Select Language

By Patricia Zengerle

WASHINGTON (Reuters) - U.S. Senate leaders said on Tuesday they expect President Joe Biden to send them a request by the end of this week for billions of dollars in assistance for Israel, Ukraine and Taiwan and for security at the U.S. border.

The size of the request was not known, but a congressional source familiar with the request said Israel had asked for $10 billion, as it responds to an attack on its citizens by the Iran-backed militant group Hamas.

Israel's request is not an indication that the Biden administration would request, or Congress would approve, that amount.

"We are going to do everything in our power to ensure the Senate delivers the support for Israel and the rest of the package. We intend to get the package the end of this week," the Senate's majority leader, Democratic Senator Chuck Schumer, told his weekly press conference.

The top Senate Republican, Senator Mitch McConnell, said he expected the request to include assistance for Israel, Ukraine and Taiwan, and said Republicans want it to include "something serious" for the border.

Top Biden administration officials will hold a classified briefing on Wednesday for the Senate on the situation in Israel and Gaza. Schumer said that Democratic Senator Bob Menendez, who faces charges of acting as an unregistered agent for Egypt, would not attend.

Menendez has denied wrongdoing.

LONDON (Reuters) - Artificial intelligence should improve pensions performance by cutting costs and highlighting upcoming risks, the Mercer CFA Institute's global pensions report said on Tuesday, with the Netherlands in top spot in this year's index.

Additional uses for AI could include building customised portfolios and identifying market anomalies, although AI was unlikely to be able to predict market movements with accuracy so uncertainty will remain, the report said.

"The ongoing expansion of AI within the operations and decisions of investment managers could lead to more efficient and better-informed decision-making processes, which could potentially lead to higher real investment returns to pension plan members," said David Knox, senior partner at Mercer.

The annual survey, which is sponsored by the CFA Institute association of investment professionals in collaboration with Mercer and the Monash Centre for Financial Studies, also pointed to risks of AI models generating fake information when used in a new context, and of cyber attacks against pension members' data.

The Netherlands scored top marks in the survey of 47 pension systems around the world for the level of private and public sector pension benefits available, the sustainability of the system to last decades into the future and the quality of its governance, knocking Iceland off last year's top position.

Iceland came second and Denmark third in the 2023 index.

By Lisa Pauline Mattackal

(Reuters) - The weak crypto market is wobbling through autumn. And winter's on its way.

The long-anticipated U.S. launch of a group of exchange-traded funds tracking ether offered fresh evidence of the malaise at a time when investors are running from risk amid economic gloom and war in Ukraine and the Middle East.

The six ETFs launched on Oct. 2 offering exposure to ether futures contracts pulled in just under $10 million in their first week of trading, according to CoinShares data. Ethereum products overall saw outflows of $7.5 million in the week to Oct. 13, the data shows.

"The timing of the futures ETFs could hardly be worse," said Vetle Lunde, senior analyst at K33 Research.

The week of Oct. 2 saw Treasury yields soar to their highest level in decades, while investors pulled money from riskier assets in the face of "higher-for-longer" interest rates.

Ether prices have dropped over 5% so far this month and the size of the cryptocurrency market has dipped from $1.15 trillion to $1.12 trillion, according to CoinGecko.

Trading volumes for the ether futures ETFs remained below $2 million on their first day, according to K33 Research. By contrast, the ProShares Bitcoin Strategy ETF, the first fund tracking bitcoin futures, saw around $570 million of inflows in its first day of trading in October 2021.

The contrast with ETF launches during the height of the crypto craze in 2021 show how the institutional investors who drove much of the demand back then have retreated from digital assets as the macro picture has grown murkier and murkier.

Crypto ETFs have experienced a slowdown in activity for months, with Lunde noting bitcoin ones globally had seen net outflows of 11,157 bitcoin between Aug. 1 and Oct. 3. Such funds are favored by many traditional investors as they offer easier access via regular stock exchanges without needing to directly hold crypto.

Ben McMillan, chief investment officer at IDX Digital Assets, said his firm was positioning investments more defensively until there was more clarity around Federal Reserve policy and the likelihood of a recession.

"Investors are battening down the hatches and looking at how to make their portfolios more defensive," McMillan added. "Speculative assets - even with a compelling growth thesis - are just a much lower priority now."

