Select Language

(Reuters) - S&P Global downgraded its outlooks on five regional U.S. banks to "negative" from "stable" due to their commercial real estate (CRE) exposures, the ratings agency said on Tuesday.

It downgraded First Commonwealth (NYSE:FCF) Financial, M&T Bank (NYSE:MTB), Synovus (NYSE:SNV) Financial, Trustmark (NASDAQ:TRMK) and Valley National Bancorp (NASDAQ:VLY).

"The negative outlook revisions reflect the possibility that stress in CRE markets may hurt the asset quality and performance of the five banks, which have some of the highest exposures to CRE loans among banks we rate," S&P said.

The most recent downgrades bring the total negative outlooks on nine U.S. banks, or 18% of those that S&P rates, it said, adding most of those "relate, at least in part to sizable CRE exposures".

CRE exposures of regional banks were heavily scrutinized this year since New York Community Bancorp (NYSE:NYCB) flagged a surprise loss and slashed its dividend citing loan loss provisions on CRE loans, which triggered a sell-off in U.S. regional banking shares.

Investors and analysts alike have been worried that higher borrowing costs and low occupancy rates for office spaces could exacerbate the stress on lenders exposed to potential defaults by borrowers in the CRE sector.

However, S&P said it maintained a 'stable' outlook on F.N.B Corp, "since we see a somewhat lower probability of material deterioration in its asset quality and performance".

SEOUL (Reuters) - South Korean consumer spending will benefit from interest rate cuts when the central bank makes them, a member of its board said on Tuesday, adding that domestic demand has become more sensitive to interest rates than before.

Consumer sentiment dropped sharply in March on growing worries about higher produce prices, a survey by the Bank of Korea (BOK) showed on Tuesday, as inflation emerges as a major issue ahead of next month's elections.

"There will be positive effects from normalising interest rates after inflation is stabilised, as it will ease the burden of debt repayment," the official, Suh Young-kyung, told media prior to her last policy meeting in April.

Suh, however, declined to answer a question on the timing of cuts in interest rates.

"There are also worries about upward pressures on household loans and house prices, which may not seem that huge, but certainly remain."

Suh, whose four-year term ends a week after the April 12 meeting, said domestic spending was recovering slower than expected as it had become more sensitive to interest rates, which have stayed high over a prolonged period.

The monetary policy board will decide on interest rates after taking careful consideration of both sides, Suh said, citing inflation, domestic demand, household debt and house prices as key factors.

At their last meeting in February, most BOK board members said it was too early for a pivot in monetary policy, seeking to cool investors' aggressive rate cut expectations after keeping interest rates at a 15-year high.

HONG KONG (Reuters) - Hong Kong private home prices fell for the tenth month in a row to the lowest since September 2016 in February, and they are expected to remain suppressed even after the government recently removed the decade-long curbs for the property market.

Home prices in one of the world's most expensive property markets dropped 1.7% in February from the previous month, official data showed on Tuesday, following a revised 1.2% fall in January.

In late February, Hong Kong removed all additional stamp duties for foreign and second home buyers, as well as on those selling flats within two years of buying them, in a bid to boost the city's depressed real estate market and the property market immediately celebrated with a jump in transactions.

Mainland Chinese are also snapping up homes in Hong Kong, accounting for up to a third of new property sales, property developers and agents said, after a pandemic-induced lull spanning more than three years.

For primary sales of luxury residential properties worth more than HK$30 million ($3.84 million), the percentage was even higher, accounting for around 70%, JLL said on Monday, rebounding from less than 50% before the curbs removal. The realtor expected mainland Chinese buyers to remain active.

Housing prices have plunged more than 20% from their 2021 peak due to higher mortgage rates, an outflow of talent and a weak market outlook.

Even though sales have risen, analysts expect prices to remain suppressed as developers offer discounts to clear inventory. S&P Global Ratings estimated transaction volumes this year will recover only moderately from 2023, as interest rates remain high.

($1 = 7.8220 Hong Kong dollars)

By Tom Westbrook

SINGAPORE (Reuters) - Asian equities climbed on Tuesday but could not break this month's highs as mixed messages from U.S. Federal Reserve policymakers left doubts hanging over the timing of interest rate cuts.

