Select Language

SEOUL (Reuters) -South Korea’s exports for the first 20 days of April fell 5.2% from a year earlier, dragged down by U.S.-bound shipments, customs data showed on Monday, amid President Donald Trump’s sweeping tariff policies.

From this month, the U.S. has introduced 10% blanket tariffs and 25% auto tariffs, while 25% reciprocal tariffs on South Korea are currently paused for 90 days.

Exports to the U.S. fell 14.3%, while those to China, which is in a trade war with Washington, declined 3.4%. Shipments to the European Union rose 13.8%.

By product, exports of automobiles fell 6.5% and auto parts lost 1.7%, while semiconductors rose 10.7%.

By Kevin Buckland

TOKYO (Reuters) - Japan’s Nikkei share average rose 1% on Friday to clock its best week in three months, as investors turned more hopeful that U.S. President Donald Trump would be able to broker trade deals with some of its top trading partners, including Japan.

The Nikkei touched a two-week high of 34,758.97 before ending the day up 1.03% at 34,730.28, despite somewhat muted trading due to the Easter holidays in most other markets.

The broader Topix added 1.14%.

The Nikkei climbed 3.41% for the week - the most since January 20 - to snap a three-week losing run.

On Thursday, Trump and close ally Italian Prime Minister Giorgia Meloni expressed optimism about resolving U.S.-European Union trade tensions. Trump also signalled a potential end to tit-for-tat tariff hikes with China.

A day earlier, Japan’s top negotiator, economy minister Ryosei Akazawa, kicked off dialogue in Washington, and told reporters afterwards that Trump had said getting a deal with Japan was a "top priority". Trump hailed discussions with Japan on social media, saying "Big Progress!"

"The mood seemed overall quite positive, underscored by Trump’s social media post featuring a smiling photo of him with Akazawa in the Oval Office," said James Brady, vice president at advisory firm Teneo.

"The general sense is that the discussions got off to a reasonable start."

Shipping was the second-best performer among the Tokyo Stock Exchange’s 33 industry groupings, gaining 2.92%.

Pharmaceuticals topped the list with a 4.68% jump, led by a 17.54% surge for Chugai Pharmaceutical after an obesity drug it developed and licensed to Eli Lilly (NYSE:LLY) performed well in clinical trials.

By Lisa Barrington, Sophie Yu, Dan Catchpole and Tim Hepher

(Reuters) - A Boeing (NYSE:BA) jet that arrived at a completion plant near Shanghai last month was returning to the U.S., flight tracking data showed on Friday, in a sign that at least one Chinese airline could be halting deliveries due to U.S. tariffs.

The U.S. planemaker was reported earlier this week to face a Chinese ban on its imports, part of an escalating confrontation over U.S. President Donald Trump’s "reciprocal" global tariffs, though industry sources said the status of rules remained unclear.

In a sign that Boeing was preparing for normal business just weeks before Trump announced tariffs on April 2, tracking data showed at least four new 737 MAX planes sitting at a completion and delivery centre in Zhoushan, where Boeing installs interiors and paints liveries before handing aircraft to customers in China.

Three arrived from Boeing in Seattle in March and one arrived last week, according to Flightradar24.

On Friday morning one of those jets departed Zhoushan for Guam - one of the stops such flights make as they cross the Pacific Ocean before reaching Seattle - indicating it was making the return journey, tracking data shows.

Photos posted to planespotting websites in February showed it was decorated with a livery for Xiamen Airlines, which is majority owned by China Southern. One source said the plane was expected to be delivered to Xiamen.

In 2024 it was spotted in the U.S. with a Shandong Airlines livery and in 2018 with the Air China (OTC:AIRYY) logo, other photos showed.

None of those airlines immediately responded to requests for comment.

Aviation publication The Air Current on Thursday reported that the first of three of the four recently arrived planes had been tagged to be recalled to the United States without a handover.

Boeing declined to comment.

Boeing deliveries to China have previously been disrupted at times of tension between Washington and Beijing. In January 2024 MAX deliveries resumed after an almost five-year import freeze.