BACK TO BITCOIN?

Bitcoin's status as the original "digital gold" has supported it somewhat, outperforming ether with declines of about 2% this month. Bitcoin-focused ETFs saw inflows of $43 million in the week of Oct. 2, while bitcoin's share of the cryptocurrency market cap has crept up to 48% from 47%.

Ether prices have risen 32% this year, lagging bitcoin which is up over 70%.

The newly launched ETFs tracking solely ether futures on the Chicago Mercantile Exchange, from ProShares, VanEck and Bitwise, have all dipped over 6% since launch.

ProShares and Bitwise also launched funds tracking a mixture of bitcoin and ether futures, while Valkyrie Funds converted its pure-play bitcoin ETF into one with exposure to both bitcoin and ether. These dual-exposure funds have performed better, with Bitwise's and ProShares' down about 3% and Valkyrie's edging up 0.3%.

McMillan at IDX noted that while the response to the ether futures ETFs has been underwhelming, factors such as the use of the Ethereum blockchain by large financial firms in tokenizing assets could bring investors back to the table.

"Right now, the macro backdrop is dominating everything."

By David Brunnstrom and Michael Martina

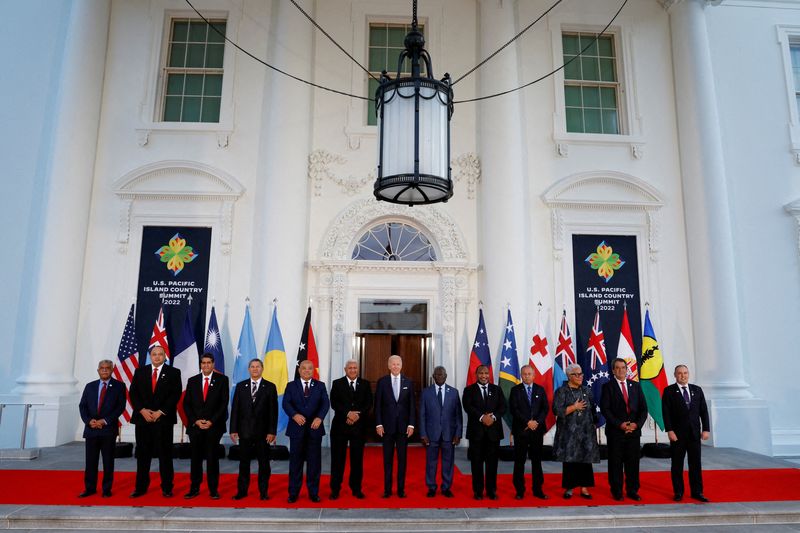

WASHINGTON (Reuters) -The United States signed a new 20-year agreement on Monday on economic assistance to the Marshall Islands worth $2.3 billion to the strategic Pacific island nation, chief U.S. negotiator Joseph Yun told Reuters.

The Republic of the Marshall Islands (RMI) is one of three sprawling but sparsely populated nations that have U.S. ties governed by so-called Compacts of Free Association (COFAs), under which Washington is responsible for their defense and provides economic assistance, while gaining exclusive military access to strategic swathes of ocean.

After decades of relative neglect, the nations have found themselves at the center of a U.S. battle for influence with China in the Northern Pacific and the Biden administration agreed new deals with the two other states, Palau and Micronesia, earlier this year.

It had been haggling for months over details with the RMI, which had called on Washington to better address the legacy of nuclear testing there in the 1940s and 1950s.

Yun said he signed the agreement with RMI Foreign Minister Jack Ading in Honolulu, Hawaii, at a ceremony also attended by Marshallese President David Kabua.

"All signed," he said "This is the last of the three compacts that we have been doing. The other two have been done."

He said the next step was for all three COFA agreements to go to the U.S. Congress for approval, adding: "I hope they will be enacted soon."

Yun, appointed last year by President Joe Biden to negotiate the COFA agreements, said Washington would be providing the Marshall Islands with $2.3 billion over the next 20 years, made up of grant assistance and trust-fund contributions.

He said the grant assistance would go to areas such as education, healthcare, environment and infrastructure, and added: "In terms of trust fund, the money, where it goes to, the new trust-fund money is determined by the Marshallese government."

