Select Language

By Ankur Banerjee

SINGAPORE (Reuters) - Asian stocks rose on Thursday ahead of U.S. inflation data that could influence the Federal Reserve's thinking on rate cuts, while the crypto world got a boost after exchange-traded funds (ETFs) to track bitcoin were approved in the United States.

MSCI's broadest index of Asia-Pacific shares outside Japan was 0.67% higher, on course to snap its seven-day losing streak.

Japan's Nikkei breached 35,000 for the first time since February 1990 in a blistering start to the year, after rising 28% in 2023, its strongest yearly performance in a decade. The Nikkei was last up 1.9% at 35,085 on Thursday.

On the other hand, China stocks loitered near 5-year lows as investor sentiment remained subdued. The blue-chip CSI 300 Index edged higher in early trading, while Hong Kong's Hang Seng Index rose 1.5%.

On Wednesday, U.S. stocks closed higher as mega caps rallied, but gains were limited ahead of inflation reports and major bank earnings later in the week. E-mini futures for the S&P 500 rose 0.14%. [.N]

Market attention has zeroed in on the U.S. consumer price index report (CPI) due later on Thursday. Core CPI is forecast to remain unchanged at 0.3% from the month before, while year-on-year inflation is expected to slow to 3.8% from November's 4%, a Reuters poll showed.

"The risk is that markets sell off on a strong print," said Ben Bennett, APAC investment strategist for Legal and General Investment Management (LGIM). "The reaction could be more muted if we get a soft number."

Investors have been rethinking just how steep and early the Fed will cut rates since the start of the year. Fed futures prices indicate traders anticipate 140 basis points of easing this year, compared with 160 bps of cuts expected at the end of 2023.

Markets are pricing in a 67% chance of a rate cut in March, the CME FedWatch tool showed.

Federal Reserve Bank of New York President John Williams said on Wednesday it is still too soon to call for rate cuts as the central bank still has some distance to go on getting inflation back to its 2% target.

LGIM's Bennett said that investors are underestimating the risk of a U.S. recession. "Soft CPI prints could eventually become a sign of disappointing demand. But that's probably still a while away."

Investor focus will also be on the earnings season, with banking giants JPMorgan Chase (NYSE:JPM), Bank of America, Citigroup and Wells Fargo all due to report earnings on Friday.

Meanwhile, the U.S. securities regulator late on Wednesday approved the first U.S.-listed ETFs to track bitcoin, in a watershed for the world's largest cryptocurrency, with most of the products expected to begin trading on Thursday.

Crypto-services firm Nexo co-founder Antoni Trenchev said the spot ETF news is possibly bitcoin's biggest since its launch but the approval shouldn't be viewed in isolation, given the timing of the upcoming halving in April which cuts the bitcoin supply and historically kick-starts the new bull market.

"Both these events combined could well send bitcoin to $100,000 in 2024."

On Thursday, bitcoin was little changed and a shade above $46,000, having surged more than 70% since October in anticipation of the decision from the regulator.

In the currency market, the Japanese yen remained under pressure and was last at 145.35 per dollar, having dropped 0.9% overnight. Data on Wednesday showed Japanese workers' real wages shrank for a 20th straight month in November - confounding officials' wishes to see wage gains before tightening policy.

The dollar and other major currencies were steady ahead of the U.S. inflation report. [FRX/]

U.S. crude rose 0.32% to $71.60 per barrel and Brent was at $77.03, up 0.3% on the day, after dropping nearly a dollar in the previous session as a surprise jump in U.S. crude stockpiles raised worries about demand in the largest oil market. [O/R]

By Jihoon Lee and Cynthia Kim

SEOUL (Reuters) -South Korea's credit market is showing signs of stability less than two weeks after officials pledged to expand a $66 billion program if needed to limit the fallout from a builder's debt woes, analysts said, but added that it was still early days.

An announcement by Taeyoung Engineering & Construction, the country's 16th largest builder, on Dec. 28 to reschedule its debt has fuelled concerns about a credit crunch in money markets, as many real estate projects rely on the short-term debt market to finance construction projects.

On Tuesday, the yield on 91-day commercial paper was quoted at 4.24%, down from a 10-month high of 4.31% in early December.

It compares with a 14-year high of 5.54% in late 2022, when a missed bond payment by Gangwong-Jungdo Development Corp, a local government-backed developer of theme park Legoland, caused a credit crunch in financial markets.

