Select Language

By David Shepardson

WASHINGTON (Reuters) - Nearly all new passenger cars and trucks sold in the United States will be required to have automatic emergency braking systems by September 2029, the National Highway Traffic Safety Administration (NHTSA) said on Monday, saying that the rule will save at least 360 lives annually and prevent at least 24,000 injuries.

The new rule comes as traffic deaths have spiked following the COVID-19 lockdowns.

Congress directed the NHTSA in the 2021 infrastructure law to create a rule to establish minimum performance standards for automatic emergency braking (AEB) systems, which use sensors like cameras and radar to detect when a vehicle is close to crashing and then automatically applies brakes if the driver has not done so.

The rule requires that systems detect pedestrians in both daylight and at night. Some small-volume manufacturers will be allowed to comply by September 2030.

The NHTSA in 2023 had proposed requiring nearly all vehicles to comply three years after publication, but automakers are now being given five years.

The NHTSA is requiring all cars and trucks be able to stop and avoid striking vehicles in front of them up to 62 miles per hour. The rule requires the system to apply brakes automatically up to 90 mph when collision with a lead vehicle is imminent, and up to 45 mph when a pedestrian is detected.

U.S. traffic deaths fell by 3.6% in 2023, the second straight yearly decline, but they remain significantly above pre-pandemic levels.

The fatality rate in 2023 was higher than any pre-pandemic year since 2008. In 2022, the number of pedestrians killed rose 0.7% to 7,522, the most since 1981.

In 2016, 20 automakers voluntarily agreed to make automatic emergency braking standard on nearly all U.S. vehicles by 2022. In December 2023, the Insurance Institute for Highway Safety said all 20 automakers had equipped at least 95% of vehicles with AEB.

By Karl Badohal

WARSAW (Reuters) - Poland is taking steps to increase the transparency of its public finances Finance Minister Andrzej Domanski told reporters, amid rising debt servicing costs.

Measures will include a review of public finances, to be published by the ministry on Monday, reining in out-of-budget spending, and establishing an independent fiscal council to assess government policy, he said.

"I will be encouraging the government to move towards maximum transparency," he told reporters on Friday in comments cleared for publication on Monday morning.

Poland is among nearly a dozen European Union countries at risk of being put under the bloc's excessive deficit procedure, imposed on those whose deficit limits exceed 3% of gross domestic product (GDP).

Warsaw, whose deficit is seen increasing at year-end to 5.4% according to a Reuters poll, points among others to spending more than 4% of economic output on defence, as Russia continues its attack on neighbouring Ukraine.

Domanski said his aim was to repair public finances following several years of elevated off-budget spending by the previous Law and Justice (PiS) government since the COVID-19 pandemic.

"Starting April 30, state-owned development bank BGK will start publishing data on all of its funds in terms of execution and current plans on a quarterly basis," he said.

He said he was in favour of merging some of BGK's funds and the finance ministry would cooperate with the bank and other ministries on this.

LONG-TERM PLAN

Poland's annual long-term financial plan, to be adopted by the government on Tuesday, will also include the framework for establishing a fiscal council to monitor government policy, including macroeconomic projections and the budget bill, Domanski said.

"It of course must be an independent institution and everything it publishes must be made public ... It has to have its own firepower when it comes to criticizing the finance minister for submitted assumptions to the budget act."

He said he expected the project to be made public within a few weeks.

Domanski noted that Poland's debt servicing costs were among the highest in the EU and said he was looking at its smaller neighbour, the Czech Republic, as a guide.

"This is a problem that will get even worse in the coming years - the debt servicing costs in relation to GDP will increase, although fortunately only slightly," he said, adding that policy changes at the U.S Federal Reserve and other main central banks were pressuring emerging markets.

"I am looking at the spread to Czech bonds - my goal is for this spread to narrow."

Domanski also said he was eyeing more private investments, in addition to higher consumption, as a driver of economic growth. "Private investments are very important to me, which is why we are talking to investors in Poland and abroad."

