Select Language

BANGKOK (Reuters) - Thailand's government is forging ahead with a 500 billion baht ($13.9 billion) handout scheme and may still need to borrow to finance it, a deputy finance minister said on Wednesday.

Julapun Amornvivat made the remarks in parliament, which began a three-day debate on a 3.48 trillion baht ($96.5 billion) budget bill for the 2024 fiscal year, aimed at reviving Southeast Asia's second-largest economy.

"We insist that it may be necessary to get a loan through a bill, but if there are any changes, we will probably seek approval from the members (of parliament) again," he said. "But the project will definitely go ahead".

The scheme would transfer 10,000 baht to 50 million Thais to spend in six months, but has been hounded by concerns over how it will be funded, with some experts calling it fiscally irresponsible.

Julapun also said the government hoped to achieve a balanced budget in an appropriate time.

The 2024 budget for the fiscal year ending September aims for a 9.3% rise in spending and a drop of 0.3% in the budget deficit to 693 billion baht from the previous year.

After the debate on the second and third readings of the budget, the budget will need further approval from the senate and the king.

The government has said the budget should be ready for use by early next month, delayed from the original start date of Oct. 1, 2023 due to prolonged political gridlock following a May election. A new government was formed in August.

($1 = 36.06 baht)

SHANGHAI/SINGAPORE (Reuters) -China left benchmark lending rates unchanged at a monthly fixing on Wednesday, in line with market expectations, after the central bank kept a key policy rate steady last week amid some signs of improvement in the broad economy.

WHY IT'S IMPORTANT

China has set an economic growth target of "around 5%" for 2024, a rate that economists say is ambitious and calls for more stimulus, including monetary and fiscal easing.

In particular, China needs to revive a battered property sector. Most new and outstanding loans in China are based on the one-year loan prime rate (LPR), while the five-year rate influences the pricing of mortgages.

But any sharp cuts to interest rates may put pressure on the yuan and banks whose net interest margins (NIMs) have been falling since last year.

BY THE NUMBERS

The one-year loan prime rate (LPR) was kept at 3.45%, while the five-year LPR was unchanged at 3.95%.

In a Reuters poll of 27 market watchers conducted this week, all respondents expected both rates would stay unchanged.

While China's factory output and retail sales beat expectations in the January-February period, property investment in China fell 9% year-on-year in the first two months of 2024, after a sharp 24% fall in December. Property sales also slid.

Credit growth has also slowed. Outstanding yuan loans grew 10.1% in February from a year earlier - the lowest on record.

CONTEXT

China's central bank left its medium-term lending facility (MLF) rate unchanged last week. The MLF rate serves as a guide for LPR, which is set by 20 designated commercial banks.

But PBOC Governor Pan Gongsheng said earlier this month that the bank would keep the yuan basically stable and sent a dovish message to the market by saying China had "rich monetary policy tools at its disposal."

Investors have since ramped up bets that authorities will roll out more monetary easing measures, including a further reduction to bank reserves, to support the economy.