The risk of Japan intervening to prevent further falls in the yen put a little pressure on the dollar, however it rose against the yuan on speculation that China may tolerate a weaker currency.

MSCI's broadest index of Asia-Pacific shares outside Japan rose 0.6%, with gains for South Korean chipmakers SK Hynix and Samsung Electronics (KS:005930) leading the Kospi up 1.2%. (KS)

Japan's rocketing Nikkei was steady, as was the yen at 151.31 per dollar.

Overnight, Chicago Fed President Austan Goolsbee said he had pencilled in three rate cuts this year, while Fed Governor Lisa Cook urged caution and Atlanta Fed President Raphael Bostic re-iterated Friday remarks trimming his expectations to one cut.

The diversity of views throws a few wildcards into the policy outlook while markets wait on the next U.S. inflation indicators due when many markets will be closed for Good Friday.

"Comments by FOMC participants suggest to us that four voters – Bostic, Bowman, Mester, and Barkin – see zero, one or two cuts this year," said Standard Chartered (OTC:SCBFF) strategist Steve Englander.

"We still think (chairman Jerome) Powell has eight votes for easing, but he probably does not want an 8-4 vote on the first cut of the cycle. Rather, he may hope that good inflation outcomes will allow him to swing a couple of votes into the cutting camp in the coming months."

Interest rate futures price about three Fed rate cuts this year and about a three-in-four chance of the first cut in June.

U.S. two-year yields, which track short-term interest rate expectations, rose in New York trade overnight then fell 4.5 basis points in the Asia morning to 4.58%. [US/]

S&P 500 futures rose 0.1% and the cash index closed 0.3% lower overnight.

In foreign exchange, Monday's rhetoric from Japan's top currency diplomat, Masato Kanda, kept the yen steady as traders weigh the risk of Japan buying heavily. Kanda said the yen's recent slide was "strange" and "speculative".

The Bank of Japan (BOJ) lifted interest rates last week but the yen has fallen near to three-decade lows on the dollar.

"Much like in 2016, when the BOJ cut rates to negative and (dollar/yen) went down, this month's BOJ decision to exit negative rates is a nothingburger and a red herring for (dollar/yen)," said Spectra Markets President Brent Donnelly.

"The pair continues to follow some combination of U.S. yields and Nikkei, with yields the primary driver."

China's yuan opened steady after a stronger-than-expected fixing of its trading band, but selling pressure soon drove it to the weak side of its 200-day moving average at 7.2165 per dollar.

Markets were unsettled by a sharp drop in the yuan on Friday, after months of tight trading, and some speculate China is loosening its grip on the currency to allow it to fall.

"Whether this reflects a shift in FX policy remains to be seen but accommodative monetary conditions are necessary in the face of growth headwinds," said BofA Securities' strategist Adarsh Sinha.

"If (yuan) depreciation sustains and coincides with a weaker credit impulse, Asia FX is vulnerable."

Later on Tuesday, the Reserve Bank of New Zealand's chief economist is due to speak and U.S. manufacturing, services and consumer confidence figures are due. U.S. core PCE data is due on Friday.

Gold and oil prices were broadly steady in commodities trade, with spot gold at $2,169 an ounce and Brent crude futures up 24 cents a barrel to $86.99. [GOL/][O/R]

Bitcoin hovered just above $70,000 after rising sharply on Monday.

