Select Language

Europe faced an unprecedented energy crisis for around seventeen months (from September 2021 to February 2023), as coal, natural gas, and electricity prices surged to all-time highs. Governments across the continent rushed in to introduce energy-saving measures and implement conservation policies, while households and businesses had to cut consumption rapidly.

Now, as 2023 draws to a close, can we confidently conclude that the energy crisis in Europe is over? How prepared is Europe to cope with the upcoming winter? What are the risks and challenges that lie ahead?

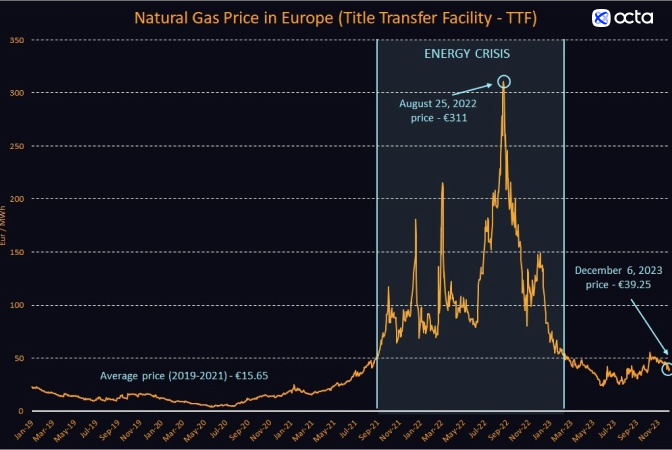

The energy crisis's most acute phase occurred in the summer of 2022. One only needs to look at the evolution of Europe's benchmark natural gas price (TTF) to assess the scale of the emergency (see the chart above). On 25 August 2022, TTF price reached €311 per megawatt-hour (MWh), the highest level ever recorded. On that specific day, the price was 44% above the previous maximum reached on March 7, 2022, and was a staggering 18 times higher than the three-year average price recorded over 2019-2021. Despite Europe's gas storage sites being 78% full in August 2022, supply worries were rife as imports from Russia dropped by around 60%, forcing Europe to rely extensively on liquefied natural gas (LNG) imports—especially from the United States. However, the aggregate supply of LNG in the global market at that time was reduced as one of the U.S. LNG export plants—Freeport LNG—had to go offline due to an explosion incident. Thus, to secure an adequate number of LNG cargoes, Europe had to outbid other customers in South and East Asia by agreeing to pay higher prices to suppliers.

A lot has changed since last summer. The European gas prices have returned to normality but remain above the level observed before the crisis. On Monday, 6 December, the front-month futures contract for delivery in January at TTF settled at €39.25 per MWh, 87% below the peak observed in August 2022 but still some two times above the historical average seen in 2019-2021. Kar Yong Ang, Octa analyst singles out several reasons for normalisation:

‘Although natural gas prices in Europe remain higher than they were before the crisis, the situation has improved dramatically. There are several reasons for this. First, there was a structural loss of demand partly due to reduced economic activity and partly due to conservation policies. Second, imports of pipeline gas and that of LNG increased. On top of it, there was a bit of luck as well, as weather conditions allowed the Europeans to build the stocks faster than normal.’

Indeed, probably the most painful adjustment that Europe had to endure was the loss of demand. According to Eurostat, total gas use in the EU's top 6 consuming countries—Germany, Italy, France, Netherlands, Spain, and Poland—was down by 17% in the first ten months of 2023 compared with the five-year average for 2017-2021. Obviously, energy-intensive industries such as chemicals and steel production had to bear the brunt of adjustment. For example, according to Statistisches Bundesamt, Germany's energy-intensive manufacturing production has decreased by about 20% since the start of 2022 and has not shown any signs of recovery yet.

Thus, Europe had to rely on imports more and more to balance its natural gas market. Russia has long been the main supplier of affordable pipeline gas into Europe, but geopolitical tensions, sanctions, and explosions of the Nord Stream pipeline have brought the flows to a minimum. According to Eurostat, Russia exported just 22.3 billion cubic metres of natural gas into Europe in the first nine months of 2023, which is 57% lower than during the same period in 2022 and 65% lower than during the same period in 2021. Concurrently, imports of LNG from the United States reached 30.01 billion cubic metres during the first nine months of the year, up a whopping 185% from the same period in 2021.

‘Overall, Europe has managed to bring its natural gas inventories to a rather comfortable level and is now well-protected to withstand future supply shocks,’ says Kar Yong Ang, Octa analyst. Indeed, according to the latest data from Gas Infrastructure Europe, gas storage levels are at record highs for this time of the year at around 94% full, said the Octa analyst, adding that the general bias for TTF price remains bearish. ‘I would not be surprised to see European natural gas prices drop to €30 per MWh in case of a normal winter. Alternatively, if this upcoming winter turns out to be colder than normal, we might see TTF temporarily hitting €60 per MWh.’