The planemaker opened the plant southeast of Shanghai in 2018 under the shadow of a previous round of trade tensions during Trump’s first presidency.

Although Boeing has not followed Airbus in assembling full airplanes in China, analysts said the aim was to build a lead in one of the world’s largest air travel markets.

Airline and aerospace industry sources said there was no confirmation of a formal ban on Boeing deliveries, reported earlier this week by Bloomberg News, but that the imposition of tariffs would effectively block imports for the time being.

Beijing has also asked that Chinese carriers halt purchases of aircraft-related equipment and parts from U.S. companies, the Bloomberg report said.

A senior industry source said Boeing and suppliers are planning on the basis that it would not be delivering planes to China for the time being.

However, two U.S. industry sources said they were given no clear instructions not to ship parts to China. A separate source, who runs a maintenance and repair shop for aircraft in China, said they have not had any issues importing American parts.

China’s foreign ministry declined to comment.

Asked by media about the reported ban, a spokesperson said: "I’d refer you to competent authorities".

DELIVERY LIMBO

For aerospace, Zhoushan is the latest staging post in a growing U.S.-led trade war. Planemakers, airlines and suppliers are reviewing contracts after Reuters reported that U.S. supplier Howmet Aerospace had ignited a debate over the cost of tariffs by declaring a "force majeure event".

Confusion over changing tariffs could leave many aircraft deliveries in limbo, with some airline CEOs saying they would defer delivery of planes rather than pay duties.

Boeing historically sent a quarter of its deliveries to China but the proportion has been falling following earlier trade tensions, a 737 MAX safety crisis and the impact of the COVID-19 pandemic.

Analysts said a short-term halt in deliveries to China would not have an immediate major impact on Boeing, since it could serve other airlines and Airbus lacks spare capacity.

In the longer term, China remains a strategic market. Boeing says China will more than double its fleet by 2043, with the country set to overtake the U.S. in terms of air traffic.

Boeing data shows 130 unfilled orders for China-based airlines and lessors, including 96 of the 737 MAX. Industry sources say a significant portion of the more than 760 unfilled orders for which Boeing has yet to name a buyer are for China.

Chinese airlines lease 55% of their jets and it is "highly probable" they will try to extend any expiring leases for the time being, IBA (EBR:IBAB) Chief Economist Stuart Hatcher said.

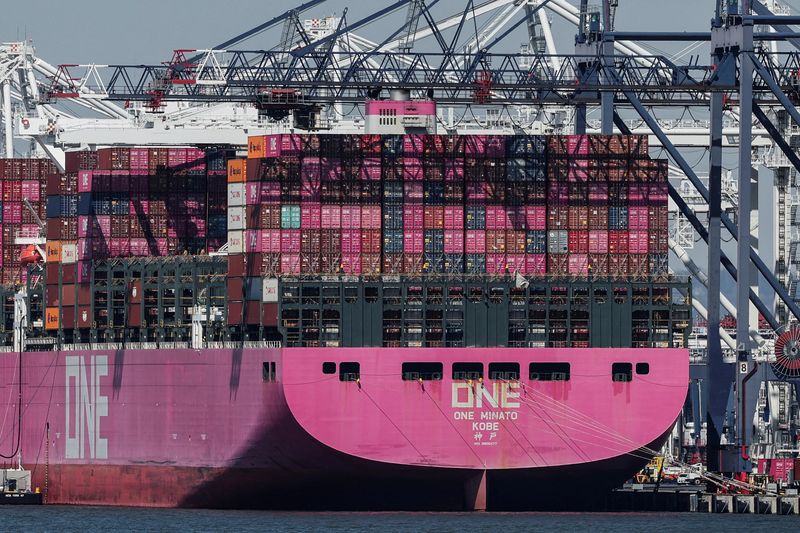

By Jonathan Saul, Lisa Baertlein, David Lawder and Andrea Shalal

LOS ANGELES (Reuters) - The Trump administration shielded on Thursday domestic exporters and vessel owners servicing the Great Lakes, the Caribbean and U.S. territories from port fees to be levied on China-built vessels, aiming to revive U.S. shipbuilding and counter China’s maritime dominance.

