Select Language

By Stephanie Kelly

NEW YORK (Reuters) -The U.S. government said on Thursday it approved a request from Midwestern governors allowing expanded sales of gasoline with higher blends of ethanol in their states, starting in 2025.

Reuters had exclusively reported the impending announcement earlier this week.

The government currently restricts sales of E15 gasoline, or gasoline with 15% ethanol, in summer months due to environmental concerns over smog, though the biofuel industry says those concerns are unfounded.

The corn-based ethanol industry has been fighting for years for year-round sales of E15 but was frustrated by the 2025 start date, one year later than proposed.

In 2022, the governors of Illinois, Iowa, Minnesota, Missouri, Nebraska, Ohio, South Dakota, and Wisconsin made the request for year-round E15 sales, saying the move could help lower pump prices by boosting fuel volumes.

Some oil refiners have argued that allowing E15 in select states as opposed to nationwide could prompt localized fuel price spikes and supply issues.

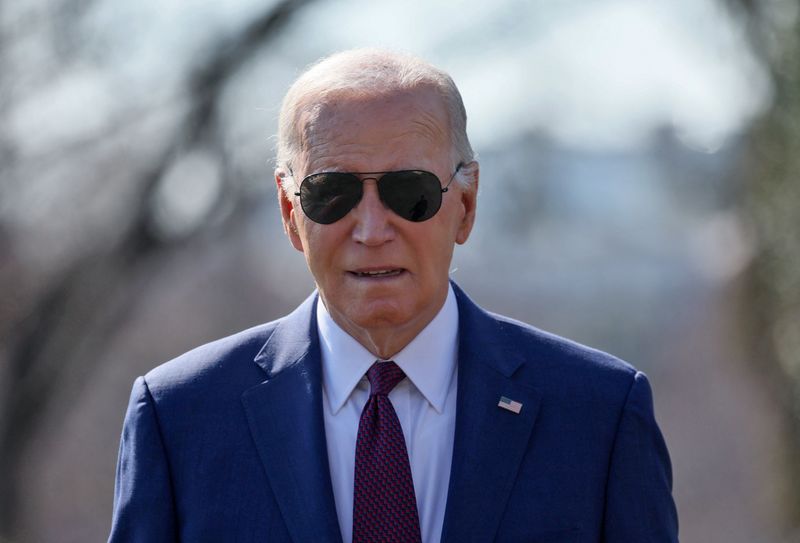

The delay enables President Joe Biden's administration to put off potential price spikes stemming from the decision until after the 2024 U.S. presidential election in November. Two states the decision affects, Wisconsin and Minnesota, are battleground states in this year's contest.

Inflation and the economy are key vulnerabilities for Biden's re-election campaign.

The Environmental Protection Agency had sent a final rule on the proposal to the White House in December with an effective date of April 28, 2024. The new timeline would push the effective date to April 28, 2025.

"By extending the implementation date, this final action reduces the risk of gasoline supply issues this summer and the price impacts that could have come with 2024 implementation," an EPA official said on Thursday.

The EPA did not comment on whether it would issue a temporary waiver enabling E15 sales this summer.

"We cannot speculate about the 2024 summer driving season. We will continue to monitor the situation, consult closely with the Department of Energy, and be prepared to act should conditions warrant," the agency said.

After the news, the Renewable Fuels Association, a biofuels trade group, called on the administration to take action to ensure consumers have access to E15 this summer, and said it was disappointed over the new rule's 2025 start date.

The American Petroleum Institute, an oil industry group, meanwhile, said it supported a legislative solution that would allow year-round sales of E15 nationwide.

By Anant Chandak

BENGALURU (Reuters) - Indian business activity expanded at its fastest pace in seven months in February as demand remained strong for both manufacturing and services, according to a business survey released on Thursday, which also showed an easing in price pressures.

That supports the findings in a Reuters poll which found India, the fastest growing major economy, is expected to continue to grow at a steady pace over the coming years.

HSBC's flash India Composite Purchasing Managers' Index (PMI), compiled by S&P Global, rose to 61.5 this month from January's final reading of 61.2, staying above the 50-mark that separates expansion from contraction for a 31st straight month.