By Tetsushi Kajimoto

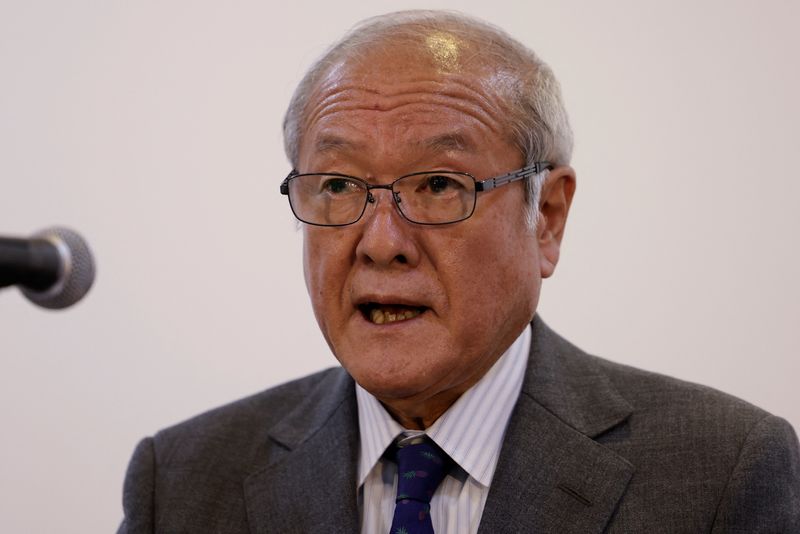

TOKYO (Reuters) -Japanese Finance Minister Shunichi Suzuki said on Tuesday that he would not rule out any measures to rein in weakness in the yen, echoing a warning from the nation's top currency diplomat the previous day.

Suzuki said a weak yen has both positive and negative effects on the economy but excessive volatility raises uncertainty for business operations. This in turn could hurt the economy, the minister said, reinforcing Tokyo's focus on the velocity of market moves, rather than on specific currency levels.

"Rapid currency moves are undesirable," Suzuki told reporters after a cabinet meeting. "It is important for currencies to move stably, reflecting economic fundamentals."

Early on Tuesday, the dollar was off slightly against the yen, fetching 151.26 and facing great resistance near the 152 level due to the threat of intervention from Japanese authorities. The greenback is up about 7% on the yen since the start of the year.

Suzuki declined to comment on the possibility of Tokyo intervening to stem the yen weakness, but suggested the speed of the currency's fluctuations will be a factor in any decision to enter the market.

"If I answer the question about currency intervention, it could have unintended effects on the market," Suzuki said, adding "if there's excessive moves, we will respond appropriately without ruling out any measures."

Japan last intervened in the currency market in September and October 2022 to stem the yen's declines, initially when the dollar hit around 145 to the yen, and later in October when the U.S. currency surged to a 32-year high near 152 levels.

By Lucia Mutikani

WASHINGTON (Reuters) -Sales of new U.S. single-family homes unexpectedly fell in February after mortgage rates increased during the month, but the underlying trend remained strong amid a chronic shortage of previously owned houses on the market.

The report from the Commerce Department on Monday also showed the median new house price last month was the lowest in more than 2-1/2 years, while supply was the highest since November 2022. Builders are ramping up construction, while offering price cuts and other incentives as well as reducing floor size to make housing more affordable.

"Housing activity is stabilizing as homebuilders appear to be building cheaper, and therefore, likely smaller homes," said Conrad DeQuadros, senior economic advisor at Brean Capital. "Sales have been relatively stable at December's level over the last two months and prices have been falling at mid-single-digit rates on a year-over-year basis."

New home sales slipped 0.3% to a seasonally adjusted annual rate of 662,000 units last month, the Commerce Department's Census Bureau said. The sales pace for January was revised up to 664,000 units from the previously reported 661,000 units.

Economists polled by Reuters had forecast new home sales, which account for 13.1% of U.S. home sales, would rise to a rate of 675,000 units. New home sales are counted at the signing of a contract, making them a leading indicator of the housing market. They, however, can be volatile on a month-to-month basis. Sales advanced 5.9% on a year-on-year basis in February.

The new homes market has defied 525 basis points worth of interest rate hikes from the Federal Reserve since March 2022, bolstered by a dearth of previously owned houses for sale.

The overall housing market has likely turned the corner, with home resales surging to a one-year high in February. Nonetheless, supply remains inadequate, keeping house prices elevated and homeownership out of the reach of many.

The average rate on the popular 30-year fixed-rate mortgage jumped to 6.94% in late February, before retreating to just below 7.0% by mid-March, according to data from mortgage finance agency Freddie Mac. The U.S. central bank is expected to start cutting rates sometime this year.

Stocks on Wall Street were trading lower. The dollar rose against a basket of currencies. U.S. Treasury prices fell.

UPBEAT OUTLOOK

Last month, new home sales plunged 31.5% in the Northeast and declined 2.4% in the Midwest. Sales in the densely populated South increased 3.7% and climbed 2.3% in the West.

"It's worth noting that mortgage rates rose from 6.8% to 7.0% in the same month, which probably put some buyers off entering the market," said Thomas Ryan, property economist at Capital Economics. "We're sticking with our upbeat forecast for new home sales over the next few years."

