Select Language

By Brigid Riley

TOKYO (Reuters) - The U.S. dollar received a boost against major currency peers on Thursday, as a Federal Reserve official said he wasn't in a hurry to cut rates amid sticky inflation, and as traders braced for key economic data.

Meanwhile, although still not far from the 152 mark, the yen was holding its ground against the greenback after Japan's top monetary officials on Wednesday suggested they were ready to intervene.

Speaking during late U.S. trading hours on Wednesday, Federal Reserve Governor Christopher Waller said recent disappointing inflation data affirms the case for the U.S. central bank holding off on cutting its short-term interest rate target.

"There is no rush to cut the policy rate" right now, Waller said in a speech prepared for delivery before an Economic Club of New York gathering.

The dollar index, a measure of the greenback against major peer currencies, ticked up in the wake of Waller's comments and last held mostly unchanged at 104.41. It's gained around 3% so far in 2024.

Market expectations for the first rate cut to occur at the Fed's June meeting have eased somewhat, currently pricing in a 60% chance compared to 67% around this time last week, according to the CME FedWatch tool.

Waller's speech is a "clue that the Fed is more wary of stickier inflation, perhaps even a re-acceleration in price growth, said Kyle Rodda, senior financial market analyst at Capital.com.

While the central bank has signalled willingness to look through some bumps along the way to some extent, Rodda perceives the case for rate cuts has on balance weakened.

"A strong inflation read tomorrow could throw into question whether market pricing for three cuts in 2024 is justified," which would be a positive for the dollar, he added.

Traders await key U.S. core inflation figures due on Friday, following a bigger-than-expected jump in U.S. durable goods orders on Tuesday that has already boosted the dollar against the yen.

The greenback reached 151.975 yen on Wednesday, its strongest against the yen since mid-1990.

The yen gained a little after Japanese authorities held a meeting on Wednesday on the currency's weakness, and top currency diplomat Masato Kanda said he "won't rule out any steps to respond to disorderly FX moves."

Finance Minister Shunichi Suzuki said earlier on the same day that authorities could take "decisive steps," language he hasn't used since Japan last intervened in 2022.

That's put the market on edge for any signs that authorities are backing up words with action.

"It’s unlikely anyone will pay 152.01 yen for USD/JPY today because of this risk," Ray Attrill, head of currency strategy at National Australia Bank (OTC:NABZY), wrote in a note.

"But in the absence of intervention before the weekend, we strongly suspect someone will next week."

Japan intervened in the currency market three times in 2022, selling the dollar to buy yen, first in September and again in October as the yen slid towards a 32-year low of 152 to the dollar.

The Japanese currency was last pinned at 151.37 against the dollar.

Meanwhile, a summary of opinions at the Bank of Japan's March meeting released on Thursday showed policymakers were divided on whether the economy was strong enough to handle an exit from ultra-easy monetary policy.

Elsewhere, the euro was down 0.11% at $1.0814.. Sterling fell 0.17% to $1.2616.

In cryptocurrencies, bitcoin last rose 1.14% to $69,648.86.

MEXICO CITY (Reuters) - Mexico's economy is seen growing between 2.5% and 3.5% this year and then expanding 2.0% to 3.0% in 2025, a draft budget from the country's finance ministry showed on Wednesday.

Inflation in Latin America's second-biggest economy is expected to tick down to 3.8% this year, according to the draft, essentially meeting the central bank's target of 3%, plus or minus one percentage point. The expected 2024 inflation rate would also signal a slowdown from the 4.40% annualized growth rate in consumer prices in February.

For 2025, the draft budget predicts that inflation will further ease to 3.3%.

The document, which is used by lawmakers to plan future spending, also sees Mexico's peso trading at 17.8 pesos per dollar this year, and slightly weakening to 18.0 versus the U.S. currency next year.

Average crude oil production this year is forecast at 1.85 million barrels per day (bpd), rising slightly to 1.86 million bpd in 2025.

While the draft budget said the estimates refer to crude volumes, the government generally combines crude with condensate liquids in its figures.

Official data shows that state-owned oil company Pemex pumped an average of 1.55 million bpd of crude in February, its lowest level since 1979.

Pemex's oil output, the sales of which are a major contributor to public finances, has been on a steady decline from its peak of 3.4 million bpd two decades ago.

Meanwhile, crude exports are expected to reach 967,600 bpd this year and drop to 958,400 bpd next year.

(Reuters) - Global ratings agency S&P affirmed its "AA+" long-term and "A-1+" short-term unsolicited sovereign credit ratings on the U.S. on Thursday, and kept the outlook on the long-term rating as 'stable'.

