Select Language

BEIJING (Reuters) -Profits at China's industrial firms extended gains for a second month in September, adding to signs of a stabilising economy as the authorities launched a burst of supportive policy measures.

The 11.9% year-on-year rise came on the back of a surprise 17.2% gain in August, and follows stronger-than-expected industrial and consumption activity over September.

For the first nine months, profits slid 9% from a year earlier, narrowing from a 11.7% decline in the first eight months, data from the National Bureau of Statistics (NBS) showed on Friday.

Industrial profits recovered quarter by quarter and swung to a 7.7% growth in the July-September period from declines over the previous two quarters, NBS statistician Yu Weining said in an accompanying statement.

The September number reflects an overall improvement in domestic industrial sector operations and a continued recovery in market demand, said Zhou Maohua, an analyst at China Everbright (OTC:CHFFF) Bank, adding the slowdown in year-on-year growth was due to a high base last year.

A fall in producer prices last month indicated that some industrial firms were still cutting prices to promote sales, putting a drag on overall industrial revenues and profits, Zhou said.

The improvement in industrial profits is expected to sustain in the coming months, partly due to the lag effect in domestic macro pump-priming, he added.

China's blue chip CSI300 Index gained 0.6% after opening lower in the morning session.

A run of recent data has pointed to a steadying in the world's second-largest economy, which expanded at a faster-than-expected clip in the third quarter after a rapid loss of momentum following a brief post-COVID bounce.

Analysts attribute the stabilisation to a series of policy measures rolled out in the past few months, but the persistent weakness in the crisis-hit property sector remains a major drag on the economy and corporate earnings.

Last week, Chinese battery giant CATL reported a sharp slowdown in profit growth in the third quarter, its weakest quarter since the start of last year amid slowing demand and stiff competition.

In his first remarks on policy following third-quarter gross domestic product data, China's central bank governor Pan Gongsheng vowed to bolster the economic recovery, with a focus on expanding domestic demand while curbing financial risks.

According to a breakdown of the NBS data, state-owned firms saw earnings fall 11.5% in the first nine months, foreign firms booked a 10.5% decline and private-sector companies recorded a 3.2% slide.

Industrial profit numbers cover firms with annual revenues of at least 20 million yuan ($2.73 million) from their main operations.

($1 = 7.3150 Chinese yuan)

By Stella Qiu

SYDNEY (Reuters) - Asian shares tracked Wall Street futures higher on Friday as Amazon (NASDAQ:AMZN) provided some welcome earnings relief, while bonds were able to sustain a rally amid signs U.S. inflation was easing.

All eyes were on U.S. data later in the session that may show core inflation growing 0.3% in September on a monthly basis, pushing the annual rate lower to 3.7% from 3.9% a month ago.

Overnight, the European Central Bank left interest rates unchanged as expected, sending the euro briefly to a two-week low. The dollar is is trading above the critical 150 yen level, with traders on guard for any signs of intervention ahead of the Bank of Japan policy meeting on Tuesday.

S&P 500 futures rose 0.4% while Nasdaq futures rallied 0.7%, driven by a 5% jump in Amazon shares in after-hours trading. In a statement after the U.S. close, the tech giant predicted higher holiday season sales and a stabilisation in its cloud business.

MSCI's broadest index of Asia-Pacific shares outside Japan bounced 0.6% on Friday after hitting a fresh 11-month low a day ago. It is, however, on track for a weekly loss of 1.2%.

Tokyo's Nikkei rose 1%, but was still down 1.2% for the week.

China's blue chips were flat, while Hong Kong's Hang Seng index surged 1%.

U.S. data overnight confirmed a resilient economy with inflation easing, feeding soft landing hopes. The U.S. economy grew almost 5% in the third quarter, but a slowdown in expected from here.

"The U.S. economy once again surprised on the upside with U.S. GDP accelerating in the third quarter of 2023," said Nathaniel Casey, an investment strategist at wealth management firm Evelyn Partners.