"The pace of acceleration in the output of India's manufacturers and service providers, combined, was at a 7-month high in February. Encouragingly, new export orders rose sharply, particularly for goods producers," noted Pranjul Bhandari, chief India economist at HSBC.

The flash manufacturing PMI for February rose to 56.7 from last month's 56.5, its highest since September, and the preliminary services PMI was at a seven-month high of 62.0 from 61.8 in January.

New orders across the private sector continued to rise at a robust pace driven by demand in the dominant services industry, which expanded at the fastest pace since mid-2010. Factory output accelerated to a five-month high.

Overall international orders increased at the quickest pace since September.

That bolstered the view for the coming 12 months with optimism among manufacturers at the highest since December 2022. However, overall business confidence slipped from January's four-month high.

However, employment didn't increase for the first time since May 2022.

Although services companies noted a stronger increase in cost burdens than manufacturers, the flash data showed a moderation in cost pressures. Overall input prices rose at the weakest pace in three-and-a-half years.

"Producers were able to do both – lower the rate of increase in output prices and improve margins," added Bhandari.

That would likely provide comfort to the Reserve Bank of India, which is expected to keep its key repo rate unchanged before a first cut in the July-September quarter.

By Cynthia Kim and Jihoon Lee

SEOUL (Reuters) - South Korea's central bank on Thursday joined its peers in the U.S. and Australia in seeking to hose down investors' aggressive rate cut expectations after keeping interest rates at a 15-year high.

"Most board members still see it as premature to discuss any interest rate cuts as inflation is above our target level and we need to check its slowdown path," governor Rhee Chang-yong said in a news conference in Seoul. The Bank of Korea (BOK) kept interest rates steady at 3.50%, as expected by all 38 analysts polled by Reuters.

That echoes recent comments from Federal Reserve Chairman Jerome Powell, who has repeatedly said policymakers should be prudent in deciding when to make policies less restrictive and be confident inflation will continue falling.

The BOK's decision on Thursday to hold rates steady was a unanimous one.

However, Rhee on Thursday added one of the board's seven members said the door for a rate cut should remain open over the next three-months.

That was enough to keep the chance of a rate cut on investors' radar with South Korea's policy-sensitive three-year treasury bond futures rising during the news conference.

"I don't think that one board member's view signals an imminent rate cut but rather that the bank is slowly gearing up for a pivot towards interest rate cuts," said Kong Dong-rak, a fixed-income analyst at Daishin Securities, who sees the bank cutting rates in the third quarter of this year.

The consensus forecast from analysts is that the BOK will start cutting rates in the third quarter of this year, but that would largely depend on when the Federal Reserve starts easing, analysts say.

South Korea's 300 basis points of interest rate hikes have stalled economic growth in Asia's fourth-largest economy as construction investment took a hit from higher borrowing costs even as exports continued to improve.

Rhee said he still sees very little chance of rate cuts in the first half of this year as inflation, while cooling, is still above the central bank's target of 2%.

Consumer inflation hit a six-month low of 2.8% in January, still above the central bank's target but easing for a third straight month mostly due to falling oil prices.

The BOK kept its economic growth forecast for this year unchanged at 2.1% and inflation at 2.6%, it said along with the rate announcement.

Thursday's rate decision was the first for board member Hwang Kun-il, who began his three-year term on Feb. 13.

By Kevin Buckland

TOKYO (Reuters) - Japan's Nikkei share average climbed to the cusp of an all-time peak on Thursday after unexpectedly strong revenue forecasts from U.S. chip designer Nvidia (NASDAQ:NVDA) lifted Asian tech stocks.

However, the regional mood was tempered by a retreat in Chinese stocks from multi-month highs reached amid Beijing's efforts to boost market confidence.

Long-term U.S. bond yields hugged three-month highs while the dollar sagged after minutes from the last Federal Open Market Committee meeting confirmed the view that interest rate cuts would be slow in coming, but weren't markedly more hawkish that the Fed's previously expressed views.