A survey from the National Association of Home Builders last week showed a measure of sales over the next six months rising to a nine-month high in March. A gauge of prospective buyers was the highest since last August.

The median new house price in February was $400,500, the lowest since June 2021 and a 7.6% drop from a year ago.

Economists welcomed the decline in the median new house price, which they said bode well for both affordability and inflation. Housing, through higher rents, has accounted for much of the increase in inflation.

Overall house prices, however, continue to rise because of the supply squeeze in the home resales market.

Most of the new homes sold last month were in the $300,000-$399,000 price range. The government reported last week that housing completions hit their highest level in 17 years in February. More new home supply is in the pipeline, which could further dampen house price inflation.

There were 463,000 new homes on the market at the end of February, the most since November 2022. That was up from 457,000 units in January. At February's sales pace it would take 8.4 months to clear the supply of houses on the market, up from 8.3 months in January.

Houses under construction accounted for 58.7% of inventory. Homes yet to be built made 22.9% of supply, while completed houses accounted for 18.4%.

"Rate incentives from builders are still able to ease the financial burden for buyers and have made new homes more appealing, but it's unknown for how long builders can continue to offer such incentives," said Daniel Vielhaber, an economist at Nationwide.

SYDNEY (Reuters) - Australia's government will support a minimum wage increase in line with inflation this year as low-income families continue to grapple with costs of living, although the rise would be smaller as inflation eased.

In a submission to the Fair Work Commission's 2023-24 Annual Wage Review to be unveiled on Thursday, the Labor government will recommend the increase to ensure "the real wages of the low-paid workers do not go backwards", a position the government has held in the last two years.

"Certainly the expectation is that the minimum wage will be lifted. What we're trying to ensure is that people on the lowest pay in our economy and in our country don't go backwards," Treasurer Jim Chalmers said in an TV interview on Monday.

"This is all about ensuring that people can earn more... And that's because we recognise that these cost-of-living pressures do fall disproportionately on the lowest paid in our workplaces."

Last July, the FWC hiked the minimum wage by 5.75% as costs of living surged, a decision some had feared would further stoke inflation. However, there has been no sign of a damaging wage-price spiral and inflation has slowed to two-year lows of 3.4% from a peak of 8.4%.

The Reserve Bank of Australia sees inflation edging down to 3.3% by June 2024.

The Labor government has also pledged more costs of living relief in the upcoming budget in May. It will deliver tax cuts for every taxpayer from July this year.

SINGAPORE (Reuters) -Singapore's February core inflation accelerated to its fastest pace in seven months, official data showed on Monday, as seasonal effects from the Lunar New Year drove services and food prices higher.

The core inflation rate, which excludes private road transport and accommodation costs, came in 3.6% in February from a year earlier, faster than the 3.4% forecast by a Reuters poll of economists and the 3.1% seen in January.

The February figure was the highest since the 3.8% in July 2023 according to LSEG data.

Headline consumer prices in February were up 3.4% from the same month last year, stronger than the 3.3% forecast in the poll and the 2.9% rise in January.

"This was driven by higher services and food inflation, partly reflecting seasonal effects associated with the Chinese New Year," the Trade Ministry and Monetary Authority of Singapore (MAS) said in a statement on Monday.

Core inflation is expected to resume a gradual moderating trend over the rest of the year, it said, as import cost pressures continue to decline and tightness in the domestic labour market eases.

They projected both headline and core inflation to average 2.5% to 3.5% for 2024, unchanged from previous official forecast.

"Going forward, we expect inflation to remain elevated in March before easing to 2% by the end of the year," Goldman strategists Rina Jio and Jonathan Sequeira wrote in a research note on Monday.

"We continue to expect the MAS to keep its monetary policy parameters unchanged this year," they added.

While inflation has slowed from its peak of 5.5% in January last year, it remains sticky amid slowing economic growth and an increase in goods and service tax by one-percentage point this year.

The economy expanded 1.1% last year, moderating from the 3.8% in 2022.

Singapore expects higher economic growth at 1% to 3% this year but warned of a mixed economic outlook due to geopolitical risks. MAS in January left monetary policy settings unchanged in its first review of 2024.

MAS, which uses exchange rate as its primary tool, has increased the frequency of its reviews from twice a year to quarterly starting this year. It is due to revisit monetary settings in April.

