Select Language

By Stella Qiu

SYDNEY (Reuters) -Asian stocks edged up, helped by the technology sector, while the dollar held firm on Wednesday ahead of a key U.S. inflation report and Federal Reserve policy decision that would determine the near-term outlook for interest rates.

European markets are also set to open slightly higher, with EUROSTOXX 50 futures up 0.3% and the FTSE futures gaining 0.4%. S&P 500 futures and Nasdaq futures turned 0.1% higher in Asia.

MSCI's broadest index of Asia-Pacific shares outside Japan rose 0.3%, while Japan's Nikkei slid 0.5%. Technology shares in the region outperformed, with MSCI Asia-Pacific ex-Japan IT index up 1.8%.

Overnight on Wall Street, Apple (NASDAQ:AAPL) surged 7% to a record high a day after it unveiled new AI features meant to rekindle demand for iPhones. That helped Nasdaq Composite rise 0.9% and the S&P 500 gain 0.3% to record closing highs.

Tech-heavy Taiwan and South Korean shares followed suit with gains of 1.3% and 0.4%, respectively. Chipmaker Taiwan Semiconductor Manufacturing Co jumped 3.2%.

Elsewhere, caution reigned, with still soft price data from China failing to lift sentiment much. Data showed on Wednesday that China's consumer prices fell 0.1% in May from a month earlier, missing forecasts. On an annual basis, they rose 0.3%.

China's blue chips wobbled between gains and losses and were last up 0.1%, while Hong Kong's Hang Seng index fell 1.1%, weighed by a 20% plunge in China Evergrande (HK:3333) New Energy Vehicle Group, after the unit of developer China Evergrande warned of losing assets.

Focus is now turning to the U.S. CPI data later in the day, which is forecast to rise a slim 0.1% in May from a month earlier, but with the core up 0.3%.

"The countdown is on, with the market going into full risk management mode," said Chris Weston, head of research at Pepperstone. "There aren't a whole lot of reasons to jump in and support the opening weakness either, so we could easily see further selling on open."

"I like to use U.S. core CPI m/m as my simple playbook guide, so any number that rounds to 0.2% m/m could offer relief in risk markets and bring out USD sellers, while a number that rounds to 0.4% could see U.S. two-year yields rise and with it the USD comes in hot."

In the currency markets, the dollar index has maintained all of its post-payrolls gains since Friday, standing tall at 105.26 against its major peers.

The euro was nursing heavy losses at $1.0737, down for a fourth straight session, amid political turmoil brought about by far right gains in European elections and the snap election in France.

Hours after the release of the U.S. CPI data, the Fed is considered certain to hold steady at its policy meeting, but the focus is on whether it keeps three rate cuts in its "dot plot" projections for this year.

Futures imply 39 basis points of Fed easing for this year, equivalent to just one and a half cuts.

Treasuries, which rallied overnight on the robust result of a 10-year Treasury auction, steadied. The 10-year yield held at 4.4079%, after falling 7 bps the previous session.

"Treasuries will react to the dot plot and possible dovish lean from Powell with a modest bull steepening. However, continued range trading is likely given ongoing "data dependent" outlook," said analysts at TD Securities.

Oil prices extended gains for a third straight session. Brent futures rose 0.5% to $82.36 a barrel, while U.S. crude futures gained 0.7% to $78.45 a barrel.

Gold prices edged 0.1% lower to $2,313.72 per ounce.

By Ashitha Shivaprasad and Brijesh Patel

SINGAPORE (Reuters) - Demand for gold in Asia is surging despite prices hovering near the record highs it hit in May, industry officials say, as buyers snap up the metal to hedge against geopolitical and economic uncertainty.

Spot gold is trading a little over $2,300 per ounce, up about 12% year-to-date and only about 6% shy of the record high it hit last month.

Lower confidence in other investment options, such as real estate and equities, is also a factor behind the demand for gold, analysts say.

"When the macro-economic backdrop returns to normal, when real estate and equities are more interesting, I think that price sensitivity will return," Ruth Crowell, chief executive of the London Bullion Market Association, told Reuters.

In Japan, there are more gold bulls than bears despite record high prices, according to Bruce Ikemizu, chief director of the Japan Bullion Market Association.

