Select Language

By Ashitha Shivaprasad and Brijesh Patel

SINGAPORE (Reuters) - Vietnam is expected to allow companies to import gold for the first time in over a decade, as it aims to bridge the widening gap between local prices and international benchmarks, an industry official told Reuters.

The Vietnam Gold Traders Association (VGTA) has been in protracted talks with the government over measures to correct the imbalance in supply and demand of gold, Huynh Trung Khanh, the association's vice chair said.

Vietnam's government virtually took full control of imports and local bullion sales in 2012, with certain large companies allowed to import provided they repurposed it as jewellery for exports.

"The government said they will start official gold imports by July or August. We hope that by July they will allow gold companies to import directly," Khanh said on the sidelines of the Asia Pacific Precious Metals conference.

VGTA expects the proposed change to kick in as early as next month. It would mark a significant departure from the current policy, under which the central bank tightly controls imports. The State Bank of Vietnam did not immediately respond to a request seeking comment.

Attempts to narrow the gap with international benchmarks by holding auctions and allowing four local banks to sell gold in a bid to increase liquidity have largely failed to have a sustained impact, with domestic prices still trading at stubbornly high premiums to global prices.

Immediately reducing premiums on domestic prices is crucial, as VGTA estimates Vietnam's gold demand to surge this year. The southeast nation is among the top 10 consumers of gold.

Gold purchases are set to rise 10% on a yearly basis to 33 million metric tons during the first six months of this year, Khanh said in his presentation at the conference.

Retail buyers, who view gold as a wealth preservation tool used to guard against economic uncertainty, account for a lion's share of the purchases in the south east Asian economy, home to about 100 million people.

"The key reasons for this strong retail investment demand were the sharp decrease in saving interest rates, the frozen real estate and the constant devaluation of the national currency versus the U.S. dollar," Khanh said.

"We have had people queuing in the streets, in the sun and rain to buy more gold."

A sharp surge in demand for gold has also lead to higher smuggling, especially from neighbouring Cambodia, Khanh said, adding that it made immediate policy action critical.

"It is a very big underground system network. With such a big price hike, the rate of smuggling is still high."

The VGTA and the World Gold Council are currently working with the Vietnamese central bank and other government agencies to set-up a national gold exchange, a move it believes would provide more market stability.

(Reporting Ashitha Shivaprasad and Brijesh Patel in Singapore)

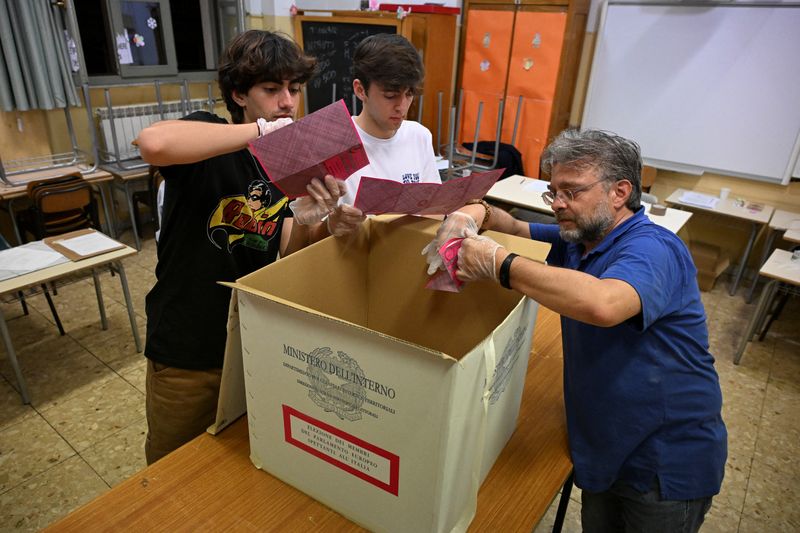

BRUSSELS (Reuters) - The economy, migration and international conflicts were the top concerns for voters in the European Union election, data from the bloc's biggest member countries suggested on Monday.