"The gradually strengthening S$ trade-weighted exchange rate should also continue to temper Singapore's imported inflation in the quarters ahead," MAS and the Trade Ministry said.

By Richard Cowan, David Morgan and Makini Brice

WASHINGTON (Reuters) - President Joe Biden on Saturday signed into law a $1.2 trillion spending package, keeping the U.S. government funded through a fiscal year that began six months ago.

Biden described the package, which Congress overwhelmingly passed in the early hours of Saturday, as investing in Americans as well as strengthening the economy and national security. The Democratic president urged Congress to pass other bills stuck in the legislative chambers.

"The House must pass the bipartisan national security supplemental to advance our national security interests," Biden said in a statement. "And Congress must pass the bipartisan border security agreement, the toughest and fairest reforms in decades, to ensure we have the policies and funding needed to secure the border. It's time to get this done."

The Democratic-majority Senate passed the spending bill with a 74-24 vote. Key federal agencies including the departments of Homeland Security, Justice, State and Treasury, which houses the Internal Revenue Service, will remain funded through Sept. 30.

But the measure did not include funding for mostly military aid to Ukraine, Taiwan or Israel, which are included in a different Senate-passed bill that the Republican-led House of Representatives has ignored.

The business community welcomed the passage of the spending bill and committed to continue working with policymakers to advance legislation that would enhance tax breaks for businesses and low-income families.

"A fully operational U.S. government provides important stability for American businesses, workers and families," Business Roundtable CEO Joshua Bolten said in a statement. "We look forward to continuing to work with Members of Congress to advance sound policies, including the Tax Relief for American Families and Workers Act."

Senate leaders spent hours on Friday negotiating a number of amendments to the budget bill that ultimately were defeated. The delay pushed passage beyond a Friday midnight deadline.

But the White House Office of Management and Budget issued a statement saying agencies would not be ordered to shut, expressing confidence the Senate would promptly pass the bill, which it did.

While Congress got the job done, deep partisan divides were on display again, as well as bitter disagreement within the House's narrow and fractious Republican majority. Conservative firebrand Representative Marjorie Taylor Greene threatened to force a vote to remove Speaker Mike Johnson, a fellow Republican, for allowing the measure to pass.

The 1,012-page bill provides $886 billion in funding for the Defense Department, including a raise for U.S. troops.

Johnson, as he has done more than 60 times since succeeding his ousted predecessor Kevin McCarthy in October, relied on a parliamentary maneuver on Friday to bypass hardliners within his own party, allowing the measure to pass by a 286-134 vote that had substantially more Democratic support than Republican.

For most of the past six months, the government was funded with four short-term stopgap measures, a sign of the repeated brinkmanship that ratings agencies have warned could hurt the creditworthiness of a federal government that has nearly $34.6 trillion in debt.

"This legislation is truly a national security bill — 70% of the funding in this package is for our national defense, including investments that strengthen our military readiness and industrial base, provide pay and benefit increases for our brave servicemembers and support our closest allies," said Republican Senator Susan Collins, one of the main negotiators.

Opponents cast the bill as too expensive.

"It's reckless. It leads to inflation. It's a direct vote to steal your paycheck," said Senator Rand Paul, part of a band of Republicans who generally oppose most spending bills.

The last partial federal government shutdown occurred during Donald Trump's presidency, from Dec. 22, 2018, until Jan. 25, 2019. The record-long interruption in government services came as the Republican insisted on money to build a wall along the U.S. border with Mexico and was unable to broker a deal with Democrats.

GREENE LASHES OUT

The new budget bill passed the House with 185 Democratic and 101 Republican votes, which led Greene, a hardline conservative, to introduce her measure to oust Johnson.

That move had echoes of October, when a small band of hardliners engineered a vote that removed McCarthy for relying on Democrats to pass a stopgap measure to avert another partial government shutdown. They had been angry at McCarthy since June, when he agreed with Biden on the outlines of the fiscal 2024 spending that were passed on Friday.

McCarthy's ouster brought the House to a halt for three weeks as Republicans struggled to agree on a new leader, an experience many in the party said they did not want to repeat as the November election draws nearer.

And Greene said she would not push for an immediate vote on her move to force Johnson out.

"I filed a motion to vacate today. But it's more of a warning than a pink slip," the Georgia Republican told reporters on Friday.

