Select Language

Most Asian stocks moved in a tight range on Monday as investors digested the prospect of less severe trade tariffs under U.S. President Donald Trump, while Japanese markets retreated on weak business activity readings.

Chinese markets reversed early losses on renewed optimism over the country’s artificial intelligence capabilities, after Bloomberg reported that Jack Ma-backed Ant Group used Chinese-made chips to develop new low-cost techniques for training AI models.

Broader regional markets kept to a tight range as investors gauged just how Trump’s trade tariffs will play out as an April 2 deadline approaches.

Media reports over the weekend showed Trump will not impose industry-specific tariffs on April 2 as previously threatened, and will limit his plans for reciprocal tariffs to about 15 countries which he sees as having major trade imbalances with Washington.

The report offered some relief to risk-averse markets, with Wall Street futures rising sharply in Asian trade.

But Asian markets were less enthused, given that a bulk of the 15 targeted countries lie within the region.

Japan stocks fall after weak March PMI

Japan’s Nikkei 225 index was flat, while the TOPIX shed 0.3% after purchasing managers index data contracted for the first time in five months in March.

Manufacturing PMI fell for a ninth straight month, while services shrank for the first time since mid-2024.

The weak print came as local exporters grappled with easing overseas demand amid tariff-related headwinds. Broader Japanese businesses were also pressured by soft spending and dwindling domestic demand.

The readings marked a weak end to the first quarter of 2025 for the Japanese economy, and raised some questions about just how much headroom the Bank of Japan will have to keep raising rates.

Chinese stocks reverse early losses on AI hype

China’s Shanghai Shenzhen CSI 300 rose 0.5%, while the Shanghai Composite index added 0.2%. Hong Kong’s Hang Seng was flat after sharply reversing early losses.

Chinese markets were nursing some losses from last week, as a rally so far in 2025- on optimism over more stimulus and Chinese AI competitiveness- gave way to some profit-taking.

But reports on Monday could potentially reignite this rally. Bloomberg reported that Ant Group had developed less costly techniques for training AI models using locally developed chips, highlighting the country’s growing independence in chip production after it was recently blacklisted by the U.S.

Ant used chips developed by Ma’s Alibaba (HK:9988) and Huawei Technologies, and achieved results similar to those seen with chips developed by NVIDIA Corporation (NASDAQ:NVDA), the report said.

Alibaba reversed early losses to trade up 0.5% in Hong Kong trade.

Broader Asian markets kept to a tight range. Australia’s ASX 200 moved little despite positive PMI data for March.

Singapore’s Straits Times index was flat, while South Korea’s KOSPI moved little in anticipation of heightened political turmoil in the country, as investors awaited a court ruling on impeached President Yun Suk Yeol.

Futures for India’s Nifty 50 index pointed to a flat open after the index marked strong gains last week.

Japanese business activity shrank for the first time in five months in March, preliminary purchasing managers index data showed on Monday, as sticky local inflation and soft overseas manufacturing demand weighed.

The au Jibun Bank manufacturing PMI fell to 48.3 in March from 49.0 in February, shrinking for a ninth consecutive month. The reading was also weaker than expectations of 49.2.

A PMI print below 50 entails contraction.

The drop in manufacturing was driven chiefly by softer overseas demand for goods, which weighed on new work orders. This came as markets fretted over the economic impact of more trade tariffs under U.S. President Donald Trump.

Trump is set to unveil plans for reciprocal trade tariffs on April 2.

Japanese services activity shrank for the first time since mid-2024, with the au Jibun Bank services PMI falling to 49.5 in March from 53.7 in the prior month.

The decline in services activity was driven by waning demand in the face of heightened concerns over growing costs, especially as Japanese inflation remained strong and above the Bank of Japan’s target.

Higher inflation also pressured services demand in March, especially as average input costs rose sharply.

The declines in manufacturing and services activity saw the overall composite PMI fall to 48.5 in March from 52.0 in Feb- its first decline in five months.

The PMI data reflected some cooling in the Japanese economy, especially as private spending comes off last year’s highs. Rising domestic interest rates and sticky inflation have also weighed on business activity, as did uncertainty over U.S. trade policies.

U.S. President Donald Trump is planning a narrower, more targeted agenda for increased trade tariffs set to take effect on April 2, reports from Bloomberg and the Wall Street Journal said on Sunday.

Trump is now expected to not impose industry-specific tariffs next week, and will instead apply reciprocal duties only on a targeted set of countries that account for a bulk of the U.S.’ foreign trade, the reports said.

