Select Language

By Fergal Smith

(Reuters) -Canada's main stock index edged lower on Friday but still notched its fourth straight weekly gain as bigger-than-expected U.S. and Canadian jobs gains bolstered prospects of a soft economic landing.

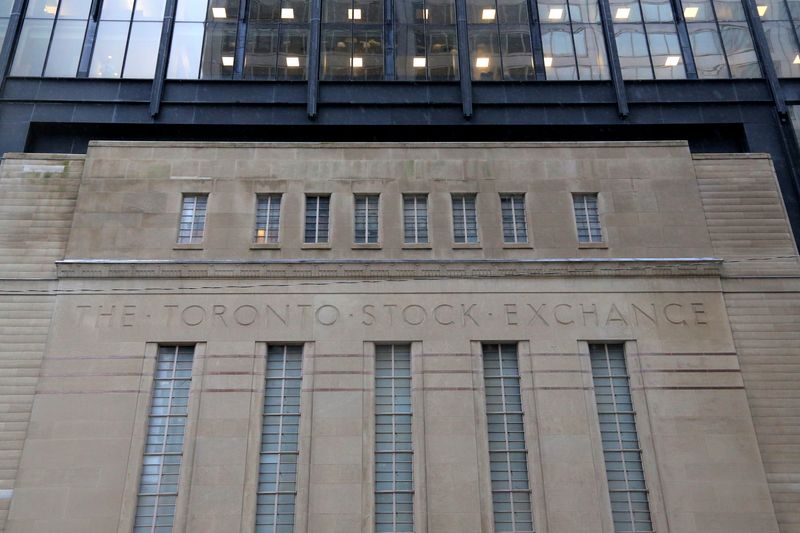

The Toronto Stock Exchange's S&P/TSX composite index ended down 57.03 points, or 0.3%, at 21,737.53, after posting on Thursday its highest closing level in nearly two years.

For the week, the index was up 0.9%. The weekly winning steak was the longest since April 2023.

"The U.S. still seems very much on course for a soft landing. In Canada, it's a little bit more nuanced I think, but by all indications the market is holding up relatively well," said Elvis Picardo, a portfolio manager at Luft Financial, iA Private Wealth.

U.S. job growth accelerated in February, but that likely masks underlying softening labor market conditions as the unemployment rate increased to a two-year high of 3.9%.

Canada's economy added 40,700 jobs in February, double the expected gain but and wage growth slowed for a second consecutive month as the central bank continues to hold interest rates at a 22-year high.

The energy sector fell 0.7% as oil settled 1.2% lower at $78.01 a barrel and shares of uranium miners declined. Nexgen Energy Ltd lost 8.7% and Cameco Corp (TSX:CCO) was down 6.2%.

Consumer-related stocks also lost ground, with the consumer staples sector falling 1% and consumer discretionary ending 0.4% lower.

The materials index which includes precious and base metals miners and fertilizer companies, edged up 0.2% as gold added to its record-setting rally.

"Despite gold being at an all-time high, despite the geopolitical uncertainty, the resource sector which is a big driver hasn't really taken off. That's impeding the TSX's progress a little bit," Picardo said.

Investing.com – February data including consumer prices and retail sales will offer more cues on the prospects for potential Federal Reserve rate cuts. Bitcoin hits record highs, while Wall Street could be in for another volatile week. Here’s what you need to know to start your week.

US inflation data

Investors will be looking to Tuesday's U.S. inflation data as they try to gauge how soon the Fed could start cutting interest rates.

Economists are expecting February's consumer price index to rise 0.4% after a faster than expected increase of 0.3% in January.

On Thursday, Fed Chair Jerome Powell said it would likely be appropriate to cut rates “at some point this year,” but made it clear that he and his colleagues aren’t ready yet.

Market watchers will also be looking to Thursday’s retail sales data for February, which is expected to rebound 0.8% after falling the same amount a month earlier.

The economic calendar also features updates on industrial production, consumer sentiment and weekly data on initial jobless claims.

Fed officials will be entering the traditional blackout period ahead of their upcoming meeting next week.

