Select Language

Investing.com-- Gold prices rose in Asian trade on Thursday, briefly hitting a record high as safe haven demand was underpinned by U.S. President Donald Trump threatening to impose more trade tariffs.

But gains in the yellow metal were stymied by some resilience in the dollar, following hawkish signals from the minutes of the Federal Reserve’s January meeting.

Spot gold rose 0.3% to $2,940.96 an ounce, briefly hitting a record high of $2,947.23 an ounce earlier in the session.

Gold futures expiring in April rose 0.2% to $2,957.80 an ounce.

Gold buoyed by haven demand as Trump talks tariffs

Trump on Wednesday said his planned 25% tariffs on automobiles, pharmaceuticals, and semiconductors will be imposed within the coming month.

He also flagged the potential for 25% tariffs on all lumber imports to the U.S.

Trump’s comments ramped up concerns that increased U.S. tariffs will disrupt global trade and spark a renewed trade war between the world’s biggest economies.

The U.S. President had recently threatened to impose reciprocal tariffs on major trading partners. Still, Trump also said on Wednesday that a trade deal with China was possible, even though he recently imposed 10% tariffs on the country, drawing ire and retaliation from Beijing.

Concerns over Trump’s trade policies battered risk-driven markets on Thursday, pushing up demand for safe havens such as gold and the yen. U.S. policy uncertainty has been a key driver of gold’s recent gains.

Other precious metals also advanced, but were nursing some losses this week. Platinum futures rose 0.2% to $992.70 an ounce, while silver futures rose 0.9% to $33.353 an ounce.

Among industrial metals, copper prices advanced as top importer China kept its benchmark loan prime rate at record lows. Benchmark copper futures on the London Metal Exchange rose 0.7% to $9,507.30 a ton, while March copper futures rose 0.2% to $4.5785 a pound.

Dollar strength, Fed jitters limit gold gains

Gold spent only a brief period at record highs, as strength in the dollar and concerns over high-for-longer U.S. interest rates weighed.

The greenback caught some bids this week as several Fed officials reiterated the bank’s caution over cutting interest rates further, due to signs of sticky inflation and resilience in the U.S. economy.

This messaging was repeated in the Fed’s January minutes on Wednesday, which showed policymakers also cautious over the inflationary effects of Trump’s trade policies.

By Ankur Banerjee and Chibuike Oguh

SINGAPORE/NEW YORK (Reuters) - Asian shares fell sharply on Thursday, tracking choppy trading on Wall Street and a dip in European stocks as U.S. President Donald Trump's tariff plans and a cautious stance from Federal Reserve policymakers hurt risk sentiment.

The risk-off mood lifted gold prices to a record high, while safe-haven currencies led by the Japanese yen also firmed on geopolitical worries. [GOL/] [FRX/]

Trump said on Tuesday that sector-wide tariffs on pharmaceuticals and semiconductor chips would start at "25% or higher," rising substantially over the course of a year. He intends to impose similar tariffs on autos as soon as April 2.

That along with other threats has exacerbated fears of a wide-ranging trade war, leaving investors jittery, although some analysts see the moves by Trump as a negotiation tool.

"In general the bias for markets remains upwards but if you look shorter term over the last few days, it's more mixed because the market tends to trade around the latest indications of the Trump administration," said Julian McManus, portfolio manager at Janus Henderson Investors.

"That tends to be unsettling and markets tend to trade off whenever they hear the word tariff because they think it means either risk for a particular country or they think inflation."

MSCI's broadest index of Asia-Pacific shares outside Japan fell 1% in early trading. Japan's Nikkei slid 1.4% on the strong yen.

Chinese stocks had a muted start to the session, with the blue-chip index down 0.4%. Hong Kong's Hang Seng Index slid 1.7%, having touched a four-month high earlier this week boosted by a blistering rally in tech stocks. (HK)

On Thursday, Hang Seng's tech stocks index fell more than 3%, on course for its worst one-day drop in three months. Still, the index is up nearly 6% so far in February.

Wall Street's main indexes finished higher on Wednesday, with the S&P 500 edging to a second straight closing high after wobbling between green and red throughout the session.