Trump has repeatedly touted April 2 as his “liberation day” for the U.S., when he has threatened to impose tariffs against major U.S. trading partners in line with their duties on U.S. exports. He had earlier warned that key industries such as automobiles, pharmaceuticals, semiconductors and commodities will be targeted with more duties.

But this will no longer be the case, reports over the weekend showed, citing administration officials with knowledge of the matter.

The reports said it was now unclear whether Trump’s sectoral tariffs, along with higher duties on Canada and Mexico, will come to pass. Trump had earlier in March flip-flopped on tariffs against the two countries.

Trump’s reciprocal tariffs are also expected to be more targeted than initially thought, the reports showed. The WSJ reported that the White House is looking at applying tariffs on about 15% of nations with persistent trade balances with the U.S.- a so-called “dirty 15,” according to Treasury Secretary Scott Bessent.

Targeted nations are expected to include the G-20 nations, along with India, Japan, China, and Vietnam- all of which have large trade imbalances with the U.S.

While Trump’s tariffs will still ramp up the cost of importing in the U.S., their limitation to the so-called “dirty 15” is expected to dampen their overall economic disruption.

Each targeted nation will be imposed with tariffs based on their trading relationship with the U.S.

Concerns over disruptions stemming from Trump’s tariffs had ramped up in recent weeks, fueling fears of rising inflation and slowing economic growth. The U.S. President had earlier in March slapped China with a 20% trade tariff, drawing retaliation from Beijing.

Canada, Mexico, and the European Union also warned of retaliatory action against Trump’s tariffs.

(Reuters) -Oil prices rose on Friday, and were set for second consecutive weekly gains, as fresh U.S. sanctions on Iran and a new plan from the Organization of Petroleum Exporting Countries and its allies (OPEC+) to cut output raised bets on tighter supply.

Brent crude futures climbed 21 cents, or 0.3%, to $72.21 per barrel by 0435 GMT. U.S. West Texas Intermediate crude futures were up 25 cents, or 0.4%, to $68.32 a barrel.

On a weekly basis, both Brent and WTI were on track to rise about 2%, their biggest weekly gains since the first week of 2025.

The United States Treasury on Thursday announced new Iran-related sanctions, which for the first time targeted an independent Chinese refiner among other entities and vessels involved in supplying Iranian crude oil to China.

The sanctions on Chinese entities were "a clear escalation in sanctions policy", analysts at RBC Capital Markets said in a note on Friday.

"While the physical implications are minimal, we think it reasonable that risk premium here is taken more seriously," they wrote.

That marked Washington’s fourth round of sanctions against Iran since U.S. President Donald Trump in February promised to reimpose a "maximum pressure" campaign on Tehran, pledging to drive the country’s oil exports to zero.

Analysts at ANZ Bank said they expect a 1 million barrels per day (bpd) reduction in Iranian crude oil exports because of tighter sanctions. Vessel tracking service Kpler pegged Iranian crude oil exports at over 1.8 million bpd in February.

Oil prices were also supported by a new OPEC+ plan announced Thursday for seven members to further cut output to make up for producing more than agreed levels. The plan would represent monthly cuts of between 189,000 bpd and 435,000 bpd, and will last until June 2026.

OPEC+ earlier this month confirmed that eight of its members would proceed with a monthly increase of 138,000 bpd from April, reversing some of the 5.85 million bpd of output cuts agreed in a series of steps since 2022 to support the market.

"While the group shares a plan for compensation cuts, it certainly doesn’t mean members will follow it. A handful of members have consistently produced above their target production levels," ING analysts said in a note on Friday.

Most Asian stocks moved in a flat-to-low range on Friday as investors digested the outlook for higher U.S. trade tariffs and interest rates, while Chinese markets pulled back further from a stimulus-driven rally.

Japanese markets moved little in catch-up trade, as mildly stronger-than-expected consumer inflation data lifted the prospect of more interest rate hikes by the Bank of Japan.

Regional markets tracked a middling overnight session on Wall Street, as mixed signals from the Federal Reserve, persistent threats of more trade tariffs and growing concerns over a U.S. economic slowdown kept traders to the sidelines.

U.S. stock index futures rose slightly in Asian trade, as Wall Street still attracted some bargain buying after recently sliding to six-month lows. But investors remained largely on edge over more trade tariffs, with President Donald Trump recently signaling that his April 2 deadline for reciprocal tariffs remained.

Japanese shares drift higher after CPI data

Japan’s Nikkei 225 and TOPIX indexes rose 0.1% and 0.7%, respectively, on Friday. Trade resumed after a market holiday on Thursday.