Bitcoin boom

Bitcoin has hit a new all-time high above $70,000, boosted by investor demand for new U.S. spot bitcoin ETFs that launched this year and expectations for global interest rates to fall.

Billions of dollars have flowed into ETFs in the past few weeks, while the market has also been underpinned ahead of an expected upgrade to the ethereum blockchain platform, home to the second-largest digital ether, and a bitcoin "halving" event, which slows the flow of bitcoin minting, in April.

The previous bitcoin boom in 2021 was followed by a "crypto winter", when bankruptcies and collapses at the biggest crypto firms left millions of investors out of pocket, prompting regulators to step up warnings about the risks.

But this does not seem to have deterred a new wave of money from coming in. Crypto fans say the industry has matured, but central bankers and regulators are still wary. Now investors are wondering: how much bigger can it get and is it different this time?

Oil prices

Oil prices closed 1% lower on Friday and fell even more for the week as markets remained wary of soft Chinese demand even as producer group OPEC+ extended supply cuts.

Both benchmarks fell in the week, with Brent down 1.8% and Crude Oil WTI Futures losing 2.5%.

China last week set an economic growth target for 2024 of around 5%, which many analysts say is ambitious without much more stimulus.

On the supply side, OPEC+ members led by Saudi Arabia and Russia agreed last Sunday to extend voluntary oil output cuts of 2.2 million barrels per day into the second quarter, giving extra support to the market amid concerns over global growth and rising output outside the group.

Energy traders have also been focused on the timing of possible rate cuts by the Fed and the ECB. Lower interest rates could increase oil demand by boosting economic growth.

Stock market

Wall Street's three main indexes ended lower on Friday, closing out a turbulent week with artificial intelligence darling Nvidia (NASDAQ:NVDA) going into reverse after a recent rally.

For the week the S&P 500 lost 0.26% while Nasdaq fell 1.17% and the Dow Jones Industrial Average dropped 0.93%.

Nvidia ended Friday down more than 5% in its worst one-day performance since late May. Shares in the company still ended the week with gains of over 6% amid a rally that has added more than $1 trillion to its market cap so far this year.

Analysts say investors are locking in profits after the recent run higher in markets.

Given that the upcoming inflation data likely won’t be enough to reassure the Fed that price pressures are cooling quickly enough to warrant a near-term move market participants are likely to remain somewhat cautious.

UK jobs data

The UK is to release its latest jobs report on Tuesday, with investors and the Bank of England alike focusing on wage growth amid speculation over the timing of a first rate cut.

Average hourly pay decelerated to a rate of 6.2% in December, the slowest pace of growth in over a year, but not slow enough to convince BoE officials that interest rates - at 16-year highs - will need to come down sooner rather than later.

Meanwhile, the Eurozone is to release industrial production data for January. December’s report showed a large increase in production which erased a full year of declines. Another strong reading would be an encouraging sign for first quarter GDP growth.

--Reuters contributed to this report

By David Lawder

WASHINGTON (Reuters) -U.S. President Joe Biden vowed Thursday to raise taxes on wealthy Americans and large companies, announcing plans in his State of the Union address to hike corporate minimum taxes and cut deductions for executive pay and corporate jets.

Biden previewed the steps that will be part of a proposed fiscal 2025 budget released next week that aims to decrease the federal deficit by $3 trillion over 10 years while cutting taxes for low-income Americans and aiding middle-class homebuyers.

He proposed a new tax credit that would help Americans buy first homes or trade up to larger ones by providing the equivalent of $400 per month for the next two years to offset high mortgage rates. Biden also called for the elimination of title insurance on refinancings of federally backed mortgages, a move that can save homeowners $1,000 or more.

The tax plans are expected to form a core part of the Democratic president's re-election campaign, contrasting with Republican candidate Donald Trump, who signed a 2017 law that slashed taxes on companies, the wealthy and many middle-class Americans.

"I'm a capitalist. You want to make a million, or millions of bucks? That's great. Just pay your fair share in taxes," Biden said, adding that the Trump-era tax cuts "exploded the federal deficit."

Most of Biden's tax proposals have little chance of enactment unless Democrats win strong majorities in both chambers of Congress in November, a sweep that polls suggest is unlikely.