Chinese investors grappling with currency devaluation, a protracted real estate downturn and trade tensions are also finding value in gold, experts said. China's purchases of gold coins and bars surged 27% in the first quarter of this year.

"The trend in the market has been that if the consumer wants to buy gold, they will. The price doesn't matter," Albert Cheng, CEO of the Singapore Bullion Market Association, told Reuters on the sidelines of the Asia Pacific Precious Metals Conference.

Elsewhere in Asia, retail investors have been pouring money into the safe-haven asset, with the metal finding increased acceptance among younger buyers.

In Thailand, there were queues outside gold stores as soon as there were headlines on higher prices, said Nuttapong Hirunyasiri, the CEO of MTS Gold Group.

Vietnam is seeing investors flocking to stock up, despite domestic prices trading at stubbornly high premiums to global prices.

On the other hand, India and Australia remain sensitive to high prices.

Indian gold prices have traded at a discount to international prices for five straight weeks, reflecting tepid demand in the second largest bullion consumer, while the Perth Mint's gold product sales in May fell 30% on a monthly basis. [GOL/AS]

India's gold imports in 2024 are expected to fall by nearly a fifth, as record high prices have pushed retail consumers to exchange old jewellery for new items instead of buying afresh.

By Caroline Valetkevitch

NEW YORK (Reuters) -The S&P 500 and Nasdaq registered record closing highs for a second straight day on Tuesday, helped by a gain of more than 7% in Apple shares (NASDAQ:AAPL), while investors also awaited consumer prices data and a policy announcement from the Federal Reserve.

Apple shares jumped 7.3% to a record-high close and gave the S&P 500 and Nasdaq their biggest boosts after the stock declined in the previous session.

At its annual developer event that kicked off on Monday, Apple unveiled new artificial-intelligence features meant to increase the appeal of its devices, including an improved Siri virtual assistant that can answer a wider range of queries and accomplish more complicated tasks than earlier.

The S&P 500 technology index climbed 1.7% and also posted a record closing high.

The Consumer Price Index report will be released before the bell on Wednesday, and the U.S. central bank's policy announcement is due later the same day.

The central bank is likely to leave interest rates unchanged but will release its updated economic projections and "dot plot," which shows where policymakers expect interest rates to stand this year and longer-term.

"Everybody is feeling uneasy, but the data and actions consumers are taking continue to point toward resiliency, and that tends to be overall fairly bullish," said Oliver Pursche, senior vice president and adviser for Wealthspire Advisors in Westport, Connecticut.

The Dow Jones Industrial Average fell 120.62 points, or 0.31%, to 38,747.42, the S&P 500 gained 14.53 points, or 0.27%, to 5,375.32 and the Nasdaq Composite added 151.02

Friday's U.S. monthly jobs report was stronger than expected. Markets have dialed back expectations for the Fed's first rate cut happening in September, now pricing in about a 50% chance, according to the CME's FedWatch tool.

General Motors (NYSE:GM) gained 1.35% after the automaker announced a $6 billion share buyback plan. GM also cut its annual EV production forecast.

After the closing bell, Oracle (NYSE:ORCL) shares rose 8% following the release of quarterly results. The stock ended the regular session down 0.5%.

Declining issues outnumbered advancing ones on the NYSE by a 1.52-to-1 ratio; on Nasdaq, a 1.17-to-1 ratio favored decliners.

The S&P 500 posted 19 new 52-week highs and 4 new lows; the Nasdaq Composite recorded 45 new highs and 127 new lows.

Volume on U.S. exchanges was 10.65 billion shares, compared with the 12.83 billion average for the full session over the last 20 trading days.

By David Lawder

WASHINGTON (Reuters) - The World Bank on Tuesday said the U.S. economy's stronger-than-expected performance has prompted it to lift its 2024 global growth outlook slightly but warned that overall output would remain well below pre-pandemic levels through 2026.

The World Bank said in its latest Global Economic Prospects report that the global economy would avoid a third consecutive drop in real GDP growth since a major post-pandemic jump in 2021, with 2024 growth stabilizing at 2.6%, unchanged from 2023.

