Select Language

By Joyce Lee, Hyunjoo Jin and Nandita Bose

SEOUL/WASHINGTON (Reuters) -South Korea and the United States agreed to craft a package of deals aimed at removing new U.S. tariffs before the pause on reciprocal tariffs is lifted in July, Seoul’s delegation said after the first round of trade talks in Washington.

The U.S. and South Korea had a "very successful" meeting on Thursday, U.S. Treasury Secretary Scott Bessent said afterwards.

"We may be moving faster than I thought, and we will be talking technical terms as early as next week," he told reporters.

Bessent and Trade Representative Jamieson Greer met with South Korean Finance Minister Choi Sang-mok and Industry Minister Ahn Duk-geun.

Neither side offered details on possible areas of agreement, but South Korea said in a statement it requested exemptions from reciprocal and item-specific U.S. tariffs, and offered cooperation on shipbuilding and energy as well as addressing trade imbalances.

"During the meeting, the two countries reached a broad agreement on the framework for future discussions," Ahn later told reporters. "We also agreed to hold working-level talks next week to determine the scope and structure of talks, with the goal of producing a ’July package’ by July 8."

Choi said more talks will be held in South Korea on May 15-16 with Greer.

"Discussions will focus on four key areas: tariffs and non-tariff measures, economic security, investment cooperation, and currency policy," Choi said.

AUTOS IN FOCUS

The discussions with South Korea took place as Bessent and other Trump administration trade team members met with a multitude of foreign finance and trade officials looking to strike tariff deals on the sidelines of this week’s meetings of the International Monetary Fund and World Bank Group in Washington.

South Korea, which faces 25% U.S. reciprocal tariffs, is among the first countries the Trump administration has initiated trade talks with, after its first face-to-face discussions last week with Japan, another key Asian ally slapped with 24% tariffs. Bessent was also due to meet Japanese officials on Thursday.

Choi said South Korea focused in particular on the automobile sector, which faces the greatest negative impact.

He also said South Korea’s finance ministry and U.S. Treasury will hold separate discussions on currency policy.

Choi told South Korean reporters that there was no mention of defense costs during the talks. Trump has previously said that sharing the cost of keeping U.S. troops in South Korea would be part of "one-stop shopping" negotiations with Seoul. But South Korea’s foreign minister said defense costs are separate matters from trade talks.

Ahn said there was no mention of the renegotiations of a bilateral free trade deal signed in 2017.

The South Koreans also asked for understanding from the Americans that the process could be affected by the "political schedule," apparently referring to the looming June 3 snap election in South Korea, which was called after former President Yoon Suk Yeol was ousted for his role in imposing martial law in December.

Acting President Han Duck-soo has expressed willingness to reach a deal, saying the country will not fight back against Washington as it owes the U.S. for its recovery from the 1950-1953 Korean War.

That has faced pushback from the liberal opposition who are favoured to win in the election, accusing Han of rushing talks for political gain.

Experts have also noted it may be difficult for South Korea to make any firm commitment on energy projects and defence costs under an acting president.

Trump’s energy security council plans to host a summit in Alaska in early June, when it hopes Japanese and South Korean officials will announce commitments to the Alaska LNG project, a source familiar with the matter said on Thursday.

