Select Language

Investing.com - European stock markets edged higher Friday, with investors digesting more corporate earnings as well as regional inflation data after the European Central Bank’s latest easing of monetary policy.

At 03:05 ET (08:05 GMT), the DAX index in Germany climbed 0.1%, the CAC 40 in France gained 0.2% and the FTSE 100 in the UK rose 0.2%.

ECB boosts sentiment

Sentiment has been boosted by the decision of the European Central Bank to cut interest rates on Thursday, as widely expected, and to also keep the door open to further policy easing amid concerns over lackluster economic growth.

It was the fifth ECB rate cut since June and markets expect as many as three more reductions this year.

Further evidence of the difficulties the German economy, the largest in the eurozone, is suffering came with the release of the latest retail sales data, which showed a fall of 1.6% on the month in December.

Investors will also study preliminary inflation readings from Germany, after the French consumer price index for January rose below the ECB’s 2% medium term target.

Across the pond, December's core PCE price index in the United States - the Federal Reserve's preferred measure of inflation - is set for release later in the session, and could provide further clues on the central bank's rate outlook.

Novartis boosted by strong demand for key drugs

In the corporate sector, Novartis (SIX:NOVN) reported strong fourth-quarter results Friday, with the Swiss drugmaker citing strong demand for established heart failure drug Entresto and multiple sclerosis drug Kesimpta.

Investing.com –Asian currencies declined on Friday, led by sharp losses in the South Korean won and Malaysian ringgit, as markets were rattled by fresh tariff threats from U.S. President Donald Trump, while the Japanese yen remained steady following strong inflation data from Tokyo.

Trump threatened that he would impose significant trade tariffs on BRICS nations should the bloc pursue plans to develop a common currency aimed at reducing reliance on the U.S. dollar.

The US Dollar Index was marginally higher in Asian trading hours on Friday, while Dollar Index Futures rose 0.4%.

The greenback was supported by expectations of slower rate cuts in 2025, and the lingering impact of Trump's tariff policies.

Trump's tariff threat sparks risk-off mood, Asia FX tumbles

Trump’s proposal to impose steep tariffs rattled markets, particularly export-reliant economies.

The South Korean won tumbled 0.8% against the U.S. dollar on Friday, with the USD/KRW pair set to rise nearly 2% for the week.

The Malaysian ringgit’s USD/MYR pair jumped 0.8%, and was on track for a 1% weekly gain.

Trump on Thursday reiterated his intention to implement a 25% tariff on imports from Canada and Mexico starting this Saturday, with potential additional tariffs on Chinese goods.

Additionally, he threatened that the BRICS bloc, which consists of Brazil, Russia, India, China, South Africa, and others, could face “100% tariffs” if they move away from the dollar.

Earlier in the week, the U.S. Federal Reserve held rates unchanged and indicated that the policy would remain restrictive until inflation is fully tamed.

With expectations of higher-for-longer U.S. rates, and prospects of a stronger dollar, Asian currencies faced further downward pressure..

The Chinese yuan’s onshore pair USD/CNY inched 0.2% higher, while the offshore pair USD/CNH was largely muted.

The Singapore dollar’s USD/SGD pair inched 0.2% higher, while, the Indian rupee’s USD/INR pair ticked up 0.1%.

The Indonesian rupiah fell further, with the USD/IDR pair rising 0.4%, even after the Bank Indonesia intervened to Thursday to assure the markets of stable supply and demand in forex markets

The Australian dollar's AUD/USD pair inched 0.2% amid rate hike bets.

Japanese yen muted despite rate hike bets after Tokyo CPI

The Japanese yen’s USD/JPY pair was largely unchanged, in line with the broader mood, even as a strong inflation print from Tokyo kept rate hike bets alive.

Data on Friday showed that Tokyo's consumer price index (CPI) inflation rose as expected in January, reaching a nearly two-year high, driven by strong private spending.

Headline CPI inflation accelerated to 3.4% year-on-year, up from 3% in December, marking its highest level since April 2023, while core CPI, which excludes fresh food prices, increased 2.5% year-on-year, hitting an 11-month high.

With a strong inflation print, market participants firmed up interest rate hike bets, although the Bank of Japan is not expected to raise rates further until at least mid-2025.