That's up 0.2 percentage point from the World Bank's January forecast, largely on the strength of U.S. demand.

"In a sense, we see the runway for a soft landing," World Bank Deputy Chief Economist Ayhan Kose told Reuters in an interview, noting that sharply higher interest rates have brought down inflation without major job losses and other disruptions in the U.S. or other major economies.

"That's the good news. What is not good news is that we may be stuck in the slow lane," Kose added.

The World Bank forecast global growth of 2.7% in both 2025 and 2026, a level well below the 3.1% global average in the decade prior to COVID-19. It also is forecasting that interest rates in the next three years will remain double their 2000-2019 average, keeping a brake on growth and adding debt pressure to emerging market countries that have borrowed in dollars.

Countries representing 80% of the world's population and GDP output will see weaker growth through 2026 than they had prior to the pandemic, the report said.

"Prospects for the world's poorest economies are even more worrisome. They face punishing levels of debt service, constricting trade possibilities and costly climate events," said World Bank Chief Economist Indermit Gill, adding that those countries will continue to require international assistance to fund their needs.

The report contains an alternative "higher-for-longer" interest rate scenario, in which persistent inflation in advanced economies keeps interest rates about 40 basis points above the lender's baseline forecast, cutting 2025 global growth to 2.4%.

U.S. BUOYANT

Strong demand and higher inflation readings in the U.S. have delayed expectations for Federal Reserve rate cuts, and the U.S. economy is defying predictions of a downturn for the second year in a row, according to the report. The World Bank is now forecasting 2.5% U.S. growth for 2024 - matching the 2023 pace - and up sharply from the January forecast of 1.6%.

Kose said the U.S. upgrade accounts for about 80% of the added global growth since the January forecast.

The World Bank also upgraded China's 2024 growth forecast to 4.8% from 4.5% in January, largely on the back of increased exports that have offset soft domestic demand. But it forecast China's growth will fall to 4.1% in 2025 amid weak investment and consumer confidence and an ongoing property-sector downturn.

India also saw a forecast upgrade for 2024 to 6.6% from 6.4% in January amid strong domestic demand.

The World Bank cut Japan's 2024 growth forecast to 0.7% from 0.9% due to weak consumption growth and slowing exports and stabilizing demand for tourism. It left its 2024 eurozone forecast unchanged at 0.7% amid the bloc's continued difficulties with high energy costs and weaker industrial output.

CONFLICT RISKS

In addition to the higher-for-longer rate scenario, the World Bank said the biggest downside risks to the global outlook included greater spillovers from armed conflicts in Gaza and Ukraine.

A wider war in the Middle East could cause further disruptions to shipping and push up oil prices and inflation. Likewise, more uncertainty about the path of Russia's invasion in Ukraine could also disrupt markets for oil and grains, while choking investment into neighboring countries, the bank said.

Increasing trade restrictions driven by geopolitical rivalries also could hamper the recovery of global trade volume growth, which was barely perceptible last year at about 0.1%. The World Bank forecast a rebound to 2.5% in 2024, up from 2.3% in the January forecast.

But it said rising protectionism and industrial policies in many countries could lead to more inefficiencies in global supply chains and reduce investment into emerging market and developing countries.

The World Bank also said a deeper downturn in China, the world's second-largest economy, would hamper growth, especially in commodity exporters and trade-intensive economies.

On the upside, the World Bank said that the U.S. could continue to surpass expectations, boosting global growth with lower inflation if elevated productivity and labor supply due to immigration prove persistent. Lower inflation globally, supported by productivity gains, improved supply chains and easing commodity prices, could prompt central banks to cut interest rates more quickly than now expected, boosting credit growth, the bank added.

By David Shepardson

WASHINGTON (Reuters) -Federal agencies said on Monday they have restored full access for commercial maritime transit through the Port of Baltimore after the removal of 50,000 tons of debris from the March 26 collapse of the Key Bridge.

The cargo ship Dali crashed into the Francis Scott Key Bridge in March in Baltimore, killing six people and paralyzing a major transportation artery for the U.S. Northeast. The U.S. Army Corps of Engineers said a survey on Monday certified the riverbed as safe for transit and said the Fort McHenry Federal Channel had been restored to its original operational dimensions of 700 feet wide and 50 feet deep.