Provisional results in the European Parliament election on Sunday night showed gains for nationalist and euro-sceptic parties that campaigned on tickets including clamp-downs on migration, citizens' economic woes and scrapping green policies.

Improving the economy and reducing inflation ranked highest among citizens asked what was the most important thing influencing their vote, in a survey by polling platform Focaldata, shared with Reuters.

International conflict and war was the second most important concern, followed by immigration and asylum seekers, in the poll of 6,000 citizens in the EU's five biggest countries by population - Germany, France, Italy, Spain and Poland - plus Sweden.

The survey was done on June 6th, the day voting began in the EU Parliament election.

Respondents placed climate change fifth on the list of issues influencing their vote, behind "reducing inequality" which ranked fourth.

Europe's Green parties were among the biggest losers in the EU election, with initial results suggesting they would lose 18 seats to end up with 53 EU lawmakers.

However, climate change took the third spot in Sweden and Spain, the latter of which has suffered years-long droughts made more severe by climate change.

In France, Italy and Poland, voters said economic concerns were the main thing influencing their vote, with immigration in second place in France, and war the number two concern in Italy and Spain.

German respondents ranked immigration and asylum seekers as their top concern, followed by wars and then economic concerns.

By Takaya Yamaguchi

TOKYO (Reuters) - Japan's government will highlight the need to work closely with the central bank and guide policy "flexibly" in the wake of soft consumption and uncertainty over the inflation outlook, a draft of its annual economic blueprint seen by Reuters showed.

"Monetary policy has entered a new stage," which required the government and the Bank of Japan to "continue working closely and guide policy flexibly in accordance to economic and price developments," according to the draft.

By keeping inflation stably around the BOJ's 2% target, policymakers will seek to create an environment where wages rise faster than inflation on a sustained basis, the draft said.

The government draft will be presented to ruling party lawmakers for deliberations, before being finalised at a Cabinet meeting on June 21.

In the draft, the government said consumption "lacked momentum" with the outlook on prices unclear due in part to the effect of recent yen declines.

It also flagged lingering overseas risks such as the fallout from monetary tightening by central banks across the globe, and worries about soft Chinese growth.

Japan is facing a "critical moment" in shifting away from a deflation-prone economy that prioritised cost cuts, towards one where higher productivity allows more companies to keep hiking prices and wages, the draft said.

The government will submit legislation to next year's parliament to facilitate smoother pass-through of costs in industries like construction, transportation and agriculture, the draft said.

A weak yen and subsequent rise in households' living costs have hurt Prime Minister Fumio Kishida's approval ratings, prodding the administration to highlight its efforts to generate higher wage growth.

By Rae Wee

SINGAPORE (Reuters) - Asian stocks sank on Monday as traders heavily pared back on bets for Federal Reserve rate cuts this year given a still-tight U.S. labour market, while a snap election call in France sparked wider political concerns and weighed on the euro.

Trading was thinned in Asia with Australia, China, Hong Kong and Taiwan out for public holidays, but MSCI's broadest index of Asia-Pacific shares outside Japan still slumped 0.46%.

U.S. futures eased slightly, with S&P 500 futures and Nasdaq futures down about 0.03% each, while the dollar was back on the front foot.

The halt in the global risk rally came on the back of Friday's nonfarm payrolls report which showed the U.S. economy created far more jobs than expected in May and annual wage growth reaccelerated, underscoring the resilience of the labour market.

Futures now show roughly 36 basis points (bps) worth of cuts priced in for the Fed, down from 50 bps last week. The odds for an easing cycle beginning in September have also lengthened.

The latest developments come ahead of the Fed's policy decision on Wednesday, with U.S. inflation figures for May due just before that.

"It's going to be very difficult for the Fed to continue predicting three rate cuts this year," said Rob Carnell, ING's regional head of research for Asia-Pacific.

"Quite a few of the Fed speakers are talking about the possibility of just one (cut). While the most likely outcome is we'll see the three move to two, it is possible we just get a move to one."