By Rae Wee

SINGAPORE (Reuters) - The yen was on track for its best monthly start to the year since 2018 on Friday, helped by the view that the Bank of Japan (BOJ) is likely to keep raising rates this year while its global peers elsewhere look to ease policy.

The Mexican peso and Canadian dollar were on guard ahead of a looming Feb. 1 deadline which U.S. President Donald Trump has said would be the date he imposes 25% tariffs on imports from the two countries.

The loonie languished near a five-year low at C$1.4490 and was set for a weekly decline of 1%.

Mexico's peso was recovering from its steep fall from the previous session and last stood at 20.6849 per dollar, though it remained on track for its worst weekly performance since October with a roughly 2% fall.

"If (Trump) wants to talk tough, he's got to act tough as well, and that starts with actually announcing something concrete tomorrow," said Tony Sycamore, a market analyst at IG.

"It's something which I think is coming and more than likely we'll get some more colour on that tomorrow ... It's not good to keep the uncertainty overhanging markets."

In Japan, the yen was last a touch stronger at 154.19 per dollar, having already climbed more than 1% for the week thus far. It was set to gain 1.9% for the month, which would mark its best January performance in seven years.

The yen has drawn support from expectations of further rate hikes from the BOJ this year, with Deputy Governor Ryozo Himino also saying on Thursday that the central bank will continue to raise interest rates if the economy and prices move in line with the bank's forecasts.

WASHINGTON (Reuters) - The U.S. Treasury Department said on Thursday it was withdrawing from a global body of central banks and regulators devoted to exploring ways to police climate risk in the financial system.

"The U.S. Department of the Treasury's (Treasury) Federal Insurance Office (FIO) today notified the Network of Central Banks and Supervisors for Greening the Financial System (NGFS) that it is withdrawing its membership," the U.S. Treasury Department said in a statement.

By Anjana Anil and Sherin Elizabeth Varghese

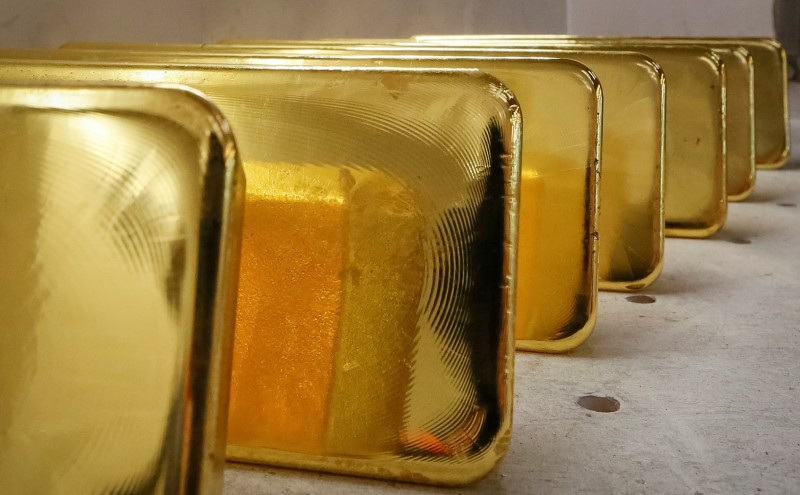

(Reuters) - Safe-haven demand due to geopolitical uncertainties and concerns over global economic growth amid U.S. President Donald Trump's tariff plans have hoisted gold prices to a record high, once again bringing the key $3,000 threshold onto investors' radar.

Spot gold climbed to a record high of $2,798.40 a troy ounce on Thursday, starting 2025 with fresh vigour after logging its strongest annual performance since 2010 last year.

"There's concerns that some of the (economic) growth may come down because of the policies and tariffs that the current administration is looking to implement," said Phillip Streible, chief market strategist at Blue Line Futures.

"So when you've got higher inflation and lower growth, stagflation becomes the economic theme. Gold tends to work very well in that particular environment."

Trump's tariff plans are widely perceived as inflationary and with potential to trigger trade wars, driving up safe-haven demand for bullion as it is traditionally seen as a hedge against price pressures and geopolitical uncertainty.

"I can see (gold) trying to reach up to that $2,900 level at some point during the first quarter; after we breach that, we'll set new levels," said Bob Haberkorn, senior market strategist at RJO Futures.

"At some point this year, gold could ultimately trade north of $3,000."

