Select Language

SEOUL (Reuters) - A voting board member, Shin Sung-hwan, who dissented in the Bank of Korea's decision to keep policy rates unchanged in January, said the economy faces bigger risks due to domestic political turmoil and U.S. policy changes, minutes from the bank's meeting showed on Tuesday.

The Bank of Korea on Jan. 16 unexpectedly voted 6-1 to keep its policy interest rate unchanged and signalled it needed to wait for the domestic political turmoil weighing on the currency to stabilise before it could make further rate cuts.

Only Shin voted to cut interest rates by 25 basis points on Jan. 16, when the bank decided to keep its benchmark interest rate unchanged at 3.00%.

Most, including Shin, said the bank should be open to near-term policy easing in the face of increased political and external uncertainties as South Korea continues to grapple with the worst political turmoil in decades after impeached President Yoon Suk Yeol's brief imposition of martial law.

They also cited uncertainties related to U.S. President Donald Trump's trade policies, describing this as clouds hanging over the trade-reliant nation.

"It is desirable to cut the interest rate after examining the effect of the last two interest rate cuts and observing the policy direction of the new U.S. government, as well as the U.S. Federal Reserve's interest rate decision, and the political and economic situation at home and abroad," one of the board members said.

Only dissenters were identified in the minutes.

South Korea's exports fell in January for the first time in 16 months and at the sharpest pace in a year and a half due to U.S. tariff uncertainty and an unfavourable calendar effect, preliminary data released on Saturday showed.

By Trevor Hunnicutt and Kevin Huang

WASHINGTON/BEIJING (Reuters) -China on Tuesday slapped tariffs on U.S. imports in a swift response to new U.S. duties on Chinese goods, renewing a trade war between the world's top two economies as President Donald Trump sought to punish China for not halting the flow of illicit drugs.

Trump's additional 10% tariff across all Chinese imports into the U.S. came into effect at 12:01 a.m. ET on Tuesday (0501 GMT).

Within minutes, China's Finance Ministry said it would impose levies of 15% for U.S. coal and LNG and 10% for crude oil, farm equipment and some autos. The new tariffs on U.S. exports will start on Feb. 10, the ministry said.

China also said it was starting an anti-monopoly investigation in Alphabet (NASDAQ:GOOGL) Inc's Google, while including both PVH Corp (NYSE:PVH), the holding company for brands including Calvin Klein, and U.S. biotechnology company Illumina (NASDAQ:ILMN) on its "unreliable entities list".

Separately, China's Commerce Ministry and its Customs Administration said it is imposing export controls on tungsten, tellurium, ruthenium, molybdenum and ruthenium-related items to "safeguard national security interests". China controls much of the world's supply of such rare earths that are critical for the clean energy transition.

Trump on Monday suspended his threat of 25% tariffs on Mexico and Canada at the last minute, agreeing to a 30-day pause in return for concessions on border and crime enforcement with the two neighbouring countries.

But there was no such reprieve for China, and a White House spokesperson said Trump would not be speaking with Chinese President Xi Jinping until later in the week.

During his first term in 2018, Trump initiated a brutal two-year trade war with China over its massive U.S. trade surplus, with tit-for-tat tariffs on hundreds of billions of dollars worth of goods upending global supply chains and damaging the world economy.

To end that trade war, China agreed in 2020 to spend an extra $200 billion a year on U.S. goods but the plan was derailed by the COVID pandemic and its annual trade deficit had widened to $361 billion, according to Chinese customs data released last month.

"The trade war is in the early stages so the likelihood of further tariffs is high," Oxford Economics said in a note as it downgraded its China economic growth forecast.

Trump warned he might increase tariffs on China further unless Beijing stemmed the flow of fentanyl, a deadly opioid, into the United States.

"China hopefully is going to stop sending us fentanyl, and if they're not, the tariffs are going to go substantially higher," he said on Monday.

China has called fentanyl America's problem and said it would challenge the tariffs at the World Trade Organization and take other countermeasures, but also left the door open for talks.

Stocks in Hong Kong pared gains after China's retaliation.

