Select Language

By Caroline Valetkevitch

NEW YORK (Reuters) - U.S. corporate earnings should improve at a stronger clip in 2024 as inflation and interest rates come down, analysts predict, but worries about slowing economic growth hang over the outlook.

S&P 500 earnings are expected to increase 11.1% overall in 2024 after rising a modest 3.1% last year, according to estimates compiled by LSEG.

But earnings growth needs to be enough to support lofty valuations in stocks. The S&P 500 index is trading at 19.8 times forward 12-month earnings estimates, well above its long-term average of 15.6 times, based on LSEG Datastream data.

Falling rates helped drive a sharp year-end rally, especially after the Federal Reserve in December opened the door to interest rate cuts in 2024 after a rate hike campaign that started in 2022.

The Dow Jones industrial average in December hit its first record high close since January 2022, while the S&P 500 is within striking distance of its all-time closing finish. The S&P 500 rose 24.2% for the year.

"The market trading where it is at current levels demands earnings to show strong growth next year," said Sameer Samana, senior global market strategist at Wells Fargo Investment Institute.

Among concerns for 2024 is the lingering effect of higher interest rates on the economy and corporate earnings, he said.

The U.S. government confirmed in December that economic growth accelerated in the third quarter. Gross domestic product increased at a 4.9% annualized rate last quarter, the Commerce Department's Bureau of Economic Analysis (BEA) said in its final estimate.

Profit estimates could weaken further as companies begin to open their books on the fourth quarter and give guidance for the first quarter and the rest of 2024. The release of fourth-quarter results will kick into high gear in mid-January.

"We're definitely seeing those (first quarter) estimates weakening at a faster pace," said Nick Raich, chief executive of The Earnings Scout. "Look at a name like FedEx (NYSE:FDX), and that's a good bellwether of the global economy."

FedEx shares tumbled 12.1% Dec. 20, a day after the package delivery company reported earnings for the quarter ended Nov. 30 that fell short of analysts' targets and cut its full-year revenue forecast.

Estimated year-over-year earnings growth for S&P 500 companies for the first quarter of 2024 is now at 7.4%, down from 9.6% on Oct. 1, based on LSEG data. For the fourth quarter of 2023, S&P 500 earnings are forecast to rise 5.2%, down from 11% growth seen on Oct. 1.

To be sure, investors point to cooling inflation as a strong positive for companies in 2024.

"The consumer still seems to be healthy, inflation is getting better, employment is still strong, interest rates are going down and gas at the pump is going down," said Gary Bradshaw, portfolio manager at Hodges Capital Management in Dallas.

Moreover, "these companies have streamlined their businesses and margins are decent," he said.

U.S. prices fell in November for the first time in more than 3-1/2 years, pushing the annual increase in inflation further below 3%, a recent Commerce Department report showed.

Optimism over growth in artificial intelligence is likely to continue to help companies with results and outlooks tied to AI technology.

"While the rebound in TECH+ (earnings per share) began in 2Q23, earnings for the rest of the market are expected to follow in the year ahead," Jonathan Golub, chief U.S. equity strategist & head of portfolio analytics at UBS Investment Research, wrote in December.

The "Magnificent 7" group of megacap stocks - Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOGL), Amazon.com (NASDAQ:AMZN), Nvidia (NASDAQ:NVDA), Meta Platforms (NASDAQ:META), and Tesla (NASDAQ:TSLA) - accounted for 62.18% of the S&P 500's total return in 2023, according to S&P Dow Jones Indices senior index analyst Howard Silverblatt.

Also, the Fed's recent dovish pivot has boosted the case for the U.S. dollar to weaken, which would make U.S. exporters' products more competitive abroad.

But whether 2024 earnings forecasts are assuming too many of these positives remains a concern.

"The market is assuming a near-perfect landing with inflation cooling without a significant impact to demand and pricing power — not likely in our view," J.P. Morgan equity strategists wrote in their 2024 outlook.

"Current consensus S&P 500 forward EPS growth at 30%ile (+11%)... is in harmony with a Goldilocks outlook for growth and inflation.