"However, as rising real yields continue to add pressure to the real economy, the resulting drag on consumption should start to put the brakes on the U.S. economy heading into the coming quarters."

Much attention was on underlying inflation, which subsided considerably last quarter, fuelling hopes that the closely watched U.S. personal consumption expenditures (PCE) for September on Friday - the Fed's preferred gauge of inflation - are likely to surprise on the downside as well.

Goldman Sachs lowered its forecasts for monthly core PCE by 1bp to 0.27% and headline PCE estimate by 1bp to 0.33%.

CME FedTool showed that any probability for a rate hike in November has been wiped out and traders trimmed bets for a December hike to 19.8%, compared with 29.3% a day earlier. Rate cuts next year are seen at about 70 basis points.

The benchmark yield on 10-year Treasury notes was up 2 basis points to 4.8657% after easing 10 basis points overnight. It breached 5% on Monday for the first time in 16 years.

The yen hit a fresh one-year low of 150.77 per dollar overnight and was last at 150.31. It was not far off the three-decade low of 151.94 it touched in October last year that led Japanese authorities to intervene in the currency market.

Speculation that the BOJ could raise an existing yield cap at its meeting next week is also keeping traders on edge.

Gold prices were flat at $1,985.79 per ounce, not far off a 2-1/2 month high of $1,997.09 hit earlier this month, as investors sought safe-haven assets amid the ongoing conflict in the Middle East.

Oil prices were higher on Friday, regaining ground after tumbling more than $2 a barrel in the previous session. They are, however, set for the first weekly drop in three weeks as the geopolitical premium built on fears that the Israel-Gaza conflict could spread and disrupt oil supply eases.

Brent crude futures climbed 0.5% to $88.38 a barrel while U.S. West Texas Intermediate was at $83.58 a barrel, up 0.4%.

HONG KONG (Reuters) - Hong Kong private home prices dropped 1.7% in September to the lowest since April 2017, official data showed on Friday, as rising interest rates and a bleak economic outlook weighed on homebuyer sentiment.

The September drop in home prices in the financial hub, one of the most expensive markets in the world, followed a revised 1.8% fall in August, according to data.

Five monthly falls in a row have erased gains made this year, and realtors expect prices will fall up to 5% for the full year.

Hong Kong's leader, John Lee, announced on Wednesday in an annual policy address that stamp duty would be halved to 7.5% from 15% for second home buyers and non-citizen buyers with immediate effect, to help revive a sector that is a pillar of the city's economy.

Martin Wong, head of Greater China research and consultancy at Knight Frank, said it would take time for the lower stamp duty to have an impact on purchasing power.

"With the market lacking other positive news, home prices will still face large pressure in the rest of this year," Wong said.

Other new adjustments to help the property market included allowing some home owners to sell their properties after two years without incurring hefty duties.

Some analysts, however, said the measures were only a band-aid solution that would be unlikely to reverse the downward trend in prices.

Wong said property developers had been cutting prices aggressively in order to clear inventory.

By Lucia Mutikani

WASHINGTON (Reuters) - The U.S. economy grew almost 5% in the third quarter, again defying dire warnings of a recession, as higher wages from a tight labor market helped to fuel consumer spending and businesses restocked at a brisk clip to meet the strong demand.

The fastest growth pace in nearly two years reported by the Commerce Department's Bureau of Economic Analysis on Thursday in its advance estimate of third-quarter gross domestic product was also spurred by a rebound in residential investment after contracting for nine straight quarters.

Government spending picked up. But business investment dipped for the first time in two years as outlays on equipment like computers declined and the boost faded from the construction of factories related to a campaign by President Joe Biden's administration to encourage more semiconductor manufacturing in the United States.

Though the blockbuster performance over the summer is likely not sustainable, it showcased the economy's stamina despite aggressive interest rate increases from the Federal Reserve. Growth could slow in the fourth quarter because of the United Auto Workers strikes, the resumption of student loan repayments by millions of Americans and the lagged effects of the rate hikes.