By Ankur Banerjee

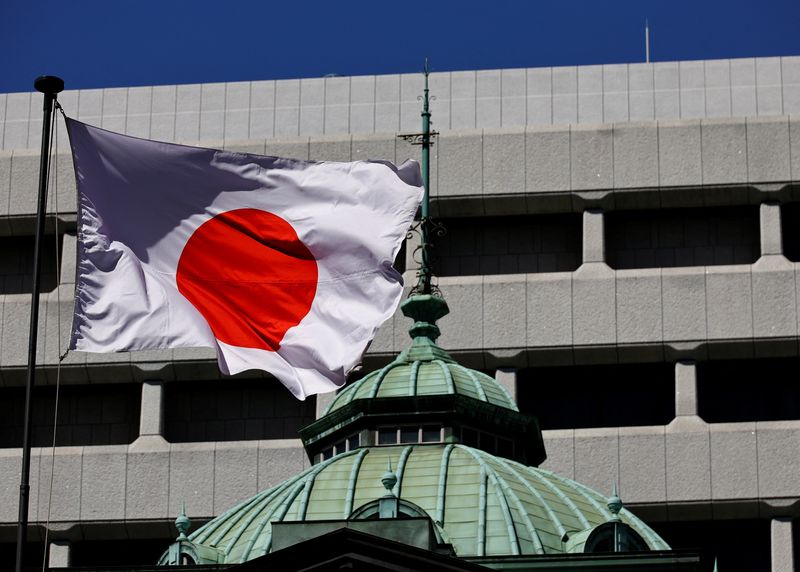

SINGAPORE (Reuters) - The yen languished near a four-month low against the U.S. dollar and a 16-year trough against the euro on Wednesday, a day after the Bank of Japan's widely anticipated decision to end its negative interest rate policy.

While the Bank of Japan ushered in the country's first rate hike in 17 years, the central bank said it expected to maintain accommodative conditions for the time being, keeping pressure on the yen as U.S.-Japanese rate differentials remain stark.

On Wednesday, the yen weakened to a four-month low of 151.34 per dollar and was last off 0.30% at 151.28, with the multi-decade low of 151.94 within sight. The Asian currency fell 1% on Tuesday after the BOJ decision as most investors had already priced in a change.

Against the euro, yen weakened to 164.35, its lowest since 2008, while against the pound, yen weakened to 192.37, lowest since 2015. Japan markets are closed on Wednesday for a holiday.

"I think the focus is again around 152 levels," said Christopher Wong, currency strategist at OCBC. Wong said the move for dollar/yen in the near term will be more a function of U.S. rates, with the Federal Reserve decision due later on Wednesday.

In a historic shift from decades of massive monetary stimulus, the Japanese central bank on Tuesday ended eight years of negative interest rates and other remnants of unorthodox economic policy.

Daniela Hathorn, senior market analyst at Capital.com said BOJ Governor Kazuo Ueda’s dovish comments after the meeting were enough to end any post-decision bullish sentiment in the Japanese currency.

"The carry trade versus the major currencies continues to be in play and is expected to continue for a while," Hathorn said. "This means the yen is likely to see further weakness, especially if the other central banks continue to delay cutting rates."

The main spotlight for the day remains on the Fed and although the central bank is not expected to move, its economic projections and comments from Chair Jerome Powell will be in focus.

Last week's stronger than expected inflation reports led traders to reduce their bets on rate cuts this year, with markets now pricing in 73 basis points (bps) of easing this year. At the start of the year, traders were pricing in 150 bps of cuts.

Traders are pricing in a 59% chance of the Fed starting its easing cycle in June, the CME FedWatch tool showed, sharply lower than earlier expectations.

The dollar index, which measures the U.S currency against six rivals, rose to 0.019% to 103.87. The euro was down 0.03% to $1.0862.

The Australian dollar eased 0.08% to $0.652, while the New Zealand dollar fell 0.17% to $0.604.

Australia's central bank held interest rates steady on Tuesday as expected, while watering down a tightening bias to say that it was not ruling anything in or out on policy.

TOKYO (Reuters) -The Bank of Japan has made "the appropriate policy decision at the appropriate time", the head of Japan's biggest business lobby said, welcoming Governor Kazuo Ueda's move to hike interest rates for the first time in 17 years.

"I think the BOJ has caught the indications that a virtuous cycle between wages and prices has started," Keidanren Chairman Masakazu Tokura told reporters.

As widely expected, the BOJ announced on Tuesday it would end eight years of negative interest rates and other remnants of its unorthodox policy. But analysts expect it will keep rates stuck around zero for some time as a fragile economic recovery forces it to go slow on any further rise in borrowing costs.

The central bank's decision was preceded by news of stronger-than-expected pay rises by companies, raising hopes of higher household spending that would feed into more durable growth in the broader economy.

"Moderate price increases are favourable for the economy as a whole, and we like the fact that the revision was conducted with the 2% price stability target in sight," Ken Kobayashi, chairman of the Japan Chamber of Commerce and Industry, said in a statement.