In addition to previous calls to raise the corporate income tax rate to 28% from 21% currently, he called for an increase to "at least 21%" for the 15% corporate minimum tax that he won as part of 2022 clean energy legislation. The tax applies to firms reporting over $1 billion in profits.

Biden administration officials also told reporters he wants to quadruple the 1% tax on corporate stock buybacks approved in 2022.

TAX BREAK CURBS

Biden also urged Congress to approve far stricter limits on business income deductions for executive pay, limiting them to $1 million for any given employee.

Current law prohibits deductions on compensation for chief executive officers, chief financial officers and other key positions. White House officials said the new proposal would cover all employees paid more than $1 million, and raise more than $250 billion in new corporate tax revenue over 10 years.

Biden also called for Congress to go after business income deductions for the use of corporate jets, an area already targeted for audits by the Internal Revenue Service. This includes extending the depreciation period for corporate jets to seven years, the same as commercial aircraft, from five years currently, reducing annual deductions, an administration official said.

Biden renewed his call for a "billionaire tax" that would impose a 25% minimum tax on income for those Americans with wealth of more than $100 million, saying it would raise $500 billion over 10 years to help fund benefits such as child care and paid family leave.

The average American worker paid about a 25% tax rate in 2022, the OECD reported. Biden said the average tax rate for some 1,000 billionaires was 8.2%, adding: "No billionaire should pay a lower tax rate than a teacher, a sanitation worker, a nurse."

He pledged to extend Trump-era tax cuts for those earning under $400,000 and revive a COVID-era expansion of the Child Tax Credit and increase a tax credit for low-wage workers.

Biden's latest proposals drew a sharp rebuke from the U.S. Chamber of Commerce, which has made preserving the 2017 Republican tax cuts a top priority.

Biden's policies "would actually result in lower economic growth, fewer new business starts, less job creation, and fewer choices for American families," said Neil Bradley, the Chamber's chief policy officer.

But Chuck Marr, who heads tax policy at the left-leaning Center on Budget and Policy Priorities, said Biden's "course correction" would make the U.S. tax system fairer.

“President Biden's tax proposals recognize that the 2017 Trump tax law - as exemplified in the corporate tax rate cut - was skewed to the wealthy, expensive, and failed to deliver on its promises," Marr said.

FIGHTING 'JUNK FEES'

As consumers continue to face high prices, Biden also said his administration would continue to crack down on "price gouging" including "junk fees" added to stated prices, and smaller package sizes - the "shrinkflation" bemoaned on Monday by Sesame Street muppet Cookie Monster in an X social media post.

After a move this week to cap credit card late fees at $8, Biden said this would save Americans $20 billion and banks were "mad" about it.

"I'm not stopping there. My new administration is proposing rules on cable, travel, utilities, online ticket sellers, telling you the total price upfront. So there are no surprises. It matters," he added.

By Harshit Verma

(Reuters) - Gold prices were poised for their biggest weekly jump in five months on Friday, hovering near a historic high, as Federal Reserve Chair Jerome Powell's remarks cemented mid-year rate cut bets, ahead of a key jobs report later in the day.

Spot gold was little changed at $2,157.16 per ounce, as of 0350 GMT, hovering around a record peak of $2,164.09 hit in the previous session.

U.S. gold futures were flat at $2,164.40.

Spot prices have gained more than 3.5% so far this week, on track to log their biggest weekly percentage gain since mid-October, when the Israel-Hamas conflict first escalated. This will also be bullion's third straight weekly climb, if gains hold.

While a spur of short-term speculative activity primarily driven by CTAs (Commodity Trade Advisors) and algorithmic trading prompted the gold rally, it's very much this expectation of interest rate cuts in the not-too-distant future that's backing it, said Nikos Kavalis, managing director at Metals Focus.

Powell said that Fed was "not far" from gaining the confidence it needs in falling inflation to begin cutting rates, which he said are likely to happen in the coming months.

Traders are pricing in three to four quarter-point (25 bps) U.S. rate cuts, with a 75% chance for the first in June, as per LSEG's interest rate probability app.