The report also showed underlying inflation subsiding considerably last quarter. Most economists have revised their forecasts and now believe the Fed can engineer a "soft-landing" for the economy, citing expectations that the July-September period will show a continuation of second-quarter strength in worker productivity and moderation in unit labor costs.

"We've seen for a period of time now a post pandemic induced negative bias about an imminent recession and persistent inflation," said Brian Bethune, an economics professor at Boston College. "But not only is the economy surprisingly resilient, we also got productivity-driven growth for two consecutive quarters in 2023, meaning the business cycle still looks very solid."

Gross domestic product increased at a 4.9% annualized rate last quarter, the fastest since the fourth quarter of 2021. Economists polled by Reuters had forecast GDP rising at a 4.3% rate. The economy grew at a 2.1% pace in the April-June quarter and is expanding at a pace well above what Fed officials regard as the non-inflationary growth rate of around 1.8%.

Growth in consumer spending, which accounts for more than two-thirds of U.S. economic activity, accelerated at a 4.0% rate after only rising at a 0.8% pace in the second quarter. It added 2.69 percentage points to GDP growth, and was driven by spending on both goods and services.

Though wage growth has slowed, it is rising a bit faster than inflation, lifting households' purchasing power.

The increase in wages last quarter was partially offset by a rise in personal taxes, resulting in income at the disposal of households after taxes falling at a 1.0% pace. That led to consumers tapping their savings to fund some of their spending. The saving rate dropped to 3.8% from 5.2% in the second quarter.

Stocks on Wall Street fell. The dollar rose against a basket of currencies. U.S. Treasury yields dipped.

SLOWDOWN AHEAD

The declining saving rate combined with the resumption of student loan repayments in October, which economists estimated was equal to roughly $70 billion, or around 0.3% of disposable personal income, could dent spending. Low-income consumers are increasingly relying on debt to fund purchases, with higher borrowing costs boosting credit card delinquencies.

Economists estimate that excess savings accumulated during the COVID-19 pandemic are mostly concentrated among high-income households and will run out by the first quarter of 2024. Some economists see a sharp slowdown around the corner, a concern shared by United Parcel Service (NYSE:UPS), which on Thursday cut its 2023 revenue forecast for the second straight quarter.

But others are not too worried, arguing that spending was not reliant on credit, but rather on the strong labor market and generous government transfers during the pandemic.

"It is too early to take slower growth for granted, especially after three quarters of consistently stronger-than-expected economic activity," said Chris Low, chief economist at FHN Financial in New York. "Any economist working on an update of their estimate of when pandemic savings will run out needs to tear it up and start thinking about what has allowed consumption to remain so strong. It is not borrowing."

Labor market resilience was highlighted by a separate report from the Labor Department on Thursday, showing initial claims for state unemployment benefits rose 10,000 to a seasonally adjusted 210,000 during the week ending Oct. 21, staying in the very low end of their range of 194,000 to 265,000 for this year.

The number of people receiving benefits after an initial week of aid, a proxy for hiring, increased 63,000 to 1.790 million for the week ended Oct. 14, the highest since early May. Economists were divided on whether this was a sign that the unemployed were experiencing longer spells of joblessness or reflected difficulties adjusting the data for seasonal fluctuations.

Inventory accumulation rose at an $80.6 billion pace last quarter, contributing 1.32 percentage points to GDP growth. Businesses relied on imports to restock, resulting in a small trade deficit that imposed a minor drag on GDP growth. Excluding inventories and trade, the economy grew at a solid 3.5% rate.

The GDP data likely has no impact on near-term monetary policy amid a surge in U.S. Treasury yields and a recent stock market selloff, which have tightened financial conditions.

Underlying price pressures abated further, with the price index for personal consumption expenditures (PCE) excluding food and energy rising at a 2.4% rate. That was the slowest pace since the fourth quarter of 2020 and followed a 3.7% pace of increase in the second quarter.