With inflation having exceeded the BOJ's 2% target for well over a year, many market players had projected an end to negative interest rates either this month or next. In a sign future rate hikes will be moderate, the BOJ said that financial conditions will remain accommodative for the time being.

"As businesses and individuals, we will need to gradually prepare for a world with interest rates," Takeshi Niinami, chairman of the business lobby Keizai Doyukai who also heads brewer Suntory Holdings, said in a statement.

"Full-fledged growth of the Japanese economy will not be achieved by monetary policy alone," he added pointing to the need for companies to do more in areas such as improving productivity.

(Reuters) - The Bank of Japan ended eight years of negative interest rates and other remnants of its unorthodox policy on Tuesday, making a historic shift away from a focus of reflating growth with decades of massive monetary stimulus.

The shift makes Japan the last central bank to exit negative rates and ends an era in which policymakers around the world sought to prop up growth through cheap money and unconventional monetary tools.

Following are excerpts from BOJ Governor Kazuo Ueda's comments at his post-meeting news conference, which was conducted in Japanese, as translated by Reuters:

IMPACT OF CENTRAL BANK'S DECISION

"Today's decision will only lead to a 0.1% increase in short-term interest rates. We will also increase bond buying nimbly if there is a sharp rise in long-term rates. I don't think deposits or lending rates will rise sharply from today's decision." SHORT-TERM RATES IN LINE WITH ECONOMIC AND PRICE OUTLOOK

"We reverted to a normal monetary policy targeting short-term interest rates, as with other central banks. We will choose the appropriate level of short-term rates in line with our economic and price outlook. But in doing so, we need to be mindful that there is some distance for inflation expectations to reach 2%. When we focus on this gap, it's necessary to maintain accommodative monetary conditions even under a normal monetary policy framework."

HIGH CHANCES OF INFLATION IN TARGET RANGE

"The likelihood of inflation stably achieving our target has been heightening, including from January through March ... As a result, the likelihood reached a certain threshold that resulted in today's decision. If the likelihood heightens further and trend inflation accelerates a bit more, that will lead to a further increase in short-term rates."

EFFECT OF BOJ'S BOND BUYING ON RATES AND MONETARY EASING

"It's true our huge bond holdings are having a huge impact on long-term interest rates that cannot be ignored. The fact we are holding huge government bonds does have a stimulative effect. But our main policy target will be the short-term interest rate."

ON THE THRESHOLD FOR THE NEXT INTEREST RATE HIKE

"If our price forecast clearly overshoots or, even if our median forecast is unchanged, we see a clear increase in upside risk to the price outlook, that will likely lead to a policy change."

DEFINING ACCOMMODATIVE MONETARY CONDITIONS

"In terms of how we define accommodative monetary conditions, it is essentially a condition in which actual interest rate is lower than the neutral rate of interest."

ON THE COUNTRY'S EXPECTATIONS ON INFLATION

"Japan's expectations of inflation, when looking at a timespan of 5 to 10 years, is likely somewhere around 1-1.5% ... At present, real interest rate is likely deeply in negative territory. Unless the neutral, real rate of interest is very deeply in negative territory, we can say Japan's monetary condition is accommodative."

ON YEN'S DROP AFTER BOJ DECISION

"As always, I won't comment on short-term currency moves. But if currency moves have a big impact on our economic and price forecasts, we stand ready to take an appropriate monetary policy response."

By Trevor Hunnicutt

WASHINGTON (Reuters) -President Joe Biden signed a new executive order on Monday that expands U.S. government research on women's health, while pledging $200 million next year to better understand issues, including sexual and reproductive conditions.

Biden is also ordering his administration to report on progress they are making to erase gender gaps in research and to study how to use artificial intelligence to improve women's health research, according to a White House summary of the order.

"I’m going to make sure women’s health is prioritized across the government," Biden told a room full of women, including actress Halle Berry and former California First Lady Maria Shriver at the White House.