“Unlike Canada and Mexico, it is clearly harder for the U.S. and China to agree on what Trump demands economically and politically. The previous market optimism on a quick deal still looks uncertain," said Gary Ng, senior economist at Natixis in Hong Kong.

"Even if the two countries can agree on some issues, it is possible to see tariffs being used as a recurrent tool, which can be a key source of market volatility this year."

NEIGHBOURLY DEALS

There was relief in Ottawa and Mexico City, as well as global financial markets, after the deals to avert the hefty tariffs on Canada and Mexico.

Both Canadian Prime Minister Justin Trudeau and Mexican President Claudia Sheinbaum said they had agreed to bolster border enforcement efforts in response to Trump's demand to crack down on immigration and drug smuggling. That would pause 25% tariffs due to take effect on Tuesday for 30 days.

Canada agreed to deploy new technology and personnel along its border with the United States and launch cooperative efforts to fight organized crime, fentanyl smuggling and money laundering.

Mexico agreed to reinforce its northern border with 10,000 National Guard members to stem the flow of illegal migration and drugs.

The United States also made a commitment to prevent trafficking of high-powered weapons to Mexico, Sheinbaum said.

"As President, it is my responsibility to ensure the safety of ALL Americans, and I am doing just that. I am very pleased with this initial outcome," Trump said on social media.

Canadian industry groups, fearful of disrupted supply chains, welcomed the pause.

"That's very encouraging news," said Chris Davison, who heads a trade group of Canadian canola producers. "We have a highly integrated industry that benefits both countries."

Trump suggested on Sunday the 27-nation European Union would be his next target, but did not say when.

EU leaders at an informal summit in Brussels on Monday said Europe would be prepared to fight back if the U.S. imposes tariffs, but also called for reason and negotiation. The U.S. is the EU's largest trade and investment partner.

Trump hinted that Britain, which left the EU in 2020, might be spared tariffs.

Trump acknowledged over the weekend that his tariffs could cause some short-term pain for U.S. consumers, but says they are needed to curb immigration and narcotics trafficking and spur domestic industries.

The tariffs as originally planned would cover almost half of all U.S. imports and would require the United States to more than double its own manufacturing output to cover the gap - an unfeasible task in the near term, ING analysts wrote.

Other analysts said the tariffs could throw Canada and Mexico into recession and trigger "stagflation" - high inflation, stagnant growth and elevated unemployment - at home.

Investing.com– Asian stocks bounced back on Tuesday after U.S. President Donald Trump postponed trade tariffs on Canada and Mexico, easing some market concerns, though caution persisted ahead of the impending tariffs on Chinese imports.

Regional equities recovered most of the ground after steep declines on Monday, which stemmed from Trump’s tariff announcement.

U.S. stock index futures were also higher in Asian trade after Wall Street ended lower on Monday.

Asia stocks jump as tariff delays ease immediate concerns

Trump had announced a 25% tariff on imports from Canada and Mexico, alongside a 10% levy on Chinese goods, effective February 4.

However, following discussions with Canadian and Mexican counterparts, Trump agreed to postpone the tariffs on Mexico and Canada by 30 days.

Asian stocks were higher as the postponement eased immediate trade war concerns and reduced the risk of supply chain disruptions.

Markets also view the delay as a potential window for further negotiations, reducing uncertainty in the short term.

Japan’s Nikkei 225 index jumped 1.5%, while TOPIX rose 1.4%.

South Korea’s KOSPI index climbed 1.8%, rebounding from its lowest level since early January.

Australia’s S&P/ASX 200 index gained 0.4%, while Philippine’s PSEi Composite jumped 2%.

Elsewhere, Futures for Nifty 50 indicated a marginal rise at open, while Thailand’s SET Index fell 0.8%, bucking the regional trend.

Chinese tariffs still on tap; Hong Kong stocks surge on AI optimism

Chinese markets were closed for the Lunar New Year holiday and will resume trade on Wednesday this week.

The implementation of U.S. tariffs on Chinese imports was still scheduled to take effect later in the day.

However, markets shrugged off most concerns about levies on China, in anticipation of future negotiations and local stimulus measures.

Additionally, with only the 10% tariff set to take effect, investors anticipate less severe economic fallout than initially feared.