The Nikkei 225 share average pushed as high as 38,924.88 for the first time since January 1990 - right when the so-called bubble economy peaked - before entering the midday recess up 1.7% from Wednesday at 38,913.84. Its all-time high is 38,957.44 set on Dec. 29, 1989.

MSCI's broadest index of Asia-Pacific shares outside Japan rose 0.07%, with a 0.71% rise for Taiwan's stock benchmark countered by losses in Hong Kong.

The Hang Seng slipped 0.41%, threatening to snap a seven-day winning streak. A subindex of tech shares slumped 0.84%.

Mainland blue chips oscillated throughout the session between small gains and losses.

Meanwhile, U.S. stock index futures signalled gains, following a mixed session on Wednesday for the main benchmarks. S&P 500 futures rallied 0.75% and tech-focused Nasdaq futures jumped 1.39%.

Following the closing bell overnight, Nvidia forecast a roughly 233% surge in quarterly revenue, sending its shares up some 10% after-hours.

The Nikkei has jumped about 16% already this year, with the S&P 500 and Nasdaq rallying some 5% each, driven in large part by mammoth expections for artificial intelligence (AI), with Nvidia's chips at the centre of that boom.

"Nvidia's earnings beat boosted sentiment and eased concerns over stretched valuations, providing room for the AI theme to continue to drive markets," Saxo Markets analysts wrote in a research note.

The 10-year U.S. Treasury yield eased slightly in Asian time on Thursday to 4.3068%, close to the 4.332% level marked a week ago and which had not been seen since the end of November.

The bulk of policymakers at the U.S. Federal Reserve's last meeting in January were concerned about the risks of cutting interest rates too soon, with broad uncertainty about how long borrowing costs should remain at their current level, minutes released on Wednesday showed.

That reinforced the view among traders that any rate cut is not imminent, with market pricing suggesting one-in-three odds for a first reduction in May, according to CME Group's (NASDAQ:CME) FedWatch Tool.

The dollar continued to retreat from a three-month high reached last week, when the U.S. dollar index, which tracks the currency against six major peers, reached 104.97. It was flat at 103.99 in early trading on Thursday.

The euro was little changed at $1.08195, while the yen was steady at 150.345 per dollar.

Elsewhere, oil prices rose slightly, adding to gains from the previous session that came amid signs of tighter supply. [O/R]

U.S. West Texas Intermediate crude futures (WTI) CLc1 rose 17 cents to $78.08 a barrel for the prompt month. The May contract gained 14 cents to $77.45 a barrel by 0150 GMT.

Brent crude for April delivery ticked up 14 cents to $83.17 a barrel, while the May contract added 13 cents to $82.24 a barrel.

Oil prices rose 1% on Wednesday, with refinery restarts in the United States supporting demand after a series of outages earlier cut U.S. refinery utilisation rates to the lowest level in two years.

By Trevor Hunnicutt and Jeff Mason

CULVER CITY, California/WASHINGTON (Reuters) -President Joe Biden said on Wednesday his administration is cancelling $1.2 billion worth of student loans for nearly 153,000 people who are eligible under a program used to make good on his promises to increase loan forgiveness.

Biden, a Democrat, last year pledged to find other avenues for tackling debt relief after the Supreme Court in June blocked his broader plan to cancel $430 billion in student loan debt.

Left-leaning progressive and young voters, whose support Biden needs to win re-election in November, have been vocal in advocating for student loan forgiveness on a wide scale. Republicans largely oppose such actions.

"While a college degree is a ticket to a better life, that ticket is too expensive," Biden said during a trip to California that has been focused primarily on fundraising for his re-election campaign.

Biden said the latest round of debt relief would be "a huge help to graduates of community college and borrowers with smaller loans, putting them back on track faster for debt forgiveness than ever before."

The administration has now canceled some $138 billion in student debt for nearly 3.9 million people through executive actions, the White House said.

The latest announcement applies to people enrolled in a repayment program known as Saving on a Valuable Education (SAVE) and covers those who borrowed $12,000 or less who have been repaying the money for at least 10 years.