The National Institutes of Health is also launching a new effort around menopause and the treatment of menopausal symptoms that will identify research gaps and work to close them, aides say.

Women globally live 5 years longer than men on average but spend 25% more of their lives in poor health, according to the World Economic Forum and the McKinsey Health Institute. They remain underrepresented in clinical trials and conditions affecting women are researched less than those that impact men.

The executive order will require medical research to better track differences between women and men, aides say.

"Medications, treatments and medical school textbooks are based on men and their bodies but that ends today. Finally, women will get the health care they deserve," First Lady Jill Biden told the crowd.

Biden has asked Congress for $12 billion in new funding for women's health research, but new financial commitments are hard to pass in a politically divided legislature during an election year.

The administration will spend the $200 million investment announced on Monday during the 2025 fiscal year, which starts this October, if Congress grants the funding levels Biden has requested.

The Democrat is seeking another four-year term in November's election against Republican candidate former President Donald Trump.

Women make up more than half of the electorate and Democrats think attacks on women's healthcare could animate voters in the aftermath of the U.S. Supreme Court overturning Roe v. Wade abortion rights in 2022.

"At this moment in states across our nation we are witnessing a full on attack against hard fought hard won freedoms and rights, including the right of women to make decisions about their own body," Vice President Kamala Harris said.

TOKYO (Reuters) - The Bank of Japan (BOJ) on Tuesday decided to end its negative interest rate policy, marking a landmark shift away from its huge stimulus programme.

It was Japan's first interest rate hike since 2007.

BOJ Governor Kazuo Ueda is expected to hold a news conference at 3:30 p.m. (0630 GMT) to explain the decision.

Under its negative interest rate policy, the BOJ had applied a 0.1% charge to a small pool of financial institutions' excess reserves parked with the central bank. The policy had been in place since 2016.

With inflation having exceeded the BOJ's 2% target for well over a year, many market players had expected the central bank to exit its ultra-loose monetary policy in March or April.

By Amina Niasse

NEW YORK (Reuters) - U.S. homebuilder confidence rose in March to the highest level since July due to easing mortgage rates and an improved pricing environment amid a continued existing home inventory shortage, the National Association of Home Builders said on Monday.

The NAHB/Wells Fargo Housing Market Index of builder confidence rose to 51 this month from an unrevised 48 in February. A Reuters poll showed economists expected the outlook to remain unchanged at 48 in March.

"Buyer demand remains brisk and we expect more consumers to jump off the sidelines and into the marketplace if mortgage rates continue to fall later this year," NAHB Chairman Carl Harris said in a statement.

Traffic slowed during the second half of last year on the back of the Federal Reserve's interest rate hikes, which were launched in March of 2022 in an effort to curb rising inflation. The monetary policy tightening drove the average rate on the 30-year fixed-rate mortgage to two-decade highs near 8% in October.

With the U.S. central bank likely near the end of its rate hiking cycle, the 30-year fixed-rate mortgage averaged 6.74% for the week ended March 14, according to Freddie Mac. The drop has drawn buyers from the sidelines, raising the index of prospective buyers from a 13-month low of 21 in November to 34 in March – the highest since August 2023, according to the NAHB.

The easing of mortgage rates has also allowed builders to hold off on slashing home prices. As recently as December, more than a third of builders reported offering price concessions. In March, that was down to 24%, the lowest level since July 2023, the NAHB said.

By Elizabeth Howcroft

LONDON (Reuters) - European venture capital-backed companies are signing up to increasingly complex convertible debt deals which risk giving investors more control or bigger payouts further down the road, people involved in the deals told Reuters.

Ultra-low interest rates allowed growing companies to complete equity funding rounds at sky-high valuations during a boom in 2020 and 2021. But as venture funding has dried up, companies and their investors have been wary of equity funding rounds which risk establishing a new, lower valuation.

Convertible debt, which changes into equity after a set period, can enable company founders to raise cash quickly and privately, without publishing an updated valuation.