This sentiment was reflected in Hong Kong stocks, with Hang Seng index jumping 3% on Monday.

Hong Kong-listed Chinese tech stocks surged on optimism around local artificial intelligence (AI) models like DeepSeek and Alibaba's (HK:9988) Qwen.

Semiconductor Manufacturing International Corp (HK:0981) (SMIC) shares led the gains with a 7.2% rise, while Xiaomi (HK:1810) and Alibaba stock rose 5%, each.

Investing.com -- President Donald Trump is set to pause tariffs on Canada for 30 days on following a call with Canadian Prime Minister Justin Trudeau in which the two leaders struck a deal to reinforce the U.S.-Canada border and implement measures to stem the flow of illegal drugs in the United States.

Trump's proposed tariffs of 25% on imported goods from Canada goods, which was set to come into effect on Tuesday, "will be paused for at least 30 days while we work together," Prime Minister Justin Trudeau said on Monday.

The updates comes on heels of Trump reportedly saying that the call with Trudeau went "very well."

Mexico struck a similar concession with Trump earlier Monday, also averting a 25% tariff that was set for Tuesday. Attention now turns to the U.S.-China call, which Trump said should get underway over the next 24 hours. Ahead of the call Trump warned that he could hike tariffs on China beyond the 10% levy he announced on Sunday, but markets are hoping that the two nations can agreed to measures that would avoid another U.S.-China trade war.

SAO PAULO - Brazil's real closed trading on Monday stronger versus the U.S. dollar for the 11th consecutive session, marking its longest streak of gains since April 2005.

The Brazilian currency closed at 5.8159 reais per greenback, the strongest since Nov. 26, when it closed at 5.8096 reais per dollar.

It weakened more than 1% against the dollar in early morning trading on Monday before reversing those losses after U.S. President Donald Trump agreed to pause tariffs on Mexico for a month, with the real closing 0.3% stronger.

Brazil's real weakened more than 20% last year against the U.S. dollar, after a sell-off in the final months of 2024 drove the Latin America currency to its weakest-ever amid investor distrust of the Brazilian government's fiscal policy and an outflow of resources.

Year-to-date, the Brazilian real has strengthened by nearly 6%.

Among industrial metals, benchmark copper futures on the London Metal Exchange fell 1.1% to $8,944.25 a ton, while March copper futures fell 1.9% to $4.1960 a pound.

Copper was also pressured by softer-than-expected private purchasing managers index data from top importer China, as business activity remained soft in the first month of 2025.

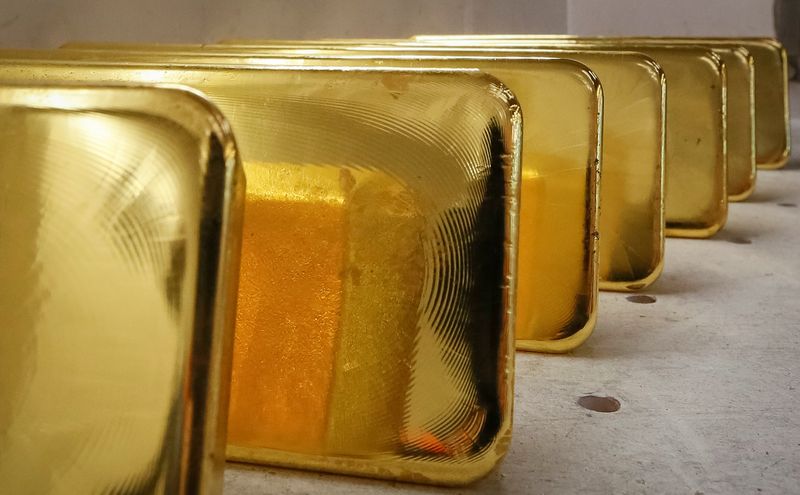

JPMorgan reiterates bull case for gold

JPMorgan analysts said in a Monday note that they maintained their bullish view on gold in the medium-term, stating that risk aversion in broader markets could still drive investors into the yellow metal.

The investment bank still expects gold to rise to $3,000 an ounce by late-2025, stating that lower U.S. interest rates and a stabler, albeit slower economy, will drive flows into the yellow metal.