The pan-European STOXX 600 index dropped 0.9%, logging its biggest daily fall since the start of the year.

Trump's initial policy proposals raised concern at the Fed about higher inflation, with firms telling the U.S. central bank they generally expected to raise prices to pass along the cost of import tariffs, according to the Fed's January meeting minutes released on Wednesday.

"Trump's policies ... no doubt added complexity to the Fed's balancing act between inflation and employment, forcing policymakers to lean into a wait-and-see approach," said Yeap Jun Rong, market strategist at IG.

"That said, with market expectations already well aligned for a rate hold over the next two FOMC meetings, the minutes served more as confirmation of existing sentiment."

The yen gained as market jitters escalated on geopolitical worries after Trump denounced Ukrainian President Volodymyr Zelenskiy as a "dictator" amid talks to end the Ukraine war.

The yen hit an over two-month high against the dollar and was last up nearly 0.6% at 150.57 per dollar. The yen has risen more than 4% against the dollar this year boosted by rising odds of the Bank of Japan hiking rates again in 2025.

The dollar index, which measures the greenback against a basket of currencies including the yen and the euro, eased 0.1% to 107.07. The euro was steady at $1.0429.

Gold prices rose to a fresh record high of $2,946.85 an ounce on safe-haven demand, reaching a new peak for the ninth time this year. The yellow metal was last at $2,940.63.

Oil prices eased away from a one-week high on worries about supply disruptions in Russia and the U.S., even as the market awaits the outcome of talks to end the war in Ukraine. [O/R]

By Andrea Shalal, Christian Kraemer, David Lawder

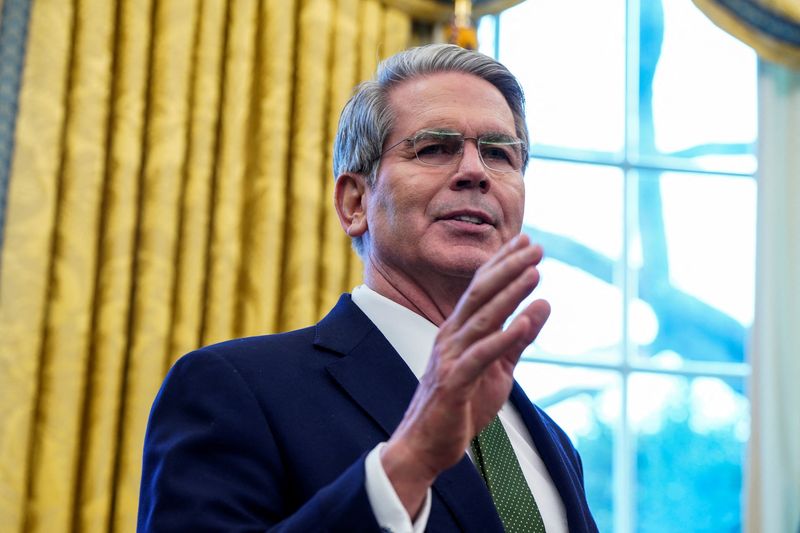

MIAMI/BERLIN (Reuters) -U.S. Treasury Secretary Scott Bessent said on Wednesday he will skip next week's meeting of finance ministers and central bank governors from the Group of 20 major economies in Cape Town, South Africa.

The decision to miss the regular gathering of finance leaders from the world's largest economies is highly unusual for a U.S. Treasury secretary, as the U.S. often leads G20 agreements on financial and monetary policy matters.

Bessent said in a post on X that he would not attend the summit due to "obligations in Washington". A senior official would attend in his place, he added.

He said he looked forward to seeing his global counterparts in Washington meetings of the International Monetary Fund and the World Bank in coming months.

One of the sources told Reuters that G20 member countries had been informed of Bessent's decision not to attend. A second source said Bessent could not attend because he had "duties with the president."

It was not immediately clear if those duties were linked to a possible summit meeting between U.S. President Donald Trump and Russian President Vladimir Putin.

Trump on Tuesday told reporters he would "probably" still meet with Putin to discuss ending the Ukraine war before the end of the month. The Kremlin echoed that hope early Wednesday, but said the meeting could happen later.