By Ankur Banerjee

SINGAPORE (Reuters) - The euro fell on Monday as the French President Emmanuel Macron called a shock election after being trounced in the European Union vote by the far-right, while the dollar was steady ahead of the Federal Reserve meeting later in the week.

The euro fell to $1.0764, its lowest since May 9, in early trading in Asia. It was last down 0.24% at $1.0776 as investors weighed the implications of renewed political uncertainty in the euro zone's second-biggest economy in a key election year.

Eurosceptic nationalists made the biggest gains in European Parliament elections in the Sunday vote, an aggregated exit poll showed, prompting Macron to take a risky gamble to try to reestablish his authority.

"The prospects of a far right victory in France's snap elections may keep the euro under pressure in the near term," said Mansoor Mohi-Uddin, chief economist at Bank Of Singapore.

"But the exchange rate is still more likely to be influenced by this week's U.S. inflation data and FOMC meeting."

The European Central Bank cut rates last week in a well-telegraphed move, but offered few hints about the outlook for monetary policy given that inflation is still above target.

The dollar index, which measures the U.S. currency against six rivals, was at 105.09, the highest since May 30, after rising 0.8% on Friday following data that showed the world's largest economy created a lot more jobs than expected in May.

U.S. nonfarm payrolls expanded by 272,000 jobs last month, data showed, while economists polled by Reuters had forecast payrolls advancing by 185,000.

Ryan Brandham, head of global capital markets for North America at Validus Risk Management, said recently the U.S. labour market data has been showing some signs of softening, supporting discussions of rate cuts in the second half of 2024.

"But this result will likely take the steam out of that conversation. The Fed has shown patience in waiting for the confidence that inflation will fully return to target before signalling rate cuts, and that caution seems warranted."

The jobs data led traders to once again shift their expectations of when the Fed will cut rates and by how much. Markets are now pricing in 36 basis points of cuts this year compared to nearly 50 bps - or at least two cuts - before the jobs data.

The chances of a rate cut in September are now at roughly 50%, from around 70% late on Thursday.

The Fed is not expected to make any change at its policy meeting this week but the focus will be on the comments from Fed Chair Jerome Powell and changes to economic projections from the policymakers. U.S. inflation data is also due on Wednesday.

"We suspect that the median dot will fall from three cuts to less than two. A hawkish hold?," said Marc Chandler, chief market strategist at Bannockburn Global Forex in New York.

The Bank of Japan is due to hold its two-day monetary policy meeting this week, with the central bank widely expected to maintain short-term interest rates in a 0-0.1% range.

The policymakers are brainstorming ways to slow its bond buying and may offer fresh guidance as early as this week, sources familiar with its thinking told Reuters, in what would be a first step to reducing its almost $5 trillion balance sheet.

The Japanese yen weakened to 156.95 in early trading on Monday. The currency remains close to the 34-year trough beyond 160 per dollar reached at the end of April, which prompted Japanese officials to spend some 9.8 trillion yen ($62.46 billion) intervening in the currency market to support it.

Sterling was flat at $1.2723 having touched $1.2700, its lowest in a week earlier in the session.

($1 = 156.9000 yen)

Investing.com -- The Federal Reserve is to meet as key U.S. inflation data is released. The Bank of Japan is also to meet and economic data out of the U.K. will inform the Bank of England as it contemplates rate cuts. Here's your look at what's happening in markets for the week ahead.

1. Fed decision

With the Fed widely expected to leave interest rates on hold at the conclusion of its two-day policy meeting on Wednesday market watchers are instead focused on how many rate cuts officials will signal for the rest of 2024.

The updated dot plot will likely point to two 25-basis point cuts this year, down from three in March.

Friday’s employment data, which showed both jobs and wage growth accelerated in May even though the unemployment rate ticked higher, saw markets pare back expectations for rate cuts this year, with the first rate cut now expected to come in September.

Recent comments by Fed officials have indicated they are in no rush to cut rates as inflation remains persistent and the outlook for growth remains solid.