JPM is set to deliver about $4 billion worth of gold against futures contracts in February. The investment bank is by far the largest dealer of gold in the world.

Investing.com-- Gold prices fell from record highs on Monday, coming under pressure from a sharp rise in the dollar after U.S. President Donald Trump imposed trade tariffs on China, Canada, and Mexico.

But the yellow metal’s decline is expected to be short-lived, given that it was sitting on a strong run-up over the past week, as a rout in global equity markets and anticipation of Trump’s tariffs ramped up safe haven demand.

The dollar surged to a near one-month high, and was back in sight of an over two-year peak after the tariffs were confirmed.

Spot gold fell 0.7% to $2,780.56 an ounce, while gold futures expiring in April fell 0.8% to $2,810.30 an ounce by 23:38 ET (04:38 GMT). Spot prices hit a record high of $2,817.57 an ounce last week.

Gold pressured by dollar spike as tariffs point to higher inflation

Trump imposed 25% tariffs on Canadian and Mexican imports, along with a 10% duty on China. All three countries balked at the tariffs and vowed retaliation.

Trump had largely telegraphed the tariffs last week, before signing an executive order imposing them on Saturday. The tariffs will take effect from Tuesday.

The dollar rose sharply on the tariff news, pressuring metal markets.

Analysts were seen warning that the trade tariffs were likely to factor into higher U.S. inflation, giving the Federal Reserve less impetus to cut interest rates further. This could diminish gold’s long-term prospects, despite strong near-term safe haven demand.

Other precious metals retreated on this notion. Platinum futures fell 1.9% to $1,024.0 an ounce, while silver futures fell 1.5% to $31.795 an ounce. Both metals, like gold, had also risen sharply last week.

Among industrial metals, benchmark copper futures on the London Metal Exchange fell 1.1% to $8,944.25 a ton, while March copper futures fell 1.9% to $4.1960 a pound.

Copper was also pressured by softer-than-expected private purchasing managers index data from top importer China, as business activity remained soft in the first month of 2025.

JPMorgan reiterates bull case for gold

JPMorgan analysts said in a Monday note that they maintained their bullish view on gold in the medium-term, stating that risk aversion in broader markets could still drive investors into the yellow metal.

The investment bank still expects gold to rise to $3,000 an ounce by late-2025, stating that lower U.S. interest rates and a stabler, albeit slower economy, will drive flows into the yellow metal.

JPM is set to deliver about $4 billion worth of gold against futures contracts in February. The investment bank is by far the largest dealer of gold in the world.

By Kevin Buckland

TOKYO (Reuters) - China's yuan slumped to a record low in offshore trading on Monday, while Mexico's peso and Canada's dollar tumbled to multi-year troughs after U.S. President Donald Trump slapped the countries with tariffs, triggering fears of an escalating trade war.

The U.S. dollar's gain was broad, with the euro also dropping to a more than two-year low and the Swiss franc - despite typically acting as a safe haven - sliding to the weakest since May.

Canada and Mexico immediately vowed retaliatory measures, and China said it would challenge Trump's levies at the World Trade Organization.

Cryptocurrency bitcoin fell back below $100,000 to its lowest in nearly three weeks.

"The surprise for markets ... is that Canada and Mexico retaliated immediately and that others, i.e. China and the EU, may follow their lead, resulting in a sharp contraction in global trade," said Tony Sycamore, a market analyst at IG.

"The starting date of U.S. tariffs on Canada, Mexico and China of Feb. 4 was also much sooner than many had anticipated."

As Trump had promised last month, the United States hit Canada and Mexico with duties of 25% and China with a 10% levy, calling the measures necessary to combat illegal immigration and the drug trade.

The tariffs, outlined in three executive orders, are due to take effect 12:01 a.m. ET (0501 GMT) on Tuesday.

Trump's move was the first strike in a what could be a destructive global trade war that would result in a surge in U.S. inflation that would "come even faster and be larger than we initially expected," said Paul Ashworth of Capital Economics.