The so-called core PCE price index is one of the inflation measures tracked by the Fed for its 2% target. The U.S. central bank is expected to leave rates unchanged next Wednesday. It has raised its benchmark overnight interest rate by 525 basis points to the current 5.25% to 5.50% range since March of last year.

"From the Fed perspective there is little here to suggest any need to start lowering rates, nor does this suggest an imminent need to raise them again either," said Richard de Chazal, macro analyst at William Blair in London.

By Henry Romero and Diego Oré

ACAPULCO, Mexico (Reuters) -Hurricane Otis claimed the lives of at least 27 people, Mexico's government said on Thursday after one of the most powerful storms ever to hit the country hammered the beach resort of Acapulco, causing damage seen running into billions of dollars.

Otis, which struck Mexico Wednesday as a Category 5 storm, flooded streets, ripped roofs off homes and hotels, submerged cars and cut communications, road and air access, leaving a trail of wreckage across Acapulco, a city of nearly 900,000.

Four people are still missing, the government said.

"What Acapulco suffered was really disastrous," President Andres Manuel Lopez Obrador told a press conference in Mexico City tallying the damage from the storm, which ripped into southern Mexico with winds of 165 miles per hour (266 kph).

Otis, which intensified unexpectedly rapidly off the Pacific coast, was so powerful it tore large trees up by the roots, scattering debris all over Acapulco. It flooded hospitals, and hundreds of patients had to be evacuated to safer areas.

Erik Lozoya, a professional magician, said he endured "three hours of terror" with his wife and two baby daughters in an Acapulco hotel room as the hurricane smashed through the windows and swept through the building with a deafening intensity.

"It literally felt as though our ears were going to explode," said the 26-year-old Lozoya, who barricaded himself in a bathroom with his family and four others. "We saw mattresses, water tanks flying. The ceiling began to cave in."

The family left the bathroom, but the eighth-floor room soon began to flood, and Lozoya had to stand carrying his daughters with water up to his ankles for two hours because the wind was so strong they could not open the door to get out.

The hurricane peeled off sections of buildings in downtown Acapulco. Some Mexican media posted videos of looting in the city. Reuters could not immediately confirm their veracity.

The government has so far not estimated the cost of Otis, but Enki Research, which tracks tropical storms and models the cost of their damage, saw it "likely approaching $15 billion."

The people still missing are believed to be members of the navy, said Lopez Obrador, who went to Acapulco on Wednesday by road, changing his vehicle more than once as the storm caused him hold-ups, according to pictures published on social media.

One showed him sitting in a military jeep stuck in mud.

On Thursday afternoon, the government said the air traffic control tower of Acapulco's international airport was up and running again and that an air bridge enabling tourists to reach Mexico City would be operating from Friday.

SHOCKING POWER

Mexican authorities said Otis was the most powerful storm ever to strike Mexico's Pacific coast, although Hurricane Patricia, which slammed into the resort of Puerto Vallarta eight years earlier, whipped up even higher wind speeds out at sea.

Nearly 8,400 members of Mexico's army, air force and national guard were deployed in and near Acapulco to assist in cleanup efforts, the defense ministry said.

The destruction wrought by Otis has added to concerns about the impact of climate change, which many scientists believe will lead to more frequent extreme weather events.

Acapulco is the biggest city in the southern state of Guerrero, one of the poorest in Mexico. The local economy depends heavily on tourism, and Otis caused extensive damage to some of the most famous hotels on the city's shoreline.

Calling the storm "totally devastating," Guerrero state Governor Evelyn Salgado said 80% of the city's hotels had been hit by the storm and that authorities were working to restore electricity and reactivate drinking water pumps.

Operations at Acapulco's international airport remain suspended, officials said, citing structural damage.

School classes were canceled in Guerrero for a second day and opposition politicians criticized the government for a lack of preparedness in the face of the storm's onslaught.