Consumer price index inflation data read slightly higher than expected for February, furthering the BOJ’s expectations for a virtuous cycle and keeping bets of more rate hikes by the central bank squarely in focus.

While headline inflation did cool from the prior month, a key gauge of underlying inflation that is watched by the BOJ rose further above the central bank’s 2% annual target.

The print came just days after the BOJ kept rates unchanged, but signaled that it expected inflation to remain sticky this year. Analysts expect the BOJ to next hike rates in May, after a 25 basis point raise in January.

Chinese stocks fall further as stimulus, AI rally cools

China’s Shanghai Shenzhen CSI 300 and Shanghai Composite indexes fell 0.3% and 0.2%, respectively, while Hong Kong’s Hang Seng index sank 0.6%. All three indexes were hit with some profit-taking this week after a strong run-up so far this year, amid increasing optimism over more stimulus measures in the country. Chinese technology stocks, especially those listed in Hong Kong, benefited greatly from increased interest in China’s artificial intelligence capabilities.

This saw the Hang Seng hit hard by profit-taking after it soared to an over three-year high this week on strength in major tech stocks. These stocks were the biggest weight on the index on Thursday and Friday.

Focus is now on Beijing’s plans for more stimulus measures, after the government recently outlined measures aimed at boosting private consumption.

Broader Asian markets moved little amid a dearth of new cues, while caution over the global economy kept traders to the sidelines. Australia’s ASX 200 rose 0.4%.

Singapore’s Straits Times index fell 0.1%, while South Korea’s KOSPI added 0.2%.

Sentiment towards South Korea was pressured by anticipation of a ruling on impeached President Yun Suk Yeol, which has now been delayed by more than three weeks.

Futures for India’s Nifty 50 index pointed to a flat open, as a recent rebound to five-week highs now appeared to be cooling.

(Reuters) - British consumer morale ticked higher for a second month running in March as people turned a little more optimistic about the economic outlook, although less so over their own finances, a survey showed on Friday.

The GfK Consumer Confidence Index rose to -19 from -20, a three-month high but still below the survey’s long-run average of -10.

Its measure of how consumers view the economy over the next 12 months increased by two points to -29.

Overall the survey added to a run of mixed data for finance minister Rachel Reeves, who is likely to announce more spending cuts next week when she outlines new economic and budget forecasts.

Confidence among consumers and businesses slid last year after the new government of Prime Minister Keir Starmer said it had inherited a troubled economy and Reeves raised taxes on employers to fund higher public spending.

"The current stability is to be welcomed but it won’t take much to upset the fragile consumer mood," said Neil Bellamy, consumer insights director at GfK.

The poll of 2,005 Britons aged 16 and over took place between February 28 and March

Investing.com-- The S&P 500 closed lower Thursday as optimism that followed the Federal Reserve’s unchanged outlook on two rate cuts this year run out of steam.

At 4:00 p.m. ET, the Dow Jones Industrial Average fell 11 points, or 0.03%, the S&P 500 index fell 0.3%, and the NASDAQ Composite fell 0.30%.

The main Wall Street indexes rose strongly during Wednesday’s session, but all three indexes remained close to six-month lows, as uncertainty over Trump’s tariffs and fears of slowing economic growth sparked a wave of extended selling.

Labor market data post Fed meeting

The number of Americans filing for first-time unemployment benefits edged marginally higher last week, suggesting ongoing resilience in the U.S. labor market despite possible headwinds looming from escalating trade tensions and a Trump administration push to downsize the federal government.

Initial jobless claims, a proxy for hiring, inched up to 223,000 in the week ended on March 15, increasing from an upwardly-revised mark of 221,000, according to Labor Department data on Thursday. Economists had seen the figure at 224,000.

The Fed kept its benchmark interest rate unchanged at 4.25% to 4.5% on Wednesday, as widely expected, leaving it there for a second consecutive meeting.

The central bank maintained its outlook that rates will fall to 3.75% to 4% in 2025, suggesting that it will cut rates twice by December.

But this came even as the central bank forecast higher inflation in 2025, with core personal consumption expenditures index- the Fed’s preferred inflation gauge- expected to be 2.8% in 2025, up from a prior forecast of 2.5% and well above the central bank’s annual 2% target.

The Fed also trimmed its gross domestic product forecast for the year, and flagged growing uncertainty over the impact of Trump’s policies on the economy.

Fed Chair Jerome Powell said it was still too soon to gauge the impact of Trump’s tariff policies on inflation and the economy at large. But the Fed’s inflation and GDP targets suggest that the impact will not be negligible.