However, Kar Yong Ang says that different kinds of challenges and risks lie ahead for Europe. ‘It appears that Europe is placing too much faith in LNG. It's betting too much on a single supply source, which may backfire in the long run. If Europe is to permanently replace relatively cheap pipeline imports from Russia with expensive LNG imports, then, I am afraid, economic activity in its traditional industries may never recover to the pre-crisis levels.’

Indeed, Europe's top competitors—the United States and China—benefit from lower prices. The United States has ample resources at home, while China is getting cheap imports from Russia. Europe risks losing its competitive standing in the global marketplace. Furthermore, as we explained at the beginning of the article, the temporary shutdown of a single LNG export plant in the U.S. has already highlighted how strongly European energy security is now connected with the intricacies of the global LNG market. Most recently, Houthi militants in Yemen have stepped up attacks on vessels in the Red Sea, which has already prompted some LNG vessels to reroute in order to avoid Bab-el-Mandeb strait between Yemen and Djibouti. So far, the maritime attacks in the region have had a much stronger impact on the price of oil, but natural gas and LNG markets could also be affected.

‘With supply options more limited than in the past, European consumers will have to get used to more volatile natural gas prices, as they will increasingly be determined by the whims of the weather and by the bargaining power of other LNG importers in Asia,’ says Kar Yong Ang, Octa analyst.

Europe has survived the energy crisis and managed to adapt but has done so at the cost of lower demand and reduced economic activity. Now, Europe will have to learn to navigate the global LNG trade successfully to secure the most favourable deals.

By Hyonhee Shin

SEOUL (Reuters) - North Korean leader Kim Jong Un has kicked off a key meeting of the country's ruling party, state media KCNA reported on Wednesday, setting the stage for unveiling policy decisions for the new year.

The ninth Plenary Meeting of the 8th Central Committee of the Workers' Party of Korea wraps up a year during which the isolated country enshrined nuclear policy in its constitution, successfully launched a spy satellite and fired a new intercontinental ballistic missile (ICBM).

The days-long assembly of the party and government officials has been used in recent years to make key policy announcements. Previously, state media released Kim's speech on New Year's Day.

On the first day of the meeting on Tuesday, participants discussed six major agenda items, including this year's policy and budget implementation, a draft budget for 2024 and ways to bolster the party's leadership, KCNA said.

Kim "defined 2023 as a year of great turn and great change," lauding progress in all areas including the military, economy, science and public health despite some "deviations," it said.

He presented a detailed report involving "indices of the overall national economy which is clearly proving that the comprehensive development of socialist construction is being pushed forward in real earnest," KCNA said.

The development of new strategic weapons including the reconnaissance satellite has put the country "on the position of a military power," it added.

Tension has rekindled in recent weeks after North Korea tested its newest ICBM which it said was aimed at gauging the war readiness of its nuclear forces against mounting U.S. hostility.

Kim also said last week that Pyongyang would not hesitate to launch a nuclear attack if an enemy provokes it with nuclear weapons.

The United States, South Korea and Japan condemned the missile test, and activated a system to detect and assess North Korea's missile launches in real-time and established a multi-year trilateral military exercise plan.

LONDON (Reuters) - Ethiopia became Africa's third default in as many years on Tuesday after it failed to make a $33 million "coupon" payment on its only international government bond.

Africa's second most populous country announced earlier this month that it intended to formally go into default, having been under severe financial strain in the wake of the COVID-19 pandemic and a two-year civil war that ended in November 2022.

It had been supposed to make the payment on Dec. 11, but technically had up until Tuesday to provide the money due to a 14-day 'grace period' clause written into the $1 billion bond.

According to two sources familiar with the situation, bondholders had not been paid the coupon as of the end of Friday Dec. 22, the last international banking working day before the grace period expires.

Ethiopian government officials did not respond to requests for comment on Friday or over the weekend, but the widely-expected default will see it join two other African nations, Zambia and Ghana, in a full-scale "Common Framework" restructuring.

The East African country first requested debt relief under the G20-led initiative in early 2021.

Progress was initially delayed by the civil war but, with its foreign exchange reserves depleted and inflation soaring, Ethiopia's official sector government creditors, including China agreed to a debt service suspension deal in November.

On Dec. 8, the government said parallel negotiations it had been having with pension funds and other private sector creditors that hold its bond had broken down.