Magician Lozoya said he and his family were not alerted by the hotel about the approach of hurricane until about 10:30 p.m. on Tuesday, barely 1-1/2 hours before Otis came ashore.

Lopez Obrador had issued a warning about two hours earlier on social media about the impending arrival of Otis.

Mexican oil and gas company Pemex said there was a enough gasoline and diesel for the port of Acapulco and the entire state of Guerrero. State power utility CFE had over 1,300 employees working to restore power it said on Wednesday evening, when some 300,000 people remained without electricity.

Telmex, the Mexican telecommunications firm controlled by the family of tycoon Carlos Slim, said it had restored its network in Acapulco by Thursday morning.

By Tetsushi Kajimoto and Leika Kihara

TOKYO (Reuters) -Japanese policymakers maintained their warning to investors against selling the yen on Thursday in the wake of the currency's renewed slide beyond 150 to the dollar, a level seen by traders as authorities' threshold for intervention.

"It's important for currency rates to move stably reflecting fundamentals. Excess volatility is undesirable," Deputy Chief Cabinet Secretary Hideki Murai told a regular news conference, when asked about the yen's declines. He declined to comment on whether Japan will intervene in the currency market.

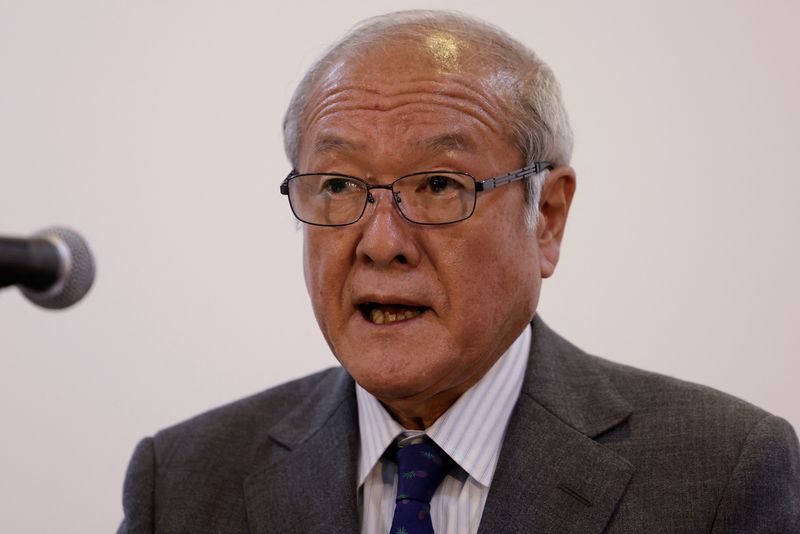

Finance Minister Shunichi Suzuki also told reporters earlier on Thursday that authorities were watching markets "with a sense of urgency," but did not make any comment about intervention.

The Japanese yen weakened to a fresh one-year low of 150.50 per dollar on Thursday and was not far off the 151.94 it touched in October last year, which prompted Japan to intervene in the currency market.

While a weak yen boosts exporters' profits, it has recently become a headache for Japanese policymakers as it inflates the cost of raw material imports and households' cost of living.

The comments on Thursday used softer language than those typically used ahead of intervention.

Authorities tend to escalate their warnings when currency intervention is imminent, saying they stand ready to take "decisive action" and that they won't rule out any options.

The yen's falls, driven by the gap between U.S. and Japanese interest rates, will likely keep pressure on the Bank of Japan to tweak its policy of capping long-term yields around zero.

Sources have told Reuters a hike to an existing yield cap set just three months ago is being discussed as a possibility in the run-up to next week's policy meeting.

Rising global yields and expectations of a near-term BOJ policy shift pushed up the benchmark 10-year Japanese government bond (JGB) yield to 0.885% on Thursday, hitting its highest since July 2013 and approaching the bank's 1.0% cap.