The White House and U.S. Treasury did not respond to requests for comment on Bessent's plans. The New York Times (NYSE:NYT) first reported Bessent's planned absence.

The G20 group - which includes the U.S., China and Russia among others - has tackled a range of issues affecting the global economy, from responding to the COVID-19 pandemic and fighting inflation to dealing with climate change, debt distress and trade conflicts.

SOUTH AFRICA TENSIONS

South Africa holds the G20 presidency from December 2024 to November 2025. The U.S. will head the group next year.

Tensions between the U.S. and South Africa have risen in recent weeks following complaints from Trump over South Africa's land policy.

Earlier this month, Trump said that "South Africa is confiscating land" and "certain classes of people" were being treated "very badly."

The White House said Washington would formulate a plan to resettle white South African farmers and their families as refugees, with U.S. officials to prioritize humanitarian relief for Afrikaners in South Africa, who are mostly white descendants of early Dutch and French settlers.

U.S. Secretary of State Marco Rubio subsequently canceled a trip to Johannesburg for a meeting of G20 foreign ministers on Thursday and Friday.

Mark Sobel, a former senior Treasury official, said the decision to skip the G20 gathering was a huge error.

"This was a golden opportunity for Bessent to meet his counterparts in plenary sessions and more importantly in behind-the-scenes bilaterals, including with China," for discussions on global economic and tax policy and exchange rates, said Sobel, U.S. chair of the OMFIF think tank.

Investing.com-- Australia's job market surged much more past expectations in January, mainly attributable to gains in the female workforce, showing continued resilience in the labor market.

The total number of employed people grew by 44,000 in January, data from the Australian Bureau of Statistics showed on Thursday. The reading was significantly higher than expectations of 19,400 people, but was below the 56,300 seen in the prior month.

This brought Australia’s participation rate- which gauges the percentage of the population that is in the labor space- to a record high of 67.3% in January, against expectations it would remain steady at 67%.

The unemployment rate rose to 4.1% in January, in line with forecasts, and compares with a 4.0% rise in the previous month.

"Most of the rise in both employment and unemployment in January reflected rises for women, with female employment rising by 44,000 and unemployment by 24,000. In contrast, male employment and unemployment both changed by less than 1,000 people," Bjorn Jarvis, ABS head of labor statistics said in a statement.

Earlier this week, the Reserve Bank of Australia (RBA) reduced the cash rate by 25 basis points to 4.1%, marking the first cut since November 2020.

In its statement, the RBA noted that inflation had decreased more rapidly than anticipated in the December quarter, indicating easing price pressures. The central bank also observed subdued growth in private demand and a moderation in wage pressures.

However, it highlighted that some recent labor market data were unexpectedly strong, suggesting a tighter labor market than previously thought. The RBA projected the unemployment rate to rise slightly this year, stabilizing just above 4%, supported by anticipated economic growth in the coming years.

This rate cut aimed to balance the need for economic stimulus with caution due to global uncertainties and domestic wage dynamics. The RBA acknowledged upside risks and expressed caution regarding further policy easing.

Strength in the labor market has also kept inflation underpinned amid strong consumer demand.

By Stephen Culp

NEW YORK (Reuters) - U.S. stocks ended modestly higher on Wednesday and the S&P 500 notched its second straight all-time closing high as investors scrutinized the minutes from the Federal Reserve's January policy meeting and digested U.S. President Donald Trump's tariff plans.

All three major U.S. equity indexes made gains on the day.

At the Fed's January policy meeting, the U.S. central bank left its key interest rate unchanged. The minutes show policymakers expressed concern about stubborn inflation and the potential effect of Trump's policy proposals, particularly tariffs, on their efforts to bring price growth down to their target.

"There was some discussion (in the minutes) that there may be some economic slowing ahead," said Paul Nolte, senior wealth adviser and market strategist at Murphy & Sylvest in Elmhurst, Illinois. "Maybe that's giving investors some thought that the Fed could cut rates. It's still on the table."

"That said, (the Fed's) not willing to do anything until they get a little bit more clarity as to what the tariffs look like," Nolte added. "So from that perspective (it's) a wait and see."