THE US MARKET

Amid concerns about the U.S. import tariff plans, the U.S. gold futures have been trading at a premium to the spot price for several months and widened the price spread again on Thursday.

In a sign of these concerns, 12.9 million troy ounces of gold were delivered to COMEX-approved warehouses since late November, raising stocks there by 73.5% to 30.4 million ounces, the highest since July 2022.

The deliveries came from London, Switzerland and other major gold-trading hubs.

The London Bullion Market Association said on Thursday that it was monitoring the situation and liaising with CME Group (NASDAQ:CME) and U.S. authorities.

London gold market stocks and liquidity remain strong with the average daily trade volume since the start of January is 47.1 million ounces, the association added.

GOLD AND THE US RATE EXPECTATIONS

Gold hit multiple record peaks last year, bolstered by the Federal Reserve's rate-cutting cycle, safe-haven demand and robust central bank buying.

The Fed, in its January meeting kept benchmark interest rates unchanged as widely expected, after easing a full basis point in 2024. This marks the first pause since the start of its easing cycle in September.

The non-yielding bullion tends to thrive in a low-interest rate environment.

As to purchases by central banks, the People's Bank of China has been a key driver of gold demand as it kept on adding bullion to its reserves over the past year despite the price growth - in what analysts see as the PBOC's broader strategy to diversify the reserves.

Analysts suggest that continued purchases by China's central bank could provide further support to gold prices in the coming months.

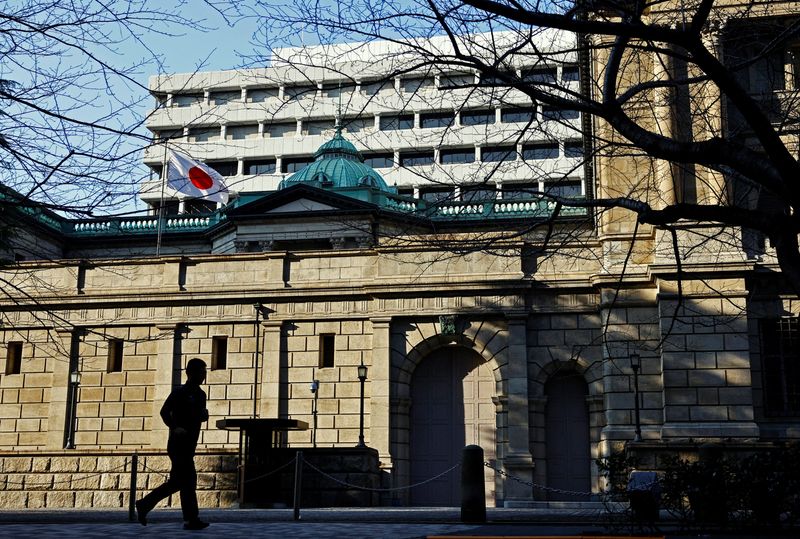

By Leika Kihara and Makiko Yamazaki

TOKYO (Reuters) -The Bank of Japan raised interest rates on Friday to their highest since the 2008 global financial crisis and revised up its inflation forecasts, underscoring its confidence that rising wages will keep inflation stable around its 2% target.

The decision marks its first rate hike since July last year and comes days after the inauguration of U.S. President Donald Trump, who is likely to keep global policymakers vigilant ahead of potential repercussions from threatened higher tariffs.

BOJ Governor Kazuo Ueda told a news conference that the weak yen continued to put upward pressure on import prices, while wage hikes were becoming more embedded and broad-based among companies.

"We have not preset idea," he said on the timing of the next rate hike, saying the BOJ will make a decision on a meeting-to-meeting basis by looking at data available at the time.

At its two-day meeting concluding on Friday, the BOJ raised its short-term policy rate from 0.25% to 0.5% - a level Japan has not seen in 17 years. It was made in a 8-1 vote with board member Toyoaki Nakamura dissenting.

The widely expected move underscores the central bank's resolve to steadily push up interest rates to around 1% - a level analysts see as neither cooling nor overheating Japan's economy.

It also marks another step Japan is taking away from the deflation and stagnant economic growth that dogged the country for decades.

"The likelihood of achieving the BOJ's outlook has been rising," with many firms saying they will continue to raise wages steadily in this year's annual wage negotiations, the central bank said in a statement announcing the decision.