Japan's core inflation hit 2.8% in September, exceeding the BOJ's 2% target for the 18th straight month, heightening expectations the central bank will soon end negative short-term rates and its yield curve control (YCC) policy.

BOJ Governor Kazuo Ueda has stressed the need to keep monetary policy ultra-loose until the current cost-driven price rises shift to a more durable, demand-driven inflation.

With wages failing to rise enough to beat inflation, the government plans to compile a package of measures to cushion the blow to households from rising living costs that could include around $33 billion for payouts and income tax cuts.

By Xie Yu

HONG KONG (Reuters) - Asian stocks slid to 11-month lows on Wednesday, U.S. futures dropped and the dollar surged as Treasury yields spiked back toward peaks on fears that U.S. interest rates will stay high.

A rebound in U.S. home sales was the latest trigger for concern in the bond market. Corporate earnings have also been mixed. Alphabet (NASDAQ:GOOGL) shares logged their worst session since March 2020 overnight, dropping 9.5% as investors were disappointed with stalling growth in its cloud division.

MSCI's broadest index of Asia-Pacific shares outside Japan fell 1%. Japan's Nikkei fell 2%. Alphabet shares slid another 2% after hours and pulled Nasdaq futures down by nearly 1%.

The benchmark 10-year Treasury yield, a bedrock for pricing risk-taking across financial markets, jumped 11 basis points (bps) overnight and traded at 4.96% on Thursday.

"There is no anchor in U.S. treasuries," said Ben Luk, Senior Multi Asset Strategist at State Street (NYSE:STT) Global Markets.

"If (the 10-year yield) doesn't stay below 5%, then I think it's still going to be a very choppy market for both U.S. and Asia," he said.

"Once you have more stable treasury environment, you will have a clearer earnings revision story," he added, noting markets dominated by tech firms, which rely heavily on financing, will be vulnerable to higher rates due to borrowing costs.

Shares in Facebook (NASDAQ:META) parent Meta fell 4% on Wednesday and another 3% in after-hours trade after publishing results showing better-than-expected revenue but a cloudy outlook, with expenses seen topping Wall Street estimates.

Australian shares fell to a one-year low, as stronger-than-expected third-quarter inflation data raised bets that the central bank might raise rates next month.

The S&P/ASX 200 index retreated 0.7% to 6,854.20 in early trade, hitting its lowest level since Oct. 31, 2022.

In the currency markets, the dollar index hit a two-week high of 106.77.

The yen weakened past 150 per dollar, a level that has put traders on guard for intervention to support the Japanese currency. By 0300 GMT the yen was trading at a one-year low of 150.43 per dollar.

The Australian dollar fell to an almost one-year low of $0.6271 in morning trade. The head of Australia's central bank on Thursday said the strong third-quarter inflation report was around policymakers' expectations, and they were still considering whether it would warrant a rate rise.

The New Zealand dollar also hit a nearly one-year low at $0.5776.

In China, markets' bounce on news that China would issue a trillion yuan ($137 billion) in sovereign debt was quickly fading away, with mainland and Hong Kong indexes winding back gains. The Hang Seng fell 0.8%.

Oil prices slipped. U.S. crude dipped 0.15% to $85.26 a barrel. Brent crude fell to $90.05 per barrel.

Oil prices rose about 2% on Wednesday on worries about the conflict in the Middle East, but gains were capped by higher U.S. crude inventories and gloomy economic prospects in Europe.

Gold was slightly higher. Spot gold was traded at $1983.015 per ounce.

South Korea's economy fared better than expected in the third quarter with the expansion underpinned by exports, backing the case for the central bank to keep rates on hold for the months ahead.

The won fell sharply, in line with the dollar's broad gains.

($1 = 7.3181 Chinese yuan renminbi)

By Lucia Mutikani

WASHINGTON (Reuters) - The U.S. economy likely grew in the third quarter at its fastest pace of any quarter in nearly two years, again defying dire warnings of a recession, as higher wages from a tight labor market helped to power consumer spending.