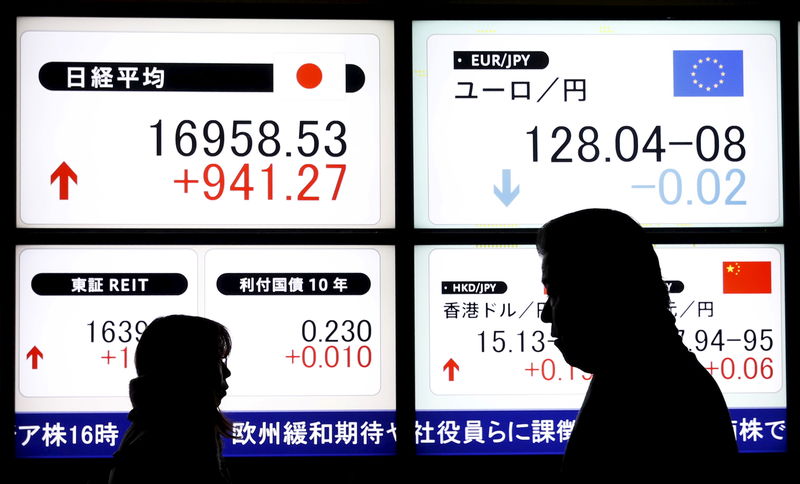

Most Asian stocks rose marginally on Thursday as investors second-guessed recent optimism over a deescalation in the U.S.-China trade war, although Japanese markets outperformed on reports of more U.S. trade dialogue.

South Korean markets were an exception, with the KOSPI lagging its peers after gross domestic product data showed an unexpected contraction for the first quarter. This largely offset positive earnings from memory chip major and Nvidia (NASDAQ:NVDA) supplier SK Hynix.

Broader Asian markets tracked overnight gains on Wall Street, as investors were encouraged by U.S. President Donald Trump flagging an eventual, albeit unspecified reduction in trade tariffs on China. Trump’s cooling rhetoric against the Federal Reserve also aided sentiment.

U.S. stock index futures trickled higher in Asian trade. But optimism over Trump’s comments was seen cooling, given that Trump signaled any deal with China will require Beijing to approach Washington- a scenario that Chinese officials have shown little indication will play out.

Comments from other U.S. officials also raised some doubts over a U.S.-China deescalation.

Japan shares lead gains on trade talk reports

Japanese markets were the best performers on Thursday, with the Nikkei 225 adding nearly 1%, while the TOPIX rose 0.8%.

A slew of media reports said Japan’s Economic Revitalization Minister Ryosei Akazawa will visit the U.S. later this month for a second round of trade negotiations.

A separate report on Wednesday showed U.S. officials stating that they will not offer Japan special treatment from Trump’s trade tariffs. But Japanese ministers were seen maintaining their calls for smaller tariffs and more transparent trade agreements.

South Korea’s economy unexpectedly contracted in the first quarter of 2025, weighed down by political unrest in the country and concerns around U.S. trade polices, preliminary data from the central bank showed.

Gross domestic product contracted 0.2% quarter-on-quarter in the three months to March 31, in contrast with expectations of a steady 0.1% rise.

Year-on-year GDP shrank 0.1%, also missing estimates of 0.2% growth, and compared with a 1.2% rise in the fourth quarter of 2024.

The contraction is largely attributed to weakening exports, a result partly influenced by the protectionist trade policies implemented by U.S. President Donald Trump.

While Trump declared a 90-day pause on reciprocal duties, South Korea is still subject to a 25% tariff on steel and automobiles.

This coincided with significant political unrest in South Korea following President Yoon Suk Yeol’s declaration of martial law in December 2024. Yoon was later impeached

The political crisis deepened when acting President Han Duck-soo was also impeached in late December. Finance Minister Choi Sang-mok then assumed the role of interim leader. The turmoil has eroded investor confidence and disrupted governance, contributing to the nation’s economic challenges.

Last week, the Bank of Korea (BOK) maintained its key interest rate at 2.75% to support the struggling Korean won, which recently hit a 16-year low while hinting at possible rate cuts in upcoming months.

The S&P 500 closed higher Wednesday, but well off session highs, as US Treasury Secretary Scott Bessent cooled some optimism on a quick resolution to the U.S.-China trade standoff.

At 4:00 p.m. ET (21:00 GMT), the Dow Jones Industrial Average rose 450 points, or 1.2%, the S&P 500 index gained 1.6%, and the NASDAQ Composite climbed 2.5%.

Bessent cools quick U.S-China trade resolution

Bessent said there was no unilateral offer from President Donald Trump to lower China trade tariffs, adding doubt to an earlier Wall Street Journal report that suggesting Trump was willing to reduce the 145% tariffs on China.