The fully operational channel will allow two-way traffic and the ending of the additional safety requirements that were required because of temporary reduced channel width.

The U.S. Army Corps and U.S. Navy Supervisor of Salvage and Diving worked to clear Key Bridge wreckage for more than two months before the final piece was removed last week. The Dali was safely moved on May 20.

More than 1,500 individual responders along with 500 specialists from around the world operated a fleet of boats during the operation which involved 56 federal, state, and local agencies.

Surveying and removal of steel at and below the 50-foot mud-line will continue to ensure future dredging operations are not impacted and wreckage will continue to be transported to Sparrows Point for follow-on processing.

In April, the FBI opened a criminal probe into the collapse. The National Transportation Safety Board said last month the Dali lost electrical power several times before it crashed into the bridge including experiencing a blackout during in-port maintenance and shortly before the crash.Maryland estimates it will cost $1.7 billion to $1.9 billion to rebuild the bridge and anticipates completion by fall 2028.

By Raul Cortes, Ana Isabel Martinez and Kylie Madry

MEXICO CITY (Reuters) -Mexican President-elect Claudia Sheinbaum said on Monday she would encourage broad discussions over proposed constitutional reforms, including a judicial overhaul that has spooked markets, before the next congressional session kicks off.

The judicial reform would replace an appointed Supreme Court with popularly elected judges, as well as for some lower courts, which critics allege would fundamentally alter the balance of power in Mexico.

Sheinbaum, speaking in a press conference following a meeting with outgoing President Andres Manuel Lopez Obrador, said the reform would be "among the first" that could be passed, along with some boosted social benefits.

She added she did not believe the proposed reforms would impact the peso, which tumbled following her election win earlier this month.

As Sheinbaum was speaking, however, the peso weakened by nearly 2% to around 18.55 per U.S. dollar in international trading.

"With the current scenario of uncertainty, an exchange rate of 20 pesos per dollar for this year can't be ruled out," analyst Gabriela Siller from Banco Base said on X.

Some of the measures are part of a slew of constitutional reforms Lopez Obrador proposed in February that would also eliminate key regulatory agencies.

At the time they did not cause market jitters, but investors sounded the alarm as the ruling coalition honed in on a congressional super-majority needed to pass constitutional reforms in the June 2 election.

The coalition led by MORENA secured a two-thirds super-majority in the lower house but fell just short in the Senate, although analysts believe those extra votes can likely be secured through negotiation.

While the newly elected Congress will take office at the beginning of September, Sheinbaum will not be inaugurated until a month later, which could give Lopez Obrador and lawmakers a window to try to enact the reforms.

"In the case of the judicial reform, (discussion) should be through the bar association, professors of law, the ministers and magistrates themselves," Sheinbaum said.

She added she would name her cabinet next week, and that she would receive a team sent by U.S. President Joe Biden on Tuesday.

Mexico's peso is now down 8% since the elections Sheinbaum and her party won in a landslide - its biggest plunge since the COVID-19 pandemic - while the country's main stock index has fallen nearly 4%.

TAIPEI (Reuters) - Taiwan's central bank is expected to keep its policy interest rate unchanged this week and to stay the course until late next year as it deals with persistent concerns over inflation, according to economists in a Reuters poll.

The central bank, in a surprise move at its last board meeting in March, hiked the benchmark discount rate to 2% from 1.875%, wary of continued inflationary pressures and ahead of a rise in electricity prices.

At its next quarterly meeting on Thursday it is expected to keep the rate steady, according to 29 of the 31 economists surveyed.

Economists who answered questions on the outlook beyond this week predicted the bank would start cutting rates only from the third quarter of 2025, with the median estimate a drop to 1.875%.

Central bank Governor Yang Chin-long indicated last week there would be no surprises at this meeting.

Taiwan's consumer price index (CPI) rose by 2.24% in May, slightly higher than forecast and also above the 1.95% recorded in April, and it is expected to further increase in June due to rainy weather impacting food prices.

Kevin Wang, an economist at Taishin Securities Investment Advisory, said the central bank will likely keep the rate unchanged this time, but there could be another rise in the offing three months hence.