By David Lawder

WASHINGTON (Reuters) - International Monetary Fund Managing Director Kristalina Georgieva said Americans should "cheer up" about the U.S. economy, as inflation subsides further in 2024 amid a strong job market and moderating interest rates.

Georgieva told CNN in an interview that aired on Tuesday that the U.S. economy is "definitely" headed for a "soft landing" with fairly strong growth prospects.

"People should be feeling good about the economy because they finally would see relief in terms of prices," Georgieva said, praising the Federal Reserve's "decisiveness" in raising interest rates to fight inflation.

"While that has been painful, especially for small businesses, it has brought the desired impact without pushing the economy into recession," Georgieva added.

Asked why many polls show Americans pessimistic about the economy, the IMF chief said that consumers had become accustomed to low inflation and very low interest rates for many years, and when both jumped in recent years, it was a shock.

"My message to everyone is, you have a job and interest rates are going to moderate this year because inflation is going down. Cheer up. It is a new year, people," Georgieva said.

Georgieva repeated her warnings against fragmentation of the global economy along geopolitical lines due to increasing national security restrictions, with countries gravitating towards separate blocs led by the United States and China.

Allowed to continue, she said this could ultimately reduce Global GDP by 7% - roughly equal to the annual out put of France and Germany," and urged Washington and Beijing to compete on a rational basis, while cooperate on globally important issues.

"So we are all better off to find ways to reduce frictions, to concentrate on security concerns that are real and meaningful, and not go willy-nilly in fragmenting the world economy. We would end up with a smaller pie," Georgieva said.

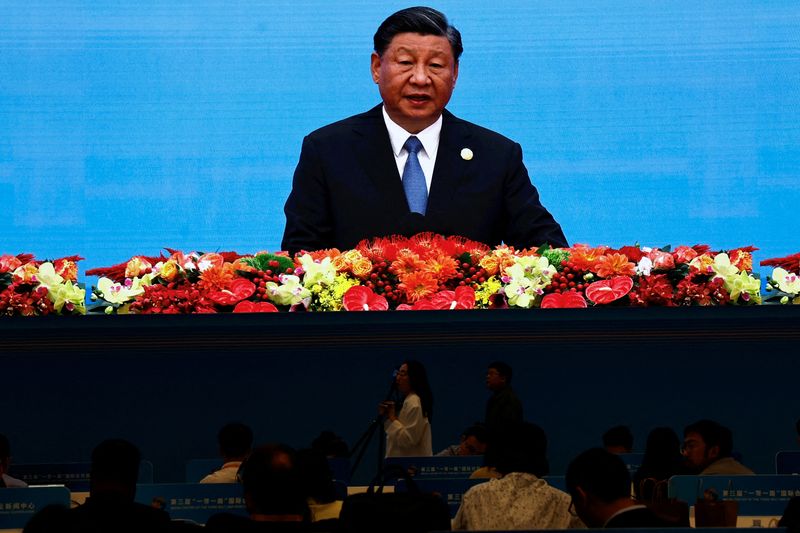

BEIJING (Reuters) - President Xi Jinping said on Sunday that China will consolidate and enhance the positive trend of its economic recovery in 2024, and sustain long-term economic development with deeper reforms.

In a televised speech to mark the New Year, Xi said China would deepen reforms to shore up confidence in the economy.

Xi said China will "consolidate and enhance the positive trend of economic recovery, and achieve stable and long-term economic development," Xi said.

"We must comprehensively deepen reform and opening up, further boost confidence in development, enhance economic vitality, and make greater efforts to promote education, promote science and technology, and cultivate talents."

Xi voiced his concerns over difficulties facing some firms' operations and the hardship facing some people in employment and their daily lives, and the impact of natural disasters such as floods and earthquakes in some regions.

China will promote high-quality development and balance development and security in a well-coordinated way, Xi added.

The government has in recent months announced a series of measures to shore up China's feeble post-pandemic economic recovery, which is being held back by a property slump, local government debt risks and slow global growth.

Analysts expect China's economic growth to hit the official target of around 5% this year, and Beijing is expected to maintain the same target next year.