The remarks injected a sense of reality into the current U.S.-China trade standoff and suggest that the Trump administration could be waiting for China to make the first move.

But China President Xi Jinping isn’t expected to cave in at the first offer of a trade truce from the Trump administration, FOX Business reported, citing unnamed CEOs with close ties to Chinese government.

This suggest the current trade standoff between the world’s two biggest economies could continue for a while longer, dampening earlier optimism for a quick resolution.

On Tuesday, Trump that high tariffs on China will come down “substantially,” but “it won’t be zero.”

Tesla rises as Musk vows to reduce DOGE activity

In the corporate sector, Tesla (NASDAQ:TSLA) stock jumped 6%, after the electric vehicle manufacturer reported first-quarter profits at its core auto business that were better than rock-bottom estimates.

Also contributing to the positive tone was the news that CEO Elon Musk plans to reduce the time he devotes to the Trump administration from next month and spend more time running the EV giant, especially amid slumping sales.

Elsewhere, Intel (NASDAQ:INTC) stock gained more than 5% after Bloomberg reported the chipmaker is set to unveil plans this week to slash more than 20% of its workforce, in a move to streamline operations and reduce bureaucratic inefficiencies.

Philip Morris (NYSE:PM) stock climbed more than 2% after the tobacco giant posted a solid first-quarter report, and raised its full-year 2025 earnings guidance.

Boeing (NYSE:BA) stock surged 6% after the aircraft manufacturer posted its first growth in quarterly revenue since 2023.

On the flip side, Enphase (NASDAQ:ENPH) stock slumped 15% after the energy technology company’s first-quarter results missed expectations, while the low end of its second-quarter revenue outlook also fell short.

(Peter Nurse, Ambar Warrick contributed to this article.)

By Andy Bruce

LONDON (Reuters) -Britain’s government borrowed almost 15 billion pounds more in the financial year that just ended than official budget forecasters had estimated a month ago, according to data that heaped more pressure on the public finances.

Public sector net borrowing for the 2024/25 financial year was 151.9 billion pounds ($202.1 billion), the Office for National Statistics said on Wednesday.

In its forecasts published in March, the Office for Budget Responsibility had projected a budget deficit for the financial year ending in March of 137.3 billion pounds.

With finance minister Rachel Reeves’ budget plans hinging on a tiny buffer against the government’s self-imposed fiscal rules - equivalent to less than 1% of annual spending - investors are watching public sector finance data more closely.

British government bonds have become increasingly volatile in recent years, reflecting unease in financial markets over Britain’s mix of low growth, high debt interest costs and persistent inflation.

"We will never play fast and loose with the public finances, that’s why our fiscal rules are non-negotiable," said deputy finance minister Darren Jones in a statement.

As a percentage of economic output, the budget deficit in 2024/25 was 5.3%, up from 4.8% in 2023/24. The OBR last month projected a reading of 4.8% for the year just ended.

Alison Ring, director of public sector and taxation at the ICAEW professional body for chartered accountants, said tax hikes enacted on businesses this month should help the public finances later this year - at least in theory.

"Unfortunately, the public finances remain vulnerable to the economic headwinds caused by those tax rises that, together with a global trade war, are likely to put significant pressure on the chancellor," Ring added, referring to Reeves.

The Institute for Fiscal Studies think tank said the data showed the risk of running a budget with only 10 billion pounds of room to spare before running afoul of the fiscal rules by 2029/30.

In March alone, the government borrowed 16.444 billion pounds, the ONS said, compared with the median forecast of 16.0 billion pounds in a Reuters poll of economists.

Debt interest costs in March stood at 4.3 billion pounds - a record for the month.

The ONS revised up borrowing for the previous 11 months of the 2024/25 financial year, largely reflecting new data that showed a weaker picture for tax receipts, including corporation and income taxes.

The Debt Management Office said on Wednesday it planned to issue more Treasury bills in response to the 2024/25 borrowing overshoot, rather than British government bonds.