Lower rates boost the appeal of non-yielding bullion.

Another factor on why gold has been so solidly supported in recent weeks is the rally in procyclical asset classes, particularly equities as investors seek to diversify their risk exposure, Kavalis said.

The dollar headed for its sharpest weekly drop of the year, making bullion less expensive for other currency holders. [USD/]

Market focus will be on key U.S. jobs data due at 1330 GMT.

Spot platinum fell 0.3% to $916.30 per ounce, silver fell 0.1% to $24.29, while palladium rose 0.5% to $1,039.17. All three metals were poised for a weekly gain.

By Rae Wee

SINGAPORE (Reuters) - Asian stocks rose to a seven-month peak on Friday, tracking global peers as investors cheered the prospect of an imminent rate easing cycle led by major central banks, keeping the dollar and Treasury yields under pressure.

Japan remained an outlier as expectations mount that the Bank of Japan (BOJ) could finally exit negative interest rates this month. That lit a fire under the yen and sent domestic bond yields rising.

MSCI's broadest index of Asia-Pacific shares outside Japan peaked at 538.47 points in early Asia trade, its strongest level since August. It was last 1% higher, and was eyeing a weekly gain of nearly 2%.

Global stock indexes had in the previous session rallied to record highs after the European Central Bank (ECB) laid the ground for a potential rate cut in June, while Federal Reserve Chair Jerome Powell struck a similar tone on the path of U.S. rates.

"Very seductive words when it is uttered by the Fed Chair, it appears, in the context of confidence to initiate rate cuts," said Vishnu Varathan, chief economist for Asia ex-Japan at Mizuho Bank. "Markets were certainly not shy in construing this as an open invitation to pivot-type rallies."

The two-year U.S. Treasury yield, which typically reflects near-term rate expectations, fell to a one-month low of 4.499% on Friday as traders added to bets of imminent Fed rate cuts.

The benchmark 10-year yield was last at 4.0923%. [US/]

Focus now turns to the closely watched nonfarm payrolls report due later on Friday for further clues on the U.S. rate outlook, particularly after January's blowout jobs report which stunned markets.

Friday's labour market data comes ahead of a reading on U.S. inflation next week.

"If we do get that hot nonfarm payrolls data tonight, followed by a hotter-than-expected CPI, it could unravel very, very quickly across equity markets, across assets including gold, bitcoin and then to currency markets," said Tony Sycamore, a market analyst at IG.

"It's something to be aware of. It's not my base case, but it's certainly a risk."

In the meantime, expectations of an imminent Fed easing cycle kept the dollar broadly weaker and it hit a roughly two-month low on the euro on Friday.

The single currency was last at $1.0948, after peaking at $1.0956 earlier in the session. Sterling similarly rose to an over two-month high of $1.2820.

BOJ PIVOT

The yen hit a one-month high against the greenback on Friday at 147.54 per dollar, helped by recent commentary from BOJ officials which fuelled speculation that the central bank could soon move away from its ultra-easy monetary policy stance.

The Japanese currency was poised for its best week since December with a nearly 1.5% rise.

BOJ governor Kazuo Ueda and board member Junko Nakagawa said on Thursday the Japanese economy was moving towards the central bank's 2% inflation target, while the country's largest trade union group said the average wage hike demand hit 5.85% for this year, topping 5% for the first time in 30 years.

The BOJ has long set broad-based and sustained wage increases as a prerequisite for a stimulus exit.

Reflecting expectations of a near-term BOJ pivot, the two-year Japanese government bond (JGB) yield rose to its highest since April 2011 at 0.2%, while the 10-year JGB yield was up 1.5 basis points at 0.74%. [JP/]

"We've had enough hawkish rhetoric of late... from BOJ members that they're telling us what's likely to happen," said IG's Sycamore. "They have everything now in place whereby they can deliver that exit from negative interest rate policy."

While a stronger yen is typically bad for Japanese stocks, the Nikkei nonetheless rode global equities higher on Friday and was last up 0.67%.

CHINA HOPES

Elsewhere in Asia, Chinese stocks started the session on a strong footing, with blue chips rising 0.4% and the Shanghai Composite Index gaining 0.25%. Both indexes, however, were set to end the week little changed.