"We cautiously do not see systematic risks from the event as we believe the government and authorities are likely to recycle policy tools from 4Q22, if necessary," Citi economists Jiuk Choi and Jin-wook Kim said in a report.

"Market impact has been limited as financial authorities are proactively announcing policy support and expanding when needed," said Choi Seong-jong, a credit market analyst at NH Investment Securities.

Authorities have been quick to limit any spillover from Taeyoung's debt troubles, and have urged the builder to fulfil creditors' demand to inject more liquidity into the company by selling its assets, including its stakes in local broadcaster SBS.

Finance minister Choi Sang-mok has vowed multiple times to "expand market stabilisation measures sufficiently as needed," although he has ruled out injecting taxpayers' money to bail out Taeyoung.

Shares of Taeyoung dropped 37% in December, hitting their lowest since early 2005, but have rebounded nearly 50% so far in January.

South Korea's property market, a key sector driving growth and affecting financial markets, has been sluggish since mid-2022 as demand dampened due to the central bank's aggressive rate hikes to tame inflation.

"Policymakers are approaching the issue with targeted measures, separating interest rate policy and liquidity support. They might consider lowering interest rates if market jitters worsen, but not pre-emptively," said Cho Yong-gu, a fixed-income analyst at Shinyoung Securities.

"There is still some worry about Taeyoung as the trouble is still at the early stage and may pick up pace after general elections in April," Cho said.

($1 = 1,314.8200 won)

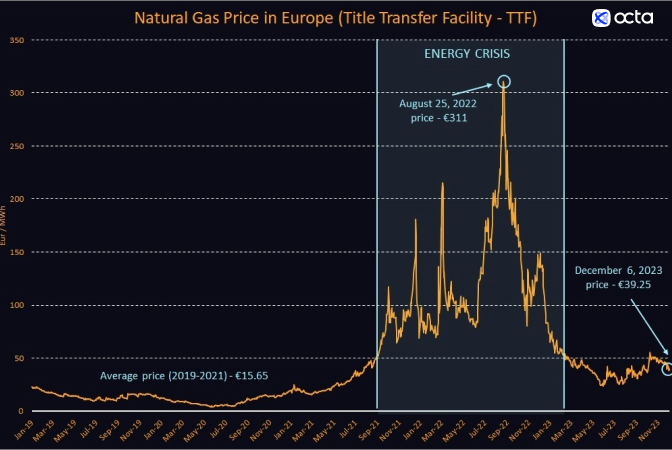

Europe faced an unprecedented energy crisis for around seventeen months (from September 2021 to February 2023), as coal, natural gas, and electricity prices surged to all-time highs. Governments across the continent rushed in to introduce energy-saving measures and implement conservation policies, while households and businesses had to cut consumption rapidly.

Now, as 2023 draws to a close, can we confidently conclude that the energy crisis in Europe is over? How prepared is Europe to cope with the upcoming winter? What are the risks and challenges that lie ahead?

The energy crisis's most acute phase occurred in the summer of 2022. One only needs to look at the evolution of Europe's benchmark natural gas price (TTF) to assess the scale of the emergency (see the chart above). On 25 August 2022, TTF price reached €311 per megawatt-hour (MWh), the highest level ever recorded. On that specific day, the price was 44% above the previous maximum reached on March 7, 2022, and was a staggering 18 times higher than the three-year average price recorded over 2019-2021. Despite Europe's gas storage sites being 78% full in August 2022, supply worries were rife as imports from Russia dropped by around 60%, forcing Europe to rely extensively on liquefied natural gas (LNG) imports—especially from the United States. However, the aggregate supply of LNG in the global market at that time was reduced as one of the U.S. LNG export plants—Freeport LNG—had to go offline due to an explosion incident. Thus, to secure an adequate number of LNG cargoes, Europe had to outbid other customers in South and East Asia by agreeing to pay higher prices to suppliers.