Apple (NASDAQ:AAPL) set to shake up executive ranks in AI push; Tesla flat on Cybertruck recall, Microchip Technology down on debt offering

Apple reportedly is set looking to tap Vision Pro creator Mike Rockwell to turn around Siri as the tech giant seeks to boost its foray into AI, Bloomberg reported, citing unnamed sources. The move comes as CEO Tim Cook has reportedly lost confidence in AI head John Giannandrea to execute on product development. Its shares fell 0.5%.

Tesla Inc (NASDAQ:TSLA) cut losses to end flat fespite after the EV maker recalling almost all Cybertrucks in the United States to fix an exterior panel that could delaminate and detach, increasing the risk of a crash.

Microchip Technology Inc (NASDAQ:MCHP) fell 6.5% after announcing late Wednesday plans to sell $1.35 billion of convertible stock to raise funds to repay existing debt enter into capped call transaction.

Earnings on tap

On the earnings calendar, investors will have the chance to parse through quarterly results from a range of companies later in the day, including logistics group FedEx (NYSE:FDX), chipmaker Micron Technology (NASDAQ:MU) and shoe seller Nike (NYSE:NKE).

Elsewhere, Five Below (NASDAQ:FIVE) stock rose 0.6% after the discount store company reported better-than-expected fourth-quarter results and forecast a strong current quarter.

Darden Restaurants (NYSE:DRI) stock rose more than 5% after the restaurant operator reported third-quarter fiscal 2025 results.

(Ambar Warrick contributed to this article.)

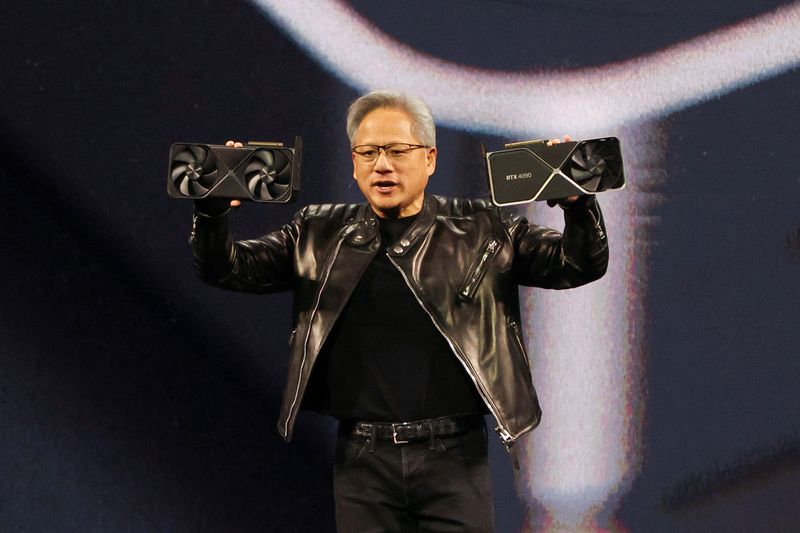

Investing.com-- NVIDIA Corporation (NASDAQ:NVDA) will spend hundreds of billions of dollars on U.S.-made chips and electronics components over the next four years, CEO Jensen Huang said in an interview with the FInancial Times.

Huang said Nvidia will procure “probably half a trillion dollars worth of electronics in total” over the next four years, and that the company sees itself manufacturing “several hundred billion of it here in the U.S.

Huang told the FT that Nvidia was now able to manufacture its latest systems through U.S. suppliers such as TSMC (NYSE:TSM) and Foxconn, and that he saw a growing competitive threat from Chinese electronics giant Huawei.

Huang’s comments mirror commitments from several other major tech CEOs to spend more money in the U.S. and wean off foreign supply chains in compliance with President Donald Trump’s America-first policies. Earlier in March, Apple (NASDAQ:AAPL) had vowed to spend hundreds of billions of dollars to bolster its U.S. operations.

Shifting supply chains also come as Trump imposes steep trade tariffs on several major U.S. trading partners, sending local firms scrambling to find alternative supply chains.

Huang told the FT that he believed the Trump administration could support the U.S. AI ind

ustry, and that Nvidia’s Blackwell line of chips were being produced in the U.S.

TSMC- a major Nvidia supplier- has invested heavily in its U.S. production capacity, with a bulk of its investment coming under the Biden-era CHIPs act.

Huang had earlier this week unveiled Nvidia’s next-generation line of AI chips, called Vera Rubin.

Investing.com-- Most Asian stocks rose on Thursday, tracking gains on Wall Street after the Federal Reserve offered no surprises in its rate decision, while Chinese markets lagged after a stellar rally gave way to profit-taking.