The Commerce Department's advance estimate of third-quarter gross domestic product on Thursday is also expected to show residential investment rebounding after nine straight quarters of declines. Business investment is believed to have slowed as the boost fades from the construction of factories. President Joe Biden's administration has taken steps to encourage more semiconductor manufacturing in the U.S.

While the anticipated robust growth pace notched last quarter is probably not sustainable, it would demonstrate the economy's resilience despite aggressive interest rate hikes from the Federal Reserve. Still, growth could slow in the fourth quarter because of the United Auto Workers strikes and the resumption student loan repayments by millions of Americans.

Most economists have revised their forecasts and now believe the Fed can engineer a "soft-landing" for the economy, citing expectations that the July-September period will show a continuation of second-quarter strength in worker productivity and moderation in unit labor costs.

"We're seeing the exact opposite (of a recession)," said Sal Guatieri, a senior economist at BMO Capital Markets in Toronto. "The American consumer, the biggest engine of the U.S. economy seems to have had a mid-year resurgence, largely because confidence improved through the summer because of the rally in the stock market and steadier gasoline prices."

According to a Reuters survey of economists, GDP likely increased at a 4.3% annualized rate last quarter, which would be the fastest since the fourth quarter of 2021. The economy grew at a 2.1% pace in the April-June quarter and is expanding at a pace well above what Fed officials regard as the non-inflationary growth rate of around 1.8%.

Estimates ranged from as low as a 2.5% rate to as high as a 6.0% pace, a wide margin reflecting that some of the input data, including September durable goods orders, goods trade deficit, wholesale and retail inventory numbers will be published at the same time as the GDP report.

Consumer spending, which accounts for more than two-thirds of U.S. economic activity, was likely the main driver, with Americans buying long-lasting goods like motor vehicles as well as going to concerts. Spending on goods appears to have picked up considerably because prices have come down.

A strong labor market has supported consumer spending. Though wage growth has slowed, it is rising a bit faster than inflation, lifting households' purchasing power. Growth in consumer spending is expected to have exceed a 4.0% rate after only rising at a 0.8% pace in the second quarter.

SPEED BUMP AHEAD

Student loan repayments resumed in October, which economists estimated was equal to roughly $70 billion, or around 0.3% of disposable personal income, and could dent spending. Though excess savings accumulated during the pandemic remain ample, they are largely concentrated among high-income households.

Low-income consumers are increasingly relying on debt to fund purchases, with higher borrowing costs boosting credit card delinquencies.

As a result, some economists see a sharp slowdown around the corner. Others are not too concerned, noting the labor market continues to churn out jobs at a solid clip.

"We see scary headlines about credit card debt rising too fast, but it had fallen quite a bit during the pandemic," said Luke Tilley, chief economist at Wilmington Trust in Philadelphia. "When you look at it as a share of people's monthly flow of income, it's actually fairly normal. I don't think that we've hit a point where it's a canary in the coal mine."

Labor market resilience should be evident in a separate report from the Labor Department on Thursday, which is expected to show a modest rise last week in the number of people filing new claims for unemployment benefits from the previous week's nine-month low.

The GDP data probably will not affect near-term monetary policy as financial conditions have already tightened with U.S. Treasury yields surging while the stock market sold off.

Financial markets expect the Fed to keep interest rates unchanged at its Oct. 31-Nov. 1 policy meeting, according to CME Group's (NASDAQ:CME) FedWatch. Since March, the U.S. central bank has raised its benchmark overnight interest rate by 525 basis points to the current 5.25% to 5.50% range since March 2022.

"I think that (strong GDP report) has already been incorporated into their thinking," said Yelena Shulyatyeva, a senior economist at BNP Paribas (OTC:BNPQY) in New York. "This has been our view that we have reached the terminal rate for this business cycle."