Earlier this month, top Chinese leaders met and laid out economic plans for 2024, pledging to take more steps to support the recovery. The central bank has pledged to step up policy adjustments to support the economy and promote a rebound in prices, amid signs of rising deflationary pressures.

By Ankur Banerjee

SINGAPORE (Reuters) -The dollar rose on the first trading day of the year as attention turned to economic data this week that may provide clues on the Federal Reserve's next moves, while bitcoin surged above $45,000 for the first time since April 2022.

The dollar index, which measures the U.S. currency against six rivals, fell 2% in 2023, snapping two years of gains. It was last at 101.54, up 0.158%, as investors weighed the prospect of the Fed cutting rates this year.

The dollar's ascent weighed on the Japanese yen the most, with the Asian currency down 0.54% at 141.63 per dollar, having slid 7% in 2023.

Rescue teams in Japan on Tuesday struggled to reach isolated areas hit by a powerful earthquake on New Year's Day, with reports of more than 20 people dead in a disaster that toppled buildings and knocked out power to thousands of homes.

Markets are now pricing in an 86% chance of interest rate cuts from the Fed to start from March, according to CME FedWatch tool, with over 150 basis points (bps) of easing anticipated in the year.

"The question is when and how fast rate cuts will be delivered," Marc Chandler, chief market strategist at Bannockburn Global Forex, said in a note.

"Moderating price pressures and weaker growth impulses have seen the pendulum of market sentiment swing dramatically from the 'higher for longer' mantra of most of last year to pricing in aggressive easing" from central banks, Chandler said.

The focus now switches to a slew of economic data due this week, including the data on job openings and nonfarm payrolls. Minutes from the last Fed meeting in December are scheduled for release on Thursday and will provide insight into the central bankers' thinking around rate cuts this year.

"The positive sentiment from end-2023 may roll over into this week as all eyes turn to the U.S. jobs report on Friday," said Nicholas Chia, macro strategist at Standard Chartered (OTC:SCBFF).

At its December policy meeting, the Fed adopted an unexpectedly dovish tone and forecast 75 basis points in rate reductions for 2024.

That contrasted with other major central banks, including the European Central Bank (ECB) and Bank of England (BoE), which reiterated they will hold rates higher for longer.

Still, traders are pricing in 158 bps of cuts by the ECB this year, while the BoE is also expected to cut rates by 144 bps in 2024.

The euro was down 0.2% at $1.1022, inching away from the five-month peak of $1.11395 it touched last week. The single currency gained 3% last year, its first yearly gain since 2020.

Sterling was last at $1.27105, down 0.15% on the day, having clocked its strongest yearly performance last year since 2017 with a 5% gain.

Elsewhere, the Australian dollar was little changed at $0.68105. The New Zealand dollar was 0.3% lower at $0.6300.

The crypto world started the year with a bang, with bitcoin touching a 21-month peak of $45,511, up 3% on the day on rising expectations that the U.S. Securities and Exchange Commission would soon approve exchange-traded spot bitcoin funds.

========================================================

Currency bid prices at 0353 GMT

Description RIC Last U.S. Close Pct Change YTD Pct High Bid Low Bid

Previous Change

Session

Euro/Dollar $1.1024 $1.1046 -0.20% -0.13% +1.1046 +1.1019

Dollar/Yen 141.5350 141.0450 +0.38% +0.38% +141.6600 +140.9400

Euro/Yen 156.04 155.66 +0.24% +0.26% +156.1600 +155.4500

Dollar/Swiss 0.8443 0.8416 +0.34% +0.34% +0.8448 +0.8409

Sterling/Dollar 1.2714 1.2730 -0.11% -0.08% +1.2735 +1.2710

Dollar/Canadian 1.3255 1.3245 +0.08% -0.01% +1.3256 +1.3224

Aussie/Dollar 0.6814 0.6810 +0.07% -0.04% +0.6822 +0.6803

NZ 0.6300 0.6319 -0.30% -0.30% +0.6323 +0.6295

Dollar/Dollar

All spots

Tokyo spots

Europe spots

Volatilities

Tokyo Forex market info from BOJ

By Xinghui Kok

SINGAPORE (Reuters) -Singapore's economy grew 2.8% in the fourth quarter year-on-year, preliminary government data showed on Tuesday, faster than some economists expected and helped by improvements in construction and manufacturing.