BEIJING (Reuters) - The export controls proposed by Japan related to semiconductors will seriously affect normal trade between Chinese and Japanese enterprises, China's commerce ministry said on Monday.

China urged Japan to rectify what it called "erroneous practices", saying the move would undermine the stability of the global supply chain.

The ministry said China will take necessary measures to firmly safeguard the legitimate rights and interests of Chinese enterprises.

Japan proposed last week to require companies to notify the government before exporting advanced materials and equipment that could be used for military applications, Nikkei reported.

By Daniel Leussink and Sarah Wu

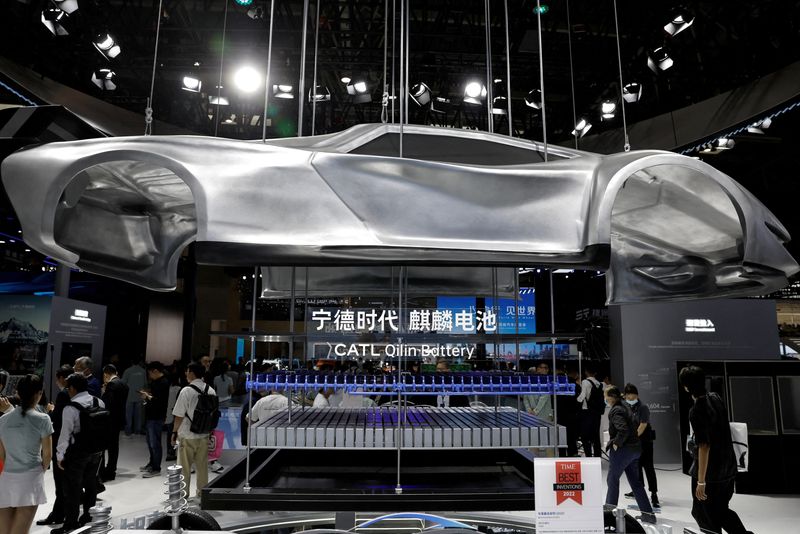

BEIJING (Reuters) -Global automakers including Volkswagen (ETR:VOWG_p) and Toyota came to this year's Beijing auto show looking to catch up to surging China EV makers that are dominating the world's largest auto market.

The show that started this week showcased a marked shift in attitude among some foreign automakers, industry executives said. After being impressed by the bold leaps made by BYD (SZ:002594) and other Chinese automakers at last year's event in Shanghai, foreign automakers are now avidly searching for Chinese partners and announcing new tie-ups, the executives said.

Among the most active were European and Japanese automakers, with announcements coming from Toyota Motor (NYSE:TM) that it would team up with Chinese gaming and social media giant Tencent on artificial intelligence and big data, and Volkswagen promoting its partnership with Chinese EV startup XPeng (NYSE:XPEV).

An executive from Renault (EPA:RENA) said on Friday it had "pivotal conversations" with Chinese EV maker Li Auto (NASDAQ:LI) and Xiaomi (OTC:XIACF), the smartphone maker that just introduced its first car, to explore EV and smart-vehicle technologies. Nissan (OTC:NSANY), meanwhile, announced a tie-up with Chinese tech firm Baidu (NASDAQ:BIDU) to carry out research on AI and "smart cars."

Nissan CEO Makoto Uchida visited several booths including that of Chinese tech giant Huawei, which is becoming a major auto supplier.

European automakers sent "much more senior management" to visit the booth of LIDAR remote sensing technology supplier Hesai Technology this year versus last year, said Bob in den Bosch, senior vice president of global sales at the Shanghai-headquartered firm.

"They're looking for a partner to close the gap," he said. "They came here with a plan and a mission."

Foreign brands have dominated China's auto business since the 1990s and have brought extensive know-how to the Asian country. But last year, foreign brands' collective share of China's passenger car market fell to 48%, down sharply from 57% just two years earlier, according to data from the China Association of Automobile Manufacturers.