The SAVE plan, according to the White House, takes into account a debt holder's income and family size when setting monthly payments and makes sure balances cannot grow from unpaid interest if the borrowers are making regular payments.

Recipients of the relief will receive an e-mail from Biden.

"I hope this relief gives you a little more breathing room," Biden writes in the note, provided by the White House. "I've heard from countless people who have told me that relieving the burden of their student loan debt will allow them to support themselves and their families, buy their first home, start a small business, and move forward with life plans they've put on hold."

By Karin Strohecker, Jorgelina do Rosario and Libby George

LONDON (Reuters) -The World Bank warned that high borrowing costs have "changed dramatically" the need for developing nations to boost sluggish economic growth.

The multilateral lender's latest warning comes as international bond sales from emerging market governments hit an all-time record of $47 billion in January, led by less risky emerging economies such as Saudi Arabia, Mexico and Romania.

However, some riskier issuers have started to tap markets at higher rates. Kenya recently paid more than 10% on a new international bond - the threshold above which experts often consider borrowing unaffordable.

"When it comes to borrowing, the story has changed dramatically. You need to grow much faster," Ayhan Kose, deputy chief economist of the World Bank, told Reuters in an interview in London on Tuesday, though he declined to comment on individual countries.

"If I had a mortgage with a 10% interest rate, I would be worried," he added.

Kose added that faster growth, especially a real growth rate higher than the real cost of borrowing, could prove elusive.

Data published by the Institute of International Finance on Wednesday showed global debt levels had touched a new record of $313 trillion in 2023 while the debt-to-GDP ratio - a reading indicating a country's ability to pay back debts - across emerging economies also scaled fresh peaks, indicating more potential strains ahead.

The World Bank warned in its Global Economic Prospects report, published in January, that the global economy was set for the weakest half-decade performance in 30 years during 2020-2024, even if recession is avoided.

Global growth is expected to slow for a third consecutive year to 2.4%, before ticking up to 2.7% in 2025.

Those rates are still well below the 3.1% average of the 2010s, the report showed.

The growth slowdown is particularly acute for emerging economies, around a third of which have seen no recovery since the COVID-19 pandemic and have per capita income below their 2019 levels. Kose said this throws many education, health and climate spending goals into question.

"I think that it's going to be difficult to meet those objectives, if not impossible, given the type of growth we have seen," Kose said.

An escalation of the Middle East conflict is a further downside risk, adding to concerns over tight monetary policy and weak global trade.

"Trade has been a critical driver of poverty reduction, and obviously for emerging market economies, a critical source of earnings," Kose said.

DEBT RESTRUCTURE

If growth remains low, some emerging economies might face having to restructure debt, Kose added, by reprofiling maturities or agreeing haircuts with creditors.

"Sooner or later you need to restructure the debt and you need to have a framework. That has not happened in the way the global community was hoping for."

G20 nations launched the Common Framework in 2020, when the pandemic upended nations' finances. The programme aimed to speed up and simplify the process of getting overstretched debt-distressed countries back on their feet.

But the process has been beset by delays, with Zambia locked in default for more than three years.

"If growth remains weak and financing conditions remain tight, you will not see an easy path out of this problem," Kose said. "But if growth magically goes up, it's like a medicine."

HONG KONG (Reuters) - China's housing authority said 123.6 billion yuan ($17.20 billion) of development loans have been approved and 29.4 billion yuan have been issued under a special mechanism aimed at injecting liquidity into the crisis-hit property sector.

Under China's "whitelist" mechanism launched on Jan. 26, city governments recommend residential projects to banks suitable for financial support, and coordinate with financial institutions to meet project needs.

The mechanism is a key plank of Beijing's efforts to stabilise the property sector's debt crisis and boost confidence in an industry that accounts for a quarter of China's GDP.

So far 214 cities across the nation have set up the mechanism, recommending more than 5,300 projects to banks, according to statement from the Ministry of Housing and Urban-Rural Development on Tuesday evening. Of this total, 29.4 billion yuan of loans involving 162 projects in 52 cities have been issued, it added.