Hong Kong's Hang Seng Index jumped more than 1%.

Data on Thursday showed China's export and import growth in the January-February period beat forecasts, though that did little to turn battered sentiment around, as investors were left underwhelmed by the lack of details for strong stimulus from Beijing to shore up the country's economic recovery at this week's annual parliament session.

"China's 2024 National People's Congress met expectations with respect to key policy actions, but disappointed in terms of sentiment - market participants (were) clearly hopeful the new year would bring a more aggressive policy style," said Elliot Clarke, head of international economics at Westpac.

In commodity markets, Brent rose 31 cents to $83.27 a barrel, while U.S. crude gained 40 cents to $79.33 per barrel. [O/R]

Spot gold edged 0.1% lower to $2,157 an ounce after touching an all-time high of $2,164.09 in the previous session, as the prospect of an imminent Fed easing cycle boosted the appeal for the non-yielding yellow metal. [GOL/]

By Tetsushi Kajimoto

TOKYO (Reuters) - Japan's current account extended its surplus for a full year in January, Ministry of Finance data showed on Friday, as rises in overseas interest rates boosted gains from foreign bond holdings.

The data showed Japan's current account surplus stood at 438.2 billion yen ($2.96 billion) in January, compared with economists' median forecast for a deficit of 330.4 billion yen in a Reuters poll.

It followed 744.3 billion yen of surplus in December.

A breakdown of the data showed exports grew 7.6% year-on-year in January driven by demand for cars, car parts and chip-making equipment while imports fell 12.1% reflecting declines of coal, liquefied natural gas and communications equipment.

Primary income gains, or returns from past direct investment and portfolio investment overseas, saw Japan log a primary income surplus of 2.8516 trillion yen.

In addition, the current account data showed a record gain in travel account due to a boost from inbound tourism.

($1 = 148.0500 yen)

By Howard Schneider

WASHINGTON (Reuters) -Federal Reserve Chair Jerome Powell said on Thursday the U.S. central bank was "not far" from gaining the confidence it needs in falling inflation to begin cutting interest rates.

"I think we are in the right place," Powell said of the current stance of monetary policy in a hearing before the Senate Banking Committee. "We are waiting to become more confident that inflation is moving sustainably down to 2%. When we do get that confidence, and we’re not far from it, it will be appropriate to begin to dial back the level of restriction so that we don’t drive the economy into recession.”

The comment showed Powell's faith that recent higher-than-expected inflation readings and other strong economic data won't interrupt the ongoing decline in price pressures that took root last year.

The Fed chair has been reluctant to declare the inflation battle finished, and cautioned in testimony to the Senate panel, as he did Wednesday before the House Financial Services Committee, that further progress back to the Fed's 2% target was not assured.

The most recent data showed headline inflation, as measured by the Fed's preferred Personal Consumption Expenditures price index, at 2.4%, with a related measure of underlying inflation at a slightly higher 2.8%.

But both have been "coming down sharply since the middle of last year," Powell said. "We've got a ways to go on that, but we've made a lot of progress."

Yields on 2-year Treasury notes fell slightly after Powell's remarks, and investors firmed bets that an initial Fed rate cut would occur in June.

The central bank next meets on March 19-20, and will issue a new policy statement as well as updated rate and economic projections that should shed more light on policymakers' expectations for the year.

Powell's appearance before the Senate committee and a House panel on Wednesday, as is often the case in the twice-yearly round of hearings, was dominated less by monetary policy and more with an ongoing debate about Fed bank regulatory proposals, as well as a host of other issues, including housing policy and whether the Fed would issue a central bank digital currency.

But Powell's update on monetary policy kept intact the sense that the central bank is nearing the point where the current policy rate of interest, held at a more than 20-year high since July in a range between 5.25% and 5.5%, will be lowered in the months ahead.

Pressed at the start of the hearing by the panel's chair, Ohio Democrat Sherrod Brown, on why the Fed was not quicker to cut rates "to prevent workers from losing their jobs," Powell said that was a top-of-mind concern, while nodding also to the economy's resilience.