A lot has changed since last summer. The European gas prices have returned to normality but remain above the level observed before the crisis. On Monday, 6 December, the front-month futures contract for delivery in January at TTF settled at €39.25 per MWh, 87% below the peak observed in August 2022 but still some two times above the historical average seen in 2019-2021. Kar Yong Ang, Octa analyst singles out several reasons for normalisation:

‘Although natural gas prices in Europe remain higher than they were before the crisis, the situation has improved dramatically. There are several reasons for this. First, there was a structural loss of demand partly due to reduced economic activity and partly due to conservation policies. Second, imports of pipeline gas and that of LNG increased. On top of it, there was a bit of luck as well, as weather conditions allowed the Europeans to build the stocks faster than normal.’

Indeed, probably the most painful adjustment that Europe had to endure was the loss of demand. According to Eurostat, total gas use in the EU's top 6 consuming countries—Germany, Italy, France, Netherlands, Spain, and Poland—was down by 17% in the first ten months of 2023 compared with the five-year average for 2017-2021. Obviously, energy-intensive industries such as chemicals and steel production had to bear the brunt of adjustment. For example, according to Statistisches Bundesamt, Germany's energy-intensive manufacturing production has decreased by about 20% since the start of 2022 and has not shown any signs of recovery yet.

Thus, Europe had to rely on imports more and more to balance its natural gas market. Russia has long been the main supplier of affordable pipeline gas into Europe, but geopolitical tensions, sanctions, and explosions of the Nord Stream pipeline have brought the flows to a minimum. According to Eurostat, Russia exported just 22.3 billion cubic metres of natural gas into Europe in the first nine months of 2023, which is 57% lower than during the same period in 2022 and 65% lower than during the same period in 2021. Concurrently, imports of LNG from the United States reached 30.01 billion cubic metres during the first nine months of the year, up a whopping 185% from the same period in 2021.

‘Overall, Europe has managed to bring its natural gas inventories to a rather comfortable level and is now well-protected to withstand future supply shocks,’ says Kar Yong Ang, Octa analyst. Indeed, according to the latest data from Gas Infrastructure Europe, gas storage levels are at record highs for this time of the year at around 94% full, said the Octa analyst, adding that the general bias for TTF price remains bearish. ‘I would not be surprised to see European natural gas prices drop to €30 per MWh in case of a normal winter. Alternatively, if this upcoming winter turns out to be colder than normal, we might see TTF temporarily hitting €60 per MWh.’

However, Kar Yong Ang says that different kinds of challenges and risks lie ahead for Europe. ‘It appears that Europe is placing too much faith in LNG. It's betting too much on a single supply source, which may backfire in the long run. If Europe is to permanently replace relatively cheap pipeline imports from Russia with expensive LNG imports, then, I am afraid, economic activity in its traditional industries may never recover to the pre-crisis levels.’

Indeed, Europe's top competitors—the United States and China—benefit from lower prices. The United States has ample resources at home, while China is getting cheap imports from Russia. Europe risks losing its competitive standing in the global marketplace. Furthermore, as we explained at the beginning of the article, the temporary shutdown of a single LNG export plant in the U.S. has already highlighted how strongly European energy security is now connected with the intricacies of the global LNG market. Most recently, Houthi militants in Yemen have stepped up attacks on vessels in the Red Sea, which has already prompted some LNG vessels to reroute in order to avoid Bab-el-Mandeb strait between Yemen and Djibouti. So far, the maritime attacks in the region have had a much stronger impact on the price of oil, but natural gas and LNG markets could also be affected.

‘With supply options more limited than in the past, European consumers will have to get used to more volatile natural gas prices, as they will increasingly be determined by the whims of the weather and by the bargaining power of other LNG importers in Asia,’ says Kar Yong Ang, Octa analyst.

Europe has survived the energy crisis and managed to adapt but has done so at the cost of lower demand and reduced economic activity. Now, Europe will have to learn to navigate the global LNG trade successfully to secure the most favourable deals.

TOKYO (Reuters) -Japan's Nikkei share average ended at its highest in 34 years as technology shares tracked overnight gains in U.S. peers, while a weaker yen boosted exporters.

The Nikkei index jumped 2.01% to close at 34,441.72, its highest close since February 1990. The index crossed the 34,000 level for the first time since March 1990.

The broader Topix rose 1.3% to 2,444.48, its highest since March 1990.

"The Nikkei rallied to the 34,000 level and that prompted investors to buy more stocks," said Masahiro Ichikawa, chief market strategist at Sumitomo Mitsui (NYSE:SMFG) DS Asset Management.

