Select Language

By Ann Saphir and Michael S. Derby

(Reuters) -A pair of Federal Reserve policymakers often considered to have divergent monetary policy leanings on Tuesday both said they think it would be "reasonable" to cut U.S. interest rates three times this year, even as stronger recent economic data has sown investor doubts about that outcome.

Cleveland Fed Bank President Loretta Mester and San Francisco Fed Bank President Mary Daly last month joined the U.S. central bank's unanimous vote to leave short-term interest-rates in the 5.25%-5.5% range to keep putting downward pressure on inflation.

"At this point, the economy and policy are in a good place," Daly said at an event in Las Vegas. "Inflation is coming down, but it's slow, it's bumpy and slow. The labor market is still going strong and growth is going strong. So there's really no urgency to adjust the rate."

Projections published at the Fed's March meeting showed the typical policymaker expected to deliver three quarter-point interest rate cuts this year, though nearly half of officials - nine of the 19 - see two or less this year, according to forecasts issued last month.

"I think that is a very reasonable baseline," said Daly, often pegged as dovish though a self-described policy centrist.

Still, Daly said, there is a "real risk" of cutting rates too soon and locking in the "toxic tax" of too-high inflation.

Mester, on the more hawkish end of the Fed's policy spectrum, told reporters on Tuesday that three rate cuts for this year remain a "reasonable" forecast while deeming it a "close call."

Though, like Daly, she acknowledged the risk of keeping rates high for too long and unnecessarily harming the labor market, "at this point, I think the bigger risk would be to begin reducing the funds rate too early," Mester said at an event in Cleveland.

Inflation by the Fed's targeted measure was 2.5% in February, far below its mid-2022 peak of around 7% but still above the 2% goal, with progress slower so far this year than for much of last year. Meanwhile the labor market has been strong, with unemployment at 3.9% in February.

Data this week showed manufacturing unexpectedly rebounding, with a rise in raw materials prices raising fears that inflation could resurge.

Investors are eager to hear how Fed Chair Jerome Powell, speaking at Stanford University on Wednesday, adds it all up. They are also focused on whether the next monthly read on the U.S. labor market, due on Friday, backs up other data suggesting the labor market is cooling, and if fresh inflation reads ahead of the Fed's next two meetings, April 30-May 1 and June 11-12, show prices are as well.

Powell, speaking last Friday, said the stronger-than-expected inflation readings so far this year have not changed his overall view that inflation is headed downward and the Fed will cut rates later this year.

Financial markets are betting heavily against a May 1 rate cut. Mester on Tuesday said she does not think there will be enough information between now and then to justify it.

But that could change by June, Mester said.

"We have to be data dependent so I don't want to rule that out," Mester told reporters after her speech.

Interest-rate futures prices currently imply about a 65% chance of a rate hike by June, down from about 70% after the Fed's March meeting.

By Stella Qiu

SYDNEY (Reuters) - Asian shares tracked Wall Street lower on Wednesday as U.S. yields held near four-month highs, while a powerful earthquake in the region raised concerns about possible disruptions to the vital chip-making industry.

Markets are also pondering the risk of slower rate cuts ahead of U.S. data and an appearance by the world's most powerful central banker later in the day. Oil extended its ascent, while gold prices hit another a record high.

MSCI's broadest index of Asia-Pacific shares outside Japan fell 0.7%. Japan's Nikkei dropped 1%, after a 20% blockbuster rally in the first quarter.

Taiwan's shares skidded 0.8% after a powerful earthquake with a magnitude of 7.2 rocked Taipei, the capital, sparking a tsunami warning for the islands of southern Japan and the Philippines.

Shares of the chip giant Taiwan Semiconductor Manufacturing Co fell 1.4% after the company said some facilities were evacuated following the quake.

China's blue chips eased 0.3% while Hong Kong's Hang Seng index fell 0.6%, even as a private survey showed that the expansion in the services industry picked up pace in March.

On Wall Street, a recent run of solid U.S. economic data - including an unexpected expansion in the manufacturing sector and the slow easing in the labour market - has stoked doubts about the amount of the Fed easing likely this year and next.

A pair of Fed policymakers on Tuesday both said they think it would be "reasonable" to cut U.S. interest rates three times this year, but markets only see about 69 basis points in easing.