Regional markets rose across the board, tracking an over 1% overnight jump on Wall Street after the Fed kept rates unchanged and offered no changes to its outlook for rate cuts.

U.S. stock index futures rose in Asian trade as markets were somewhat relieved by the Fed announcing no drastic action in the face of a brewing trade war and global economic disruptions. Fears of these put Wall Street at six-month lows last week.

But the central bank did trim its annual growth forecast and said it expected higher inflation.

In Asia, trading volumes were somewhat limited by a holiday in Japan. Nikkei 225 Futures fell 0.1%.

Australia stocks rise as soft jobs data fuels rate cut bets

Australia’s ASX 200 rose 1.1%, recovering further from a recent seven-month low.

Sentiment towards Australian markets was boosted largely by softer-than-expected employment data, which showed an unexpected contraction in job growth in February.

The soft data drummed up expectations for an interest rate cut by the Reserve Bank of Australia, given that it has flagged a largely data-driven approach to further easing after a cut in February. Softer inflation and a cooling labor market are expected to be the RBA’s biggest considerations.

But while Australian labor data did show a contraction in February, other indicators showed that the labor market still remained strong.

Broader Asian markets all advanced, tracking strength in Wall Street. Optimism over more China stimulus had also underpinned Asian markets over the past week, helping them weather weakness in their global peers.

South Korea’s KOSPI index rose 0.5%, while Singapore’s Straits Times index added 0.7%.

Futures for India’s Nifty 50 index pointed to a positive open, as the index rebounded further from a recent nine-month low.

Hong Kong slides, China weak on tech profit-taking

Hong Kong’s Hang Seng index was an outlier in Asia, falling 1.1% from a three-year high. Local technology and internet stocks were the biggest weights on the index, as investors locked-in profits from a stellar run-up in the sector this year.

Growing confidence in China’s artificial intelligence capabilities, coupled with optimism over more stimulus measures from Beijing, were the biggest drivers of Hong Kong’s stock rally this year. The Hang Seng is trading up nearly 25% so far in 2025, vastly outperforming its global peers.

But this rally showed some cooling on Thursday.

Broader Chinese markets also fell, with the Shanghai Shenzhen CSI 300 and Shanghai Composite indexes down 0.6% and 0.3%, respectively.

Focus is squarely on more fiscal measures from Beijing to support private spending and boost economic growth, after encouraging signals from policymakers over the past week.

On the monetary front, the People’s Bank of China kept its benchmark loan prime rate unchanged, as widely expected, on Thursday.

By Anjana Anil

(Reuters) - Gold rose to an all-time high on Thursday as the Federal Reserve hinted at two possible interest rate cuts this year, bolstering bullion’s appeal amid ongoing geopolitical and economic woes.

Spot gold was up 0.1% at $3,049.89 an ounce as of 0210 GMT. Bullion reached an all-time high of $3,055.96 earlier in the session.

U.S. gold futures gained 0.6% to $3,058.40.

Gold is driven by "a lot of uncertain market situations, geopolitical tensions, weaker U.S. dollar, and expectations that interest rates will be cut later," said Dick Poon, general manager at Heraeus Metals Hong Kong Ltd. [USD/]

The Fed held its benchmark overnight rate steady in the 4.25%-4.50% range on Wednesday. Policymakers expect the central bank to deliver two quarter-percentage-point rate cuts by the end of 2025.

The Trump administration’s initial policies, including extensive import tariffs, appear to have tilted the U.S. economy towards slower growth and at least temporarily higher inflation, Federal Reserve Chair Jerome Powell said.

Trump’s tariffs, which have flared trade tensions, are widely thought to be inflationary and detrimental to economic growth.

The tariff uncertainty, the possibility of rate cuts and the resumption of tensions in the Middle East have contributed to gold’s record rally, prompting bullion to notch 16 record highs so far in 2025, four of them above the $3,000 milestone.

The Israeli military resumed ground operations in central and southern Gaza as airstrikes killed at least 48 Palestinians, local health workers said.

Non-yielding gold is considered a hedge against global uncertainties, and thrives in a low interest rate environment.

"Given the very good performance in gold through Q1, I think a correction is not out of the question," said Nicholas Frappell, global head of institutional markets at ABC Refinery.

"However so far corrections have been relatively short-lived and well bid...$3,090~$3,100 may see some resistance."

Spot silver was steady at $33.81 an ounce, platinum inched up 0.1% to $994.05, and palladium edged up 0.1% to $957.42.