Indeed, some Democrats said on Friday that they would vote to keep Johnson, if he were to call a vote on a $95 billion security assistance package already approved by the Senate for Ukraine, Israel and Taiwan.

That measure is unlikely to come up anytime soon, as lawmakers will now leave Washington for a two-week break.

Pockets of Republican opposition to more funding for Ukraine have led to fears that Russia could seriously erode Kyiv's ability to continue defending itself.

Life is unlikely to become easier for Johnson anytime soon, with the looming departure of two members of his caucus - Ken Buck and Mike Gallagher - set to whittle his majority to a mere 217-213 in a month's time. At that point, Johnson could afford to lose only one vote from his party on any measure that Democrats unite to oppose.

By Wayne Cole

SYDNEY (Reuters) - Asian shares dithered on Monday as investors worried U.S. inflation data this week could derail the outlook for lower interest rates, while the risk of currency intervention from Japan stalled the yen's decline for the moment.

China's central bank also engineered a rally in the yuan after setting a firmer fix for the currency, nudging the dollar lower more broadly.

The main data event of the week will be U.S. core personal consumption expenditure (PCE) price index on Friday which is seen rising 0.3% in February, keeping the annual pace at 2.8%. Anything higher would be taken as a setback to hopes for a Federal Reserve rate cut in June.

Many markets are closed for Easter on Friday, when the PCE data is due for release, so the full reaction will have to wait until next week.

Fed Chair Jerome Powell was sufficiently dovish last week to leave futures implying around a 74% chance of a June easing, up from 55% a week earlier.

Powell will participate in a moderated discussion at a policy conference on Friday, while Fed governors Lisa Cook and Christopher Waller are also appearing this week.

Europe has its own inflation tests with consumer price data out from France, Italy, Belgium and Spain, ahead of the overall EU CPI report on April 3.

Sweden's central bank meets on Wednesday and is generally expected to keep rates at 4.0%, though a surprise easing by the Swiss National Bank (SNB) last week has markets anticipating a dovish statement.

Expectations for falling borrowing costs globally has been a boon for equities, with the S&P 500 up almost 10% for the year to date. On Monday, S&P 500 futures and Nasdaq futures were trading little changed.

EUROSTOXX 50 futures added 0.1%, while FTSE futures barely budged.

MSCI's broadest index of Asia-Pacific shares outside Japan was flat, just below eight-month highs.

Japan's Nikkei dipped 0.6%, having spiked 5.6% last week to a fresh all-time peak as the yen weakened. (T)

While the Fed sounded dovish last week, it was hardly alone, with the Swiss central bank (SNB) actually cutting rates while the Bank of England (BoE) and European Central Bank (ECB) left markets looking for easings from June onwards.

JAPAN JAWBONES THE YEN

"We think the dollar's rebound reflects the more explicitly dovish stance of other major central banks – in particular the SNB and the BoE," said Jonas Goltermann, deputy chief markets economist at Capital Economics.

"The PBOC's apparent decision to let the renminbi weaken sharply has added to the overall dollar-positive tone," he added. "Overall, the greenback heads into the Easter holiday period firmly on the front foot, and continued solid U.S. economic data is likely to keep it that way."

Even a shift away from super-easy policies by the Bank of Japan (BOJ) could not dent the dollar, as investors assumed it was not the start of a series of hikes and futures imply a rate of just 20 basis points by year end.

On Monday, the dollar was a shade lower at 151.23 yen, having climbed 1.6% last week to a peak of 151.86. Markets are wary of testing 152.00 as that is a level that has drawn Japanese intervention in the past. [USD/]

Indeed, Japan's top currency official on Monday warned the yen's current weakness did not reflect fundamentals and excessive moves were unwelcome.

The euro was pinned at $1.0815, having been dragged down in the wake of the Swiss franc after the SNB's shock rate cut.

The strength of the dollar had taken some shine off gold, though the metal was edging higher again to $2,174 an ounce, after hitting a record peak of $2,217.79 last week. [GOL/]

Oil prices were underpinned by Ukraine's attacks on Russian refineries, along with data showing a fall in U.S. rig counts. [O/R]

Brent rose 46 cents to $85.89 a barrel, while U.S. crude firmed 48 cents to $81.11 per barrel. [O/R]