The volume of convertible debt issued by European venture capital-backed firms hit a record $2.5 billion in 2023, up from $1.7 billion in 2022, Dealroom data compiled for Reuters shows.

But as the deals become more complex, they can offer investors more upside and create risks for the companies, according to Reuters interviews with lawyers, company founders and an investor familiar with the deals.

"If you don't know what you're doing, structured debt can be a Trojan horse," said Ali Niknam, CEO of Dutch digital bank Bunq, who has raised via convertible debt at a previous company.

"If for whatever reason you don't make it, and it gets converted, sometimes people lose control."

James Wootton, a partner at law firm Linklaters, said that as companies have found it harder to raise money, the power has shifted towards investors.

This means deals are becoming increasingly "structured", including terms that favour investors such as handing them bigger stakes if management does not meet certain targets.

Deals can be structured to create an incentive for the company to IPO or raise more funds, for example by having interest rates which accrue over time, Wootton said.

Newer convertibles include clauses that grant investors more equity if profit margins drop below a certain level or if financial targets are missed, one venture capital investor familiar with recent convertible deals said, speaking on condition of anonymity.

Termsheets have also featured agreements whereby the more time that passes until an IPO, the bigger the discount at which the debt is converted into shares, the investor added.

For some, convertibles offer an opportunity to secure alternative longer-term funding while waiting for venture capital market conditions to improve.

Josef Fuss, a London-based partner at law firm Taylor Wessing who has worked on recent deals, said he had seen an increase in the size and duration of convertible notes.

"You're kicking the can down the road and you're saying we're all optimistic here, in 18 months, 24 months, the world's going to be a different place hopefully and then we can have the valuation discussion then – that is the basic premise," he said.

HARDEST MARKET

Venture fundraising in Europe has slowed sharply, from $130 billion in 2021 to $62 billion in 2023, PitchBook data shows, leaving some early-stage firms in a funding crunch as they burn through cash.

"It's the hardest market I've worked in my professional career," said James Downing, who has worked in finance for 20 years and is managing director for Europe at Hercules, a venture lender.

Hercules loaned around $200 million in the UK and Europe last year, down from around $400 million in 2022.

"(Start-ups) are not as lend-able as they were a couple of years ago when they were flush with VC equity," Downing said, adding that fintech, software and consumer-focused companies were those running out of cash fastest.

Traditional bank loans are not available to everyone and can be expensive - market rates are around 9-13% for earlier-stage and 7.5%-10% for later-stage companies, said Sonya Iovieno, head of venture and growth banking at HSBC Innovation Banking.

To be sure, not all firms using debt are running out of cash or avoiding a revaluation, and convertibles are not necessarily risky, the industry participants who spoke to Reuters said.

Norwegian lithium-ion battery business Morrow is among the VC-backed companies which helped swell convertible debt issued by start-ups to last year's record.

Morrow told Reuters it placed a convertible loan last year among its main shareholders.

"Like other start-ups, Morrow Batteries has found that the capital markets have become more challenging the last couple of years for companies in the scale-up phase as we are," CEO Lars Christian Bacher said in emailed comments.

Later-stage companies are also getting a taste for convertibles. Swedish battery-maker Northvolt has raised $3.5 billion in such debt since 2022 and listed companies in the U.S. are turning to convertible bonds to save on interest costs.

While venture capital firms are optimistic that equity fundraising will recover when rates fall, some companies may not be able to stave off lower valuations indefinitely, said Aberdeen University's Chair of Finance, Gerhard Kling.

"Delaying revaluations is not a good strategy because at the end of the day it's the truth, it comes out, you can’t escape," he said. "It's a bit of a gamble, you hope the market condition improves but I'm not entirely convinced it will."

By Wayne Cole

SYDNEY (Reuters) -Asian shares firmed on Monday as Chinese data surprised on the upside for once, while investors looked to navigate a minefield of central bank meetings this week that could see the end of free money in Japan and a slower glide path for U.S. rate cuts.