Credit ratings agency S&P Global then downgraded the bond, to "Default" on Dec. 15 on the assumption that the coupon payment would not be made.

(Reuters) -U.S. retail sales rose 3.1% between Nov. 1 and Dec. 24, as shoppers looked for last-minute Christmas deals amid big promotions, a Mastercard (NYSE:MA) report showed on Tuesday.

The increase is lower than the 3.7% growth Mastercard forecast in September and last year's 7.6% rise as higher interest rates and inflation pressured consumer spending.

Amazon.com (NASDAQ:AMZN) and Walmart (NYSE:WMT) ramped up promotions through November in the United States to entice bargain-hunting shoppers, but analysts said that the discounts were not as deep as the prior year, when retailers were saddled with excess stock after the pandemic.

Some of those discounts were rolled back starting in December, when customers were expected to buy last-minute gifts and household goods on the Saturday before Christmas - dubbed "Super Saturday."

Arun Sundaram, an analyst at CRFA Research, said many shoppers waited for Black Friday and Cyber Monday to make holiday purchases and finished the final sprint during Super Saturday.

"Consumers are still spending, but they're still price conscious and want to stretch their budgets," Sundaram said. He said the weeks between Cyber Monday and Super Saturday were a "soft period" for spending, but shoppers used the final weekend before Christmas to look for "big deals."

Ecommerce sales grew at the slower pace of 6.3% compared to last year's 10.6% as the popularity of online shopping came off pandemic highs, the report showed.

Sales in the apparel and restaurant categories rose 2.4% and 7.8%, respectively, during the holiday shopping period, according to the Mastercard SpendingPulse report, while sales of electronics fell 0.4%.

Mastercard SpendingPulse measures in-store and online retail sales across all forms of payment. It excludes automotive sales.

LONDON (Reuters) - Ethiopia became Africa's third default in as many years on Tuesday after it failed to make a $33 million "coupon" payment on its only international government bond.

Africa's second most populous country announced earlier this month that it intended to formally go into default, having been under severe financial strain in the wake of the COVID-19 pandemic and a two-year civil war that ended in November 2022.

It had been supposed to make the payment on Dec. 11, but technically had up until Tuesday to provide the money due to a 14-day 'grace period' clause written into the $1 billion bond.

According to two sources familiar with the situation, bondholders had not been paid the coupon as of the end of Friday Dec. 22, the last international banking working day before the grace period expires.

Ethiopian government officials did not respond to requests for comment on Friday or over the weekend, but the widely-expected default will see it join two other African nations, Zambia and Ghana, in a full-scale "Common Framework" restructuring.

The East African country first requested debt relief under the G20-led initiative in early 2021.

Progress was initially delayed by the civil war but, with its foreign exchange reserves depleted and inflation soaring, Ethiopia's official sector government creditors, including China agreed to a debt service suspension deal in November.

On Dec. 8, the government said parallel negotiations it had been having with pension funds and other private sector creditors that hold its bond had broken down.

Credit ratings agency S&P Global then downgraded the bond, to "Default" on Dec. 15 on the assumption that the coupon payment would not be made.

MANILA (Reuters) - Philippine President Ferdinand Marcos Jr. has approved the extension of reduced tariffs on rice and other food items until the end-2024 to keep prices stable amid a threat of dry weather in the coming months, his office said on Tuesday.

The modified rates first approved in 2021 had already been extended this year due to high inflation, and Marcos said another extension was needed until the end of next year.

"The present economic condition warrants the continued application of the reduced tariff rates on rice, corn, and (pork)...to maintain affordable prices for the purpose of ensuring food security," Marcos was quoted as saying in a statement.

Inflation was at 4.1% in November, easing for a second straight month, but has averaged 6.2% in the first 11 months of 2023, well outside the Philippine central bank's 2%-4% target for the year.

The extension of the modified tariffs, Marcos said, is aimed at ensuring affordable prices of rice, corn and meat products with the looming effects of the El Nino dry weather phenomenon early next year and the continued threat of African Swine Fever.

The tariff rate for rice will remain at 35%, while import levies on corn will stay at 5%-15% and 15%-25% for pork products, according to the new executive order extending the modified tariff rates.

NEW DELHI (Reuters) - The Indian government said on Friday a warning from the International Monetary Fund (IMF) that the country's debt to GDP ratio could hit 100% was a worst-case scenario, and not a "fait accompli".

The IMF, in a so-called article IV review, said India's general government debt, which includes federal and state government debt, could be 100% of GDP under adverse circumstances by fiscal 2028.

India's finance ministry said this was "a worst-case scenario and is not fait accompli".

