Select Language

By Lisa Baertlein

(Reuters) - U.S. container imports hit a record high in January, with goods from China notching a year-over-year gain of 10.2%, supply chain technology provider Descartes (NASDAQ:DSGX) said on Monday.

U.S. seaports handled 2.49 million 20-foot equivalent units (TEUs) in January, topping the previous January import record set in 2022. Goods from China accounted for 997,909 TEUs of last month's total.

Some U.S. importers have been rushing in some goods ahead of expected new tariffs and other potential supply-chain disruptions. Goods ranging from plastic toys to parts from machinery have ticked higher in recent months, experts said.

President Donald Trump imposed a new 10% tariff on Chinese goods as of February 4 but paused until March more aggressive 25% tariffs on imports from Mexico and Canada to allow for further negotiations.

By Lisa Baertlein

(Reuters) - U.S. container imports hit a record high in January, with goods from China notching a year-over-year gain of 10.2%, supply chain technology provider Descartes (NASDAQ:DSGX) said on Monday.

U.S. seaports handled 2.49 million 20-foot equivalent units (TEUs) in January, topping the previous January import record set in 2022. Goods from China accounted for 997,909 TEUs of last month's total.

Some U.S. importers have been rushing in some goods ahead of expected new tariffs and other potential supply-chain disruptions. Goods ranging from plastic toys to parts from machinery have ticked higher in recent months, experts said.

President Donald Trump imposed a new 10% tariff on Chinese goods as of February 4 but paused until March more aggressive 25% tariffs on imports from Mexico and Canada to allow for further negotiations.

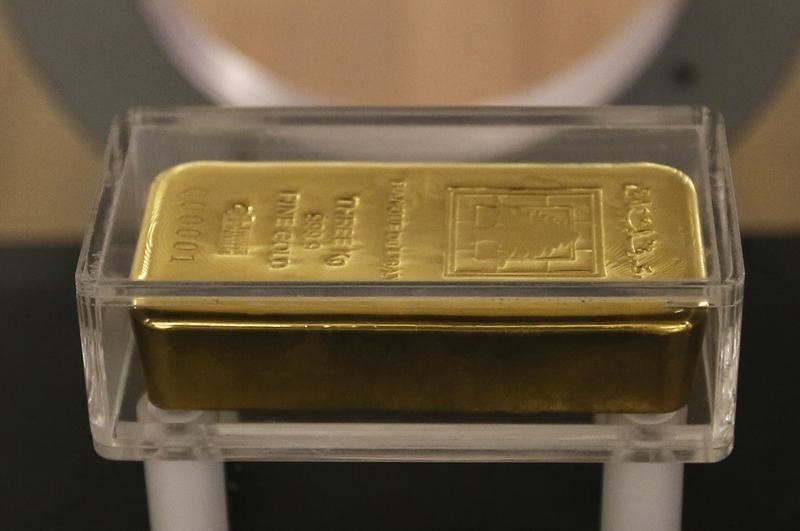

Investing.com-- Gold prices rose to record highs on Monday, buoyed by increased safe haven demand after U.S. President Donald Trump announced more trade tariffs, this time aimed at commodity imports.

Trump also flagged the potential for more tariffs this week, keeping markets largely on edge. Risk-driven assets retreated across Asia, while the dollar firmed.

But strength in the dollar did little to limit gold’s near-term advance.

Spot gold rose 1.1% to a record high $2,892.30 an ounce, while gold futures expiring in April rose 0.9% to $2,916.05 an ounce.

Trump announces 25% tariffs, sends traders running for gold

Trump on Sunday said he will impose 25% trade tariffs on all imports of aluminum and steel to the U.S., sparking jitters over more headwinds to global trade.

Trump also flagged plans for reciprocal tariffs, which will see U.S. import duties increased to match those imposed by the country’s other trading partners.

The announcement came just days after Trump’s 10% tariffs against China took effect. Beijing had retaliated with its own trade measures against the tariffs.

The tariffs ramped up concerns over an escalating trade war between the world’s biggest economies, which could disrupt trade and bode poorly for global growth.

This notion spurred safe haven plays into gold.