"At this last meeting, they still indicate three times, but these movements tend to have some momentum. As they start to shift, you find that they will probably shift again next meeting and then by next meeting, they probably will be indicating that they're going to cut only twice," said Andrew Lilley, chief rates strategist at Barrenjoey in Sydney.

"And there's a very high chance of one in three, that they don't ease at all."

The three major Wall Street indexes fell about 0.7%-1%. Tesla (NASDAQ:TSLA) shares lost about 5% after quarterly deliveries fell for the first time in nearly four years.

Long-term Treasury yields climbed to multi-month highs overnight before paring some of the movements. The benchmark 10-year yield was last at 4.3471% on Wednesday, after hitting a four-month high of 4.405% overnight.

Investors now await euro zone inflation data, which could surprise on the downside after German inflation eased more than expected. In the U.S., a private payrolls report and a services sector survey are the key data risks, along with a speech from Fed Chair Jerome Powell on the economic outlook.

In currency markets, the dollar failed to get a lift from higher yields but still loomed large against major peers. The yen was jittery at 151.50 per dollar, just a whisker away from the 152 level that prompted authorities to intervene in late 2022.

Oil gained for a fourth straight day as escalating geopolitical tensions fuelled worries about tighter supplies ahead of an OPEC+ meeting where the group is unlikely to change output policy. Brent eased 0.2% to $87.18 a barrel, while U.S. crude lost 0.3% to $83.21 per barrel.

Gold prices extended their record rally on Wednesday. Spot gold hit an all-time high of $2,288.09 per ounce earlier in the session before running into some profit taking and was last flat at $2,277.99.

WASHINGTON (Reuters) - New orders for U.S.-manufactured goods rebounded more than expected in February, boosted by demand for machinery and commercial aircraft as manufacturing regains its footing.

Factory orders increased 1.4% after dropping 3.8% in January, the Commerce Department's Census Bureau said on Tuesday. Economists polled by Reuters had forecast orders rebounding 1.0%. They rose 1.0% year-on-year in February.

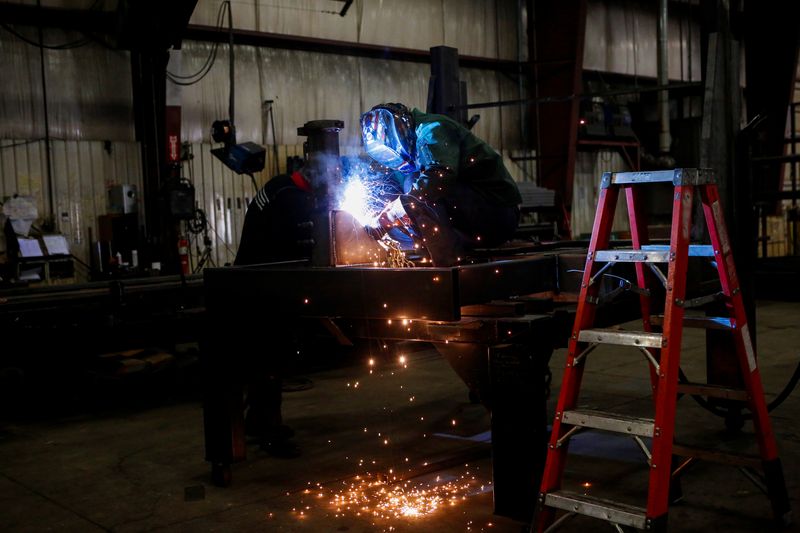

Manufacturing, which accounts for 10.4% of the U.S. economy, has turned the corner after struggling in the aftermath of 525 basis points worth of interest rate hikes from the Federal Reserve since March 2022. A survey from the Institute for Supply Management on Monday showed its manufacturing PMI rising above the 50 mark in March for the first time since September 2022.

Commercial aircraft orders increased 24.6% in February after slumping 63.5% in the prior month. Orders for motor vehicle bodies, parts and trailers rose 0.3%. Overall transportation orders rebounded 3.3% after tumbling 18.3% in January.

Machinery orders increased 1.8%, lifted by a 12.5% surge in mining, oil field and gas field machinery. There were also increases in orders for fabricated metal products and primary metals. But orders for computers and electronic products declined 1.4%, while those for electrical equipment, appliances and components decreased 2.1%.