GOING LOCAL

German automakers including Volkswagen and Mercedes, in particular, emphasized their efforts to localize production and invest more in local partnerships, with Volkswagen saying repeatedly its goal was to remain the best-selling foreign automaker in China into 2030.

Hildegard Mueller, president of Germany's powerful car lobby VDA, told Reuters that the German automakers are, in addition, exploring new marketing strategies to attract Chinese consumers. This includes partnering with the country’s army of car influencers, who promote and discuss new vehicle models and trends with their large followings on social media.

"It’s huge (online) traffic and huge potential,” she said.

The market share in China of Toyota, the world's top-selling automaker, declined last year, according to data from the China Passenger Car Association (CPCA). Toyota's China joint ventures with GAC and FAW held a combined 7.9% of the Chinese auto market last year, compared with an 8.6% share in 2022, the CPCA said. Toyota has said it will include technology from Tencent in a China-made passenger vehicle the Japanese automaker will put on sale this year as part of a new tie-up.

On Thursday, Toyota took care to emphasize the new tie-up, with its chief technology officer, Hiroki Nakajima, inviting a senior Tencent executive onstage to its auto show presentation.

"We want to, with Toyota, build products and services that are closer to consumers, to jointly build mobility solutions of the future and we look forward to the fruits of our cooperation," said Dowson Tong, CEO of Tencent Cloud and Smart Industries Group.

PESSIMISM

Some foreign auto executives were more pessimistic about their ability to fight back.

Katsuhide Moriyama, president of GAC Honda (NYSE:HMC) Automobile, Honda's joint venture with Guangzhou Automobile Group, cited how China's leading EV makers have found ways to slash vehicle development time.

"Manufacturers should shorten the lead time to compete with those competitors," Moriyama said outside the automaker's booth at the show. "But a two-year model cycle is too short for us."

The number of American car executives paled compared with visitors from other foreign markets, noted Hesai's In den Bosch.

The market share in China of major American brands including Ford (NYSE:F) and General Motors (NYSE:GM) has plummeted amid declining gasoline-car sales and the shift from foreign to Chinese brands.

Ford's chief financial officer, John Lawler, told reporters in the United States on Wednesday that the automaker wants to maintain its existing China presence but is not planning to invest more.

"We're not putting capital into China," he said.

By Vidya Ranganathan

SINGAPORE (Reuters) - The Japanese yen hit its weakest levels since April 1990 on Monday, in trading thinned by a holiday in Japan and attempts by traders to test key levels and stop-loss orders in a nervous, illiquid market.

The dollar rose as far as 160.245 yen in a sudden move after the yen traded in a narrow 158.05-158.15 range in early deals.

A portfolio manager said "stops" on the pair at the key 160 level had been "taken out", meaning the yen's descent had forced those with long yen holdings and stop-loss orders around that big level to square positions, exacerbating its slide.

The yen's move barely affected the euro and sterling, both of which stayed near the bottom of the ranges hit during Friday's volatile session.

Markets are on guard for any intervention by Japanese authorities to contain the yen's nearly 11% fall this year.

While the yen had its biggest drop in six months on Friday, it also briefly surged to 154.97 to the dollar, triggering speculation that Japanese authorities may have checked currency rates ahead of likely intervention. It was not immediately clear what caused the move.

Japan's yen was at 159.105 by 0200 GMT, down 0.5%. Tokyo markets were closed for the first of the country's Golden Week holidays.

The yen had moved nearly 3.5 yen between 158.445 and 154.97 on Friday as traders vented their disappointment after the Bank of Japan kept policy settings unchanged and offered few clues on reducing its Japanese government bond (JGB) purchases - a move that might have put a floor under the yen.

The Federal Reserve's May 1 policy review is the prime focus for markets this week, with investors already anticipating a delay in its rate cuts after a batch of sticky U.S. inflation and as officials including Chair Jerome Powell emphasise even those plans are dependent on data.