Trump announced on Tuesday he would impose tariffs "in the neighborhood of 25%" on autos, semiconductors and pharmaceuticals, the latest in a series of measures that have raised concerns over the consequences of a global trade war.

"I think people are starting to see it as a bargaining chip or bluster, more bark than bite," Nolte said.

The Commerce Department said housing starts tumbled by 9.8% in January, a plunge attributed to soft demand, elevated mortgage rates and a spate of unusually frigid weather.

Housing stocks were underperformers, dropping 1.5%.

The Dow Jones Industrial Average rose 71.25 points, or 0.16%, to 44,627.59. The S&P 500 gained 14.57 points, or 0.24%, at 6,144.15 and the Nasdaq Composite edged up 14.99 points, or 0.07%, to 20,056.25.

Among the 11 major sectors of the S&P 500, healthcare enjoyed the largest percentage gain, while materials and financials were the laggards.

Fourth-quarter earnings season is approaching the finish line, and 74% of the S&P 500 constituents have posted better-than-expected results, according to LSEG.

Analysts now see fourth-quarter S&P 500 earnings growth of 15.3% year-on-year, a significant improvement over the 9.6% estimate at the beginning of the year, according to LSEG.

Electric truck maker Nikola (NASDAQ:NKLA) plunged 39.1% in the wake of its filing for Chapter 11 bankruptcy protection.

Specialty chemicals company Celanese (NYSE:CE) tumbled 21.5% after reporting a quarterly loss.

Shares of Shift4 slid 17.5% following its fourth-quarter results and on news that the payments processor has agreed to buy Global Blue in a deal valued at $2.5 billion.

Shares of Global Blue jumped 17.5%.

Analog Devices (NASDAQ:ADI) gained 9.7% after beating quarterly profit and revenue estimates.

Declining issues outnumbered advancers by a 1.1-to-1 ratio on the NYSE. There were 254 new highs and 101 new lows on the NYSE.

On the Nasdaq, 1,962 stocks rose and 2,389 fell as declining issues outnumbered advancers by a 1.22-to-1 ratio.

The S&P 500 posted 28 new 52-week highs and seven new lows while the Nasdaq Composite recorded 96 new highs and 119 new lows.

Volume on U.S. exchanges was 16.36 billion shares, compared with the 15.57 billion average for the full session over the last 20 trading days.

By Thanadech Staporncharnchai and Kitiphong Thaichareon

BANGKOK (Reuters) - A Thai industry body said it wanted more government support to counter global trade risks even as data on Wednesday showed industrial sentiment at a 10-month high, and the prime minister repeated calls for the central bank to cut interest rates.The Federation of Thai Industries said its industrial sentiment index rose to a 10-month high of 91.6 in January from 90.1 in December, bolstered by government stimulus, exports and tourism.

But it said uncertainty over U.S. President Donald Trump's trade policies has subsequently affected business confidence, adding to the challenges industry faces from an influx of Chinese products and stubbornly high household debt.

"The government has to move a bit faster in implementing safeguards," said FTI vice chairman Apichit Prasoprat.

Prime Minister Paetongtarn Shinawatra told a business forum that speeding up government investment would stimulate activity and job creation to reach a target of 3% growth this year, and said the central bank should cut rates to help the public.

On Tuesday, she had said the government would push for 3.5% growth this year and would seek to work more closely with the central bank.Southeast Asia's second-largest economy grew 2.5% in 2024, lagging regional peers.

The Bank of Thailand will review policy settings on February 26. At its last meeting in December, it held interest rates steady after a surprise cut in October.

The BOT Governor told Reuters last month the policy rate remained suitable given high household debt, even though growth could miss the government target.Separately, Danucha Pichayanan, head of the National Economic and Social Development Council, said good preparations were the key to shielding the economy from the fallout of Trump's trade policies.

The government is concerned that Thailand's trade surplus with the United States could make it a target for tariffs.

"If we can prepare well for trade volatility, I believe the Thai economy will grow more than expected," Danucha said.

On Monday, the NESDC said it was maintaining its forecast range for economic growth of 2.3% to 3.3% this year.