"Underlying inflation is heightening towards the BOJ's 2% target," the central bank said, adding that financial markets remain stable as a whole.

The BOJ made no change to its guidance on future policy, saying that it will continue to raise interest rates if its economic and price forecasts are realized.

But it removed a phrase stressing the need to scrutinise risks surrounding overseas economies and markets, underscoring its conviction that solid U.S. growth will underpin Japan's economy - at least for now.

The BOJ revised up its inflation forecasts and said risks to the price outlook were skewed to the upside, signaling its focus on the growing case for more rate hikes.

"Their logic remains the same. They are still far away from neutral, so it's natural to make an adjustment," said Naka Matsuzawa, chief macro strategist at Nomura Securities in Tokyo.

"Unless the BOJ either changes the logic of rate hikes, or even raises the neutral point, which they have been mulling - about 1% - there's not going to much room for the market to price in further hikes in the future."

The BOJ's path is bound with uncertainty, however, with trade uncertainties and Trump calling for further rate cuts by the U.S. Federal Reserve and similar action from central banks around the world.

The yen rose around 0.5% to 155.32 per dollar after the BOJ's decision and inflation upgrades, while the two-year Japanese government bond (JGB) yield rose to 0.705%, the highest since October 2008.

In its quarterly outlook report, the board raised its price forecasts to project core inflation moving at or above its 2% target for three straight years.

It also said risks to the inflation outlook were skewed to the upside amid intensifying labour shortages, rising prices of rice and the boost to import costs from a weak yen.

"With regards to this year's annual wage negotiations, there have been many views expressed by firms that they will continue to raise wages steadily," the report said.

The head of Japan's union umbrella group told Reuters on Friday that Japanese annual pay increases must exceed the 5.1% secured last year as real wages continue to fall.

The board now projects core consumer inflation to hit 2.4% in fiscal 2025 before slowing to 2.0% in 2026. In the previous projection made in October, it expected inflation to hit 1.9% in both fiscal 2025 and 2026.

It made no change to its forecasts that Japan's economy will grow 1.1% in fiscal 2025 and 1.0% in 2026.

While the U.S. economy has been solid and financial markets stable as a whole, the BOJ must be vigilant to uncertainties surrounding U.S. policy conduct, the report said.

"The hike may have been expected but in what feels like the first time in a very long time, there were no major downgrades to their economic outlook," said Matt Simpson, senior market analyst at City Index in Brisbane.

"This keeps the door open to another 25bps hike by the year-end, and rates to sit at a whopping 0.75%."

Japan's core consumer inflation accelerated to 3.0% in December, the fastest annual pace in 16 months, data showed earlier on Friday, in a sign rising fuel and food prices continue to push up living costs for households.

After taking the helm in April 2023, Ueda dismantled his predecessor's radical stimulus programme in March last year, and pushed up short-term interest rates to 0.25% in July.

BOJ policymakers have repeatedly said the central bank will keep raising rates, if Japan makes progress in achieving a cycle in which rising inflation boosts wages and lifts consumption - thereby allowing firms to continue passing on higher costs.

By Sinéad Carew and Johann M Cherian

(Reuters) -The benchmark S&P 500 rose to a record closing high on Thursday, as investors assessed a mixed bag of corporate earnings and digested comments from President Donald Trump, including a call for cuts in interest rates and oil prices.

At the World Economic Forum in Davos, Switzerland, Trump demanded that OPEC lower oil prices and that central banks reduce interest rates, while he warned global business leaders they will face tariffs for products made outside of the U.S.

While investors have been cautiously monitoring Trump's comments about tariffs, they "like the idea of interest rates coming down, of oil prices coming down," said Lindsey Bell, chief strategist at 248 Ventures.

"All in all, the market is optimistic the more they hear about Trump policies. We're just seeing a reflection of that optimism," said Bell.

However, investors have been concerned that tariffs could add to inflation pressures and slow the pace of interest rate cuts by the U.S. Federal Reserve.

The Fed is expected to leave interest rates unchanged next week at its first policy meeting of the year.

Peter Tuz, president of Chase Investment Counsel in Charlottesville, Virginia, said the Fed is expected to base rate decisions on economic data rather than presidential demands.

"I don't think the Fed is going to pay much attention to this," said Tuz, referring to Trump's comments on rates. "They're looking at the data and they're going to make their decision based on what they see."