($1 = 0.7517 pounds)

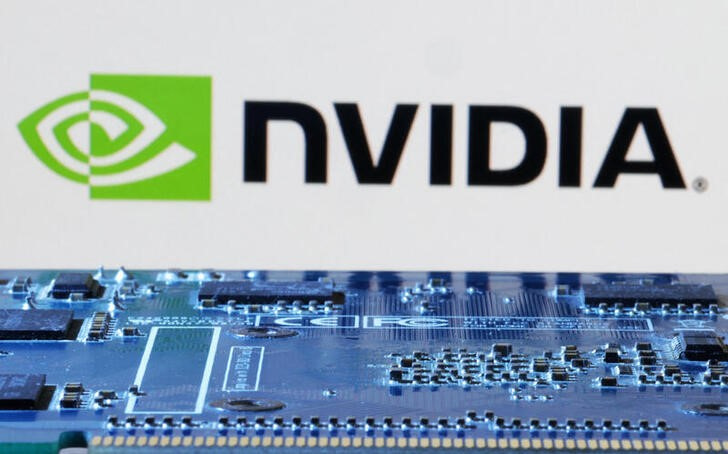

China’s major internet companies, including ByteDance, Alibaba (HK:9988), and Tencent (HK:0700), stockpiled billions of dollars worth of Nvidia’s (NASDAQ:NVDA) H20 artificial intelligence (AI) chips ahead of U.S. restrictions on their export, Nikkei Asia reported on Wednesday citing sources.

The three companies rushed to secure around one million H20 chips — nearly a full year’s supply — in anticipation of the U.S. cutting off shipments in April, the Nikkei report said.

These chips, specifically designed to comply with U.S. export controls, are vital for AI applications, particularly inference tasks.

ByteDance, one of the most aggressive buyers, and other firms reportedly placed rush orders worth over $12 billion, with several billion dollars’ worth shipped before the new restrictions took effect earlier this month, according to the report.

The H20 is a downgraded version of Nvidia’s H100 chip, popular in China due to its lower power requirements compared to the original model.

Earlier this month, Nvidia said it would take a $5.5 billion hit in the first quarter due to the new restrictions.

With the new curbs, Chinese firms are looking at alternatives like Huawei’s Ascend chips and exploring ways to bypass the export restrictions, including setting up overseas subsidiaries, Nikkei reported.

The stockpiling comes amid surging demand for AI computing power in China, fueled by the rise of applications like DeepSeek integrated into Tencent’s WeChat.

Most Asian stocks rose sharply on Wednesday, tracking an overnight rally on Wall Street after U.S. President Donald Trump flagged an eventual lowering in steep trade tariffs against China.

But mainland Chinese stocks were little enthused by his comments, and traded sideways on Wednesday. Hong Kong stocks, however, rallied with their Asian peers.

Regional markets took a positive lead-in from Wall Street after Trump’s comments. The President also downplayed his recent tirade against Federal Reserve Chair Jerome Powell, granting markets more relief.

U.S. stock index futures rose in Asian trade, with S&P 500 Futures rising 1.4%.

Hong Kong, Japan, lead Asia stock gains on Trump comments

Hong Kong’s Hang Seng index and Japan’s Nikkei 225 were among the top performers in Asia on Wednesday, rising between 1.7% and 2%.

Japan’s TOPIX also added about 1.8%, while South Korea’s KOSPI rose 1.4%. Japanese shares rose past mixed purchasing managers index data, which showed strength in services and a prolonged decline in manufacturing in April.

Asian technology shares were the best performers on Wednesday, benefiting greatly from bargain buying after suffering outsized losses in recent weeks.

But other sectors also rose. Australia’s ASX 200 soared 1.6% on gains in mining and bank stocks, while Singapore’s Straits Times index added 0.7% on sustained gains in local financial stocks.

Futures for India’s Nifty 50 index pointed to a strong open.