"A diversified and resilient economy with solid growth, extensive monetary policy flexibility, and benefits associated with the unique status as the issuer of the world's leading reserve currency underpin the U.S. sovereign rating," S&P said.

It expects the Federal Reserve System, which provides the U.S. with considerable monetary policy flexibility, to navigate the challenges of lowering domestic inflation and addressing financial market vulnerabilities.

Earlier in the month, peer Fitch affirmed United States' long-term foreign currency sovereign credit rating at "AA+" with a "stable" outlook.

By Michael S. Derby

(Reuters) -The Federal Reserve said on Tuesday that it officially saw a net negative income of $114.3 billion in 2023, a record loss tied to expenses related to managing the U.S. central bank's short-term interest rate target.

The loss last year follows $58.8 billion in net income in 2022, the Fed said. The numbers released were an audited tally following preliminary numbers reported earlier this year. The Fed has stressed repeatedly that net negative income does not impede its ability to operate or conduct monetary policy.

By law, the Fed hands over any profits after covering operational expenses to the Treasury. The Fed earns income from services it provides the financial system and from interest income on securities it owns. It has earned significant profits over recent years amid very low rates and large levels of bond holdings.

The Fed's move to aggressively boost the federal funds rate starting in the spring of 2022 has upended central bank finances. To cool inflation pressures, the Fed lifted the target from near zero levels to its current 5.25% to 5.5% range.

The Fed maintains that target by paying banks, money funds and other financial firms to park cash at the central bank, and that is meant paying out substantially more in interest.

The Fed's audited interest expenses for banks' reserve balances hit $176.8 billion last year, up $116.4 billion from 2022's level, while interest payouts from its reverse repo facility was $104.3 billion last year, from $41.9 billion the prior year.

Meanwhile, the income the Fed earned from bonds it owns was at $163.8 billion last year, little changed from 2022.

The Fed can create money to fund its operations when dealing with operating losses which means it faces no obstacles to operate. It captures its loss in an accounting device called a deferred asset.

The official level of the deferred asset stood at $133.3 billion at the close of 2023. As of March 20, it had risen to $157.8 billion and it is unclear how much larger it will get.

When the Fed returns to profitability it will use excess earnings to reduce the deferred asset and when it is extinguished the Fed will start returning excess profits to the Treasury again.

Fed officials have noted they've handed back substantial sums to the Treasury over recent years. A St. Louis Fed report last year said it could take years before the Fed is able to once again return profits to the government.

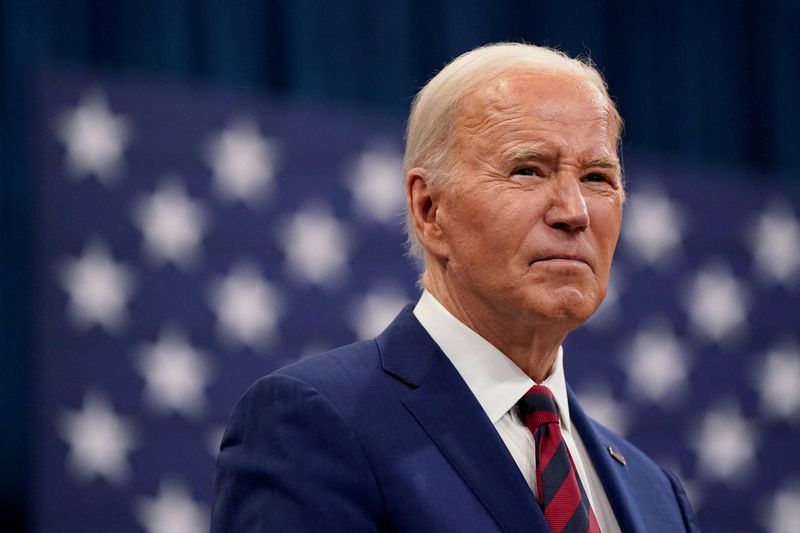

WASHINGTON (Reuters) - U.S. President Joe Biden's approval ratings ticked up slightly in the last month, according to a poll conducted by Reuters/Ipsos, as more Americans named extremism and threats to democracy as their top worry ahead of the Nov. 5 election.

Two-fifths of Americans surveyed said they approved of Biden's performance, while 56% said they disapproved. That was a slight increase from last month's poll, which showed that 37% of respondents approved of Biden, close to the lowest level of his presidency.

The online poll was conducted March 22-24, after Biden's annual State of the Union address to Congress, where he delivered an energetic speech challenging Republicans that was intended to tamp down concerns about his age and vigor.

Biden, 81, is seeking a second term in office, where he is expected to face off against former President Donald Trump, 77, in the election.

A slightly larger number of respondents also expressed concerns over political extremism or threats to democracy, with 23% of respondents saying that was their top concern, up from 21% last month.

