Select Language

Nevertheless, a quarterly central bank survey suggested the headwinds from the slowing global economy have yet to be fully felt by manufacturers, with the business mood holding up and companies retaining robust spending plans.

That opens up the risk that things could get much bumpier in the coming months, especially as worries over slow global growth join nervousness around the outcome of the U.S. presidential election next month and an escalating conflict in the Middle East.

($1 = 149.5400 yen)

By Makiko Yamazaki

TOKYO (Reuters) - Japan's exports fell for the first time in 10 months in September, data showed on Thursday, a worry for policymakers as any prolonged weakness in global demand will delay plans for a further interest rate hike.

Soft demand in China and slowing U.S. growth have been cited by analysts as a key risk factor for Japan's export-reliant economy and one that could complicate the central bank's path toward fully exiting years of ultra-easy monetary policy.

Total exports dropped 1.7% year-on-year in September, Ministry of Finance data showed, missing a median market forecast for a 0.5% increase and following a revised 5.5% rise in August.

Exports to China, Japan's biggest trading partner, fell 7.3% in September from a year earlier, while those to the United States were down 2.4%, the data showed.

Imports grew 2.1% in September from a year earlier, compared with market forecasts for a 3.2% increase.

As a result, Japan ran a trade deficit of 294.3 billion yen ($1.97 billion) for September, compared with the forecast of a deficit of 237.6 billion yen.

Bank of Japan (BOJ) Governor Kazuo Ueda has highlighted external risks such as U.S. economic uncertainties in his recent dovish commentary, emphasising that policymakers can afford to spend time scrutinising such risks in timing the next interest rate hike.

While the BOJ is expected to keep interest rates steady at its Oct.30-31 meeting, it will roughly maintain its forecast for inflation to stay around its 2% target through March 2027, according to sources familiar with its thinking.

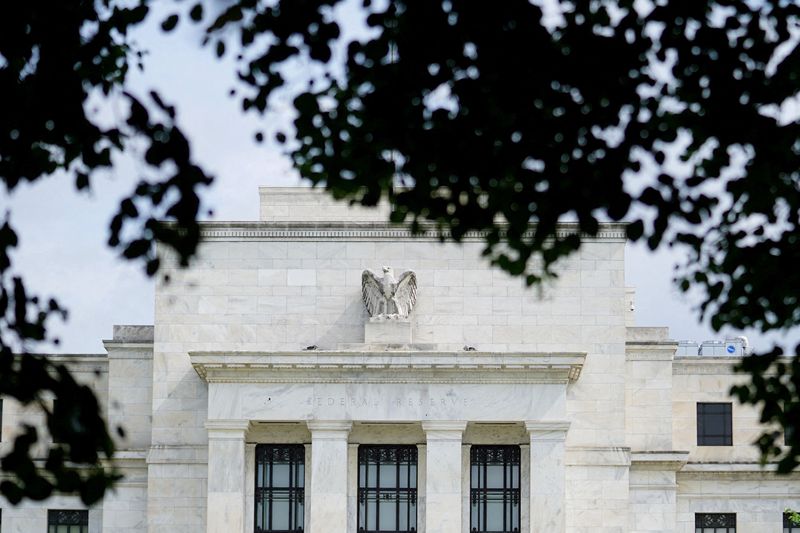

(Reuters) - Goldman Sachs said on Wednesday it expects the U.S. Federal Reserve to deliver consecutive 25-basis-point (bps) interest rate cuts from November 2024 through June 2025 to a terminal rate range of 3.25-3.5%.

Last month, the U.S. central bank cut the overnight rate by half a percentage point, citing greater confidence that inflation will keep receding to its 2% annual target.

The overnight rate, which guides how much interest banks pay each other and affects rates for consumers, is now at 4.75%-5.00%.

Markets are currently pricing in a 94.1% chance for a cut of 25 bps at the Fed's next meeting, with only a 5.9% chance the central bank will hold rates steady, according to CME's Fedwatch Tool.