India's debt to GDP ratio, which was 81% in 2022/23, may decline to below 70% in the same period under favourable circumstances, the IMF report also said, according to the ministry.

"Therefore, any interpretation that the report implies that General Government debt would exceed 100% of GDP in the medium term is misconstrued," the ministry added.

By Terje Solsvik and Gus Trompiz

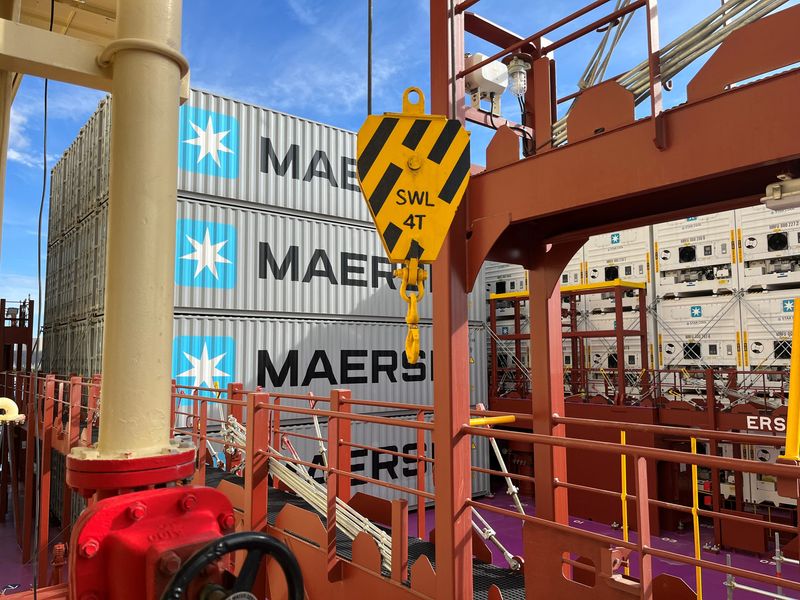

OSLO/PARIS (Reuters) -Some of the world's largest shipping firms, including Maersk and CMA CGM, will impose extra charges after they re-routed ships in response to attacks on vessels in the Red Sea, as worries about disruption to global trade grow.

The surcharges, designed to cover longer voyages around Africa compared with routes via the Suez Canal, will add to rising costs for sea transport since Yemen's Houthi militant group started targeting vessels.

Maersk and CMA CGM were the first to introduce the fees, followed by Germany's Hapag-Lloyd later on Friday.

The three are among leading shipping lines to have suspended the passage of vessels through the Red Sea that connects with the Suez Canal, the quickest sea route between Asia and Europe.

Instead, they are directing ships around the Cape of Good Hope at the southern tip of Africa, adding about 10 days to a journey that would normally take about 27 days from China to northern Europe.

Citing "severe operational disruption", Maersk said late on Thursday it was imposing an immediate transit disruption surcharge (TDS) to cover extra costs associated with the longer journey, plus a peak season surcharge (PSS) from Jan. 1.

Hapag-Lloyd has said it would redirect 25 ships by the end of the year to avoid the area.

On Friday, Chinese automaker Geely told Reuters its electric vehicle sales were likely to be hurt by a delay in deliveries to Europe, the latest company to warn of disruption.

China's second largest automaker by sales said most of the shipping firms it uses for European exports have plans to go around southern Africa.

The alert bodes ill for other automakers in China as they seek to increase exports to Europe due to overcapacity and weak demand at home.

The United States has announced a multinational force to patrol the Red Sea, but shipping sources say details have yet to emerge and companies continue to avoid the area.

In a message to customers, logistics firm CH Robinson Worldwide (NASDAQ:CHRW) said it had re-routed more than 25 vessels to southern Africa over the past week.

"That number will likely continue to grow due to ongoing war risks in the Red Sea and the drought in the Panama Canal," it said.

SURCHARGES

CH Robinson said cancellations and rate increases were expected to continue into the first quarter and recommended customers book 4-6 weeks in advance to ensure space on vessels.

Maersk said a standard 20-foot container travelling from China to Northern Europe now faced total extra charges of $700, consisting of a $200 TDS and $500 PSS.

Containers bound for the east coast of North America will be charged $500 each, consisting of the $200 TDS payment and a $300 PSS, the company added.

Maersk also said routes in other parts of its network would be affected by the Suez disruption, triggering emergency contingency surcharges on a wide range of journeys.

CMA CGM announced surcharges late on Thursday including an extra $325 per 20-foot container on the North Europe to Asia route and $500 per 20-foot container for Asia to the Mediterranean.

The charges were part of its contingency plan to re-route vessels around the Cape of Good Hope, it said.