Growth last quarter was also seen lifted by a smaller trade deficit, thanks to strong exports and increased inventory investment. No impact was expected from the auto strikes, which started in mid-September. But the labor dispute, which is costing auto makers millions of dollars per week, could weigh on growth in the fourth quarter.

"I see a speed bump because of the strikes," said Brian Bethune, an Economics professor at Boston College. "But I don't see that suddenly we'll get thrown overboard."

By Milounee Purohit

BENGALURU (Reuters) - Indian consumer spending during this year's festival season will be slightly better than in 2022, said economists polled by Reuters, but probably not enough to ramp up the speed of what is already the world's fastest-growing major economy.

The broadly optimistic survey data, taken together with expectations for 6.3% growth this fiscal year and next, suggest even with a dip in inflation, prospects for a Reserve Bank of India interest rate cut are still a long way off.

Battered during the pandemic, consumption, which makes up for about 60% of Asia's third-largest economy has been slow to reach its pre-COVID levels.

While consumer spending in the current quarter was predicted to provide some lift to the economy, the overall growth outlook for the year has remained largely unchanged.

Nearly 75% of economists, 25 of 33, said spending during this year's festival season, which lasts from October through December, will be higher compared to last year. Among those, 21 said slightly higher and four said significantly higher.

The remaining eight said slightly lower.

GDP growth will average 6.3% this fiscal year and next, based on the median forecasts of a wider sample of 63 economists in the Oct. 16-25 survey. The median forecast was almost exactly the same in a September poll, 6.2% and 6.3%, respectively.

"Festive demand could be substantial this time, and I think that bodes well for private consumption expenditure in Q4, and I hope it delivers that extra kick it does every year," said Dhiraj Nim, an economist at ANZ Research.

"From a year-on-year growth rate perspective, it may not be a substantial upside so to speak."

Economists generally agree India needs an even higher growth rate to generate enough jobs for millions of young people who enter the workforce every year.

The RBI's bulletin early this year said India needs to grow 7.6% annually for the next 25 years to become a developed nation. No economist in the poll expects India to grow at that rate this year or next.

"India's long-term success will ultimately depend on whether it can create enough adequate jobs to leverage its huge demographic dividend. At the moment, employment is largely concentrated in the low-productivity agricultural sector," said Alexandra Hermann at Oxford Economics.

"In the current services-based model, achieving sustainable and inclusive growth will be challenging, though not inconceivable."

When asked what was India's potential economic growth rate over the next 2-3 years, economists returned a median range of 6.0%-7.0%.

The survey also showed inflation averaging 5.5% this year and 4.8% in 2024, higher than the mid-point of the RBI's 2-6% target range.

The RBI was expected to leave its repo rate unchanged at 6.50% until at least end-June of next year, with the first 25 basis point cut forecast to come in the July-September quarter, poll medians showed.

(For other stories from the Reuters global economic poll:)

WASHINGTON (Reuters) - U.S. Treasury Secretary Janet Yellen said on Wednesday that $8.5 billion in COVID-era investments in community development financial institutions and minority-owned banking firms will boost lending to Black and Latino communities by nearly $140 billion over a decade.

Yellen said in prepared remarks to the Treasury's Freedman's Bank Forum that early reporting from the investment program indicates that one-third of total originations by recipient lenders were "deep impact" loans made to the hardest-to-serve borrowers.

"This is just the start," Yellen said of the Emergency Capital Investment Program (ECIP). "Over the next decade, we expect that ECIP will result in nearly $80 billion in increased lending in Black communities and nearly $58 billion in Latino communities."

The ECIP funding was authorized as part of a COVID-19 aid package approved by Congress in December 2020 and signed into law by then-President Donald Trump just before he left office. The program was implemented by the Biden administration.

Earlier on Wednesday, the Treasury announced a new goal to attract $3 billion in deposits to community development financial institutions and minority-owned banking institutions to help meet these lending targets, up from a $1 billion target for deposits reached in June.