The fourth quarter growth in gross domestic product (GDP) was faster than the 1% expansion in the third quarter of 2023.

For the full year of 2023, Singapore's economy grew 1.2%, moderating from the 3.6% growth in 2022.

Both OCBC economist Selena Ling and Maybank economist Chua Hak Bin said the year-on-year growth was better than they had anticipated in the fourth quarter. Ling was expecting a 1.8% expansion while Chua was looking at 2.5%.

"Green shoots are sprouting in exports and manufacturing, brightening the outlook for 2024," said Maybank's Chua, who expects GDP growth of 2.2% in 2024.

OCBC's Ling forecast range for 2024 is 1-3%, in line with the trade ministry's projection.

"The key question is how much of a pickup in growth momentum we will have this year given the current uncertainties over whether the U.S. will escape a recession, and if or when the Fed will cut rates, and how geopolitics will play out with U.S and other elections," she said.

On a quarter-on-quarter seasonally adjusted basis, GDP expanded 1.7% in the October to December period, extending the 1.3% expansion in the third quarter.

Monetary policy is due for review no later than January 29, said the central bank on Tuesday. The Monetary Authority of Singapore (MAS) had increased the frequency of reviews from twice a year to quarterly starting in 2024.

In October, the MAS left policy settings unchanged as inflation in the city-state moderated.

Singapore's core inflation slowed to 3.2% in November last year from a peak of 5.5% in January and February.

By Andrea Shalal

(Reuters) - Higher consumer spending over the holiday season, real wage gains over the last nine months and a jump in consumer confidence point to a good start for 2024, said Jared Bernstein, chair of the White House Council of Economic Advisers on Sunday.

Bernstein told "Fox News Sunday" that President Joe Biden would continue to focus on lowering costs for Americans if he won a second term in the November 2024 presidential election.

"If you actually look at the trend in the economy ... I think you see some real momentum getting us in a good start for the new year," Bernstein said.

U.S. consumer confidence increased to a five-month high in December, the Conference Board reported on Dec. 20, mirroring a nearly 14% increase in the University of Michigan's benchmark Consumer Sentiment Index, its biggest jump in more than three decades. For most of Biden's term, the Michigan index has reflected widespread pessimism among households about the economy, but the new data showed Americans' growing confidence that inflation was finally trending lower.

Michigan survey director Joanne Hsu noted the upswing in December reversed "all declines from the previous four months. These trends are rooted in substantial improvements in how consumers view the trajectory of inflation."

Indeed, inflation has eased substantially over the course of 2023. The Labor Department's Consumer Price Index began the year with annual price increases averaging 6.4%. By November, that was down to 3.1%. Bernstein noted that gasoline was below $3 a gallon in more than half the states.

The U.S. national average retail gasoline price could drop by 13 cents next year to $3.38 a gallon, a second straight year of dropping fuel costs, according to price tracker GasBuddy.com's annual outlook.

"This has been a very strong Christmas season," Bernstein said, adding that spending at restaurants rose 8% from Nov. 1 to Christmas Eve, with spending on online sales up 6%, with overall retail spending rising 3%.

Despite the growing optimism, the Biden administration says it remains alert to geopolitical risks, including Russia's ongoing war in Ukraine, which has the potential to disrupt grain markets and push up inflation again.

In the Middle East, Israel predicts its war with Hamas militants will last for months, increasing the risk of regional escalation. In the Red Sea, attacks by Iranian-backed Houthi militants in Yemen have disrupted world trade. Maersk, one of the world's major cargo shippers, on Sunday said it would pause all sailing through the Red Sea for 48 hours after a Houthi attack on one of its container vessels.

Bernstein also cited big gains in the startup of new businesses, especially by people of color, which he said reflected more optimism and confidence about the U.S. economy.

Bernstein said the Biden administration was keeping an eye on rising credit card debt but saw it as a return to normal levels of delinquencies or debt levels. Record increases in wealth among Americans of all income levels and among people of color would also help offset the increases, he said.