France-based CMA CGM listed 22 of its vessels as having been re-routed.

MOSCOW (Reuters) - Russia was short of around 4.8 million workers in 2023 and the problem will remain acute in 2024, the Izvestia newspaper reported on Sunday, citing experts and research from the Russian Academy of Science's Institute of Economics.

Central Bank Governor Elvira Nabiullina said last month that Russia's depleted labour force was causing acute labour shortages and threatening economic growth as Moscow pumps fiscal and physical resources into the military.

Hundreds of thousands of Russians left the country following what the Kremlin calls its special military operation in Ukraine which began in February 2022, including highly-qualified IT specialists.

Those who took flight either disagreed with the war or feared being called up to fight in it.

The outflows intensified after President Vladimir Putin, who earlier this month lauded a historically low jobless rate of 2.9%, announced a partial military mobilisation of around 300,000 recruits in September 2022.

Putin has said he sees no need for a new wave of mobilisation for now.

Izvestia, citing the author of the research, Nikolai Akhapkin, said that labour shortages had sharply increased in 2022 and 2023. It said that drivers and shop workers were in particularly high demand.

According to official data, cited by the newspaper, the number of vacancies in the total workforce rose to 6.8% by the middle of 2023, up from 5.8% a year earlier.

"If we extend the data presented by Rosstat (the official statistics agency) to the entire workforce, the shortage of workers in 2023 will tentatively amount to 4.8 million people," the newspaper cited the new research as saying.

It noted that Labour Minister Anton Kotyakov had said that workforce shortages were felt hard in the manufacturing, construction and transportation sectors, forcing companies to raise wages to try to attract more employees.

The newspaper cited Tatyana Zakharova of Russia's University of Economics named after G.V. Plekhanov as saying that the labour shortages would probably persist next year, as vacancies for factory workers, engineers, doctors, teachers and other professions would he especially hard to fill.

She cited poor demographics and "the migration of the population" as among the reasons for the labour shortages.

By Siyi Liu and Dominique Patton

BEIJING (Reuters) - This Dec. 21 story has been corrected to clarify that the ban was on the export of technology to make rare earth magnets and that the ban on technology to extract and separate critical materials was already in place, in paragraphs 1 and 6. It also removes context and the comment on rare earth processing operations, in paragraphs 3 and paragraphs 18-20.

China, the world's top processor of rare earths, banned the export of technology to make rare earth magnets on Thursday, adding it to a ban already in place on technology to extract and separate the critical materials.

Rare earths are a group of 17 metals used to make magnets that turn power into motion for use in electric vehicles, wind turbines and electronics.

"This should be a clarion call that dependence on China in any part of the value chain is not sustainable," said Nathan Picarsic, co-founder of the geopolitical consulting firm Horizon Advisory.

China's commerce ministry sought public opinion last December on the potential move to add the technology to prepare smarium-cobalt magnets, neodymium-iron-boron magnets and cerium magnets to its "Catalogue of Technologies Prohibited and Restricted from Export."

In the list it also banned technology to make rare-earth calcium oxyborate and production technology for rare earth metals, adding them to a previous ban on production of rare earth alloy materials.

The catalogue's stated aims include protecting national security and public interest.

China has significantly tightened rules guiding exports of several metals this year, in an escalating battle with the West over control of critical minerals.

It introduced export permits for chipmaking materials gallium and germanium in August, followed by similar requirements for several types of graphite since Dec. 1.

"China is driven to maintain its market dominance," said Don Swartz, CEO of American Rare Earths, which is developing a rare earths mine and processing facility in Wyoming. "This is now a race."

WEST STRUGGLES

The move to protect its rare earth technology comes as Europe and the United States scramble to wean themselves off rare earths from China, which accounts for nearly 90% of global refined output.

China has mastered the solvent extraction process to refine the strategic minerals, which MP Materials and other Western rare earth companies have struggled to deploy due to technical complexities and pollution concerns.

Shares of MP, which has slowly begun increasing rare earths processing in California, jumped more than 10% on Thursday after China's move. The company did not immediately respond to requests for comment.

Ucore Rare Metals said on Thursday that it had finished commissioning of a facility to test its own rare earths processing technology, which is being funded in part by the U.S. Department of Defense.

"New technologies will be needed to outmaneuver the Chinese grip on these important areas," said Ucore CEO Pat Ryan. Ucore's stock rose more than 16%.

It is not clear to what extent China's rare earths technology is actually being exported. Beijing has discouraged its export for years, said Constantine Karayannopoulos, former CEO of Neo Performance Materials, which separates rare earths in Estonia.

"This announcement just formalises what everyone knew to be the case," Karayannopoulos said.