By Michelle Nichols

UNITED NATIONS (Reuters) - The United States will leave the World Health Organization on Jan. 22, 2026, the United Nations said on Thursday, after being formally notified of the decision by President Donald Trump, who has accused the agency of mishandling the pandemic and other international health crises.

Trump announced the move on Monday, hours after he was sworn in for a second four-year term. The WHO said on Tuesday that it regretted the move from its top donor country.

Trump must give a one-year notice of U.S. withdrawal from the Geneva-based body and pay Washington's dues under a 1948 joint resolution of the U.S. Congress.

The United States is by far the WHO's biggest financial backer, contributing around 18% of its overall funding. WHO's most recent two-year budget, for 2024-2025, was $6.8 billion. It was not immediately clear how much the U.S. owes.

"I can confirm we have now received the U.S. letter on the WHO withdrawal. It is dated 22 January 2025. It would take effect a year from yesterday, on 22 January 2026," said deputy U.N. spokesperson Farhan Haq.

The U.S. departure will likely put at risk programs across the organization, according to several experts inside and outside the WHO, notably those tackling tuberculosis, the world’s biggest infectious disease killer, as well as HIV/AIDS and other health emergencies.

The withdrawal order signed by Trump said the administration would cease negotiations on the WHO pandemic treaty while the withdrawal is in progress. U.S. government personnel working with the WHO will be recalled and reassigned, and the government will look for partners to take over necessary WHO activities, according to the order.

By Leika Kihara

TOKYO (Reuters) - Japan's core consumer prices rose 3.0% in December from a year earlier to mark the fastest annual pace in 16 months, data showed on Friday, keeping alive market expectations that the central bank will keep raising ultra-low interest rates.

The data comes hours before the Bank of Japan concludes its two-day policy meeting, when it is expected to raise short-term interest rates to 0.5% from 0.25%.

The increase in the core consumer price index (CPI), which excludes the impact of volatile fresh food prices, matched a median market forecast and followed a 2.7% gain in November.

It was the largest year-on-year increase since a 3.1% gain marked in August 2023.

The rise was due largely to the phase-out of government subsidies aimed at curbing utility bills, and the impact of stubbornly high food prices as the weak yen kept import costs elevated.

An index stripping away the effect of both fresh food and fuel costs, which is closely watched by the BOJ as a better gauge of price pressure driven by domestic demand, rose 2.4% in December from a year earlier, steady from November.

The BOJ ended negative interest rates in March and raised its short-term rate target to 0.25% in July on the view Japan was on track to sustainably meet the bank's 2% inflation target.

Governor Kazuo Ueda has signalled readiness to raise rates further if broadening wage hikes underpin consumption and allow companies to keep hiking prices not just for goods but services.

By Lucy Craymer

WELLINGTON (Reuters) -People leaving New Zealand hit record levels in the year to November 2024, in another sign of the weakness in the country’s economy that moved to a technical recession in the third quarter.

Data released by Statistics New Zealand on Thursday showed that 127,800 people left the Pacific nation in the year to November, up 28% on the prior 12 month period. This was provisionally the highest number of people leaving in an annual period ever, according to the statistics bureau.

Of those leaving, more than 50% were New Zealand citizens, according to the data.

New Zealand, which has a population of just 5.3 million, has seen its economy struggle over the last couple of years as the central bank increased the official cash rate to dampen historically high inflation.

Michael Gordon, senior economist at Westpac said that a lot of people come to New Zealand for work opportunities and when these dry up people leave.

"It’s about work opportunities, especially here (New Zealand) versus Australia. Australia’s economy is still running reasonably strongly," Gordon said. “There are more opportunities over there now so we are seeing quite high outflows of Kiwis.”

However, people leaving does continue to be offset by inward migration.

Statistics New Zealand said net migration – the number of people moving to New Zealand permanently minus those leaving New Zealand – was at 30,600 in the year to November 2024. Net migration peaked in the year ended October 2023 at 135,700.

Gordon added that net migration was now back at historic averages and that over the longer term net migration would support the country's economy.

“It’s something to keep in mind, that for a big chunk of the world, New Zealand is an attractive place to live, but also for us (New Zealanders) there are also places look more attractive Australia, or going to the U.S. or the UK,” Gordon said.