The S&P 500 and Dow closed lower overnight, but the technology-heavy Nasdaq edged higher. [.N]

"The weaker yen was a tailwind for Japanese stocks. This came after the yen's gain against the dollar weighed on sentiment and limited the Nikkei's gains at the end of last year," said Shuutarou Yasuda, a market analyst at Tokai Tokyo Research Institute.

The Japanese yen weakened against the dollar in Asian trade ahead of U.S. inflation data later this week that could influence the Federal Reserve's policy. [FRX/]

A softer yen helps exporters as it increases the value of overseas profits in yen terms when firms repatriate them to Japan.

Uniqlo-brand clothing retail chain operator Fast Retailing jumped 3.83% to become the biggest boost for the Nikkei.

Chip-making equipment maker Tokyo Electron gained 1.91% and ceramics maker Kyocera climbed 6.09%.

Sony (NYSE:SONY) Group rose 3.82% to become the biggest boost for the Topix. Electronics maker Keyence (OTC:KYCCF) jumped 4.86%.

Computer maker Fujitsu fell 1.94% and was the biggest percentage loser.

Of the 225 components, 176 shares rose, 47 fell and two were flat.

BERLIN (Reuters) -German construction spending is set to fall in 2024 for the first time since the financial crisis, according to a study by a prominent research institute, in a further bad sign for the property industry as it suffers its worst crisis in decades.

Construction volume will shrink by 3.5% in 2024 to 546 billion euros ($597.38 billion) before recovering slightly with a 0.5% increase in 2025, the DIW economic institute said in a study to be published on Wednesday and seen by Reuters.

For years, the property sector in Germany and elsewhere in Europe boomed as interest rates were low and demand strong.

But a sharp rise in rates and costs put an end to the run, tipping developers into insolvency as bank financing dries up and deals freeze.

The last time that German construction spending declined was in 2009.

"The slump in the construction industry is taking longer than expected," said Laura Pagenhardt, an author of the study.

A survey published Wednesday by the Ifo economic institute that showed sentiment in residential construction at an all-time low further drove home the dire situation in the industry.

"There is as yet no sign that the situation is easing," said Klaus Wohlrabe, head of surveys at Ifo, after the December mood was recorded at the lowest level since the survey began in 1991.

"These exceptionally weak expectations show that companies currently have no hope. The prospects for 2024 are bleak," he added.

($1 = 0.9140 euros)

SEOUL (Reuters) - South Korea's President Yoon Suk Yeol on Wednesday vowed to relax tax rules on multiple homeowners and ease rules governing the reconstruction of apartment buildings in a bid to curb housing costs and boost supplies.

His comments come three months ahead of general elections in April. Despite a recent property downturn, housing costs remain stubbornly high in the country and are cited as a key reason for discouraging marriage and childbirth.

"House prices rose more due to insufficient supply and that is still unresolved," Yoon told a discussion forum on television, calling the issue a "huge problem".

House prices in the capital Seoul were 15.2 times higher than the average annual income in 2022, up from 14.1 times in 2021, according to government data.

South Korea's real estate market has cooled since mid-2022 as demand dampened due to aggressive rate hikes by the central bank, with its policy rate currently at the highest since late 2008.

At the forum, measures to provide liquidity support for the construction sector were also discussed to help the financing of home building, the presidential office said.

By Andrea Shalal and David Lawder

WASHINGTON (Reuters) -U.S. Treasury Secretary Janet Yellen pledged U.S. support for Egypt's economy and reforms after meeting with the North African nation's authorities on Tuesday in Washington amid talks over expanding Egypt's $3 billion International Monetary Fund loan program.

The Egyptian officials, including the country's finance minister and central bank governor, also were due to meet with IMF Managing Director Kristalina Georgieva during their visit to Washington on Tuesday, an IMF spokesperson said, without providing further details.

The high-level meetings come as U.S. Secretary of State Antony Blinken visits the Middle East and works to prevent the Israel-Gaza war from expanding into a wider regional conflict.

Georgieva told Reuters in November that the IMF was "seriously considering" augmenting Egypt's $3 billion loan program as the country struggles with the economic impact from Israel's invasion of Gaza.

Already facing high foreign debt levels, Egypt has been hit hard by the war in the neighboring Gaza Strip, which threatens to disrupt tourism bookings and natural gas imports, as well as recent attacks on Red Sea ships.