Analysts and former officials had blamed a delay in finalizing the Marshall Islands COFA on U.S. State Department lawyers wanting to control how new funds were spent and objecting to their being earmarked to address the nuclear legacy, fearing this could lay the U.S. open to more claims.

A person familiar with the deal said all current federal programs, including education programs and the U.S. Postal Service, are set to continue. The outlays also include money for long-neglected civilian infrastructure around the crucial U.S. missile test range on Kwajalein Atoll, the source said.

The Biden administration had hoped to see Congress endorse new funding for the three COFA totaling $7.1 billion over 20 years by Sept. 30, but that did not prove possible amid budget haggling in the U.S. Congress.

A 45-day stopgap funding measure passed by Congress last month averted a U.S. government shutdown but has left potential funding shortfalls for the COFA states until their deals can be endorsed by the U.S. legislature, which analysts and former officials said makes the U.S. allies economically vulnerable and possibly more receptive to Chinese approaches.

BEIJING (Reuters) - Russian President Vladimir Putin arrived in Beijing on Tuesday to meet with his Chinese counterpart Xi Jinping on a widely watched trip aimed at showcasing the deep mutual trust and "no-limits" partnership between China and its giant neighbour.

Putin and his entourage flew into the Beijing Capital International Airport on Tuesday morning, according to Reuters video footage, in the Kremlin chief's first official trip outside of the former Soviet Union this year.

Putin has travelled little abroad since the Hague-based International Criminal Court (ICC) issued an arrest warrant for him in March, accusing him of illegally deporting children from Ukraine. Putin visited Kyrgyzstan, a former Soviet republic, earlier this month.

The ICC's move obliges the court's 123 member states to arrest Putin and transfer him to The Hague for trial if he sets foot on their territory. Neither Kyrgyzstan nor China are members of the ICC, established to prosecute war crimes.

Xi last saw his "dear friend" in Moscow just days after the warrant was issued. At the time, Xi invited Putin to attend the third Belt and Road forum in Beijing, an international cooperation forum championed by the Chinese leader. Putin will meet with Xi on Wednesday.

Beijing has rejected Western criticism of its partnership with Moscow even as the war in Ukraine showed no sign of ceasing, insisting that their ties do not violate international norms, and China has the right to collaborate with whichever country it chooses.

Putin last visited China for the Beijing Winter Olympics in February 2022 when Russia and China declared a "no-limits" partnership days before the Russian president sent tens of thousands of troops into Ukraine.

It would be Putin's third attendance of the Belt and Road Forum, which runs through Wednesday. He attended the two previous forums in 2017 and 2019.

BELT AND ROAD

The forum centres on the Belt and Road initiative, a grand plan launched by Xi a decade ago that he hopes would build global infrastructure and energy networks connecting Asia with Africa and Europe through overland and maritime routes.

Putin has praised the initiative, saying it is a platform for international cooperation.

"In my opinion, the main advantage of the cooperation concept proposed by China is that within the framework of cooperation, no one imposes anything on others," Putin told Chinese media ahead of his visit.

"This is the difference between President Xi Jinping's Belt and Road Initiative and other projects pursued by countries with a colonialist flavour," Putin was quoted as saying.

Since the start of the Ukrainian conflict, Russia has cemented its energy ties with China in a sign of their economic cooperation.

Russia exports around 2.0 million barrels of oil per day to China, more than a third of its total crude oil exports. Moscow also aims to build a second natural gas pipeline to China.

While the heads of Russia's oil and gas giants Rosneft and Gazprom (MCX:GAZP) will be part of Putin's travelling delegation, no new deals in energy can be expected.

The trip is not a "full-fledged bilateral" visit, but one made on the sidelines of an international conference, according to the Kremlin.

Ghana's Finance Minister, Ken Ofori-Atta, announced on Monday a significant debt reduction plan under a $3 billion International Monetary Fund (IMF) bailout. The country aims to reduce its debt to 55% of GDP by 2028, a significant decrease from the current level of 109%.

Ofori-Atta revealed the plans during a livestreamed investor presentation, where he discussed ongoing negotiations with bondholders, including those holding $13 billion of public Eurobonds. The restructuring terms under consideration include haircuts between 30% and 40%, coupons not exceeding 5%, and final maturities not surpassing 20 years.