Inflation has cooled after aggressive rate hikes starting in 2022 but has not yet fallen to its 2% target.

2. May inflation data

Inflation figures for May are due to be released just hours before the Fed statement on Wednesday. Further signs of inflation easing could cement expectations for rate cuts, especially given signs of economic weakness.

Wall Street, boosted by cooling inflation, will be watching closely. Traders continue to price in some monetary easing this year, with even some slim hopes of a July cut.

A bad inflation miss could spook investors and bring back recession fears that have laid dormant for months.

No doubt, the data could fire markets up ahead of Fed Chair Jerome Powell's post-meeting press conference.

3. Wall Street

Wall Street will be closely watching Wednesday’s inflation data and Fed meeting for clues on whether the soft-landing hopes that drove stocks to record highs are still justified.

"No one expects the Fed to cut (rates next week), but will they open the door for a cut as soon as September is the big question on everyone's mind," Ryan Detrick, chief market strategist at the Carson Group told Reuters, adding he still sees a September reduction on the table.

This year's rally has lifted the S&P 500 up more than 12% year-to-date, on expectations the Fed can cool inflation without hurting growth. Yet recent economic data have sent conflicting signals: Friday’s jobs report was far stronger than expected, while earlier reports showed a slowdown in manufacturing and a first-quarter growth rate revised lower.

“The market would like some clarity and not see the Fed have to wait until December or January to begin cutting rates,” said Paul Christopher, head of global market strategy at the Wells Fargo Investment Institute, adding a long period of elevated borrowing costs could hurt the economy.

4. UK data

Market participants will be closely watching the latest U.K. jobs report on Tuesday as they try to gauge whether wage pressures are easing fast enough to make a Bank of England rate cut a near-term prospect.

Average weekly earnings, excluding bonuses, rose by an annual 6% in the three months to March, and April's 9.8% increase to Britain's minimum wage may push that growth rate higher.

Until recently, economists expected a June rate cut but persistent inflation pressures mean markets are not now fulling pricing in a move until November.

Meanwhile, April GDP data on Wednesday is expected to show growth softened after a robust 0.6% expansion in the first quarter.

Elsewhere, the opposition Labour Party is to launch its manifesto ahead of the July 4 election. While polls suggest Labour will hammer Prime Minister Rishi Sunak's Conservatives, some business leaders doubt Labour can turn around Britain's recent weak growth performance.

5. BOJ

Bank of Japan Governor Kazuo Ueda has already hinted at some kind of taper of the bank’s long-running quantitative easing program when the BOJ concludes its two-day meeting on Friday.

On Thursday he said it would be appropriate to reduce still-massive bond purchases as the BOJ exits decades of stimulus, stressing policymakers will move "cautiously" on rate hikes after delivering its first rise since 2007 in March.

Mizuho Securities sees a good chance of a 1 trillion yen ($6.4 billion) cut in monthly purchases to roughly 5 trillion yen per month, which could be weathered by bond markets.

Whether that supports the battered yen is a separate matter, with the BOJ and government concerned a weak currency could derail a hoped-for cycle of mild inflation and steady wage gains.

--Reuters contributed to this report

By Rae Wee

SINGAPORE (Reuters) -Asian stocks are set to snap a two-week losing streak on Friday after major central banks kick-started their rate easing cycles this week, adding to expectations the U.S. Federal Reserve could soon follow suit.

The European Central Bank (ECB) delivered a well-telegraphed rate cut on Thursday, a day after the Bank of Canada became the first G7 nation to trim its key policy rate.

The two join Sweden's Riksbank and the Swiss National Bank in beginning their respective monetary easing cycles, breathing new life into the global risk rally and as bets grow that the Fed could also cut rates in September.

"You've got two of the G7 cutting rates ... it certainly opens the door further to the Fed," said Tony Sycamore, a market analyst at IG. "We're not in the home straight, but we've certainly rounded the corner.