Banks that decline any loans to the "whitelist" projects must provide a reason explaining their decision to the financial regulators, the ministry said.

The Hang Seng Mainland Properties Index rose 4% by midday on Wednesday, versus a 3% gain in the broader market.

China aims to ramp up financing for residential projects but banks' reluctance to lend to the sector could be a major obstacle for distressed developers most in need of funds.

Developers and analysts have said any such loans can only be used for ensuring the completion of selected projects, and cannot be used to repay debt or help regain financial strength.

($1 = 7.1842 yuan)

By Tetsushi Kajimoto and Maki Shiraki

TOKYO (Reuters) - Toyota Motor (NYSE:TM), the world's biggest automaker, held off on Wednesday from offering responses to its union's demand for hefty pay hikes and record bonuses, raising some uncertainty about expectations for rosy wage negotiations.

Toyota has long served as the pace-setter of Japan's annual spring labour-management wage offensive, and had accepted the union's demand in full on the first day of the annual wage negotiations in the past two years.

A spokesperson for the automaker said talks would continue onto the next round.

The labour-management talks are scheduled to take place two more times on February 28 and March 6, before formally offering 2024 pay hikes on March 13, along with other blue-chip Japanese companies. If Toyota agrees to the union's demands in whole, it would mark the fourth straight year of full acceptance.

The Federation of All Toyota Workers' Union demands record bonus payments worth 7.6 months of salary, while seeking monthly pay raises of up to 28,440 yen ($189.57) depending on job qualifications and occupation.

Japanese labour unions have entered this year's annual wage talks with demands for pay rises well in excess of last year's hikes, which were the biggest in more than three decades.

Many blue-chip companies are due to formally offer unions handsome pay increases on March 13, followed by small firms in the coming months.

Private-sector economists expect major firms to offer wage hikes of about 3.9%, the largest in 31 years. Excluding seniority-led pay scale, however, base pay that determines the strength of incomes, may undershoot rising prices, heaping downward pressure on real wages.

Prime Minister Fumio Kishida's government is counting on wage talks to drive sustainable pay hikes and stable inflation and put a decisive end to about two decades of deflation.

This year's labour talks will be closely watched by the Bank of Japan, which sees sustainable wage and price hikes as a prerequisite for the central bank to normalise monetary policy.

If workers manage to secure the expected wage hikes, that could lay the ground for the BOJ to exit its negative rates as early as in March or April.

($1 = 150.0200 yen)

By Ankur Banerjee

SINGAPORE (Reuters) - Asian stocks eased on Wednesday as diminishing expectations of early interest rate cuts from the Federal Reserve sapped risk appetite, with investors looking to the minutes of the U.S. central bank's last meeting for clues on the policy outlook.

MSCI's broadest index of Asia-Pacific shares outside Japan was 0.09% lower on Wednesday. Japan's Nikkei eased 0.21%, having stuttered in the last few days within sight of the all-time high set in 1989.

China stocks were mixed in early trading, a day after the biggest ever reduction in the nation's benchmark mortgage rate as authorities stepped up efforts to prop up the struggling property market.

On Wednesday, the blue-chip CSI300 index fell 0.6%, while Hong Kong's Hang Seng Index was 1% higher.

China's stock exchanges on Tuesday said major quant fund Lingjun Investment had broken rules on orderly trading and barred it from buying and selling for three days, as part of wider regulatory measures to revive market confidence.

While analysts welcomed the big mortgage rate cut they said more steps are needed to help turn sentiment around.

"I think we should be used to the PBoC's step-by-step behaviour by now," Alicia Garcia Herrero, chief Asia-Pacific economist at Natixis told the Reuters Global Markets Forum.

"So everything comes later than expected and in bits and pieces."

Overnight, U.S. stocks ended lower, with the Nasdaq showing the largest declines as chipmaker Nvidia (NASDAQ:NVDA) stumbled ahead of its highly awaited earnings report later on Wednesday. [.N]

On the monetary policy front, traders will get a chance to assess minutes of the Federal Reserve's last meeting later in the day for any further clues on when the U.S. central bank will start its easing cycle.