Goldman Sachs also said it expects the European Central Bank to cut interest rates by 25 bps at its monetary policy meeting on Thursday, and noted it sees sequential 25-bps cuts until the policy rate reaches 2% in June 2025.

By Donny Kwok and James Pomfret

HONG KONG (Reuters) -Hong Kong's leader pledged on Wednesday to reform and revive the economy and financial markets including slashing liquor duties, while seeking to improve dire living conditions for the city's poorest.

John Lee, in his third annual policy address, highlighted the need to "deepen our reforms and explore new growth areas," in line with China's national priorities and recent calls from Beijing for all sectors to unite to promote development and economic growth.

Hong Kong's small and open economy has felt the ripple effects of a slowdown in the Chinese economy and political tensions including a years-long national security crackdown.

It grew by 3.3% in the second quarter from a year earlier, and is forecast to grow 2.5%-3.5% for the year.

Although tourism has rebounded since COVID, with 46 million visitors expected this year, consumption and retail spending remain sluggish, while stock listings have dried up and capital flight remains a challenge.

Lee told Hong Kong's legislature that duties on liquor would be slashed to 10% from 100% for drinks with more than 30% alcohol content, in a bid to stimulate the trade in spirits. The lower duties apply only to spirits priced over HK$200 ($26), and for the portion above that amount.

The move would "promote liquor trade and boost development of high value added industries including logistics and storage, tourism as well as high end food and beverage consumption," Lee said.

He hoped the move would benefit Hong Kong in the way that it became an Asian wine trading hub after wine duties were abolished in 2008.

By Andrea Shalal and David Lawder

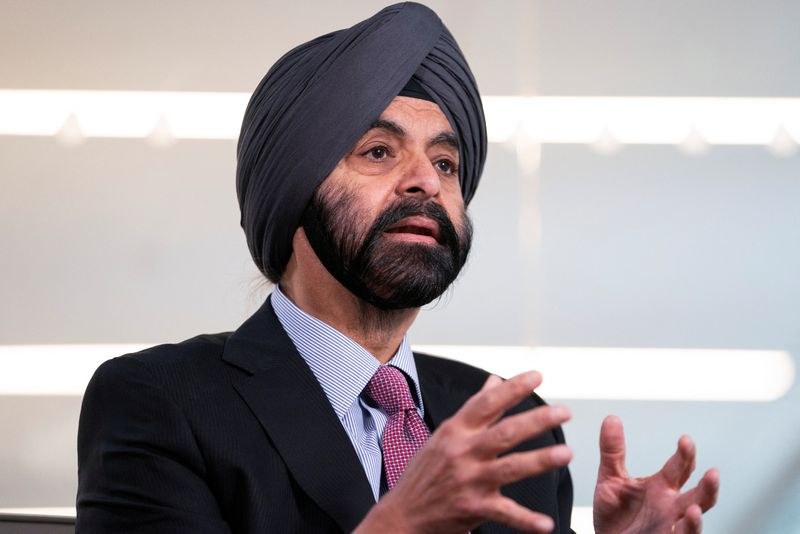

WASHINGTON (Reuters) -World Bank President Ajay Banga on Tuesday warned that a significant widening of the Israel-Gaza war could lead to major impacts on the global economy, calling the steep loss of civilian lives in the region "unconscionable."

Speaking in a Reuters NEXT Newsmaker interview, Banga said the war has had a relatively small impact on the global economy thus far, but a significant widening of the conflict would draw in other countries that are larger contributors to global growth, including commodity exporters.

"First of all, I think this unbelievable loss of life - women, children, others, civilians, is just unconscionable on all sides," Banga said. "The economic impact of this war, on the other hand, depends a great deal on how much this spreads."

"If it spreads regionally, then it becomes a completely different issue because now you start going into places that are far larger contributors to the world economy, both in terms of dollars, but also in terms of minerals and metals and oil and the like," he said.

Some Western countries are pushing for a ceasefire between Israel and Lebanon, as well as in Gaza, though the United States, Israel's strongest ally, has expressed its continued support and is sending it an anti-missile system and troops.