LONDON (Reuters) - Pay increases granted by British employers held steady in the three months to January at the lowest level since 2021, signalling a shift towards more restrained rises as businesses try to cope with economic pressures, according to a survey on Wednesday.

Human resources data firm Brightmine said the median pay award held at 3% for the second consecutive rolling quarter, following a revision of figures from 3.3% for the three months to December 2024.

"This is the lowest median pay settlement recorded since December 2021," Brightmine said in a statement, adding that upcoming increases in employers' social security contributions could further influence pay decisions in the months ahead.

Employers say the government's plan to boost the social security contributions they pay from April - when Britain's minimum wage is also due to rise by almost 7% - will reduce hiring and wage growth.

Data from the Office of National Statistics showed on Tuesday that British pay growth accelerated in late 2024 but the Bank of England expects pay increases to slow soon as weakness in the economy weighs on the labour market.

The British economy stagnated in the third quarter of 2024 but unexpectedly grew 0.1% in the last three months of the year.

Brightmine's survey also showed that turnover rates have remained largely unchanged in 2024 compared to the previous year. However, more than one-third of organisations are concerned that turnover levels are too high.

"While labour turnover rates have stabilised, the combination of pay awards stalling and ongoing concerns about workload and career progression could increase resignations later in 2025," said Brightmine's Sheila Attwood.

"Employers may need to balance cost control with competitive pay and other retention measures to avoid unwanted staff losses," Attwood added.

Investing.com-- Most Asian stocks retreated on Wednesday after U.S. President Donald Trump threatened to impose more import tariffs on key sectors, while South Korean shares rallied to a five-month high on strength in technology.

But broader Asian losses were limited, as Chinese markets continued to rally on optimism over artificial intelligence and more government support.

Regional markets took middling cues from a mostly flat overnight session on Wall Street, although the S&P 500 did inch up to a record high. U.S. stock index futures rose slightly in Asian trade, appearing unperturbed by Trump’s new tariff threats.

Focus this week is on more cues from the Federal Reserve, as well as a string of key purchasing managers index readings.

Japan, HK stocks weaken as Trump threatens more tariffs

Japan’s Nikkei 225 and TOPIX indexes fell 0.4% and 0.3%, respectively. Hong Kong’s Hang Seng was the worst performer in Asia, losing as much as 0.7%.

Trump on Tuesday evening threatened to impose 25% duties on automobiles, pharmaceuticals and semiconductor imports, with his auto tariffs coming by as soon as April.

Trump did not specify a timeline for tariffs on drugs and chips, stating that he wished to give manufacturers more time to set up U.S. operations.

The move is the latest in the U.S. President’s agenda of using tariffs to further U.S. interests.

But markets clocked relatively smaller losses than seen in the past, reflecting some resilience towards Trump’s tariff threats. While the U.S. president has imposed higher tariffs on some sectors and countries over the past month, he has stopped short of imposing some of his more steep tariffs, sparking some hopes that the tariff threats will be more of a negotiating tactic.

South Korea’s KOSPI surges on tech strength

South Korea’s KOSPI was the best performer in Asia, rallying 1.8% to a five-month high.

The KOSPI has been on a tear over the past week, buoyed by hopes of improving political conditions in the country, as a trial against impeached President Yoon Suk Yeol came to a close.

The KOSPI also benefited from sustained bargain buying, after Yeol’s attempt to impose martial law in December had sparked steep losses in South Korean markets. But they now appeared to have recouped all of their recent losses.

Local chipmakers also benefited from positive sentiment towards AI, with SK Hynix Inc (KS:000660) and Samsung Electronics Co Ltd (KS:005930) rising between 2% and 4%.

Other major Asian markets advanced on Wednesday. China’s Shanghai Shenzhen CSI 300 and Shanghai Composite indexes surged around 0.7% each after President Xi Jinping met with key tech CEOs earlier this week. Beijing was also seen vowing more support for private industries.

Singapore’s Straits Times index rose 0.4%, even as index heavyweight United Overseas Bank Ltd (SGX:UOBH) fell 0.6% from record highs. But the lender clocked stronger-than-expected quarterly earnings and announced a $2.2 billion capital return.

Futures for India’s Nifty 50 index pointed to muted open, as local stocks struggled with the prospect of higher U.S. trade tariffs against India.