Data last week showed sticky U.S. inflation, prompting investors to push back expectations of an early start to the rate-cut cycle. Markets are now pricing in June as the starting point for easing, compared with March at the start of the year.

A slim majority of economists polled by Reuters expects the Fed to cut interest rates in June.

Markets now expects 92 basis points of cuts from the Fed this year, closer to Fed's own projection of 75 bps of easing and sharply below the 150 bps of cuts priced in by traders at the start of the year.

The changing rates outlook has buoyed the dollar this year and kept the yen, which is extremely sensitive to U.S. rates, near three-months low.

The yen weakened 0.03% to 150.05 per dollar, anchored to the key 150 level for the past few days, keeping traders on the watch for intervention from Japanese officials.

Japan's exports rose more than expected in January, helping ease some concerns about demand and output after data last week showed the economy unexpectedly tipped into recession in the fourth quarter.

Against a basket of currencies, the dollar index advanced 0.038% to 104.08, not far from the three-month high of 104.97 it touched last week.

In commodities, U.S. crude rose 0.17% to $77.17 per barrel and Brent was at $82.50, up 0.19% on the day. [O/R]

Iron ore futures were rooted to their lowest level in over three months, weighed down by mounting concerns over the demand outlook in top consumer China.

Spot gold added 0.1% to $2,024.91 an ounce. [GOL/]

By Jamie McGeever

(Reuters) - A look at the day ahead in Asian markets.

A fairly heavy sprinkling of Asian economic data and an interest rate decision in Indonesia dominate the regional calendar on Wednesday, as investors digest another uptick in Chinese stocks and brace for Nvidia (NASDAQ:NVDA)'s fourth quarter earnings report.

Stocks and risk appetite in Asia could fall at the open on Wednesday after worries over the U.S. chip designer and artificial intelligence leader's results slammed its shares and pushed the broader U.S. indexes into the red on Tuesday.

The 4.4% drop in Nvidia's shares was the biggest fall since October, and the Nasdaq lost 1%.

In Asia, stock markets in Hong Kong, China and Taiwan will be particularly sensitive to the results. These three regions accounted for 46% of Nvidia's revenue in the third quarter.

Investors will be keen to see whether Nvidia warns again that U.S. curbs on selling its chips to China are hurting its business and longer-term prospects. Nvidia has come up with new products for the Chinese market, but there is a risk that they will also be banned like its first round of China market chips.

Nvidia is also grappling with supply shortages at its Taiwan-based chip contractor TSMC, the world's largest contract chipmaker.

Hong Kong's Hang Seng has underperformed this year, and is currently down 4.7% year to date. The performance of its tech sector has been even more dismal - it is down 13%.

But the tentative recovery in Chinese stocks from recent five-year lows - the CSI 300 index of leading blue chips is now basically flat year-to-date - should lend support.

The Shanghai Composite and CSI300 are gunning for a sixth and seventh straight day of gains, respectively, which would be their longest winning streaks since January last year. China's interest rate cut on Tuesday could keep that run going.

Elsewhere on the policy front, Indonesia's central bank will keep its key seven-day repo rate unchanged at 6.00% on Wednesday, according to all 30 economists in a Reuters poll.

Opinion over the rest of the year is more mixed, but the median forecast is for Bank Indonesia to start cutting rates by 25 basis points in the second quarter, and by the same amount every quarter this year, down to 5.25% by the end of December.

Indonesia's inflation rate has stayed within BI's 1.5% to 3.5% target range since July, suggesting cumulative rate hikes of 250 basis points are working. The rupiah is down 1.7% against the dollar this year, but has performed better than many of its peers.

Elsewhere in Asia on Wednesday Japan releases its latest trade data and tankan surveys of manufacturing and non-manufacturing activity, South Korea publishes producer price inflation figures, and Australia releases hourly wage growth data for Q4 last year.

Here are key developments that could provide more direction to markets on Wednesday:

- Indonesia interest rate decision

- Japan trade (January)

- South Korea produce price inflation (January)

(By Jamie McGeever; Editing by Josie Kao)