The Federal Register notice posted by the U.S. Trade Representative was watered down from a February proposal for fees on China-built ships of up to $1.5 million per port call that sent a chill through the global shipping industry.

Ocean shipping executives feared virtually every carrier could face stacking fees that made U.S. export prices unattractive and foisted annual import costs of $30 billion on American consumers.

"Ships and shipping are vital to American economic security and the free flow of commerce," U.S. Trade Representative Jamieson Greer said in a statement.

"The Trump administration’s actions will begin to reverse Chinese dominance, address threats to the U.S. supply chain, and send a demand signal for U.S.-built ships."

Still, the fees on Chinese-built ships add another irritant to swiftly rising trade tension between the world’s two largest economies as President Donald Trump seeks to draw China into talks on his new tariffs of 145% on many of its goods.

The revisions tackle major concerns voiced in a tsunami of opposition from the global maritime industry, including domestic port and vessel operators as well as U.S. shippers of everything from coal and corn to bananas and concrete.

They grant some requested carve-outs, while phasing in fees that reflect the fact U.S. shipbuilders, which turn out about five vessels annually, will need several years to compete with China’s output of more than 1,700 a year.

In February 2025, Canadian investors increased their holdings in foreign securities, with a record investment in US equity securities, according to a report by Statistics Canada. A total of $27.2 billion was invested, a significant increase from the $3.0 billion divestment seen in January. The investment was primarily concentrated in US shares, particularly in large capitalization technology and financial firms.

This surge in investment was led by an unprecedented acquisition of $29.8 billion in US shares, the largest since December 2023. This was slightly offset by the sale of $2.0 billion in non-US shares. Despite reaching an all-time high in mid-February, the Standard and Poor’s (NYSE:SPY) (S&P) 500 composite index was down by 1.4% by the end of the month.

However, Canadian investors decreased their exposure to foreign debt securities by $0.7 billion in February. While there was an increase in holdings of US government money market instruments and US corporate bonds, there was a decrease in holdings of US government bonds and non-US foreign debt instruments.

On the other hand, foreign investors decreased their holdings in Canadian securities by $6.5 billion in February, marking the first divestment in 12 months. This was led by a reduction of $21.9 billion in Canadian shares, the highest monthly divestment since October 2007. The industries most affected by this reduction were management of companies and enterprises, manufacturing, and energy and mining. The S&P/Toronto Stock Exchange composite index saw a slight decrease in February.

Despite the divestment in Canadian shares, non-resident investors increased their exposure to Canadian bonds by $9.9 billion, although this was a decrease from the $33.5 billion investment in the previous month. There was also an increase in exposure to Canadian money market instruments by $5.6 billion, following a significant divestment in January.

The activities in the Canadian bond market in February were characterized by foreign acquisitions of $19.2 billion of corporate bonds, which were offset by divestments of $6.4 billion in federal government bonds and $2.9 billion in provincial government bonds. The foreign investment in Canadian money market instruments targeted private corporate paper, with an increase of $7.3 billion, and provincial governments paper, with an increase of $1.9 billion.

The S&P 500 closed slightly Thursday after giving up the bulk of gains as ongoing tariff uncertainty prompted profit taking in a holiday-shortened week.

At 4:00 p.m. ET (21:00 GMT), the Dow Jones Industrial Average fell 527 points, or 1.3%, while the S&P 500 index gained 0.2%, and the NASDAQ Composite fell 0.1%. Markets will be closed on Friday to observe the Good Friday holiday.

The major U.S. indexes are all heading for a weekly decline, with the Nasdaq Composite very close to bear market territory.

Unitedhealth cuts profit forecast; Google in legal setback

There were more quarterly corporate earnings to digest Thursday, headlined by hefty losses by Unitedhealth, the largest U.S. health insurance company. Its stock dropped 22% after the health insurer cut its annual profit forecast in anticipation of higher-than-expected medical costs.