Vishnu Varathan, head of Asia economics and strategy at Mizuho Bank in Singapore, expects the dollar-yen pair will see more two-way action until the Federal Open Market Committee (FOMC) meeting, unlike in the past few weeks when hawkish Fed expectations had kept the dollar steadily rising against most other currencies.

"The bar is pretty high for a sustained hawkish surprise, which would in turn lift yields," he said, referring to the Fed.

"So, from a yield-spread perspective between U.S. Treasuries and JGBs, for that to continue to fuel further yen depreciation, the bar is really high because the Fed may not be tilting as hawkish as markets expect either."

"The BOJ disappointment might be transcribed onto the FOMC insofar that they may be more undecided than decidedly hawkish."

The Fed is seen holding its benchmark interest rate steady at 5.25%-to-5.5% at the April 30-May 1 meeting. Investors now see perhaps only a single cut this year, currently anticipated by November, according to the CME's FedWatch tool.

Sterling was at $1.2522, up 0.22%, but still some distance from Friday's $1.2541 highs.

Investing.com -- It’s set to be another hectic week in markets with the Federal Reserve’s latest policy meeting front and center. The U.S. is to release its latest employment report on Friday and the last of the "Magnificent Seven" big tech names are to report earnings. Meanwhile the euro zone and China are to release what will be closely watched economic data. Here’s what you need to know to start your week.

1. Fed decision

Investors will be awaiting indications about whether the Fed still expects to cut interest rates at some stage this year when officials conclude their two-day policy meeting on Wednesday. Fed Chair Jerome Powell has said the central bank needs more confidence that inflation is heading towards its 2% goal before cutting rates.

Friday’s inflation data for March, which was broadly in line with consensus, did little to alter market expectations for a first rate cut in September.

Expectations for interest rate cuts have faded as data on the labor market and inflation continued to surprise on the upside. Financial markets initially expected the first rate cut to come in March. That expectation got pushed back to June and then September.

2. Nonfarm payrolls

Friday’s monthly jobs report will give a fresh look at the strength of the U.S. labor market, with economists expecting the economy to have added 243,000 jobs in April, moderating from 303,000 in March. The unemployment rate is expected to remain steady at 3.8%.

Ahead of Friday, there will be ADP data on private sector hiring as well as the report on JOLTS job openings and other survey data that will help firm up expectations.

Investors will also be looking to Tuesday’s data on the employment cost index for signs that inflation pressures arising from the labor market continue to cool.

3. Tech earnings

The last of the "Magnificent Seven" megacaps that drove markets higher last year to report are Amazon (NASDAQ:AMZN), on Tuesday, and Apple, on Thursday.

Apple shares (NASDAQ:AAPL) have tumbled over 10% so far this year and the iPhone maker is expected to post a decline in first quarter earnings after China smartphone shipments fell 19%.

Amazon's cloud computing business will be in focus while investors will also be watching what the online retailing giant has to say about consumer spending.

Solid reports from Microsoft (NASDAQ:MSFT) and Google parent Alphabet (NASDAQ:GOOGL) on Thursday helped the S&P 500 register its biggest weekly gain since November.

But some of their peers such as Tesla (NASDAQ:TSLA) and Facebook parent Meta Platforms (NASDAQ:META) have given a mixed performance.

"We cautioned that potential earnings beats might not lead to equity upside during the results season, given the already strong equities run leading up to the earnings season, and stretched positioning...," JPMorgan analysts said in a note. "Indeed, stock price reactions in the US (have) been underwhelming so far."

4. China PMI data

Market watchers will be looking to Chinese manufacturing data for April for signs that a long-awaited recovery in the world's second largest economy is gathering momentum after last months stronger than expected data.

Official figures for China's purchasing managers' index are due on Tuesday, followed shortly afterwards by the Caixin/S&P Global manufacturing PMI.

Upbeat data would be a relief to policymakers who have been trying to shore up growth and bolster investor sentiment.

Global investment houses have turned increasingly bullish on Chinese stocks, helping the blue-chip index tack on more than 10% from a February trough. But Beijing has lately found itself in a bind over its currency. The yuan is sliding against a robust dollar but is stronger against its major trading partners - an unwelcome sign for China's export-dependent economy.