Israel launched the offensive against Hamas after the militant group's Oct. 7 attack on Israel, in which 1,200 people were killed and around 250 taken hostage to Gaza, by Israeli tallies. More than 42,000 Palestinians have been killed in the offensive so far, according to Gaza's health authorities.

Israeli strikes have also killed at least 2,350 people over the last year in Lebanon and left nearly 11,000 wounded, according to the Lebanese health ministry, and more than 1.2 million people have been displaced.

Banga said war damage from Israeli strikes on Gaza is now probably in the $14-20 billion range, and destruction from Israel's bombing of southern Lebanon will add to that regional total.

Banga said the World Bank had provided $300 million, six times what was normally given, to the Palestinian Authority to help it manage the crisis on the ground, but that was small compared to the "large number" it would ultimately need.

He said the multilateral development bank had also assembled a group of experts from Jordan, Israel, Palestine, Europe, the U.S. and Egypt to study what short- and longer-term actions it could take if a peace agreement could be reached.

"We're going to have to figure out how to have that publicly discussed and debated and then find the resources for it," he said, adding that the effort would require private and public resources.

By Ankur Banerjee

SINGAPORE (Reuters) - Asian equities fell on Wednesday after disappointing earnings from Europe's biggest tech firm ASML (AS:ASML) dragged chip stocks around the world, while expectations that the Federal Reserve will take a modest rate cut path propped up the dollar.

Also weighing on the market was lacklustre earnings from French luxury giant LVMH that showed demand in China for luxury goods worsened, denting some of the enthusiasm around China spurred by stimulus measures.

Tech-heavy South Korean stocks fell 0.6%, while chip stocks led Japan's Nikkei 1.8% lower. Taiwan stocks slipped 1.2%. That left MSCI's broadest index of Asia-Pacific shares outside Japan down 0.32%.

Matt Simpson, senior market analyst at City Index, said investors are likely questioning how exposed to risk they really want to be, given there are risk events and a U.S. election looming on Nov. 5.

"I expect investors to become increasingly twitchy as we head towards November 5th, and keen that book profits at frothy levels."

ASML, whose customers include AI chipmaker TSMC, logic chip makers Intel (NASDAQ:INTC) and Samsung (KS:005930) as well as memory chip specialists Micron (NASDAQ:MU) and SK Hynix, forecast lower than expected 2025 sales.

The Dutch chip equipment maker said despite a boom in AI-related chips, other parts of the semiconductor market are weaker for longer than expected, leading to customer cautiousness.

"The AMSL numbers were not good and suggest that all is not well in semiconductor chips outside of AI," said Nick Ferres, CIO at Vantage Point Asset Management in Singapore.

A Bloomberg News report that U.S. officials have been considering implementing a cap on export licenses for AI chips to specific countries also weighed on sentiment.

The dour mood meant Chinese stocks fell in early trading as investors awaited concrete details on stimulus plans. The blue-chip CSI300 index fell 0.6%, while Hong Kong's Hang Seng Index was 0.7% lower in early trading.

Investor focus is now on Thursday when China will hold a press conference to discuss promoting the "steady and healthy" development of the property sector.

"We believe investors should view the policy announcements since Sept. 24 as an integrated plan rather than isolated messages - the policy pivot looks very much here to stay," HSBC strategist Steven Sun said in a report.

RISING DOLLAR

On the macro side, investors remain enthralled by U.S. rates and the shifting rate cut expectations in the wake of data that has shown the U.S. economy to be resilient and inflation to tick just a bit higher.

That has kept traders on the fence of how deep the rate cuts will be in the near term, with traders pricing in 46 basis points (bps) of easing this year. The Fed started its easing cycle with an aggressive 50 bp cut in September.

Markets are ascribing a 96% chance of a 25 bp cut from the Fed next month, CME FedWatch tool showed, compared to a 50% chance a month earlier when investors were weighing towards another 50 bp cut from the U.S. central bank.

The dollar as a result has surged in recent weeks, with the U.S. dollar index, which measures the U.S. unit versus major rivals, at 103.24, hovering near its highest levels since early August.