"We're well aware of that risk, of course, and very conscious of avoiding it," Powell said. "If what we expect and what we're seeing - continued strong growth, strong labor market and continuing progress in bringing inflation down - if that happens, if the economy evolves over that path, then we do think that the process of carefully removing the restrictive stance of policy can and will begin over the course of this year."

By Francesco Canepa and Balazs Koranyi

FRANKFURT (Reuters) - The European Central Bank is set to keep interest rates at record highs on Thursday and take baby steps towards cutting them in the coming months as inflation continues to fall despite stubbornly high underlying price pressures.

Having reacted too slowly to a sudden surge in prices two years ago, the central bank for the 20 countries sharing the euro is now reluctant to declare victory over the most brutal bout of inflation in decades.

It is universally expected to keep its policy rate at a record 4.0%, and ECB policymakers are likely to repeat that they need more evidence that inflation is under control and that ongoing wage increases will not give it another leg up.

But the ECB's new economic projections are likely to point to lower economic growth and inflation this year, which may require the central bank and its president Christine Lagarde to tweak their message slightly, without adding to already widespread rate cut bets.

"We expect a neutral policy stance and balanced communication, acknowledging the continued progress on inflation but avoiding a premature declaration of victory," said Frederik Ducrozet, head of macroeconomic research at Pictet Wealth Management.

Sources have been telling Reuters for months that the ECB is unlikely to reduce borrowing costs before its June 6 meeting as crucial data about wages will only become available in May.

This gives the ECB another meeting - on April 11 - to explicitly open the door to what ECB Chief Economist Philip Lane has said is likely be the first in a series of rate cuts.

"There is still no conclusive evidence that current high labour cost growth will not end up in higher consumer prices, feeding a wage-price spiral," Societe Generale (OTC:SCGLY) economist Anatoli Annenkov said. "Progress on core inflation could be slow, due to weak labour productivity dynamics, potentially slowing the rate cut path."

Investors have pencilled in 91 basis points of cuts in the 4% deposit rate this year with the first move seen in June, then several more steps with a pause or two along the way..

The ECB will announce its rate decision at 1315 GMT and Lagarde will hold a press conference at 1345 GMT.

INFLATION

Inflation has been coming down for nearly 18 months and it was 2.6% in February, slightly above the ECB's 2% target.

This was partly the result of a steep fall in fuel costs, which had been boosted by Russia's invasion of Ukraine, but also reflected the ECB's steepest ever increase in borrowing costs, which has brought lending to a standstill.

But inflation excluding volatile food and fuel prices was still at 3.1%, while it has hovered near 4% for services, a sector often seen as a proxy for wage growth.

"Disinflation is going much quicker than we expected on the headline level but we can't be certain yet about core inflation because wage developments remain unclear," ECB policymaker Peter Kazimir told Reuters in a recent interview.

His German colleague - and fellow policy hawk - Joachim Nagel also said the ECB should resist the temptation to make an early rate cut, and wait for wages data.

The ECB's quarterly macroeconomic projections, due to be published on Thursday, are nevertheless set to confirm the trend.

The inflation expectation for this year is likely to be cut from December's 2.7% projection on account of much lower gas prices. Economists polled by Reuters see 2024 inflation at 2.3%.

That means the ECB may hit its inflation goal later this year, rather than in 2025 as it has been expecting.

GDP growth for 2024 was also likely to be cut, reflecting a weaker-than-expected recovery, particularly in Germany.

Flagging growth and inflation has led several members of the ECB's policy-making Governing Council, including Spanish central bank chief Pablo Hernandez de Cos, to start talking about an upcoming rate cut. Greece's Yannis Stournaras has pointed to June as a likely date.

By Leigh Thomas

PARIS (Reuters) - France's mid-February emergency budget cuts to keep its deficit-reduction plans on track are unlikely to be the last, leaving the government struggling to strike a balance between financial imperatives and political realities.

The timing for any more cuts could hardly be worse, with annual European Union budget-vetting, credit rating agency updates and EU parliamentary elections that the French far right is likely to do well in all due in the next three months.