Other precious metals were less upbeat. Silver futures were flat at $32.465 an ounce, while platinum futures rose 0.6% to $1,015.10 an ounce.

Among industrial metals, benchmark copper futures on the London Metal Exchange were flat at $9,416.45 a ton, while March copper futures fell slightly to $4.5990 a pound.

Gold gains limited by rate jitters; inflation in focus

While gold was sitting on strong gains and record highs in the past week, bigger gains were somewhat limited by resilience in the dollar, with traders also bracing for high U.S. interest rates in the coming months.

Analysts and Federal Reserve officials have warned that Trump’s tariffs, which will be borne by U.S. importers, could underpin inflation and give the Fed less impetus to cut interest rates.

To this end, U.S. consumer price index inflation data for January is due later this week, and is widely expected to factor into expectations for U.S. interest rates.

Investing.com-- Asian stocks had a mixed start to the week, with most indices retreating after fresh tariff announcements from U.S. President Donald Trump, while Chinese shares extended their rally on optimism around AI and fresh stimulus hopes following weak inflation data.

U.S. stock index futures were higher in Asia hours on Monday.

Asia mining stocks drop after Trump tariffs on steel, aluminum imports

Most Asian stock markets were under pressure after Trump announced new 25% tariffs on all steel and aluminum imports.

This move has heightened concerns over escalating trade tensions and their potential impact on the global economy.

China’s retaliatory tariffs on U.S. goods are set to take effect later in the day, and is further contributing to a subdued sentiment.

South Korea’s KOSPI ticked 0.1% lower, but major steel producers experienced notable declines.

POSCO (NYSE:PKX) Holdings (KS:005490) shares dropped nearly 2%, while Hyundai Steel (KS:004020) stock saw a 2.5% fall.

Japan’s Nikkei 225 edged 0.2% lower, while TOPIX fell 0.3%. Nippon Steel Corp (TYO:5401) shares were 1.5% lower, while Uacj Corp (TYO:5741) fell more than 1%

Australia's S&P/ASX 200 index fell 0.4%, with the mining sub-index S&P/ASX 300 Metals & Mining dropping nealy 1%.

Indonesia's Jakarta Stock Exchange Composite Index index slumped 2%, while India's Nifty 50 opened 0.4% lower.

China AI stocks extend bullish run, markets assess Jan CPI

Despite the escalating trade war between the world’s two biggest economies, China's AI sector, led by companies like DeepSeek, has demonstrated resilience, bolstering investor confidence.

China’s Shanghai Composite rose 0.4% on Monday, while the Shanghai Shenzhen CSI 300 index was largely unchanged. Hong Kong’s Hang Seng index jumped 1.5%.

Hong Kong-listed Chinese AI-related stocks continued their bullish run.

Baidu (NASDAQ:BIDU) Inc (HK:9888) shares gained 3.5%, while Alibaba (NYSE:BABA) Group (HK:9988) stock jumped more than 4%.

Xiaomi (OTC:XIACF) Corp (HK:1810) shares were 1.5% higher after hitting a record high in the previous session.

Meanwhile, investors assessed the January inflation report from China.

The consumer price index (CPI) rose moderately in January, while the producer price index (PPI) saw consistent declines.

This data highlighted persistent weakness in both household spending and industrial activity, key drivers of economic growth.

Markets are closely watching China’s policy response. Weak inflation could prompt Beijing to roll out more stimulus measures, such as interest rate cuts or infrastructure spending, to boost its sluggish economy.

By Makiko Yamazaki

TOKYO (Reuters) - Japan's current account surplus jumped to a record last year, data from the finance ministry showed on Monday, as a weaker yen boosted returns on foreign investments that helped to comfortably offset a trade deficit.

The surplus in the current account stood at 29.3 trillion yen ($192.67 billion) in 2024, the largest since comparable data became available in 1985. It represented a 29.5% increase from the previous year.

Primary income from securities and direct investment overseas remained the biggest driver with a record 40.2 trillion yen in surplus, as Japanese companies pursue growth abroad, including acquisitions of foreign firms.

The trade deficit narrowed by 40% to 3.9 trillion yen on brisk exports of automobiles and chipmaking equipment as well as lower costs of energy imports.