Shipments of manufactured goods increased 1.4%, while inventories rose 0.3%. Unfilled orders at factories were unchanged for a second straight month.

The government also reported that orders for non-defense capital goods excluding aircraft, which are seen as a measure of business spending plans on equipment, rose by an unrevised 0.7% in February. Shipments of these so-called core capital goods declined 0.6% instead of 0.4% as reported last week.

Nondefense capital goods orders rebounded 4.3% instead of 4.4% as initially estimated. Shipments of these goods increased 2.6% instead of 2.7% as reported last week.

These shipments go into the calculation of the business spending on equipment component in the gross domestic product report. Business spending on equipment has contracted in four of the last five quarters.

By Lucia Mutikani

WASHINGTON (Reuters) - U.S. job openings edged up in February, though labor market conditions are gradually easing in support of expectations that the Federal Reserve will start cutting interest rates by June.

The Job Openings and Labor Turnover Survey, or JOLTS report, from the Labor Department on Tuesday showed there were 1.36 vacancies for every unemployed person in February, down from 1.43 in January. The decline in the vacancy-to-unemployment ratio reflected a spike in unemployment at the start of the year. Economists, however, argued that the drop in the ratio in February did not mark a material shift in the labor market.

"There is nothing here to worry Fed policymakers, who want a strong labor market, but the very slow progress in reducing the apparent excess demand for labor is not likely to encourage the Fed to cut interest rates in the immediate future," said Conrad DeQuadros, senior economic advisor at Brean Capital in New York.

Job openings, a measure of labor demand, edged up 8,000 to 8.756 million on the last day of February, the Labor Department's Bureau of Labor Statistics said. Data for January was revised lower to show 8.748 million unfilled positions instead of the previously reported 8.863 million.

Economists polled by Reuters had forecast 8.750 million job openings in February. Vacancies peaked at a record 12.0 million in March 2022.

Cleveland Fed President Loretta Mester, currently a voting member of the Fed policy-setting committee, said on Tuesday she anticipated that the U.S. central bank "will be able to move rates down gradually." The timing remains unclear.

Fed officials last month left the central bank's policy rate unchanged in the current 5.25%-5.50% range, having raised it by 525 basis points since March 2022.

Policymakers anticipate three rate cuts this year. Financial markets expect the first rate reduction in June.

There were an additional 126,000 open positions in finance and insurance in February. Unfilled positions in state and local government, excluding education increased by 91,000, while arts, entertainment and recreation had 51,000 more job openings.

But vacancies in the information industry declined 85,000, while the federal government had 21,000 fewer open positions.

The job openings rate was unchanged at 5.3% for the third straight month. Medium-sized businesses accounted for the increase in overall job openings. Small businesses with 10 to 49 employees saw unfilled jobs declining 152,000. Job openings were higher in the West, while the South reported a large decline.

Stocks on Wall Street were trading lower. The dollar slipped against a basket of currencies. U.S. Treasury prices fell.

QUITS CLIMB

Hiring increased 120,000 to 5.818 million. It was driven by retail trade, with 78,000 hires. There were also notable gains in transportation, warehousing and utilities. Much of the hiring came from small businesses with 10 to 49 employees, and was in the South. The hires rate rose to 3.7% from 3.6% in January.

"We view the openings data as indicative of demand for labor still being strong relative to supply but with there being less imbalance recently than there was a couple of years ago," said Daniel Silver, an economist at JPMorgan in New York.

The number of workers resigning from their jobs, likely for greener pastures, increased 38,000 to 3.484 million in February.

About 77,000 retail workers quit their jobs, while resignations increased 42,000 in the professional and business services sector. Most of the quits were in medium-sized firms. But quits decreased 53,000 in accommodation and food services.

The quits rate, viewed as a measure of labor market confidence, was unchanged at 2.2% for the fourth consecutive month. A steady quits rate suggests wage increases will likely continue to moderate, which bodes well for overall inflation.

Layoffs increased 128,000 to 1.724 million, the highest level in 11 months, driven by the arts, entertainment and recreation industry as well as accommodation and food services. They were mostly among small and medium-sized businesses and were concentrated in the South and Midwest. But job cuts decreased in professional and business services.