SEOUL (Reuters) - Bank of Korea Governor Rhee Chang-yong said on Monday recent market concerns over a financially troubled builder are a "warning sign" over the financial risks of prolonged monetary tightening.

While managing inflation remains the top priority, it is important to find the right policy mix as South Korea approaches the end of its long fight to bring consumer prices under control, Rhee said in a New Year message.

He cited doubts about the integrity of commercial real estate loans in major countries and a mid-sized local developer that was forced to restructure its heavy debt load as some of the warning signs for the economy.

"There is a need to be thoroughly prepared for the possibility of financial instability that can arise as tightened policy continues," he said.

"We need to pay particular attention to make sure credit risks do not grow around what is a weak link in our economy."

Rhee met with Finance Minister Choi Sang-mok and financial regulators on Friday and pledged to provide liquidity support after an announcement by Taeyoung Engineering & Construction to restructure its debt caused market jitters.

The country's 16th largest builder has 4.58 trillion won ($3.6 billion) of debt, including project financing loans.

The central bank's inflation target of 2% remains valid although external and domestic factors require more fine tuning to determine the optimal interest rate path and how much longer to maintain tightened monetary policy, Rhee said.

South Korea's annual consumer inflation eased for a second month in December to 3.2%, supporting the BOK's view on the inflation path, which is that price pressure will ease gradually to its target level of 2% towards the end of 2024.

President Yoon Suk Yeol said on Monday that pressure on prices is expected to ease further in 2024 and the government will take measures to ensure the financially more vulnerable, including small business owners, see the benefits of a pull back in inflation.

BEIJING/SEOUL (Reuters) -All Boeing (NYSE:BA) 737 MAX jets operated by Chinese carriers are back in service at the end of 2023, the U.S. planemaker's China head said on Friday, nearly a year after they started returning following a global grounding in 2019.

The best-selling Boeing model was grounded after fatal crashes in Indonesia and Ethiopia. The MAX returned to service around the world starting in late 2020 after modifications to the aircraft and pilot training, but Chinese airlines started to fly them again only in January 2023.

"All China civil aviation 737 MAXs have resumed operations," Boeing China CEO Liu Qing said on Chinese social media, adding this amounted to nearly 100 planes.

Liu also said Boeing has delivered new planes to Chinese clients this year, though he did not specify which models.

Boeing last week made its first direct delivery of a 787 Dreamliner to China since 2019, a step seen as a possible prelude to the end of Beijing's freeze on 737 MAX deliveries.

Boeing has been virtually frozen out of new orders from China since 2017 amid Sino-U.S. trade tensions.

A restart of MAX deliveries would represent a reset of Boeing's relationship with China and be a financial boon that would allow it to offload dozens of planes in its inventory.

By Rae Wee

SINGAPORE (Reuters) - The dollar looked set on Friday to end 2023 with a loss, reversing two straight years of gains, dragged by market expectations that the U.S. Federal Reserve could begin easing rates as early as next March.

The greenback stayed broadly on the back foot on the last trading day of the year, with currency moves subdued amid a holiday lull leading up to the New Year.

Since the Fed launched its aggressive rate-hike cycle in early 2022, expectations of how far U.S. rates would have to rise have been a huge driver of the dollar for the most part of the past two years.

But as economic data subsequently pointed to signs that inflation in the United States is cooling, investors turned their focus to how soon the Fed could begin cutting rates - expectations which gathered steam after a dovish tilt at the central bank's December policy meeting.

Against a basket of currencies, the greenback fell 0.02% to 101.18, languishing near a five-month trough of 100.61 hit in the previous session.

The dollar index was on track to lose more than 2% for the month and roughly 2.2% for the year.

"The dollar is likely to come under pressure in 2024 as (the) Fed formally signals a dovish pivot, but we need to see how growth outside the U.S. transcends," said Charu Chanana, head of FX strategy at Saxo.

A weakening dollar meanwhile brought relief to other currencies, with the euro last at $1.1076, hovering near a five-month peak, and on track to rise more than 3% for the year.

