest lenders - BNP Paribas (OTC:BNPQY), Societe Generale (OTC:SCGLY) and Credit Agricole (OTC:CRARY) - which have dropped as much as 9.8% since June 9, also reversed earlier gains and were down 0.4%-1.2% at 1418 GMT.

Banks had been hard hit in the run-up to the vote on concerns that higher political uncertainty would translate into increased economic risks and fears of possible windfall taxes.

With the left more than 100 seats short of an absolute majority and President Emmanuel Macron's centrist grouping in second place, a hung parliament was still seen as the best outcome for investors in French assets, with it expected to limit the left's spending plans and avert a potential budget-driven market crisis.

The NFP's plans include scrapping Macron's pension reform raising the minimum wage and capping the prices of key goods.

It says the costs of its program would be offset by measures including tax increases.

But some investors had deemed an NFP absolute majority a bigger threat to markets than the RN, as the left alliance has said it doesn't plan to reduce France's high budget deficit.

"When you look at the composition of the parliament, the bar for the far-left to start doing anything market unfriendly is very, very high," said Gabriele Foa, portfolio manager at Algebris Investments, noting that the more moderate Socialists won a sizable share of the NFP seats.

Possibilities for a new government include the NFP forming a minority government, Macron peeling off Socialists and Greens from the NFP to isolate Jean-Luc Melenchon's far-left France Unbowed for a coalition with his own bloc, or a technocratic government.

By David Randall

NEW YORK (Reuters) - A decline of 10% in the benchmark S&P 500 stock index before the U.S. presidential election in November is "highly likely," Morgan Stanley Chief Investment Officer Mike Wilson said in an interview on Monday with Bloomberg TV.

Among the reasons for a decline are uncertainty over how swiftly the Federal Reserve will bring interest rates down from nearly two-decade highs and falling pricing power on the part of companies, increasing the likelihood of disappointing earnings results, he said.

"The average company has not had good earnings results," he said, adding that a nearly 17% gain in the S&P 500 for the year to date has been powered by a small number of companies.

At the same time, price to earnings multiples have been rising. "Valuations to me look very unexciting," he said.

Wilson maintained a bearish outlook for the majority of this year, one of few prominent forecasters to do so. In late May, he lifted his base-case 12-month forecast for the S&P500, an estimate of what the fair value of the index will be in a year, to 5,400 points. At the time, that was only 2% above its level but 20% higher than his previous forecast of 4,500.

The S&P 500 closed Monday at 5,572, some 3% above Wilson's 12-month target price.