Alongside these efforts, Ghana is in the process of reaching an agreement with bilateral lenders. This agreement will be discussed in an upcoming IMF board meeting and will serve as the foundation for negotiations with commercial and external creditors under the Group of 20 Common Framework for Debt Treatment.

Ghana's $77 billion economy is restructuring a large part of its $50 billion public debt under this framework. The expanded Paris Club of sovereign creditors, which includes China, is part of this initiative. The government plans to achieve its ambitious debt reduction target through domestic debt restructuring and fiscal adjustments. It expects the agreement with external creditors to provide the remaining relief needed to reach its target.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.

LONDON (Reuters) -Geopolitics are at the forefront of everyone's minds after war broke out between Israel and Palestinian militant group Hamas, and the mood in markets is jittery at best.

This week might offer some reassurance that both households and businesses are holding up in an uncertain macro environment as some of the world's biggest companies report earnings, and economic data offers a look at growth, wages and consumer spending in the likes of the Unites States, China and Britain.

Here's your week ahead in markets from Kevin Buckland in Tokyo, Lewis Krauskopf in New York, and Naomi Rovnick, Karin Strohecker and Amanda Cooper in London.

1/ EARNINGS HEAT UP

A number of major U.S. companies report results, revving up a third-quarter earnings season expected to show a pickup in profit growth after a tepid first half.

Tesla (NASDAQ:TSLA) kicks off earnings for the megacaps on Oct. 18. These companies' shares have been key drivers of the equity rally in 2023.

Bank of America and Goldman Sachs both report Oct. 17. Other heavy hitters include healthcare giant Johnson & Johnson (NYSE:JNJ) on Oct. 17, Netflix (NASDAQ:NFLX) on Oct. 18 and Philip Morris International (NYSE:PM) on Oct. 19

In economic data, U.S. retail sales for September, due on Tuesday, will provide a key look into the health of the consumer. Investors are keen to determine if the economy can avoid a hard landing. U.S. retail sales increased more than expected in August as a surge in gasoline prices boosted receipts at service stations.

2/ CASTLES OF SAND The clock is ticking loudly for China's biggest private property developer. Country Garden has until Tuesday to meet coupon payments or have all its nearly $11 billion in offshore debt deemed in default. It's not alone. Companies accounting for 40% of Chinese home sales have defaulted since 2021, when a liquidity crisis hit the sector, which accounts for about a quarter of the economy. Beijing has rolled out a raft of measures recently, but with little impact on home sales. There have been reports the government is looking to increase its budget deficit to meet this year's 5% growth target. Recent data already suggests the worst may be over for parts of the economy. Wednesday could bring confirmation, with the release of GDP, industrial output and retail sales figures.

3/ POLES TO THE POLLS

Poles voted for a new government in a high-stakes election on Sunday, following a tight, unpredictable race in central Europe's largest economy. The cost of living and migration are key domestic issues, but the vote will shape Poland's - currently frayed - ties with Brussels, and also be hugely consequential for European elections in summer 2024.

Ruling nationalist Law and Justice party (PiS) was ahead in the election, but looked likely to fall short of a majority, according to a late exit poll on Monday. The risk is such an outcome could lead to fragile government, or even a political vacuum, which could bring more pain for the zloty, domestic bonds and the country's stock markets.

On Sunday, business heir Daniel Noboa won Ecuador's presidential election with more than 52% of the vote, while Argentinians head to the polls on Oct. 22.

4/ BANK ON SOME OPTIMISM

Storm clouds are brewing over European banking stocks as the boost from higher interest rates fades and recession risks rise, but some big investors are hanging on to shares.

Banks have long underperformed the region's main stock market. And just ahead of quarterly earnings next week, European bank shares are sporting a dividend yield of almost 8%, making them cheaper on this basis than during the 2008 global financial crisis.

Banks have had a major boost from hiking their loan costs in line with central bank rates.

Analyst forecasts collated by European asset manager Amundi show European banks are expected to grow adjusted earnings by 25% this year, followed by a 6% gain in 2024.