MSCI's broadest index of Asia-Pacific shares outside Japan rose 0.2% and was on track to end the week nearly 3% higher, though some of its gains were capped by a selloff in Chinese stocks.

Europe looked set to extend the positive momentum, with EUROSTOXX 50 futures advancing 0.02% while FTSE futures gained 0.17%. S&P 500 futures were up 0.1%, with Nasdaq futures adding 0.16%.

Market moves were largely subdued as traders stayed on guard ahead of Friday's U.S. nonfarm payrolls report, where expectations are for the world's largest economy to have added 185,000 jobs last month.

"If we did get a little softer data tonight ... We could see 10-year Treasury yields pushing down towards the 4% level," said Rob Carnell, ING's regional head of research for Asia-Pacific.

By Kevin Buckland

TOKYO (Reuters) -The dollar hovered close to an eight-week low on Friday ahead of a crucial U.S. jobs report that could provide clues on the timing of Federal Reserve interest rate cuts.

The euro held on to overnight gains after the European Central Bank reduced rates in a well-telegraphed move, but offered few hints about future easing as lingering inflation clouds the outlook.

The U.S. dollar index, which tracks the currency against the euro and five other major rivals, was little changed at 104.09 as of 0453 GMT, not far from this week's low of 103.99, the first time it had broken below 104 since April 9.

For the week, the index was on track for a 0.54% slide following a run of weaker macro data that put prompted investors to put two, quarter-point Fed rate cuts back on the table for this year.

That has seen traders positioned for a softer non-farm payrolls report later in the day, with the possibility that jobs growth comes in below the 185,000 median forecast of economists.

The Federal Open Market Committee is not expected to make any change at its policy meeting next week, but markets currently price in 50 basis points of cuts by end-December, with the first cut most likely coming in September.

"We expect the overall message from the non‑farm payrolls report to be one of strength, albeit ebbing," Joseph Capurso, head of international economics at Commonwealth Bank of Australia (OTC:CMWAY), wrote in a client note.

BEIJING (Reuters) - China's trade surplus with the United States was $30.8 billion in May, customs data showed on Friday, widening from the $27.24 billion surplus in April.

The trade surplus with the United States stood at $128.2 billion for January-May.

By Satoshi Sugiyama

TOKYO (Reuters) -Japanese household spending rose for the first time in 14 months in April from the year earlier, data showed on Friday, although the tepid growth showed consumers remained reluctant to loosen their purse-strings in the face of higher prices.

Consumer spending rose 0.5% in April from a year earlier, data from the internal affairs ministry showed. That was slightly below the median market forecast for a 0.6% uptick.

On a seasonally adjusted, month-on-month basis, spending fell 1.2%, versus an estimated 0.2% rise.

"Personal consumption, which has been stagnant for a long time, continues to be weak," said Masato Koike, economist at Sompo Institute Plus. "High prices are weighing on household consumption."

Sluggish private consumption is a source of concern for policymakers striving to achieve sustained economic growth underpinned by solid wages and durable inflation, which are prerequisites for normalising monetary policy.

While spending on education and clothing and footwear increased in April, expenditures in food, entertainment and utilities decreased, the government data showed.

The consumption data comes a day after a Bank of Japan board member Toyoaki Nakamura, one of the more dovish members, said domestic consumption has been sluggish recently, expressing concern that inflation may fall short of the central bank's 2% target from fiscal 2025 onwards if such conditions persist.

Separate data released on Wednesday showed Japan's regular pay in April rose at the fastest pace in nearly three decades but that inflation-adjusted wages remained weak, extending a record streak of 25 consecutive months of decline.

Going forward, consumption is expected to gradually improve as wages hikes from this spring's labour talks materialise, inflation slows down and temporary cuts in resident and income tax boost consumption, Koike at Sompo Institute Plus said.

"If consumption continues to be weak, it will be difficult to normalise the monetary policy, but real wages are expected to recover and consumption is believed to pick up, which will give (the BOJ) momentum for policy normalisation," Koike said.