A statement from Treasury said that Yellen discussed challenges to Egypt from the Gaza war during her meeting with Egyptian Finance Minister Mohamed Maait, Minister of International Cooperation Rania Al-Mashat, and Central Bank of Egypt Governor Hassan Abdalla.

"Secretary Yellen underscored strong United States support for Egypt and its economic reform program. She underscored the goal of bolstering Egypt’s economy and supporting inclusive, sustainable growth," the Treasury said.

Egypt's $3 billion loan program agreed with the IMF in December 2022 faltered after the North African country failed to let its currency float freely or make progress on the sale of state assets.

The IMF, in which the U.S. is the largest shareholder, delayed disbursements of about $700 million expected in 2023, but in December said it was in talks to expand the $3 billion program given economic risk from the Israel-Gaza war.

A spokesperson for Egypt's embassy in Washington could not be reached for comment.

TOKYO (Reuters) - Japanese workers' real wages kept shrinking for a 20th month in November, data showed on Wednesday, raising fresh alarm for the sustainability of the country's economic recovery as firms enter the period of annual pay negotiation with labour unions.

Japan's wage trend draws an unusual amount of attention from financial markets worldwide since the Bank of Japan regards pay and inflation outlooks as the most important data in considering the dismantling of its negative interest rate policy.

Inflation-adjusted real wages, a key determinant of consumer purchasing power, fell 3.0% in November from a year earlier, faster than a 2.3% decrease in October, data from the labour ministry showed.

The consumer inflation rate the government uses to calculate real wages, which includes fresh food prices but excludes owner's equivalent rent, decelerated to 3.3%, the lowest since July 2022, thanks to falling fuel costs and moderating food price hikes.

However, nominal pay grew a paltry 0.2% in November, the slowest in nearly two years, after a 1.5% increase in October.

The main culprit behind the weak pay growth was a 13.2% contraction in special payments, which gives an early glimpse into the winter bonuses companies paid to employees. But the indicator tends to be very volatile this time of year due to the small sample size collected during the year-end period.

"It's too early, if not misleading, to judge the winter bonus trends from November's special payments figure alone," a labour ministry official said.

Regular or base salary in November rose by 1.2% year-on-year, almost the same as a revised 1.3% increase in the previous month. Overtime pay, an indicator of business activity strength, increased by 0.9% year-on-year, the first gain in three months.

Japanese businesses are entering the collective pay talks season known as "shunto", which culminates in March. Last year, major firms struck a deal with unions that resulted in the largest pay rises - 3.58% - in three decades amid four-decade-high inflation.

For the 2024 shunto, the country's biggest labour group Rengo has said it will ask for at least a 5% pay increase, including at least 3% base salary growth, to cushion the lasting blow from higher living costs.

Meanwhile, Tokyo's consumer inflation, a leading indicator of nationwide price trends, showed a further slowdown on Tuesday, raising hopes for real wages to rebound eventually, which will provide supporting ground for the Bank of Japan's monetary policy normalisation.

The table below shows preliminary data for monthly incomes and number of workers in November:

----------------------------------------------------------------

Payments (amount) (yr/yr % change)

Total cash earnings 288,741 yen ($2,004) +0.2

-Monthly wage 272,379 yen +1.2

-Regular pay 252,591 yen +1.2

-Overtime pay 19,788 yen +0.9

-Special payments 16,362 yen -13.2

----------------------------------------------------------------

Number of workers (million) (yr/yr % change)

Overall 52.807 +2.0

-General employees 35.686 +1.5

-Part-time employees 17.121 +3.6

----------------------------------------------------------------

The labour ministry defines "workers" as 1) those employed for more than one month at a company that employs more than five people, or 2) those employed on a daily basis or had less than a one-month contract but had worked more than 18 days during the two months before the survey was conducted, at a company that employs more than five people.

To view the full tables, see the labour ministry's website at:

($1 = 144.1000 yen)

By Valerie Insinna

WASHINGTON (Reuters) -Boeing early on Monday shared instructions with airlines for inspecting the 737 MAX 9 fleet, the company confirmed, after 171 MAX planes were grounded by U.S. regulators on Saturday following an accident where a cabin panel ripped off an Alaska Airlines jet while in mid-air.

The instructions, known formally as a multi-operator message, are a key step to allow airlines to complete or certify inspections have been conducted that comply with the Federal Aviation Administration's directive that would allow them to put planes back in service.