Elsewhere, Eli Lilly (NYSE:LLY) stock rose 14% after the drugmaker disclosed positive Phase 3 trial results for orforglipron, a pioneering oral medication for type 2 diabetes.

Blackstone (NYSE:BX) stock rose 0.8% after the asset manager reported a higher-than-expected profit for the first quarter, driven by proceeds from asset sales across its private equity and credit businesses.

Taiwan Semiconductor Manufacturing (NYSE:TSM) stock gave up gains to close marginally higher after the world’s largest contract chipmaker posted a 60% jump in first-quarter net profit, helped by surging demand for semiconductors used in artificial intelligence applications.

Hertz Global Holdings (OTC:HTZGQ) Inc (NASDAQ:HTZ) added to its 56% gain from a day earlier after Bill Ackman’s Pershing Square become the second-largest shareholder in the car rental company.

(Reuters) - European shares were mixed on Thursday as investors parsed corporate earnings to gauge the fallout of U.S. President Donald Trump’s erratic trade policies, while awaiting European Central Bank’s policy decision later in the day.

The pan-European STOXX 600 index edged lower 0.4%, as of 0712 GMT, with no major escalations in the trade war helping the index climb 4% this week.

Investors also shied away from making big bets ahead of a four-day-long weekend on account of Good Friday and Easter Monday.

France’s Hermes fell 4% after the Birkin bag maker posted a rare quarterly sales miss, joining rival LVMH, which also reported sales below expectations earlier this week.

Tit-for-tat tariffs sparked by Trump’s multi-front trade war have dimmed the global growth outlook in recent weeks, triggering market volatility reminiscent of the COVID-19-driven slump in March 2020.

ECB’s rate decision is scheduled for 1215 GMT, with markets seeing a rate cut as all-but-certain to cushion a struggling economy from tariff uncertainty.

Siemens (ETR:SIEGn) Energy jumped 10% after the German energy group raised its outlook for the current fiscal year after posting its best profit margin since being spun off from Siemens.

The stock helped Germany’s benchmark index outperform its European counterparts.

Asian stocks rebounded on Thursday amid hopes of U.S. tariff negotiations, while focus was squarely on Bank of Korea’s interest rate decision, Japanese trade data and Australia’s jobs report.

In corporate news, investors awaited Taiwan Semiconductor Manufacturing Co’s (TSMC) (TW:2330) first-quarter earnings due later in the day, to gauge the health of the chip manufacturing industry.

Major U.S stock indexes closed sharply lower on Wednesday, while futures tied to these benchmark indexes rose in Asian trading on Thursday.

US, Japan open tariff negotiations; China open to talks

U.S. President Donald Trump said “big progress” was made during a meeting with a Japanese trade delegation in Washington on Wednesday, as the two nations opened talks aimed at resolving tensions over a wave of U.S. tariffs.

The talks mark the start of formal negotiations to reach a bilateral trade deal amid growing concerns over the economic fallout from U.S. tariffs.

Additionally, a Bloomberg report on Wednesday showed that China is open to beginning trade talks with the Trump administration, but is demanding that the White House show more respect.

These developments alleviated some concerns, although investors still remained on edge.

Japan’s Nikkei 225 led gains with a 1.1% jump. The broader TOPIX index also added 1%.

Australia’s S&P/ASX 200 rose 0.5%, while Singapore’s Straits Times Index gained 0.6%

China’s Shanghai Composite edged 0.2% higher, while the Shanghai Shenzhen CSI 300 was largely muted.

Hong Kong’s Hang Seng index jumped 1.7%.

India’s Nifty 50 opened 0.4% lower.

BOK holds interest rates steady, KOSPI higher

The Bank of Korea (BOK) on Thursday maintained its benchmark interest rate at 2.75%, aligning with market expectations.

This decision reflects the central bank’s cautious approach amid escalating global trade tensions.