The euro loitered around two month lows and last fetched $1.0887 in early trading ahead of the European Central Bank's policy meeting on Thursday, where the central bank is largely expected to cut rates again.

The yen was steady at 149.155 per dollar but is down 3.6% in October as the dovish tilt from the Bank of Japan drags the currency.

In commodities, oil prices were steady after steep declines in the previous session as investors contended with uncertainty around tensions in the Middle East and what it means for global supply. [O/R]

Brent crude oil futures rose 0.4% to $74.56 a barrel. U.S. West Texas Intermediate crude futures rose 0.5% to $70.93 per barrel.

By Jamie McGeever

(Reuters) - A look at the day ahead in Asian markets.

Three monetary policy decisions dominate Asian markets on Wednesday, with investor sentiment and risk appetite likely to be kept in check by a selloff on Wall Street and worries over tech and the global economy the day before.

The central banks of Indonesia, Thailand and the Philippines all set interest rates on Wednesday, while the latest New Zealand inflation, South Korean unemployment and Japanese machinery orders are also on deck.

Oil prices are on the slide again, partly reflecting soft demand, particularly from China. Crude futures slumped nearly 5% on Tuesday, pushing U.S. crude below $70 a barrel and bringing the year-on-year decline back to 20%.

Tech worries pushed U.S. shares into the red, despite upbeat earnings from financial heavyweights Goldman Sachs, Citi and Bank of America. Nvidia (NASDAQ:NVDA) and ASML (AS:ASML) shares led the global tech slump, and attention later in the week turns to Taiwan Semiconductor Manufacturing Co, the contract manufacturer that produces Nvidia's processors.

It is expected to report a 40% leap in quarterly profit on Thursday, thanks to soaring demand.

On Wednesday, meanwhile, Bank Indonesia is expected to leave interest rates unchanged despite inflation falling to its lowest level since 2021, with the exchange rate at the forefront of policymakers' thinking.

Inflation is down to 1.84% and has been within BI's target of 1.5% to 3.5% all year, but the rupiah has fallen more than 3% from a September peak.

The Bank of Thailand is also expected to stay on hold and leave its one-day repo rate at 2.50% for the rest of the year. Four out of 28 economists in a Reuters poll predicted a quarter-point cut.

The Philippine central bank, on the other hand, is expected to cut its overnight borrowing rate by 25 basis points to 6.00%, and again in December as policymakers strive to support economic growth as inflation remains under control.

The central bank kicked off its easing cycle in August, and since then inflation has dropped below the bank's 2%-4% target.

Meanwhile, investors continue to digest the details and steer from China at the weekend about its stimulus measures, and the recent slew of data. None of that has been particularly encouraging and Chinese markets are drifting lower, although equities are still up substantially from 'pre-stimulus' levels.

Beijing on Tuesday announced that a press conference will be held on Thursday to discuss promoting the "steady and healthy" development of the property sector. If this announcement was aimed at reassuring investors, however, it has fallen flat.

Shanghai's blue chip index is down 13% from last Tuesday's peak, but is still up 20% from the day before Beijing first unveiled its measures to support markets, the property sector and growth.

Here are key developments that could provide more direction to markets on Wednesday:

- Indonesia, Thailand, Philippines rate decisions

- Bank of Japan's Seiji Adachi speaks

- New Zealand inflation (Q3)

MEXICO CITY (Reuters) -The International Monetary Fund on Tuesday said it sees Mexico's economic growth slowing to around 1.5% this year, citing capacity constraints and tight monetary policy.

Growth is seen slowing to 1.3% in Latin America's second-largest economy next year, the IMF said in a statement, when inflation is also expected to close in on the central bank's target of 3%.

Mexico's central bank, known as Banxico, lowered its benchmark interest rate to 10.50% in a split decision in September.

But minutes from the meeting showed that the board members expect easing inflation could allow for further rate cuts.

"Inflation risks remain on the upside," the IMF said, warning that weaker-than-expected economic growth in the United States, increased global risk aversion and unforeseen effects from recent reforms could weigh on Mexico's output.