"We agree with and fully support the FAA’s decision to require immediate inspections of 737-9 MAX airplanes with the same configuration as the affected airplane," Boeing (NYSE:BA) Commercial Airplanes head Stan Deal said in a letter to employees.

"Our teams have been working diligently – with thorough FAA review – to provide comprehensive, technical instructions to operators for the required inspections," he said. "This morning, our team issued the instructions via a multi-operator message."

The message was delivered to airlines around 3 a.m. Pacific Time (1100 GMT), a source told Reuters, who was first to report that Boeing had sent the instructions.

The U.S. Federal Aviation Administration (FAA) did not immediately comment but a source said it signed off on Boeing's instructions to airlines.

Boeing is "working closely" with MAX 9 customers and providing technical assistance, while staying in contact with the FAA, Deal said.

Boeing plans to hold a "short factory stand down" during the Monday morning meetings at the Renton, Washington-facility that makes the MAX, Deal said. Boeing CEO Dave Calhoun will host an internal Boeing webcast for employees on Tuesday.

Alaska Airlines did not immediately comment.

The FAA on Saturday ordered the temporary grounding of 171 Boeing MAX 9 jets after a door plug tore off from a brand-new MAX 9 shortly after it took off from Portland, Oregon.

On Sunday, the U.S. regulator said the affected fleet of Boeing MAX 9 planes, including those operated by other carriers such as United, would remain grounded until the regulator was satisfied they were safe.

Boeing shares were down 6.6% in Monday trading, though off the day's lows.

By Rae Wee

SINGAPORE (Reuters) - The dollar paused its rally on Tuesday, as traders reaffirmed their bets for a slew of Federal Reserve rate cuts this year on the belief that inflation in the U.S. is slowing sufficiently.

In cryptocurrencies, bitcoin hovered near its strongest level since April 2022 on growing anticipation of imminent approvals of spot bitcoin exchange-traded funds (ETF).

The euro last stood at $1.0950, away from its recent three-week low of $1.0877, while the Japanese yen distanced itself from the 145 per dollar level following a broad decline in the greenback as U.S. Treasury yields slipped. [US/]

The moves were partly driven by the New York Fed's latest Survey of Consumer Expectations which showed that U.S. consumers' projection of inflation over the short run fell to the lowest level in nearly three years in December.

A reading on U.S. inflation is due later in the week, which will likely provide further clarity on how much room the Fed has to ease rates this year.

"The big story last night, the catalyst, was the data regarding inflation expectations going forward," said Kyle Rodda, a senior financial market analyst at Capital.com.

"While it's still a tight labour market, we're still seeing those sort of disinflationary impulses in the United States, which again raises the probability that the Fed will have capacity to cut rates fairly soon."

Futures point to nearly 140 basis points worth of easing priced in for the Fed this year.

Against a basket of currencies, the U.S. dollar eased slightly by 0.08% to 102.22, having risen 1% last week.

Sterling advanced 0.04% to $1.2754, while the risk-sensitive Australian and New Zealand dollars likewise edged higher.

The Aussie last gained 0.04% to $0.6723, away from its three-week low of $0.6641 hit last Friday. The kiwi rose 0.05% to $0.6256 and was similarly some distance away from Friday's three-week trough of $0.6182.

In Asia, data on Tuesday showed core inflation in Japan's capital slowed for the second straight month in December, taking some pressure off the Bank of Japan (BOJ) to rush into exiting ultra-loose monetary policy.

The yen was little changed following the release, and was last 0.17% higher at 143.975 per dollar.

Elsewhere, bitcoin hovered near the $47,000 mark and last stood at $46,923, after having scaled a 21-month top of $47,281 in the previous session.

A raft of investment managers had on Monday disclosed the fees they plan to charge for their proposed spot bitcoin ETF, in another step toward approval this week by the U.S. securities regulator.

"Obviously, there's clearly fundamental reasons why you'd feel bullish about this - it shows greater integration of crypto assets into the traditional financial ecosystem, there's likely going to be increased flow and demand, by extension, for bitcoin and other cryptocurrencies," said Capital.com's Rodda.

"What I'd be very wary of is a 'buy the rumour, sell the fact' situation."

Ether, the second-largest cryptocurrency, steadied at $2,314.70.