5. Eurozone data

The eurozone is to release inflation and economic growth data on Tuesday which will likely strengthen market bets for a June rate cut by the European Central Bank.

Inflation has fallen quickly over the past year and the ECB has indicated it plans to cut rates in June, but the longer-term outlook remains clouded by rising energy costs, stubbornly high services inflation and continued geopolitical tensions that threaten to disrupt trade.

Economists are expecting the bloc’s gross domestic product to have expanded by just 0.2% in the first quarter, on a year-over-year basis.

Progress on inflation is expected to have stalled with consumer prices expected to have risen by 2.4% in April, matching the previous month amid rising energy costs.

(Reuters contributed reporting)

By Iain Withers

LONDON (Reuters) - Real estate deals in Europe fell through in their highest numbers since the global financial crisis in the first quarter of 2024, data firm MSCI Real Assets said on Thursday, as economic uncertainty in the region continues to loom large.

Europe's commercial property sector has been hammered in recent years by a punishing rise in debt costs and tumbling prices, exacerbated by some offices and high streets emptying after the pandemic.

Investors globally are rethinking when they expect central banks to start cutting interest rates, cooling hopes for a rapid rebound in rate-sensitive sectors like real estate.

The MSCI data showed the number of property deals worth more than 5 million euros ($5.4 million) terminated and for-sale properties withdrawn from the market in the quarter spiked to 110, the highest since 2010 when the sector was still gripped by the fallout from the global financial crisis.

The total value of European commercial property sales also slumped by 26% in the first quarter compared to the prior year, to 34.5 billion euros, the lowest since 2011 and the seventh straight quarter of annual declines.

"After a very slow 2023, there were hopes that European property investment would start to pick up...(but) the market remains a difficult place in which to transact," said Tom Leahy, Head of EMEA Real Assets Research at MSCI.

"Buyer and seller price expectations have diverged and until interest rates start to come back down or the growth prospects for European economies improve markedly, the price gap is likely to remain in place."

By Lucia Mutikani

WASHINGTON (Reuters) - U.S. economic growth likely slowed to a still-solid pace in the first quarter while inflation accelerated, reinforcing financial market expectations that the Federal Reserve would delay cutting interest rates until September.

The Commerce Department's snapshot of first-quarter gross domestic product on Thursday is expected to show consumers still doing the heavy lifting for the economy, thanks to a resilient labor market. The economy has defied prophecies of doom since late 2022 following the U.S. central bank's aggressive rate hiking campaign to snuff out inflation.

The United States is outperforming other advanced economies. Consumers locked in lower mortgage rates, while businesses refinanced debt before the tightening cycle began, economists say. Companies are also hoarding workers after experiencing difficulties finding labor during and after the COVID-19 pandemic, and are enjoying higher profit gains because of strong pricing power.

"They have been relatively insulated from the rate increases," said Richard de Chazal, macro analyst at William Blair. "In past economic cycles, at the first whiff of an economic slowdown, companies in the U.S. used to fire workers very quickly and then they knew that they could hire them back very quickly once the cycle turned."

Gross domestic product likely increased at a 2.4% annualized rate last quarter, according to a Reuters survey of economists. Estimates ranged from a 1.0% pace to a 3.1% rate. The economy grew at a 3.4% pace in the fourth quarter.

It is expanding at a pace above what Fed officials regard as the non-inflationary growth rate of 1.8%. The International Monetary Fund last week upgraded its forecast for 2024 U.S. growth to 2.7% from the 2.1% projected in January, citing stronger-than-expected employment and consumer spending.

Job gains in the first quarter averaged 276,000 per month compared to the October-December quarter's average of 212,000.

Labor market resilience is likely to be underscored by the Labor Department's weekly jobless claims report, which is expected to show first-time applications for unemployment benefits climbing 3,000 to a seasonally adjusted 215,000 in the week ending April 20. Initial claims have bounced around in a 194,000-225,000 range this year.