5/ THE OLD LADY'S DILEMMA

Poor Old Lady of Threadneedle Street. The Bank of England (BoE) has been constantly wrongfooted by inflation data for months. For most of the year, it's come in above expectations and well above the central bank's own forecasts. Suddenly in August, it slowed more than expected. Many believe the data pushed the BoE to leave rates unchanged at its last meeting.

That said, inflation is still over three times the BoE's 2% target and growth isn't exactly stellar. Meanwhile, at the last count, the labour market was starting to cool, but basic pay grew at its fastest rate on record - making the BoE's juggling act even tougher.

More surprises on Oct. 17 and 18, when employment and inflation data land, respectively, could set an awkward scene for the BoE's November meeting a little over two weeks later.

By Rae Wee

SINGAPORE (Reuters) - The dollar came off highs in Asian trade on Monday, but held at elevated levels as Middle East tensions escalated, and investors awaited clues to the outlook for U.S. interest rates from a speech by Federal Reserve Chair Jerome Powell later this week.

The dollar stayed near a one-week high against the euro and sterling as risk sentiment remained fragile.

The euro was last 0.13% higher at $1.05265, having slid to a one-week low of $1.0496 on Friday.

Sterling gained 0.13% to $1.2160, steadying from Friday's one-week low of $1.2123.

The dollar index fell 0.07% to 106.49.

"I view what's going on in Israel as a regional conflict, which typically does not have meaningful impacts on financial markets over time," said David Chao, Invesco's global market strategist for Asia Pacific ex-Japan.

"I don't see it altering growth trajectories of the major economies nor does it make the Fed more hawkish. If anything, I think the Fed is less inclined to tighten going forward given the perception of heightened risks."

Elsewhere, the Israeli shekel slid to a more than an eight-year low of 3.99 per dollar, after the country's Prime Minister Benjamin Netanyahu vowed on Sunday to "demolish Hamas" as his troops prepared to move into the Gaza Strip.

The shekel has fallen more than 3% against the dollar since gunmen from the Palestinian group Hamas rampaged through Israeli towns on Oct. 7.

The yen was last 0.1% stronger at 149.39 per dollar, edging away from the sensitive 150-level. Some traders expect an increased potential for Japanese authorities to intervene to suppot the yen if it weakens past that level.

Carry trades funded by the yen could be the biggest casualty of further escalation in the war, analysts said, as global investors who have for months been shorting the yen to invest in higher-yielding currencies buy it back as a safe-haven.

"Obviously war is inflationary, disrupts growth and threatens risk assets," said James Malcolm, head of FX strategy at UBS in London.

"The largest overhang I can see in this regard is dollar-yen, where the BOJ must pivot regardless and the carry trade that has built up now amounts to nearly half a trillion dollars."

The BOJ has continued to maintain its ultra-easy policy settings although markets are rife with speculation that it could move to gradually exit from the accommodative stance sooner rather than later.

If the BOJ does start its exit, the yen's yield gap against the dollar could narrow, but that depends on what the Fed decides on U.S. rates.

Traders were keenly awaiting Powell's speech before the Economic Club of New York later this week for clues on how much further U.S. interest rates could rise, after data last week showed consumer prices increased more than expected in September.

Markets are largely expecting the Fed to keep rates on hold when it announces its next monetary policy decision in November, according to the CME FedWatch tool, though they see a roughly 32% chance the central bank could deliver a rate hike in December.

In other currencies, the Australian dollar, often used as a proxy for risk appetite, gained 0.45% to $0.63255, after sliding 1.4% last week.

The New Zealand dollar rose 0.65% to $0.5923.

New Zealand's centre-right National Party led by Christopher Luxon will form a new government with its preferred coalition party ACT, as Prime Minister Chris Hipkins conceded his Labour Party could not form a government after Saturday's general election.

"The kiwi dollar jumped... following a clear and decisive victory of New Zealand's opposition National Party," said Kyle Rodda, senior financial market analyst at Capital.com.

"It appears the Nationals are in the position to win power while only requiring one coalition partner, excluding the populist New Zealand First party.

"The kiwi has jumped on the prospect such dysfunction has been avoided."