By Andrea Shalal and Nandita Bose

PALM BEACH, Florida (Reuters) -U.S. President Donald Trump said on Tuesday he intends to impose auto tariffs "in the neighborhood of 25%" and similar duties on semiconductors and pharmaceutical imports, the latest in a series of measures threatening to upend international trade.

On Friday, Trump said levies on automobiles would come as soon as April 2, the day after members of his cabinet are due to deliver reports to him outlining options for a range of import duties as he seeks to reshape global trade.

Trump has long railed against what he calls the unfair treatment of U.S. automotive exports in foreign markets.

The European Union, for instance, collects a 10% duty on vehicle imports, four times the U.S. passenger car tariff rate of 2.5%. The U.S., though, collects a 25% tariff on pickup trucks from countries other than Mexico and Canada, a tax that makes the vehicles highly profitable for Detroit automakers.

EU trade chief Maros Sefcovic will meet with U.S. counterparts - Commerce Secretary Howard Lutnick, Trump's nominee to be U.S. Trade Representative Jamieson Greer and National Economic Council director Kevin Hassett - in Washington on Wednesday to discuss the various tariffs threatened by Trump.

Asked whether the EU could avoid reciprocal tariffs he proposed last week, Trump repeated his claim that the EU had already signaled it would lower its tariffs on U.S. cars to the U.S. rate, although EU lawmakers have denied doing so.

He said he would press EU officials to increase U.S. imports of cars and other products.

By Andrea Shalal and Nandita Bose

PALM BEACH, Florida (Reuters) -U.S. President Donald Trump said on Tuesday he intends to impose auto tariffs "in the neighborhood of 25%" and similar duties on semiconductors and pharmaceutical imports, the latest in a series of measures threatening to upend international trade.

On Friday, Trump said levies on automobiles would come as soon as April 2, the day after members of his cabinet are due to deliver reports to him outlining options for a range of import duties as he seeks to reshape global trade.

Trump has long railed against what he calls the unfair treatment of U.S. automotive exports in foreign markets.

The European Union, for instance, collects a 10% duty on vehicle imports, four times the U.S. passenger car tariff rate of 2.5%. The U.S., though, collects a 25% tariff on pickup trucks from countries other than Mexico and Canada, a tax that makes the vehicles highly profitable for Detroit automakers.

EU trade chief Maros Sefcovic will meet with U.S. counterparts - Commerce Secretary Howard Lutnick, Trump's nominee to be U.S. Trade Representative Jamieson Greer and National Economic Council director Kevin Hassett - in Washington on Wednesday to discuss the various tariffs threatened by Trump.

PHARMA, CHIPS DUTIES

Trump told reporters at his Mar-a-Lago estate in Florida on Tuesday that sectoral tariffs on pharmaceuticals and semiconductor chips would also start at "25% or higher", rising substantially over the course of a year.

He did not provide a date for announcing those duties and said he wanted to provide some time for drug and chip makers to set up U.S. factories so that they can avoid tariffs.

Trump said he expected some of the biggest companies in the world to announce new investments in the United States in the next couple of weeks. He provided no further details.

Since his inauguration four weeks ago, Trump has imposed a 10% tariff on all imports from China, on top of existing levies, over China's failure to halt fentanyl trafficking. He also announced, and then delayed for a month, 25% tariffs on goods from Mexico and non-energy imports from Canada.

He has also set a March 12 start date for 25% tariffs on all imported steel and aluminum, eliminating exemptions for Canada, Mexico, the European Union and other trading partners. Trump also announced that these tariffs would apply to hundreds of imported downstream products made of steel and aluminum, from electrical conduit tubing to bulldozer blades.

Last week, he directed his economic team to devise plans to impose reciprocal tariffs that match the tariff rates of every country product-by-product.

SHELVED CAR TARIFFS

An auto import tariff of 25% would be a game-changer for a global auto industry that is already reeling from uncertainty caused by Trump's tariff drama.

Asked whether the EU could avoid reciprocal tariffs he proposed last week, Trump repeated his claim that the EU had already signaled it would lower its tariffs on U.S. cars to the U.S. rate, although EU lawmakers have denied doing so.