Asian markets surged as Trump said he wanted a deal with China where trade tariffs against the country will be well below current levels of 145%. This came after Treasury Secretary Scott Bessent reportedly said that the ongoing Sino-U.S. trade war was unsustainable, and that he expected a de-escalation soon.

Bank of America analysts cut their annual gross domestic product forecast for China on Tuesday, stating that the country faces significant headwinds from a bitter trade war with the United States.

BofA cut its China GDP forecast to 4% in 2025 from 4.5%, further below the government’s 5% annual target.

The investment bank sees the greatest hit from the tariff shock coming in the second quarter, which could see GDP shrink 1.8% from the prior quarter. China’s economy grew more than expected in the first quarter, but this outperformance is expected to be largely offset by underperformance in the next three quarters.

BofA also cut China’s 2026 GDP forecast to 4.2%.

The softer outlook comes largely on the back of a bitter trade war between the U.S. and China, after U.S. President Donald Trump slapped China with 145% trade tariffs. China retaliated with a 125% tariff against the United States.

The U.S. tariffs are expected to greatly crimp China’s exports, which are a major GDP driver.

Still, BofA said that the trade conflict could push China back towards growth-centric policy, while Beijing could also be forced to open up further in trade and investment with the rest of the world.

China is also expected to dole out more stimulus measures, and could announce even more measures to boost household consumption. BofA said its downgraded forecast reflected additional stimulus measures.

But BofA also warned that if Beijing unlocked stimulus a “little too late,” growth could worsen further by the fourth quarter of 2025.

The S&P 500 closed higher Tuesday, clawing back losses from a day earlier after Treasury Secretary Scott Bessent stokes hopes for a possible de-escalation in the U.S.-China trade war.

At 4:00 p.m. ET (21:00 GMT), the Dow Jones Industrial Average rose 1016 points, or 2.7%, the S&P 500 index gained 2.5%, and the NASDAQ Composite climbed 2.7%.

Bessent tees up hopes of U.S.-China trade deescalation

U.S. Treasury Secretary Scott Bessent reportedly said that he expects de-escalation in the ongoing tariff standoff between the US and China in the "very near future, CNBC reported, citing individuals present at the event.

"The next steps with China are, no one thinks the current status quo is sustainable” with tariff rates at their current levels," Bessent said at a private investor summit hosted by JPMorgan Chase (NYSE:JPM) & Co. (NYSE:JPM), CNBC reported, citing sources. The Treasury Secretary said he expects there will be a de-escalation” in the U.S.-China trade war in the “very near future,” a person in the room told CNBC.

The remarks come on the heels of a Bloomberg report. citing individuals present at the event, that the Treasury Secretary anticipates a de-escalation in the situation.

Fed speakers, meanwhile, continued to rise concern about the impact of tariffs. Minneapolis Federal Reserve President Neel Kashkari flagged worries about a tariff-driven recession following a sharp turn lower in economic confidence in the wake of President Donald Trump’s tariff rollout.

Richmond Fed president Thomas Barkin, however, delivered remarks that were in sharp contrast to those of his colleagues on inflation, saying that inflation expectations may have "loosened." This suggests that the Richmond Fed president’s focus could be on the other Fed’s mandate maximum employment pointing to possible backing of rate cuts if the labor market deteriorates.

Earnings continue to flow

The quarterly earnings season continued apace Tuesday.

Verizon Communications (NYSE:VZ) stock rose 0.6% after the telecom giant reported that retail phone customers slipped by more than expected, as it backed away from promotions to attract customers to help protect profits.

3M Company (NYSE:MMM) stock rose 8% after the industrial conglomerate reported first-quarter 2025 results that exceeded analyst expectations, driven by organic sales growth and improved margins.

Halliburton Company (NYSE:HAL) stock fell 5.6% after the oilfield services provider posted lower first-quarter profit as a slowdown in drilling activity in North America dampened demand for its services and equipment.

Northrop Grumman (NYSE:NOC) stock slumped nearly 13% after the aerospace and defense firm slashed its annual profit outlook and missed first-quarter earnings estimates by a wide margin.