The layoffs rate climbed to a still low 1.1% from 1.0% in January. Low layoffs have accounted for most of the employment gains in recent months.

The Labor Department is expected to report on Friday that nonfarm payrolls increased by 200,000 jobs in March, according to a Reuters survey of economists.

The economy added 275,000 jobs in February. The unemployment rate is forecast unchanged at 3.9%.

"We expect job growth to moderate over the course of this year as demand for labor softens but remain positive," said Nancy Vanden Houten, U.S. lead economist at Oxford Economics in New York.

By Uditha Jayasinghe

COLOMBO (Reuters) - The World Bank raised its forecast for Sri Lanka's economy on Tuesday, projecting a growth of 2.2% for 2024, as the crisis-hit nation makes a faster-than-expected recovery from its worst financial crisis in decades.

Sri Lanka secured a $2.9 billion bailout from the International Monetary Fund (IMF) in March last year, helping it temper inflation, increase state revenue, and rebuild foreign exchange reserves after its economy crumpled in 2022.

The IMF programme helped Sri Lanka's economy stabilise, and it is expected to return to growth this year after contracting 2.3% in 2023.

The World Bank, in its latest report on South Asia, raised its growth forecast for Sri Lanka by 50 basis points. Real GDP growth was also expected to strengthen further to 2.5% in 2025, with modest recoveries in reserves, remittances and tourism, the development bank's report said.

South Asia, excluding Afghanistan, was expected to grow 6.1% in 2025, remaining the fastest-growing region in the world for the next two years, with India's expected growth of 6.6% for fiscal year 2025 leading the way.

The World Bank expects Pakistan's fiscal year 2024 growth at 1.8%, below the State Bank of Pakistan's projection of 2%-3%. Real GDP is seen expanding 2.3% in fiscal year 2025, the report said.

By Nafisa Eltahir and Patrick Werr

CAIRO (Reuters) -The IMF will tie payments to Egypt under an $8 billion financial programme to Cairo's letting market conditions determine the price of its currency and its making foreign exchange available to businesses and private individuals, the IMF said on Monday.

Egypt, which signed the loan agreement on March 6, will have immediate access to $820 million this week and another $820 million after a review to be completed by the end of June.

Subsequent reviews will be made every six months, with each unlocking payments of $1.3 billion provided certain conditions are met, with the last payment in autumn of 2026, mission chief Ivanna Vladkova Hollar told a news conference.

The International Monetary Fund's executive board approved the programme on Friday, expanding on a $3 billion Extended Fund Facility signed in December 2022 after the crisis in neighbouring Gaza further shook Egypt's already precarious economy.

Egypt allowed its currency to weaken sharply after the 2022 agreement, but within months had re-pegged it to the dollar, prompting the IMF to put the programme on hold.

Under last month's agreement Egypt again let its currency plunge and has since let its price fluctuate.

"This is an important reform that needs to be sustained. It's not a one-off reform," Hollar said.

"At each individual review, the expectation is that the conditions that we're seeing now in the market are going to continue to hold, in the sense that we do not see a return to a system of FX rationing and lack of FX availability," she said.

The Gaza crisis exacerbated Egypt's chronic foreign crisis by slowing tourism growth and triggering attacks from Yemen on shipping in the Red Sea, halving Suez Canal revenue. Tourism and canal revenue are two of its main sources of foreign exchange.

Among other reforms the IMF is seeking is that Egypt ensure a level playing field between private and state firms and that the state reduce its role in the economy.

An additional loan from the IMF's Resilience and Sustainability Facility would be discussed during the next review, Vladkova Hollar said.

"To qualify, countries need to have in place a strong set of policies that are intended to address the bases of climate change," she added.

The IMF forecasts that Egypt's inflation will remain high in the near term, with average inflation for the coming fiscal year, which begins on July 1, expected at 25.5%, falling to 15.25% by the end of that year, she said. Inflation rose to a record high of 38% in September before easing in February to 35%.

The country, whose budget has been stretched in recent years, needs to replace untargeted fuel subsidies with targeted spending designed to reach households in need, she added.

Egypt raised fuel prices late last month as part of a programme to reduce subsidies. Fuel subsidies would continue to fall as part of Egypt's quarterly pricing committee meetings, Hollar said.