More than a third of Democrats - 36% - said that was their top worry, while 11% of Republicans and a quarter of independent voters said the same.

Trump has claimed, without evidence, that the 2020 election was stolen from him, including in a fiery speech shortly before hundreds of his supporters stormed the U.S. Capitol in 2021. Five people died.

Trump faces several legal challenges, including some tied to his role in attempting to overturn the results of the 2020 election.

On the campaign trail, Trump has said he would release people imprisoned for their role in the Jan. 6 attack and has referred to them as "hostages." He has also made a series of racist and inflammatory statements in his latest run for office.

Other top issues for voters were the economy, which 19% of respondents said was the most important problem for the country, and immigration, with 17% of respondents citing it as the top issue.

While 32% of Republican voters said immigration was their top concern, that was a decrease from last month's poll, which showed 38% of Republicans saw it as the top issue for the country.

Voters largely disapproved of the country's institutions.

Most people surveyed had unfavorable opinions of the House of Representatives (65%), the Senate (60%) and the Supreme Court (56%).

The Federal Reserve was the only institution that a majority favored, with 53% of poll respondents saying they had a favorable view.

The U.S. central bank has raised interest rates since March 2022 in a bid to lower inflation, but has kept rates steady since July and is expected to cut rates later this year.

The Reuters/Ipsos poll gathered responses online from 1,021 adults, using a nationally representative sample, with a margin of error of about 3 percentage points.

By Tom Westbrook

SINGAPORE (Reuters) -The dollar climbed on Wednesday in the wake of more strong U.S. economic data, nudging the Japanese yen to a 34-year low and into the zone that drew official market intervention in 2022.

The yen traded at 151.97 per dollar in the Asia session, down about 0.2% and weaker than 151.94 where Japanese authorities stepped in during October 2022 to buy the currency and its weakest level since the middle of 1990.

For the quarter ending later this week the yen is the worst-performing major, down more than 7% on the dollar even after Japan's exit last week from negative interest rates.

Officials have been making near daily warnings against speculative moves and markets are jittery about a test of 152 per dollar as Finance Minister Shunichi Suzuki said Japan won't rule out any steps if it thinks the yen is falling too fast.

"The market is very sensitive to the 152 area," said National Australia Bank (OTC:NABZY) strategist Rodrigo Catril.

"If we were to break that level then recent history would suggest that intervention would be much more likely."

BOJ policymaker Naoki Tamura said on Wednesday the central bank must proceed slowly but steadily toward normalising its policies - seemingly giving the yen a little push weaker.

The move set the dollar higher more broadly, with the Chinese yuan and New Zealand dollar sold very close to four-month lows.

The yuan weakened to 7.2285 per dollar despite a strong fix of its trading band by the central bank. The New Zealand dollar fell 0.2% to $0.5988. New Zealand's Treasury revised its economic growth forecasts lower on Tuesday.

Australian data published in the morning showed inflation holding at a two-year low of 3.4% in February, reinforcing market wagers that the next move in interest rates would be down. The Aussie slipped 0.3% to $0.6515.

It is down 4.4% for the quarter. Other moves in Asia were kept in check as markets wait for Friday's release of U.S. core inflation data.

Overnight data showed a bigger-than-expected jump in U.S. durable goods orders in February. While that only partly made up for a large drop in January and came with sub-par consumer confidence data, it pushed the dollar up a little bit.

The euro, at $1.0825 is more or less in the middle of a range it has kept for a year and is down 1.9% for a quarter where expectations for U.S. rate cuts have been scaled back.

The Swiss franc, still reeling from a surprise rate cut in Switzerland last week, fell about 0.5% on the dollar to a four-month low of 0.9042 overnight.

It is down about 7% for the first quarter of the year. The U.S. dollar index is up 3% for the quarter to 104.4.

Sterling was steady at $1.2621 and was broadly steady for the quarter, too, down just 0.8%.

On Tuesday Bank of England policymaker Catherine Mann said she changed her mind to vote for a rate hold last week, instead of a hike, due to consumers turning more stingy. But she still believes financial markets have too many cuts priced in.

BEIJING (Reuters) -China's industrial firms posted higher profits in the opening months of the year, official data showed on Wednesday, suggesting an economic recovery was gaining momentum despite persistent sluggishness in the property sector.

Profits at China's industrial firms jumped 10.2% in the first two months from the same period last year, following a 2.3% profit decline for the whole of 2023, National Bureau of Statistics (NBS) data showed.

A slew of upbeat economic indicators in January-February was tempered by the persistent fragility in the property market, pointing to a divergence in the post-pandemic economic recovery.