Low layoffs are keeping wage growth elevated, sustaining consumer spending, which accounts for more than two-thirds of economic activity.

Though inflation probably surged, with the personal consumption expenditures (PCE) price index excluding food and energy forecast increasing at a 3.4% rate after rising at 2.0% pace in the fourth quarter, economists were not worried about a resurgence in price pressures.

RATE CUTS STILL EXPECTED

The so-called core PCE price index is one of the inflation measures tracked by the Fed for its 2% target. The central bank has kept its policy rate in the 5.25%-5.50% range since July. It has raised the benchmark overnight interest rate by 525 basis points since March of 2022.

James Knightley, chief international economist at ING, said persistent inflation would require higher wages, which would give consumers more purchasing power and allow companies to raise prices..."but what we're seeing is labor demand and cost indicators weakening quite considerably."

"There doesn't appear to be a threat of wage growth accelerating and keeping inflation elevated for longer."

Economists believe consumer spending more or less maintained the 3.3% growth pace seen in the fourth quarter, also supported by higher stock market prices.

They, however, worry that lower-income households have depleted their pandemic savings and are largely relying on debt to fund purchases. Recent data and comments from bank executives indicated that lower-income borrowers were increasingly struggling to keep up with their loan payments.

The economy was also likely supported by the housing market, with double-digit growth anticipated in residential investment thanks to a severe shortage of previously owned homes for sale, which is encouraging the construction and sale of new single-family homes. Business spending on intellectual property was probably a boost as companies invest in artificial intelligence.

Though investment in nonresidential structures continued to rise, the pace likely slowed sharply from the past year when companies took advantage of policies by President Joe Biden's administration to bring the production of semiconductor manufacturing back to the United States by building factories.

Trade likely subtracted from GDP growth as some of the increase in consumer spending was satiated by imports.

Business spending on equipment was probably another drag, contracting for the third straight quarter. That together with weakness in sentiment surveys have led some economists to believe the economy is likely not as strong as portrayed by the GDP and labor market data and to expect a slowdown in growth.

Others, however, cautioned against reading too much into the divergence between the so-called hard data and the sentiment surveys, arguing that the pandemic had made it difficult to get a clear signal from the surveys. They also argued that businesses were generally conservative by nature.

"Those (survey) gauges still have not normalized yet, relative to the reality of the economy," said Brian Bethune, an economics professor at Boston College. "Businesses are seeing things pan out somewhat better than what they expected, which is what matters for them."

Investing.com-- The Bank of Japan is widely expected to keep interest rates on hold at the conclusion of a meeting this week, although an improved outlook for Japanese wages and a sharp decline in the yen may elicit hawkish signals from the central bank.

The BOJ is set to keep its benchmark interest rate at 0.1%, after hiking the rate from negative territory in March- its first rate increase since 2007. The BOJ had also largely ended its yield curve control and asset buying measures.

While the move did mark a shift in the BOJ’s policy, the central bank had offered a largely dovish outlook on future rate moves. The bank had signaled it would keep monetary conditions accommodative in the near-term, with the intent to foster economic growth in Japan.

But the factors that had initially driven the BOJ’s March rate hike still remained in play. Chiefly, Japanese wage growth is expected to pick up in the coming months, especially after major labor unions in the country won bumper wage hikes for the year.

BOJ Governor Kazuo Ueda signaled that higher wages and inflation will eventually draw more rate hikes by the BOJ this year. But he also emphasized on the need for loose policy in the near-term, citing a fragile Japanese economy.

The case for a hawkish BOJ

A recent pick-up in Japanese inflation- from two-year lows- could see the BOJ hike its inflation outlook for the year. Such a scenario also appears more likely in the face of stronger wage growth this year.

Recent purchasing managers index data also showed Japanese business activity remained resilient- a trend that is also expected to continue with strong wage growth.

Signs of resilience in the Japanese economy, coupled with stickier inflation, give the BOJ more impetus and headroom to tighten monetary policy.