The surplus from travel rose to 5.9 trillion yen, reflecting thriving inbound tourism.

For December, Japan's current account surplus stood at 1.08 trillion yen, down from the previous month's 3.35 trillion yen.

The country's current account surplus was once considered a sign of export might and a source of confidence in the safe-haven yen.

But the composition has changed over the last decade with trade no longer generating a surplus due to a surge in the cost of energy imports and an increase in offshore manufacturing by Japanese companies.

Japan now offsets the trade deficit with the robust primary income surplus, which includes interest payments and dividends from past investments overseas.

But the bulk of such income earned overseas is re-invested abroad instead of being converted into yen and repatriated home, which analysts say may be keeping the Japanese currency weak.

"There is no reason to repatriate because overseas investments yield higher returns than at home," said Norinchukin Research Institute chief economist Takeshi Minami.

Japan is now facing pressure from the United States, its largest export destination, to close its $68.5 billion annual trade surplus, a call that President Donald Trump made during Prime Minister Shigeru Ishiba's first White House visit on Friday.

($1 = 151.5700 yen)

BEIJING (Reuters) -China's consumer inflation accelerated to its fastest in five months in January while producer price deflation persisted, reflecting mixed consumer spending and weak factory activity.

Deflationary pressures are likely to persist in China this year, analysts say, unless policymakers can rekindle sluggish domestic demand, with tariffs by U.S. President Donald Trump on Chinese goods adding pressure on Beijing to spur growth in the world's second-largest economy.

The consumer price index rose 0.5% last month from a year earlier, quickening from December's 0.1% gain, data from the National Bureau of Statistics showed on Sunday, above the 0.4% rise estimate in a Reuters poll of economists.

Core inflation, excluding volatile prices for food and fuel, sped up to 0.6% in January from 0.4% the previous month.

Although consumer prices are expected to rise gradually, producer prices are unlikely to return to positive territory in the short term as overcapacity in industrial goods persists, said Xu Tianchen, senior economist at the Economist Intelligence Unit.

"If measured by the GDP deflator, it will still take a few quarters to get out of deflation, " Xu said.

The numbers were skewed by seasonal factors, as the Lunar New Year, China's biggest annual holiday, began in January this year versus February last year. Typically, prices rise as consumers stockpile goods, particularly food for big family gatherings.

Prices of airplane tickets rose 8.9% from a year earlier, tourism inflation was 7.0% and movie and performance ticket prices rose 11.0%.

Consumer spending reports over the holidays were mixed, reflecting worries over wage and job security.

Investing.com-- U.S. President Donald Trump said on Sunday that he will announce additional 25% tariffs on all steel and aluminum imports into the U.S., and will also announce reciprocal duties over what he sees as unfair trading practices.

Speaking to reporters on Air Force One, Trump said he will announce the 25% tariffs on Monday, and will announce the reciprocal tariffs on Tuesday or Wednesday, with both duties to be effective immediately.

The president was on his way to the NFL Super Bowl in New Orleans- a route that saw him fly over the Gulf of America, which the president had recently renamed from the Gulf of Mexico.

Trump on Sunday also signed an executive order recognizing February 9 as “Gulf of America Day.”

Trump’s tariff threat comes just days after his 10% duties against China took effect, as the U.S. president uses tougher trade policy to push through his broader international agenda. Beijing had retaliated with a slew of measures and duties.

He had threatened 25% tariffs against Canada and Mexico over stricter border control, but had postponed the tariffs on assurances from the two countries.

Canada, Brazil, Mexico, South Korea, and Vietnam are the biggest exporters of steel to the U.S., government data showed.

Canada is also by far the biggest exporter of aluminum to the U.S.

Trump had in his first term imposed 25% tariffs on steel and 10% tariffs on aluminum, but had later granted duty-free quotas to allies such as Canada, Mexico, and Brazil.

On reciprocal tariffs, Trump said he will hold a conference later this week to provide more information on reciprocal trade tariffs- plans for which he had first revealed on Friday.

The president has consistently criticized uneven import duties imposed by other countries on U.S. goods. He has long criticized the European Union’s 10% tariffs on U.S. auto imports, which is much higher than the 2.5% import duty charged by the U.S.