Earlier in March, Chinese electric vehicle battery giant CATL posted its first drop in quarterly earnings since the second quarter of 2022, amid intensified competition and slowing demand in the world's largest auto market.

In the face of lingering economic weakness, a deputy central bank chief last week assured markets of policy options at its disposal, including cuts in banks' reserve requirement ratios (RRR). The central bank announced the biggest RRR reduction in two years in January.

State-owned firms recorded a 0.5% rise in earnings in January-February, foreign firms saw a 31.2% gain while private-sector companies booked a 12.7% increase, the data showed.

The statistics bureau publishes combined data for the first two months to sort out distortions due to the varied timing of the Lunar New Year.

Industrial profit numbers cover firms with annual revenues of at least 20 million yuan ($2.78 million) from their main operations.

($1 = 7.1986 yuan)

(Reuters) - S&P Global downgraded its outlooks on five regional U.S. banks to "negative" from "stable" due to their commercial real estate (CRE) exposures, the ratings agency said on Tuesday.

It downgraded First Commonwealth (NYSE:FCF) Financial, M&T Bank (NYSE:MTB), Synovus (NYSE:SNV) Financial, Trustmark (NASDAQ:TRMK) and Valley National Bancorp (NASDAQ:VLY).

"The negative outlook revisions reflect the possibility that stress in CRE markets may hurt the asset quality and performance of the five banks, which have some of the highest exposures to CRE loans among banks we rate," S&P said.

The most recent downgrades bring the total negative outlooks on nine U.S. banks, or 18% of those that S&P rates, it said, adding most of those "relate, at least in part to sizable CRE exposures".

CRE exposures of regional banks were heavily scrutinized this year since New York Community Bancorp (NYSE:NYCB) flagged a surprise loss and slashed its dividend citing loan loss provisions on CRE loans, which triggered a sell-off in U.S. regional banking shares.

Investors and analysts alike have been worried that higher borrowing costs and low occupancy rates for office spaces could exacerbate the stress on lenders exposed to potential defaults by borrowers in the CRE sector.

However, S&P said it maintained a 'stable' outlook on F.N.B Corp, "since we see a somewhat lower probability of material deterioration in its asset quality and performance".

SEOUL (Reuters) - South Korean consumer spending will benefit from interest rate cuts when the central bank makes them, a member of its board said on Tuesday, adding that domestic demand has become more sensitive to interest rates than before.

Consumer sentiment dropped sharply in March on growing worries about higher produce prices, a survey by the Bank of Korea (BOK) showed on Tuesday, as inflation emerges as a major issue ahead of next month's elections.

"There will be positive effects from normalising interest rates after inflation is stabilised, as it will ease the burden of debt repayment," the official, Suh Young-kyung, told media prior to her last policy meeting in April.

Suh, however, declined to answer a question on the timing of cuts in interest rates.

"There are also worries about upward pressures on household loans and house prices, which may not seem that huge, but certainly remain."

Suh, whose four-year term ends a week after the April 12 meeting, said domestic spending was recovering slower than expected as it had become more sensitive to interest rates, which have stayed high over a prolonged period.

The monetary policy board will decide on interest rates after taking careful consideration of both sides, Suh said, citing inflation, domestic demand, household debt and house prices as key factors.

At their last meeting in February, most BOK board members said it was too early for a pivot in monetary policy, seeking to cool investors' aggressive rate cut expectations after keeping interest rates at a 15-year high.

HONG KONG (Reuters) - Hong Kong private home prices fell for the tenth month in a row to the lowest since September 2016 in February, and they are expected to remain suppressed even after the government recently removed the decade-long curbs for the property market.

Home prices in one of the world's most expensive property markets dropped 1.7% in February from the previous month, official data showed on Tuesday, following a revised 1.2% fall in January.

In late February, Hong Kong removed all additional stamp duties for foreign and second home buyers, as well as on those selling flats within two years of buying them, in a bid to boost the city's depressed real estate market and the property market immediately celebrated with a jump in transactions.

Mainland Chinese are also snapping up homes in Hong Kong, accounting for up to a third of new property sales, property developers and agents said, after a pandemic-induced lull spanning more than three years.

For primary sales of luxury residential properties worth more than HK$30 million ($3.84 million), the percentage was even higher, accounting for around 70%, JLL said on Monday, rebounding from less than 50% before the curbs removal. The realtor expected mainland Chinese buyers to remain active.

Housing prices have plunged more than 20% from their 2021 peak due to higher mortgage rates, an outflow of talent and a weak market outlook.

Even though sales have risen, analysts expect prices to remain suppressed as developers offer discounts to clear inventory. S&P Global Ratings estimated transaction volumes this year will recover only moderately from 2023, as interest rates remain high.

($1 = 7.8220 Hong Kong dollars)