"Inflation will rise markedly after June, maybe exceeding 3%, so the pressure to hike will be relatively high" in September, he added.

The European Central Bank went ahead with its first interest rate cut since 2019 last Thursday, while the U.S. Federal Reserve is expected to hold interest rates steady at its meeting this week.

Taiwan's tech-centred, export-dependent economy is doing well, especially as the artificial intelligence boom drives orders for the likes of TSMC, the world's largest contract chipmaker. Taiwan's stock market is at record highs.

In March, the central bank raised its gross domestic product growth forecast for 2024 to 3.22% from a previous prediction of 3.12%. The economy grew by just 1.31% in 2023, its slowest pace in 14 years.

The central bank will also announce its revised economic growth and inflation forecasts on Thursday.

(Poll compiled by Devayani Sathyan and Milounee Purohit; Reporting by Ben Blanchard and Faith Hung; Additional reporting by Roger Tung; Editing by Jamie Freed)

By Yuka Obayashi

TOKYO (Reuters) - Oil prices rose on Tuesday, extending the previous day's rally on hopes of higher seasonal fuel demand and potential U.S. crude purchases for its petroleum reserve, though gains were capped by a firmer dollar.

Brent crude futures climbed 28 cents, or 0.3%, to $81.91 per barrel by 0038 GMT and U.S. West Texas Intermediate crude futures rose 31 cents, or 0.4%, to $78.05.

Prices climbed about 3% to a one-week high on Monday, buoyed by expectations of rising fuel demand this summer despite the dollar's climb on expectations the U.S. Federal Reserve will leave interest rates higher for longer.

"The oil market was supported by anticipation of rising fuel demand this summer and the prospect that if WTI stays below $79 the U.S. will move to build up its strategic reserves," said Hiroyuki Kikukawa, president of NS Trading, a unit of Nissan (OTC:NSANY) Securities.

"Since WTI is near its 200-day average, we expect oil prices to remain close to current levels for a while," he said.

The U.S. could hasten the rate of replenishing the Strategic Petroleum Reserve as maintenance on the stockpile is completed by the end of the year, Energy Secretary Jennifer Granholm told Reuters last week. It wants to buy back oil at about $79 a barrel.

Goldman Sachs analysts, meanwhile, said they expect Brent to rise to $86 a barrel in the third quarter, noting in a report that solid summer transport demand will push the oil market into a third-quarter deficit of 1.3 million barrels per day (bpd).

Investor attention is on the release of U.S. consumer price index data for May and the conclusion of the Fed's two-day policy meeting on Wednesday for hints on when the Fed may start reducing interest rates.

The market is also watching for reports from the American Petroleum Institute industry group, due later on Tuesday, and the Energy Information Administration, the statistical arm of the U.S. Department of Energy, due on Wednesday.

U.S. crude oil stockpiles were expected to have fallen while product inventories likely rose last week, a preliminary Reuters poll showed on Monday.

Investors are also waiting for monthly oil supply and demand data from the U.S. Energy Information Administration (EIA) and OPEC on Tuesday and the International Energy Agency (IEA) on Wednesday.

By Ashitha Shivaprasad and Brijesh Patel

SINGAPORE (Reuters) - Vietnam is expected to allow companies to import gold for the first time in over a decade, as it aims to bridge the widening gap between local prices and international benchmarks, an industry official told Reuters.

The Vietnam Gold Traders Association (VGTA) has been in protracted talks with the government over measures to correct the imbalance in supply and demand of gold, Huynh Trung Khanh, the association's vice chair said.

Vietnam's government virtually took full control of imports and local bullion sales in 2012, with certain large companies allowed to import provided they repurposed it as jewellery for exports.

"The government said they will start official gold imports by July or August. We hope that by July they will allow gold companies to import directly," Khanh said on the sidelines of the Asia Pacific Precious Metals conference.

VGTA expects the proposed change to kick in as early as next month. It would mark a significant departure from the current policy, under which the central bank tightly controls imports. The State Bank of Vietnam did not immediately respond to a request seeking comment.