Sterling was similarly on track for a 5% yearly gain, its best performance since 2017. The British pound was last 0.04% higher at $1.2740.

While policymakers at the European Central Bank (ECB) and the Bank of England (BoE) did not signal any imminent rate cuts at their policy meetings this month, traders continue to bet that a Fed pivot and the prospect of lower U.S. rates next year would give room for other major central banks to follow suit.

"We believe central banks in the advanced economies are on pace to pull forward the timing of pivoting to interest rate cuts," said economists at Wells Fargo in their 2024 outlook.

"As far as the outlook for G10 central banks, the 'higher for longer' stance that many institutions adopted in 2023 is becoming less of a priority."

All in, the prospect that 2024 could be a year where major central banks begin easing rates have sparked a risk-on rally, sending global equities higher [MKTS/GLOB].

Global bonds have likewise marched higher, after being battered for the most part of the past two years as interest rates rise. The benchmark 10-year U.S. Treasury yield was last at 3.8387%, having fallen nearly 120 basis points from its 16-year high of 5.021% hit in October. [US/]

Yields fall when bond prices rise.

The risk-sensitive Australian and New Zealand dollars were on track to gain 3.5% and 3% for the month, respectively, though were largely unchanged for the year.

The Aussie, which was last 0.14% higher at $0.68385, looked set to eke out a marginal yearly gain of 0.3%. The kiwi was on track to lose 0.2% for the year.

Both currencies, often used as liquid proxies for the Chinese yuan, have come under pressure as a result of an underwhelming post-COVID economic recovery in China.

ASIA CONTRAST

The yen was meanwhile set to fall more than 7% in 2023, extending into a third straight year of losses, as the Japanese currency continues to come under pressure as a result of the Bank of Japan's (BOJ) ultra-loose monetary policy stance.

While market expectations are for the BOJ to exit negative interest rates in 2024, the central bank continues to stand by its dovish stance and has provided little clues on if, and how, such a scenario could play out.

BOJ Governor Kazuo Ueda said he was in no rush to unwind ultra-loose monetary policy as the risk of inflation running well above 2% and accelerating was small, public broadcaster NHK reported on Wednesday.

A summary of opinions from the BOJ's policy meeting this month showed some policymakers called for deeper debate on a future exit from ultra-loose monetary policy as the economy makes progress toward achieving the bank's price target.

"The outlook for Japan is encouraging going into 2024, with expectations of robust economic growth and improving inflation that shows signs of being sustainable," said Aadish Kumar, international economist at T. Rowe Price, citing a weak currency and accommodative policy stance as "key supports" to the view.

"Any potential moves to tighten policy via a hike in interest rates represent a key risk to the outlook. Given the BOJ will not want to risk undoing all the good work achieved to date, we believe it will remain dovish in its communication and keep policy accommodative."

The yen was last steady at 141.45 per dollar.

In China, the onshore yuan was headed for a yearly loss of nearly 3%, pressured by a faltering post-COVID recovery in the world's second-largest economy.

The country's central bank said on Thursday it would step up macroeconomic policy adjustments to support the economy and promote a rebound in prices, amid signs of rising deflationary pressures.

The yuan last stood at 7.0925 per dollar, while its offshore counterpart was last at 7.0898 per dollar.

(Reuters) - The interest rate on the most common type of U.S. home loan fell for a ninth straight week this week to close out the year at their lowest level since May, according to data released Thursday by Freddie Mac.

The interest rate on a 30-year fixed-rate mortgage averaged 6.61% as of Dec. 28, down from 6.67% a week earlier. The rate has declined each week since hitting the highest level in 22 years in late October, tumbling 1.18 percentage points in that span.

Rates, which had tumbled to below 3% during the height of the COVID-19 pandemic, had surged starting in 2022 when the Federal Reserve began an aggressive rate hiking campaign to rein in inflation.

The Fed recently signaled that it is done with rate hikes and is likely to start lowering them in 2024. Bond markets have responded with a ferocious end-of-year rally that has brought yields on the 10-year Treasury note used to set mortgage rates to below 4% from around 5% in late October.