By Leika Kihara

TOKYO (Reuters) - Japanese Finance Minister Shunichi Suzuki said on Tuesday that authorities were ready to take appropriate action against excessive currency market volatility, without ruling out any options.

"We are carefully watching daily market moves," Suzuki told a news conference after a regular cabinet meeting, when asked about the yen's continued declines.

"We are watching currency moves with a strong sense of urgency," he said.

The yen has been on a downtrend despite the Bank of Japan's decision on March 19 to end eight years of negative interest rates, and hit a 34-year low against the dollar at 151.975 last week. It stood at 151.655 in Asia on Tuesday.

With the BOJ's policy rate still stuck around zero, expectations the gap between U.S. and Japanese interest rates will remain wide are giving traders an excuse to keep selling the yen, analysts said.

Suzuki said monetary policy was only among many factors that affect currency moves, such as each country's current account balance, price developments, geo-political risks, market sentiment and speculative moves.

"It's important for currency rates to move stably reflecting fundamentals. Excessive volatility is undesirable," he said.

Suzuki declined to comment when asked whether Japan would intervene heavily in a single blow to unwind speculative positions, or conduct intervention in several stages to smooth volatile moves.

SANTIAGO (Reuters) - Chile's economic activity index posted its largest year-on-year increase in almost two years in February, central bank data showed on Monday, reinforcing its positive momentum after a major beat in the previous month.

Economic activity in the world's largest copper producer was up 4.5% in February from a year earlier, the central bank said, the most since May 2022, when it had risen 5.1%.

All activities surveyed by the monetary authority had a positive performance in the month, with mining and services - especially transportation - among the highlights.

A number of independent analysts had already pointed out last week that economic activity growth of more than 4% in February was on the cards after sectoral statistics confirmed a good start to the year for the Andean country.

The result, however, still came in as a surprise for analysts polled by the central bank, whose median forecast for activity in February stood at a 1.5% expansion, according to a poll released last month.

The data comes after Chile's economic activity rose by a revised 2.3% year-on-year in January, overshooting market estimates.

The Monthly Economic Activity Indicator (Imacec), which represents about 90% of gross domestic product (GDP), was also up 0.8% in February from the previous month.

"In all, the momentum of both ex-mining and mining activity has clearly outpaced our expectations," JPMorgan economist Diego Pereira said, noting that accommodative fiscal policy and less restrictive monetary policy have provided a boost.

"The question is whether mining would be able to consolidate this level, gain further, or drop in a similar manner to what happened in the prior two years."

Chile faced a sharp economic downturn in 2023 after a rapid post-pandemic recovery. The economy struggled while consumer prices soared, leading the central bank to hike interest rates which it has now been cutting as inflation cooled.

The latest rate cut came in January, when the bank reduced borrowing costs by 100 basis points. The monetary authority's rate-setting committee will meet again this week and is expected to deliver a 75-basis-point rate cut to 6.50%.

By Florence Tan

SINGAPORE (Reuters) -Oil prices rose on Monday, adding to recent gains amid expectations of tighter supply from OPEC+ cuts, attacks on Russian refineries and as upbeat Chinese manufacturing data supported outlooks for improving demand.

Brent crude rose 24 cents, or 0.3%, to $87.24 a barrel by 0649 GMT after rising 2.4% last week. U.S. West Texas Intermediate crude was at $83.45 a barrel, up 28 cents, or 0.3%, following a 3.2% gain last week.

Trade volumes are expected to be thin on Monday as several countries are closed for Easter holidays.

Both benchmarks finished higher for a third consecutive month in March, with Brent holding above $85 a barrel since the middle of last month, as the Organization of the Petroleum Exporting Countries (OPEC) and their allies, a group known as OPEC+, pledged to extend production cuts to the end of June which could tighten crude supply during summer in the Northern Hemisphere.

Russian Deputy Prime Minister Alexander Novak said on Friday that its oil companies will focus on reducing output rather than exports in the second quarter in order to evenly spread production cuts with other OPEC+ member countries.

Drone attacks from Ukraine have knocked out several Russian refineries, which is expected to reduce Russia's fuel exports.

"Geopolitical risks to crude and heavy feedstock supplies add to strong Q2 24 demand fundamentals," Energy Aspects analysts said in a note.