Attempts to narrow the gap with international benchmarks by holding auctions and allowing four local banks to sell gold in a bid to increase liquidity have largely failed to have a sustained impact, with domestic prices still trading at stubbornly high premiums to global prices.

Immediately reducing premiums on domestic prices is crucial, as VGTA estimates Vietnam's gold demand to surge this year. The southeast nation is among the top 10 consumers of gold.

Gold purchases are set to rise 10% on a yearly basis to 33 million metric tons during the first six months of this year, Khanh said in his presentation at the conference.

Retail buyers, who view gold as a wealth preservation tool used to guard against economic uncertainty, account for a lion's share of the purchases in the south east Asian economy, home to about 100 million people.

"The key reasons for this strong retail investment demand were the sharp decrease in saving interest rates, the frozen real estate and the constant devaluation of the national currency versus the U.S. dollar," Khanh said.

"We have had people queuing in the streets, in the sun and rain to buy more gold."

A sharp surge in demand for gold has also lead to higher smuggling, especially from neighbouring Cambodia, Khanh said, adding that it made immediate policy action critical.

"It is a very big underground system network. With such a big price hike, the rate of smuggling is still high."

The VGTA and the World Gold Council are currently working with the Vietnamese central bank and other government agencies to set-up a national gold exchange, a move it believes would provide more market stability.

(Reporting Ashitha Shivaprasad and Brijesh Patel in Singapore)

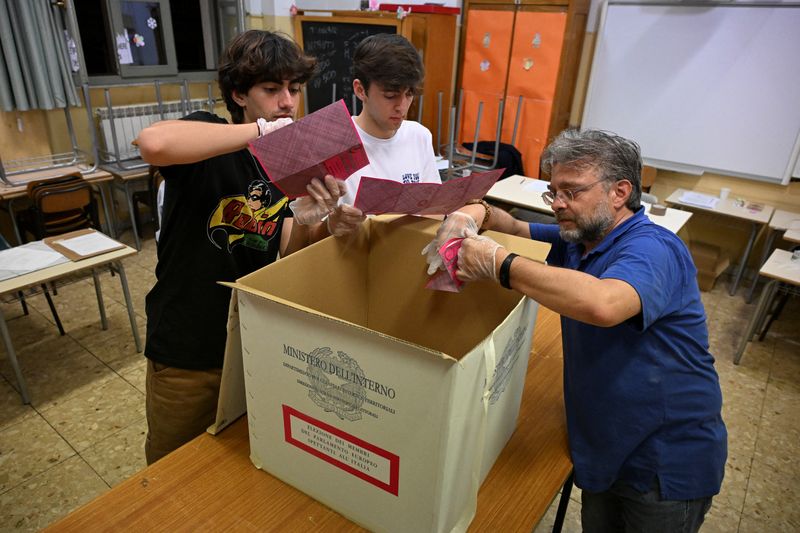

BRUSSELS (Reuters) - The economy, migration and international conflicts were the top concerns for voters in the European Union election, data from the bloc's biggest member countries suggested on Monday.

Provisional results in the European Parliament election on Sunday night showed gains for nationalist and euro-sceptic parties that campaigned on tickets including clamp-downs on migration, citizens' economic woes and scrapping green policies.

Improving the economy and reducing inflation ranked highest among citizens asked what was the most important thing influencing their vote, in a survey by polling platform Focaldata, shared with Reuters.

International conflict and war was the second most important concern, followed by immigration and asylum seekers, in the poll of 6,000 citizens in the EU's five biggest countries by population - Germany, France, Italy, Spain and Poland - plus Sweden.

The survey was done on June 6th, the day voting began in the EU Parliament election.

Respondents placed climate change fifth on the list of issues influencing their vote, behind "reducing inequality" which ranked fourth.

Europe's Green parties were among the biggest losers in the EU election, with initial results suggesting they would lose 18 seats to end up with 53 EU lawmakers.

However, climate change took the third spot in Sweden and Spain, the latter of which has suffered years-long droughts made more severe by climate change.

In France, Italy and Poland, voters said economic concerns were the main thing influencing their vote, with immigration in second place in France, and war the number two concern in Italy and Spain.

German respondents ranked immigration and asylum seekers as their top concern, followed by wars and then economic concerns.