When asked about the IMF projections, Mexico's new President Claudia Sheinbaum said the country's "economy is strong," adding that agricultural production is expected to grow next year.

The president also said that none of the proposed constitutional reforms pose a problem for investment in Mexico, despite the IMF's concerns.

The IMF said that a recent judicial overhaul creates "important uncertainties about the effectiveness of contract enforcement and the predictability of the rule of law."

Mexico's ruling party and allies pushed the reform through last month, arguing that it will reduce corruption in the judiciary by implementing the popular election of judges and magistrates.

But the reform has sparked concerns from major trade partners like the U.S. and Canada and protests from judges and magistrates.

TOKYO (Reuters) -Japanese Prime Minister Shigeru Ishiba said his government is aiming to compile a supplementary budget for the current fiscal year in excess of last year's 13.1 trillion yen ($87.6 billion) to fund an economic support package, the Nikkei business daily reported on Tuesday.

"Last year's supplementary budget was 13 trillion yen, and I would like to ask for a larger supplementary budget than that, and have it deliberated and passed by the parliament," Ishiba was quoted as saying on Tuesday during a stump speech as the campaigning for the lower house election kicks off.

Ishiba earlier this month formally instructed his ministers to draw up the measure to cushion the blow to households from rising living costs. The prime minister, who took the helm on Oct. 1, has stressed that his focus is to get the economy to fully shake off the growth-sapping deflation of the last three decades.

The fresh package will include payouts to low-income households and subsidies to local governments.

($1 = 149.6200 yen)

ISTANBUL (Reuters) -Turkey's economy will grow 3% this year and next, lower than the government's recently updated forecasts, a Reuters poll of economists showed on Monday, pointing to a much deeper slowdown as authorities seek to douse rampant inflation.

Poll respondents also unanimously agreed the central bank would hold its key interest rate at 50% on Thursday, but eventually ease policy by 250 basis points by year-end.

Ankara launched its tightening drive in mid-2023 to reverse a years-long low-rates strategy championed by President Tayyip Erdogan to boost economic growth.

The central bank has since raised rates by 4,150 basis points, while the government adopted tax and savings measures meant to rebalance the economy and leave behind a series of currency crisis and price rises.

The drive to cool prices is expected to lower gross domestic product growth to average 3% this year and next, according to the median of 42 economists in the Oct. 8-14 Reuters poll.

That compares to the government's prediction of 3.5% GDP growth this year and 4% next year, in its three-year policy roadmap. The economy grew 4.5% in 2023.

GDP will rise 3.6% in 2026, the poll's median showed.

Natixis said the government had kept its promise of orthodox economic policies and announced fiscal consolidation and budget measures that had further squeezed growth and helped the central bank tackle inflation.

"The impact from a much tighter policy mix on economic activity is, indeed, seen via a number of indicators ... Recession is not yet on the table though as we anticipate a slowdown in the real GDP growth," the investment management firm said.

The central bank will announce its interest rate decision at 1100 GMT on Oct. 17.

In the poll, economists predicted it would not significantly ease policy until next year. The bank was forecast to have reduced rates by 20 percentage points to 30% by end-2025.

Economists expect the policy rate to fall to 42.5% in the first quarter of next year and to 35.0% in the second quarter, based on the median response. They expect the cutting cycle to be completed in the third quarter of next year, leaving the policy rate at 30.0%.

Tight policy, fiscal measures and base effects brought inflation down to 49.38% in September from a recent peak of 75.45% in May.

The poll median showed economists expect inflation to fall to 43.5% this year and to 25.2% by the end of 2025. The government forecasts annual inflation will fall to 41.5% in 2024 and 17.5% next year.

Turkey's current account deficit in 2024 is expected to be 1.8% of GDP this year and next, the median forecast showed, compared to a government forecast of 1.7% and 2.0% respectively.

(Other stories from the October Reuters global economic poll)

(Polling by Indradip Ghosh and Mumal Rathore; Writing by Ezgi Erkoyun; Editing by Jonathan Spicer and Alison Williams)