Almost 1 million barrels per day (bpd) of Russian crude processing capacity is offline from the attacks, impacting its high-sulphur fuel oil exports which are processed at Chinese and Indian refineries, the consultancy added.

In Europe, oil demand was firmer than expected, rising 100,000 bpd on year in February, Goldman Sachs analysts said, versus its forecast of a 200,000 bpd contraction in 2024.

Europe's firm demand, softness in U.S. supply growth coupled with a possible extension of OPEC+ cuts through 2024 outweigh downside risk from persistent softness in China's demand, they said in a note.

Crude oil production by the United States, the world's largest producer, dropped 6% in January from December's record high, following freezing weather, data from the Energy Information Administration showed on Friday.

"We see the risks to our forecast that Brent will average $83/bbl in 2024Q4 as skewed moderately to the upside," the analysts said.

Also supportive for prices, China's manufacturing activity expanded for the first time in six months in March, an official factory survey showed on Sunday, supporting oil demand at the world's largest crude importer, even as a crisis in the property sector remains a drag on the economy.

Investors are also scouring U.S. economic data for signs of when the Federal Reserve will cut interest rates this year which will support the global economy and oil demand.

By Gabriella Borter

WASHINGTON (Reuters) -With efforts underway to clean up thousands of tons of steel debris from the collapsed bridge in Baltimore's harbor, Maryland Governor Wes Moore on Sunday urged Republicans to work with Democrats to approve the federal funding needed for rebuilding the bridge and to get the port economy back on its feet.

Baltimore's Francis Scott Key bridge collapsed early on Tuesday morning, killing six road workers, when a container ship nearly the size of the Eiffel Tower lost power and crashed into a support pylon. Much of the span crashed into the Patapsco River, blocking the Port of Baltimore's shipping channel.

The Biden administration released $60 million in initial emergency aid on Thursday to assist in cleaning up the bridge debris and reopening the port, which is the largest in the U.S. for "roll-on, roll-off" vehicle imports and exports of farm and construction equipment. The port has been closed since Tuesday, leaving in limbo the jobs of some 15,000 people who rely on its daily operations.

Federal officials have told Maryland lawmakers the final cost of rebuilding the bridge could soar to at least $2 billion, Roll Call reported, citing a source familiar with the discussions.

Democratic President Joe Biden has pledged that the federal government will cover the cost, but that will depend on passage of legislation authorizing the funds by both the Republican-led House of Representatives and Democratic-led Senate. The divided Congress has been repeatedly riven by partisan battles over funding, with hardline Republicans often at odds even with members of their own party.

Moore, a Democrat, said Republicans should be willing to approve the funding for the sake of not just the city of Baltimore, but for the national economy.

"The reason that we need people to move in a bipartisan basis ... is not because we need you to do Maryland a favor," Moore told CNN on Sunday. "We need to make sure that we're actually moving quickly to get the American economy going again, because the Port of Baltimore is instrumental in our larger economic growth."

Secretary of Transportation Pete Buttigieg expressed optimism on Sunday that Congress would approve the funds necessary for the cleanup and rebuild, noting that the divided legislative body had passed Biden's $1 trillion infrastructure package in 2021.

"If there's anything left in this country that is more bipartisan than infrastructure, it should be emergency response. This is both, and I hope that Congress will be willing if and when we turn to them," Buttigieg told CBS's "Face the Nation."

Biden was expected to visit the bridge collapse site this week.

An enormous crane began cutting up portions of the collapsed bridge to prepare them for removal on Saturday, which officials said was the first step of what will be a long and complicated cleanup. A spokesperson for the governor's office said on Sunday that a 200-ton (180-metric ton) piece of the bridge had been removed and officials were working to determine the best strategy for pulling the ship off the wreckage.

Later Sunday officials said they were preparing to establish an alternate route for "commercially essential vessels," although few additional details were released and the timing of the alternate route's opening wasn't made clear.

In a statement, coordinator Capt. David O'Connell said that the alternate would "support the flow of marine traffic into Baltimore." Video released by responders showed Coast Guard officials dropping buoys into the water near the site of the collision.

The wreckage and hazardous weather conditions have made it impossible for divers to continue searching for the four remaining bodies of the deceased construction workers in recent days, Moore said.

Moore and other officials have declined to give an estimated timeline for the reopening of the port and the rebuilding of the bridge.