Kimberly-Clark (NYSE:KMB) stock fell more than 1% after the consumer goods company slashed its annual profit forecast, warning that the broad-based trade tariffs would push up its supply-chain costs.

GE Aerospace (NYSE:GE), meanwhile, climbed 6% as better-than-expected quarterly earnings offset revenue that just missed of Wall Street expectations.

Amazon (NASDAQ:AMZN), up more than 3%, clawed back some losses from a day earlier, when the tech giant said it would be pausing some investment into new data centers.

Additionally, Tesla (NASDAQ:TSLA),will release its latest numbers after the close - the first of Wall Street’s so-called Magnificent Seven to report this earnings season.

Analysts are bracing for a negative quarter, as Tesla grapples with tepid demand and a backlash to CEO Elon Musk’s political activities.

Sales at Tesla have slumped as the firm deals with increased competition and controversy over Musk’s close proximity to Trump. Musk has helmed the so-called Department of Government Efficiency, or DOGE, which has been tasked by the White House with helping cut the size of the federal government.

Against this backdrop, investors will likely be keen for Musk to provide more details on the roll-out of a more affordable vehicle launch and plans for Tesla’s much-hyped robotaxi business.

(Peter Nurse, Ambar Warrick contributed to this article.)

Updates with the latest moves, milestones

Investing.com-- Gold prices surged to hit a new record high in Asian trading on Tuesday, buoyed by sustained safe-haven appeal over elevated U.S.-China trade tensions, and concerns around President Donald Trump’s plan to overhaul the Federal Reserve.

As of 00:27 ET (04:27 GMT), Spot Gold jumped 1.7% to $3,482.76 per ounce, while Gold Futures expiring in June surged 1.9% to $3,491.20 an ounce.

Gold jumped more than 3% on Monday and has hit consecutive record highs in the previous three sessions, driven largely by escalating geopolitical risks, strong central bank demand, and persistent inflation concerns.

Trump mulls ousting Fed’s Powell, dollar hits 3-yr low

The latest rally was sparked by concerns surrounding U.S. monetary policy, after President Donald Trump unveiled plans to overhaul the Federal Reserve.

White House economic advisor Kevin Hassett said on Friday that President Trump and his team were continuing to study whether they could fire Fed Chair Jerome Powell.

Trump on Monday reiterated his call for the Fed to reduce rates, saying the U.S. economy could slow down if the Fed does not cut interest rates immediately.

Last week, Powell said that the central bank was not inclined to cut interest rates in the near future, citing the possible inflationary pressures and economic uncertainties stemming from the new tariffs.

These developments have stoked concerns about the independence of the Fed, sending ripples through financial markets.

The U.S. dollar remained weak after slumping to a three-year low on Monday against a basket of major currencies.

A weaker dollar tends to bolster demand for gold, as it makes the metal more affordable to investors holding foreign currencies.

US-China trade tensions remain elevated

China issued a stern warning to nations contemplating trade agreements with the U.S. that could undermine Chinese interests.

The Chinese Ministry of Commerce accused Washington of employing tariffs and monetary sanctions to coerce countries into limiting their trade with China.

Beijing emphasized that any such agreements detrimental to its interests would prompt reciprocal countermeasures.

This warning comes amid escalating tensions in the ongoing Sino-U.S. trade conflict, which has seen the U.S. impose tariffs of up to 145% on Chinese goods, leading to retaliatory duties from China.

Among other precious metals, Silver Futures gained 0.8% to $32.795 an ounce, while Platinum Futures rose 1% to $976.10 an ounce.

Copper hits 2-week high on weaker greenback

Copper prices extended on Tuesday to hit a two-week high as the greenback remained weak, but concerns of hefty U.S. tariffs on top importer China kept investors cautious.

Benchmark Copper Futures on the London Metal Exchange rose 1% to $9,311.60 a ton, while Copper Futures expiring in May gained 1.1% to $4.7713 a pound.