(This Oct. 13 story has been refiled to correct the spelling of Hiroshi Watanabe's name in paragraph 1)

By Leika Kihara

MARRAKECH, Morocco (Reuters) - Hiroshi Watanabe, Japan's former top currency diplomat, recalls how Chinese policymakers eagerly studied ways to avert a Japan-style burst of an asset bubble that led to prolonged deflation and economic stagnation - until around 2015.

"Then they stopped. In the past seven to eight years, they seem to be ignoring everything they learned," said Watanabe, who retains close ties with incumbent policymakers. "Under the Xi administration, China probably shifted its attention away from economics," he told Reuters.

Now, China may be paying the price. Inflation is stalling and its deepening real estate crisis was identified as among the biggest risks to global growth during the International Monetary Fund and World Bank meeting being held in Marrakech Oct. 9-15.

The world's second-largest economy is in the spotlight as a country on the brink of "Japanization," a term describing Japan's 15-year period of low growth and deflation after the burst of an asset-inflated bubble in the late 1990s.

Some Japanese policymakers are voicing concern partly since a prolonged slump in Japan's biggest trading partner will deal a huge blow to their export-reliant economy.

"What's fast emerging is the risk of China slipping into deflation, or the 'Japanization' of its economy," Bank of Japan (BOJ) board member Asahi Noguchi said on Thursday.

"It's not clear yet whether China is heading toward a situation similar to Japan. But it's true China's real estate sector - the backbone of its economy - is slumping, youth job losses are rising and inflation is weakening," he said in Japan.

In its World Economic Outlook, the IMF cut China's growth forecast for this year to 5.0% from 5.2% in April, and warned that its property sector crisis could deepen with global spillovers. It projects growth to slow to 4.2% next year.

Data showed on Friday China's consumer inflation was flat in September, missing forecasts for a 0.2% gain, highlighting the deflationary pressure China faces even as many other countries combat too-high inflation.

Back during its deflationary period from 1998 to 2013, Japan saw core consumer prices fall 0.2% on average, as slumping property prices hit bank balance sheets and cooled investment.

To be sure, there are differences between what is happening in China and the experience of Japan. For one, China's balance sheet stress and debt overhang are contained to the real estate sector, notably among troubled developers and local provinces.

That contrasts with Japan, where slumping property prices left banks nationwide with a huge pile of bad loans, causing a broad-based credit crunch that prolonged the economic downturn.

For now, the IMF does not see a big risk of China sliding into deflation with inflation seen accelerating, backed by a recovery in demand, Krishna Srinivasan, director of the lender's Asia and Pacific Department, told a briefing on Friday.

But he urged Beijing to take measures, such as supporting the restructuring of distressed developers and offering guidance to local provinces, to avoid the troubles from broadening.

"Overall, we believe that China can avoid a prolonged period of sub-par growth with the right policies," Srinivasan said, when asked about the chance of "Japanization" in China.

"The point we're trying to make is that it's important to address the property crisis head on, so that it doesn't become a bigger problem."

LONDON (Reuters) - Britain and South Korea have agreed to extend a period of low or zero tariffs on bilateral trade by two years, ahead of talks to forge a new trade deal, the British government said on Monday, in a boost for the car industry.

Without the extension, British businesses, such as automakers and food and drink companies, would have faced high tariffs from Jan. 1 on exports of products made using materials from the European Union, under so-called rules of origin, and on products shipped via the EU.

Annual trade between Britain and South Korea is worth 18 billion pounds ($21.9 billion), and the two sides will begin talks later this year on a new trade deal. Their current agreement was rolled over from Britain's membership of the EU.

Britain's minister for international trade, Nigel Huddleston, said extending the tariff-free period would provide welcome certainty for businesses.

"This is fantastic news for UK businesses who can continue selling their fantastic goods with confidence to South Korea," Huddleston said.

South Korea is the seventh-biggest export market for British-made cars and the third-largest supplier of new cars for Britain, meaning any new tariffs "would have been bad for both sides," said Mike Hawes, the head of the British car industry trade body.

"We look forward to the start of negotiations and swift conclusion of a modernised trade deal that delivers more benefits to our respective automotive sectors, in particular boosting trade in EVs and related technologies," Hawes, the Chief Executive of the Society of Motor Manufacturers and Traders, said.

($1 = 0.8237 pounds)