Analysts and Federal Reserve officials have expressed some concerns that Trump’s trade tariffs- which will be borne by U.S. importers, will push up inflation in the coming months.

U.S. stock index futures crept lower after Trump’s announcement.

Investing.com-- Gold prices rose in Asian trade on Friday, remaining in sight of recent record highs as traders favored safe havens amid uncertainty before key U.S. nonfarm payrolls data.

The yellow metal was set for strong weekly gains as a renewed trade war between the U.S. and China spurred haven demand, while weakness in the dollar also helped.

Fears of renewed tensions in the Middle East, after U.S. President Donald Trump claimed that the U.S. would take over the Gaza strip, also fueled some haven demand for gold.

Spot gold rose 0.2% to $2,862.67 an ounce, while gold futures rose 0.3% to $2,884.81 an ounce by 00:58 ET (05:58 GMT). Spot prices were up 2.4% this week.

Citi and UBS analysts hiked their gold price forecasts for 2025, stating that the yellow metal was likely to extend its bull market through the rest of the year. Citi sees gold hitting $3,000 an ounce in the short-term, while UBS expects $3,000 an ounce by end-2025.

Gold upbeat ahead of nonfarm payrolls data

Spot prices remained close to a record high of $2,882.35 an ounce, as weakness in the dollar underpinned the yellow metal.

But the dollar steadied on Friday, with focus turning to key nonfarm payrolls data due later in the day.

Traders were bracing for a strong payrolls reading, especially amid signs of continued resilience in the labor market. A strong labor market gives the Federal Reserve less impetus to cut interest rates.

The central bank recently signaled that it had no plans to cut interest rates quickly, amid uncertainty over sticky inflation and Trump’s policies.

Investing.com– Most Asian stocks fell on Friday but Chinese shares extended gains on AI optimism despite U.S. tariffs, while focus turned to the Reserve Bank of India’s interest rate decision due later in the day.

U.S. stock index futures were largely unchanged in Asian trading after a mixed close on Wall Street.

RBI rate decision in focus; Asian central banks see pre-emptive rate cuts

The RBI will decide on its interest rates and cash reserve ratio later in the day.

Economists widely expect the central bank to cut the benchmark repo rate by 25 basis points to 6.25%, marking the first rate reduction since May 2020.

India’s Nifty 50 Futures signaled a positive start at the open.

Recent domestic data showed that India's retail inflation eased to a four-month low of 5.2% in December, but was still above the RBI's medium-term target of 4%.

On the growth front, India's economy is projected to expand at 6.4% in the current fiscal year, a slowdown from the 8.2% growth recorded in the previous year.

These factors, coupled with growing uncertainty around U.S. policies, have bolstered bets for a rate cut.

“Due to uncertainty surrounding tariffs and external demand, Asian central banks are becoming more cautious about the domestic growth outlook, leading to pre-emptive rate cuts.” ING analysts said in a recent note.

Recently, Singapore eased monetary policy for the first time in almost five years, while Indonesia saw unexpected rate cuts.

China stocks rise bucking the regional trend

Despite the imposition of 10% tariffs by the Donald Trump administration on Chinese goods, China's AI sector, led by companies like DeepSeek, has demonstrated resilience, bolstering investor confidence.

China’s Shanghai Composite rose 0.8% on Friday, while the Shanghai Shenzhen CSI 300 index jumped 1%. Hong Kong’s Hang Seng index advanced 0.9%.

Hong Kong-listed Lenovo Group (HK:0992) jumped 7.5%, while Xiaomi (OTC:XIACF) Corp (HK:1810) rose 4.8%.

Elsewhere, most regional stocks were lower amid global uncertainty around Donald Trump’s policies, keeping investors away from riskier assets.

Indonesia’s Jakarta Stock Exchange Composite Index slumped 1.7%, while Thailand’s SET Index declines 1.9%

Japan’s Nikkei 225 lost 0.5% while TOPIX fell 0.4%.

South Korea's KOSPI index was 0.3% weaker, while Singapore's Straits Times Index was largely unchanged.

Australia's S&P/ASX 200 index advanced 0.4%.