French Finance Minister Bruno Le Maire delivered bad news on Wednesday, saying last year's public sector budget deficit would likely be worse than expected when the accounts are finalised.

That follows his announcement in mid-February - not even two months into the fiscal year - of 10 billion euros ($10.9 billion) of budget cuts needed to keep the government's deficit-cutting plans on course in the face of weaker than expected growth.

"For a long time, public spending has been the solution to all of our problems. Now it risks becoming a problem for all of us," Le Maire told the lower house of parliament's finance committee on Wednesday.

"We need to take decisions to improve our public finances."

The ministry now expects the euro zone's second-biggest economy to grow only 1% this year instead of the 1.4% on which it had based its budget planning, targeting a budget deficit of 4.4% of economic output this year.

Le Maire told Le Monde newspaper on Wednesday that the 2023 public deficit would be "significantly above" the 4.9% target due to lower tax revenues, making this year's target a stretch without a bigger budget squeeze.

"There are two possibilities: either revising the deficit-reduction plans or coming up with additional budget savings. Bruno Le Maire is dropping hints that it will be new savings," said economist Charles-Henri Colombier with the Rexecode think tank.

TRICKY TIMING

Le Maire told lawmakers the overriding objective remained to cut the deficit to less than an EU limit of 3% of output by 2027, at the end of President Emmanuel Macron's five-year term, and even target a balanced budget by 2032.

The timing of the next steps is key as France must send annual deficit-reduction plans to its EU partners next month and ratings agencies are due to update their ratings in April and May.

The government will also be loathe to announce new cuts just before EU parliamentary elections in June, with the far right polling comfortably ahead of Macron's party.

Far-right leader Marine Le Pen criticised the government last week in Les Echos business daily for lacking deeper structural efforts to rein in spending, calling for expenditures on immigration and welfare fraud to be targeted.

But the government will also want to avoid a ratings downgrade, especially from S&P which has France on a negative outlook and next updates its rating on May 31, days ahead of the vote.

"The recent announcements make a downgrade more and more likely," Colombier said.

The first wave of budget cuts are wide-ranging, hitting subsidies for energy-efficient home renovations, development aid, public research and job training to name a few targets.

However, the 10 billion euros in cuts risk being partially offset by unbudgeted spending to benefit protesting farmers and extra support for Ukraine, said former public auditor Francois Ecalle, who also runs a public finance website.

That might make it necessary to pass new 2024 budget legislation as early as mid-year, just as the government is trying to find new savings for its 2025 budget.

Budget minister Thomas Cazenave told lawmakers on Wednesday that the savings needed for the 2025 budget were probably now closer to 20 billion euros rather than the 12 billion planned previously.

Any future waves of budget cuts are likely to hit welfare spending and local government, which so far have been largely spared.

Le Maire is pushing for unemployment benefits to be tightened. Economists say that raising pensions payouts less than the inflation rate might also be necessary despite being politically unpopular.

"We need to leave behind the French exception of being incapable for the last half century to reduce spending," Le Maire said.

($1 = 0.9190 euros)

(Reuters) -The U.S. government is urging the Netherlands, Germany, South Korea and Japan to further tighten curbs on China's access to semiconductor technology, Bloomberg News reported on Wednesday.

The U.S. wants Japanese companies to limit exports to China of specialized chemicals required for chipmaking, including photoresist, the report said citing people familiar with the matter.

Washington is also pressing the Netherlands to stop semiconductor equipment maker ASML (AS:ASML) from servicing and repairing chipmaking equipment for Chinese clients bought before limits on sales of those devices were put in place this year, a source familiar with the matter told Reuters, confirming part of the Bloomberg report.

Tokyo and The Hague want to assess the impact of their current curbs before considering tougher actions, the report said, adding that the U.S. Commerce Department officials raised the issue in Tokyo during a meeting on export controls last month.

The Dutch foreign ministry declined to comment on the report, while the U.S. Commerce Department did not respond to a request for comment.

An official at Japan's industry ministry said the ministry routinely discusses export controls with relevant countries.

ASML could not be immediately reached for comment.

American officials had earlier expressed particular concerns about China's ability to employ advanced chips, and the powerful processors they enable, for its fast-growing military.