Additionally, recent weakness in the yen- where the USDJPY pair hit 34-year highs above 155- could also draw hawkish rhetoric from the BOJ, if only to stem a slide in the currency.

The yen has seen little support despite repeated warnings of currency market intervention by Japanese officials. Such a scenario could pressure Ueda into supporting the yen through hawkish commentary.

Pressure on Ueda to act could also come from fears of a scenario as that seen in 2022. Ueda’s predecessor, Haruhiko Kuroda, had avoided supporting the yen- a trend that saw the currency slump to 1990 lows, which in turn attracted record levels of intervention by the Japanese government.

“We expect the BoJ to keep its policy target unchanged, but the market’s focus should be on its quarterly outlook report. Given higher inflation in the first quarter, stronger-than-expected wage growth, and a weaker-than-expected yen, we expect the inflation outlook to be revised up,” analysts at ING wrote in a note.

“We believe that the BoJ’s rate hike expectations will grow as the year progresses.”

How will USDJPY react?

Inaction by the BOJ exposes tBut any hawkish signals from the central bank are likely to spark strong gains in the yen, dragging the USDJPY pair away from 34-year highs.

Still, any recovery in the yen is expected to be limited, given that the main point of pressure on the currency, which is higher-for-longer U.S. interest rates- has only worsened in recent weeks.

How will the Nikkei 225 react?

The Nikkei 225 was slapped with a heavy bout of profit-taking in April after a strong performance in the first quarter. Any hawkish rhetoric from the BOJ is likely to worsen the Nikkei’s losses, given that higher Japanese interest rates will mark an end to nearly a decade of easy monetary policy enjoyed by Japanese stocks.

An ultra-dovish BOJ was a key point of support for the Nikkei 225 over the past two years.

Still, analysts at UBS said that Japanese stocks retained more potential for upside, especially on the back of strong earnings. he yen to even more downside pressure- a trend that, barring any intervention by the Japanese government, could see the USDJPY pair push further beyond 155.

By Stephen Nellis

SANTA CLARA, California (Reuters) -Taiwan Semiconductor Manufacturing Co said on Wednesday that a new chip manufacturing technology called "A16" will enter production in the second half of 2026, setting up a showdown with longtime rival Intel (NASDAQ:INTC) over who can make the world's fastest chips.

TSMC, the world's biggest contract manufacturer of advanced computing chips and a key supplier to Nvidia (NASDAQ:NVDA) and Apple (NASDAQ:AAPL), announced the news at a conference in Santa Clara, California, where TSMC executives said that makers of AI chips will likely be the first adopters of the technology rather than a smartphone maker.

Analysts told Reuters that the technologies announced on Wednesday could call into question Intel's claims in February that it will overtake TSMC in making the world's fastest computing chips with a new technology Intel calls "14A."

Kevin Zhang, TSMC's senior vice president of business development, told reporters that the company has developed its new A16 chipmaking process faster than expected because of demand from AI chip firms, without naming specific customers.

AI chip firms "really want to optimize their designs to get every ounce of performance we have," Zhang said.

Zhang said that TSMC does not believe it needs to use a ASML (AS:ASML)'s new "High NA EUV" lithography tool machines to build the A16 chips. Intel last week revealed that it plans to be the first to use the machines, which can cost $373 million each, to develop its 14A chip.

TSMC also revealed a new technology for suppling power to computer chips from the backside of the chip, which helps speed up AI chips and will be available in 2026.

Intel has announced a similar technology intended to be one of its primary competitive advantages.

Analysts said the announcements called into question Intel's claims that it will retake the world chipmaking crown.

"It's debatable, but on some metrics, I don't think they're ahead," Dan Hutcheson, vice chair at analyst firm TechInsights, said of Intel.

But Kevin Krewell, a principal at TIRIAS Research, cautioned that both Intel and TSMC's technologies remain years away from delivering the technology and will need to prove that real chips match their keynote presentations.