Beijing reported industrial output climbed an annual 7% over January and February, while retail sales rose 5.5% on a year earlier. But real estate remained a worry as property investmentfell 9% on the year, underlining the case for further policy support.

Central banks in the United States, Japan, UK, Switzerland, Norway, Australia, Indonesia, Taiwan, Turkey, Brazil and Mexico all meet this week and, while many are expected to hold steady, there is plenty of scope for surprises.

Tuesday could see the end of an era as the Bank of Japan is widely tipped to end eight years of negative interest rates and cease or amend its yield curve control policy.

The Nikkei newspaper on Saturday became just the latest media outlet to flag the move, after major companies granted the biggest pay hikes in 33 years.

There is a chance the BOJ might wait for its April meeting given it will be issuing updated economic forecasts then.

"Whether or not it is March or April, we suspect the language accompanying any such move will carry a cautious tone, emphasising it more as a monetary policy adjustment rather than a tightening at this stage," said Carl Ang, a fixed income analyst at MFS Investment Management.

"For Japan a measured and gradual path of policy normalisation appears appropriate for an economy unaccustomed to higher rates and thus the policy messaging will be critical."

Markets also assume the BOJ will hike at a snail's pace and have a rate of 0.27% priced in by December, compared with the current -0.1%.

The central bank on Monday said it would conduct an unscheduled operation to buy bonds, presumably to head off any significant rise in yields and avoid market volatility.

That might be one reason the yen actually lost ground last week, with the dollar up at 149.10 yen. The euro stood at $1.0887, having eased 0.5% last week and away from a top of $1.0963.

Japan's Nikkei bounced more than 2%, having shed 2.4% last week as a run up to record highs drew some profit taking.

MSCI's broadest index of Asia-Pacific shares outside Japan gained 0.3%, after dipping 0.7% last week. Chinese blue chips firmed 0.6%.

EUROSTOXX 50 futures and FTSE futures both edged up 0.16% and 0.1%, respectively. S&P 500 futures added 0.3% and Nasdaq futures 0.54%, with tension building ahead of the Federal Reserve policy meeting in Tuesday and Wednesday.

COUNTING THE DOTS

The Fed is considered certain to keep rates at 5.25-5.5%, but there is a possibility it might signal a higher for longer outlook on policy given the stickiness of inflation at both a consumer and producer level.

"We now expect 3 cuts in 2024, vs 4 previously, mainly because of the slightly higher inflation path," said Goldman Sachs economist Jan Hatzius in a note.

He still expects the Fed will start in June, assuming inflation eases again as expected, and officials will stick with their dot plot forecasts of three cuts this year.

"The main risk is that FOMC participants might instead be more concerned about the recent inflation data and less convinced that inflation will resume its earlier soft trend," Hatzius cautioned. "In that case, they might bump up their 2024 core PCE inflation forecast to 2.5% and show a 2-cut median."

The Fed is also expected to begin formal discussion of slowing the pace of its bond sales this week, perhaps halving it to $30 billion a month.

Bonds could do with the support given the damage done by a run of uncomfortably high inflation readings. Two-year Treasury yields are up at 4.72%, having climbed 24 basis points last week, while 10-year yields stood at 4.305%. [US/]

The probability of a rate cut as early as June has dropped to 56%, from 75% a week earlier, and the market has only 72 basis points of easing priced in for 2024 compared to more than 140 basis points a month ago.

The Bank of England meets on Thursday and is expected to keep rates at 5.25% as wage growth cools, while markets see some chance the Swiss National Bank might ease this week.

The ascent in the dollar and yields took some shine off gold, which eased to $2,146.70 an ounce, having fallen 1% last week and away from all-time highs. [GOL/]

Oil prices have had a better run after the International Energy Agency raised its view on 2024 oil demand, while the supply outlook was clouded by Ukrainian strikes on Russian oil refineries. [O/R]

Brent added 35 cents to $85.69 a barrel, while U.S. crude rose 36 cents to $81.40 per barrel. [O/R]