The central bank indicated a potential rate cut as early as May in response to escalating economic risks from U.S. President Donald Trump’s aggressive tariff measures.

South Korea’s KOSPI advanced 0.7%, in line with broader Asian markets.

Japan exports rise, Australia’s job market rebounds in March

Data on Thursday showed that Japan’s exports rose for a sixth consecutive month in March, driven by companies rushing shipments ahead of potential U.S. tariffs announced on April 2.

Exports grew 3.9% year-on-year, below the 4.5% forecast and easing from February’s 11.4% gain.

In Australia, data showed that the country’s labor market remained hot with a rebound in employment and a slightly higher unemployment rate.

The total number of employed people rose by 32,200 in March, in contrast with a 52,800 decline in February.

The unemployment rate rose to 4.1% in January, from 4.0% in Feb, but was below forecasts of a 4.2% growth.

By Cynthia Kim and Jihoon Lee

SEOUL (Reuters) -South Korea’s central bank on Thursday signalled it would cut rates in May and left the door wide open to further monetary easing to cope with "significant" risks to the economy from U.S. President Donald Trump’s sweeping tariff policy.

After the Bank of Korea’s seven-member board held the benchmark interest rate at 2.75% as expected at its monetary policy review earlier in the day, Governor Rhee Chang-yong emphasised the BOK’s readiness to respond to economic uncertainties.

"Leaving me aside, all six board members are open to an interest rate cut when we look at the policy path for the three months ahead," Rhee said at a press conference.

The governor’s remarks highlight a rapidly changing global environment after the BOK’s policy statement earlier warned of a possible economic contraction in the first quarter, largely due to the worst wildfires on record as well as domestic political turmoil.

Much of the focus was on the global trade shock unleashed by the Trump administration.

"The downside risks to growth have expanded significantly," Rhee told reporters, and "given that the intensity of the U.S. tariff policy and the responses of major countries are changing rapidly in the short term, we believe that the uncertainty about the future growth path is so great that it is difficult to even set a basic scenario."

The BOK meeting comes hours after U.S. Federal Reserve chief Jerome Powell disappointed investors by pushing back on hopes he would act quickly to sooth investor fears, and as the Bank of Canada on Wednesday kept its policy rates steady amid the uncertainty around U.S. tariffs.

Recent speculation that China and Japan were dumping U.S. Treasuries took a hit on Wednesday after a report from the U.S Treasury Department showed that foreign holdings of Treasuries actually rose 3.4% in February.

Both China and Japan increased their holdings in the month.

Japan remained the largest holder and increased its holdings by 4% to $1.1259 trillion. China raised its holdings by 3% to $784.3 billion. China remained the second-largest foreign holder.

In all, foreign holdings of U.S. treasuries stood at $8.8172 trillion at the end of February.

Rumors that China or Japan was dumping treasuries kicked into high gear in April, after President Trump’s larger-than-expected reciprocal tariffs were enacted, so they could still prove true. However, today’s new data shows that both countries were increasing their U.S. debt exposure going into the tariffs.

China has retaliated against the U.S. reciprocal tariffs, while Japan has not.

The U.S has a 125% reciprocal tariff on China in addition to the 20% tariff to address the fentanyl crisis. If you included section 301 tariffs on specific goods from China, tariffs reach as high as 245% on imports from the country.

Japan currently faces a 24% reciprocal tariff from the U.S. and will be one of the first countries with which the Trump administration will engage in trade talks.

Trump revealed that Japan is coming today to negotiate tariffs, and the President will attend the meeting.

“Japan is coming in today to negotiate Tariffs, the cost of military support, and “TRADE FAIRNESS.” I will attend the meeting, along with Treasury & Commerce Secretaries,” Trump said on Truth Social. “Hopefully something can be worked out which is good (GREAT!) for Japan and the USA!”

The data could indicate that the Asian countries want to show goodwill toward the U.S. and President Trump ahead of potential tariff negotiations by raising their treasury holdings rather than decreasing them.