He said he would press EU officials to increase U.S. imports of cars and other products.

A similar drama played out in 2018 and 2019 during Trump's first term, when the Commerce Department conducted a national security investigation into auto imports and found that they weakened the domestic industrial base. Trump had threatened car tariffs of 25% at that time, but ultimately took no action, allowing the tariff authority from that probe to expire.

But some of the research that went into the 2018 investigation may be reused or updated as part of a new automotive tariff effort.

By Stephen Culp

NEW YORK (Reuters) - The S&P 500 squeaked past its previous record closing high on Tuesday at the top of a holiday-shortened week, with earnings season winding down, U.S. Federal Reserve minutes on tap, and geopolitical uncertainties churning in the background.

The three major stock indexes wobbled between red and green for much of the session, but all three managed to flip green in the closing minutes.

"There's a little bit of a three-day weekend hangover today," said Ryan Detrick, chief market strategist at Carson Group in Omaha. "There's just truly not a lot going on, which kind of a nice change as we simply consolidate right beneath potential new all-time highs."

"At the same time we have the Fed minutes, coming out tomorrow and big retail earnings also coming out later this week," Detrick added. "But when you put it all together, you have a day like today where it's just kind of 'wait-and-see.'"

On Wednesday, the U.S. Federal Reserve is expected to release the minutes of its January policy meeting, at which the voting members elected to let interest rates stand amid signs of an inflation rebound and the unknown extent and effects of President Trump's threatened tariffs.

Remarks from U.S. Federal Reserve policymakers largely adhered to the same script, with Philadelphia Fed President Patrick Harker, Governors Michelle Bowman and Christopher Waller saying they believe economic strength and elevated inflation warrant holding the policy rate steady for the time being.

San Francisco Fed President Mary Daly reiterated that a pause in rate cuts is appropriate until more visible progress is made toward bringing inflation down to the Fed's 2% goal.

The minutes will be scrutinized for clues regarding the central bank's path forward, particularly in light of recent data, which shows price growth gaining momentum, falling consumer sentiment and weaker-than-expected retail sales.

"The Fed is being reasonably transparent here," said Chuck Carlson, chief executive officer at Horizon Investment Services in Hammond, Indiana. "There's been evidence that the economy is slowing down a little bit and I'm sure they're watching that. But I don't think they feel significant pressure, at least at this point, to drop rates anytime soon."

The Dow Jones Industrial Average rose 10.26 points, or 0.02%, to 44,556.34, the S&P 500 gained 14.95 points, or 0.24%, to 6,129.58 and the Nasdaq Composite gained 14.49 points, or 0.07%, to 20,041.26.

Fourth-quarter earnings season has come around the final bend, with 383 companies in the S&P 500 having reported as of Friday. Of those, 74% have posted better-than-expected results, according to LSEG data.

Analysts currently see fourth-quarter S&P 500 earnings growth of 15.3% year-on-year, up from the 9.6% estimate as it stood on Jan. 1.

Intel (NASDAQ:INTC) jumped 16.1% after a report over the weekend said rivals Taiwan Semiconductor Manufacturing Co. and Broadcom (NASDAQ:AVGO) were considering potential deals that could split the chipmaker in two.

The move gave a boost to the Philadelphia SE semiconductor index, which gained 1.7%.

Constellation Brands (NYSE:STZ) jumped 4.0% after Warren Buffett's Berkshire Hathaway (NYSE:BRKa) disclosed a new investment in the company on Friday.

Meta Platforms (NASDAQ:META) slid 2.8%, snapping its 20-session winning streak.

Advancing issues outnumbered decliners by a 1.53-to-1 ratio on the NYSE. There were 298 new highs and 85 new lows on the NYSE.

On the Nasdaq, 2,289 stocks rose and 2,087 fell as advancing issues outnumbered decliners by a 1.1-to-1 ratio.

The S&P 500 posted 29 new 52-week highs and 11 new lows while the Nasdaq Composite recorded 126 new highs and 113 new lows.

Volume on U.S. exchanges was 16.36 billion shares, compared with the 15.57 billion average for the full session over the last 20 trading days.