Investing.com - U.S. President Donald Trump imposes tariffs on imports from Canada, Mexico, and China, exacerbating worries over the uncertain impact of an increase in global trade tensions. Google-parent Alphabet (NASDAQ:GOOGL) and e-commerce giant Amazon (NASDAQ:AMZN) post quarterly returns, as well as weight-loss drugmakers Eli Lilly (NYSE:LLY) and Novo Nordisk (NYSE:NVO). Meanwhile, new U.S. jobs data could provide a fresh glimpse into the state of labor demand in the world's largest economy -- and potentially factor into the Federal Reserve's future interest rate path. Here's your look at what's happening in markets in the week ahead.

1. Trump imposes tariffs on Canada, Mexico, and China

Tariffs, which have been a lingering source of uncertainty for markets in recent months, are set to be front of mind this week.

On Saturday, President Trump signed an executive order placing 25% levies on imports from Canada and Mexico, as well as a 10% duty on goods incoming from China. The White House has said there are "tentative plans" for the tariffs to come into effect on Tuesday.

Trump had earlier threatened these countries with a February 1 tariff deadline in order to push them to roll out actions to stem the flow of illegal immigrants and the opiate fentanyl into the U.S. However, before the weekend, Trump suggested that there was little these countries could do to avoid the levies, which could disrupt trillions of dollars in annual trade.

Some economists have argued that Trump's move may also drive up inflationary pressures in the U.S., potentially slowing the pace of possible Federal Reserve interest rate cuts this year. Indeed, Fed officials have adopted a wait-and-see approach to future monetary policy decisions, citing a murky economic outlook clouded by the prospect of tariffs.

Stock markets ended lower on Friday, weighed down by anxiety over Trump's trade stance. Analysts have widely flagged some type of a sell-off in equities on Monday.

2. Oil

The tariffs included a carve-out for energy products from Canada, with these items facing levies of 10%.

Crude oil makes up about a quarter of all imports the U.S. receives from Canada, worth roughly $100 billion in 2023, according to data from the U.S. Census Bureau cited by Reuters.

Trump added that his administration is also projected to announce wider tariffs linked to oil and natural gas around February 18, a comment that sparked a jump in oil prices in extended hours trading on Friday.

Last week, both the Brent and West Texas Intermediate crude benchmarks finished lower, as traders worried that a sharp uptick in fuel costs would dent global economic activity and broader energy demand.

3. Jobs data

Elsewhere, investors will have the chance to parse through fresh labor market data this week, including the January jobs report on Friday.

Economists forecast that the U.S. added 154,000 roles last month, down from a blockbuster 256,000 in December. Meanwhile, the unemployment rate is tipped to come in at 4.1%, matching the prior month's pace.

Average hourly earnings growth is seen at 0.3%, also equaling December's rate.

The figures will help to determine the state of labor demand in the beginning of the new year and may factor into how the Fed, which slashed interest rates several times in 2024, approaches monetary policy in the months to come.

Along with inflation remaining above the Fed's 2% target level, a robust jobs market helped underpin the central bank's decision last week to leave rates unchanged and signal that it was in no rush to bring borrowing costs down further.

4. Alphabet, Amazon to report

On the earnings front, more results from major technology companies are due out this week.

Highlighting the agenda is Google-parent Alphabet and e-commerce giant Amazon, which are set to unveil their quarterly figures on Tuesday and Thursday, respectively.

As it was with these companies' Big Tech peers Microsoft (NASDAQ:MSFT) and Meta Platforms (NASDAQ:META) last week, analysts will likely be keen to hear how Alphabet and Amazon executives view their artificial intelligence spending strategies following the emergence of a low-cost AI model from Chinese start-up DeepSeek.

DeepSeek said its model showed comparable performance to OpenAI's ChatGPT, but used less-advanced data and cost only around $6 million to build. Although doubts remains around the statement, it was enough to roil markets last week and pose questions around the necessity of billions of dollars in AI expenditures by some of Silicon Valley's most prominent businesses.

Semiconductor group Qualcomm (NASDAQ:QCOM) and chip designer Arm Holdings (NASDAQ:ARM) are also due to post their latest returns this week, as well as ride-hailer Uber (NYSE:UBER).

Beyond tech, drugmakers Eli Lilly (NYSE:LLY) and Novo Nordisk (NYSE:NVO), both of which have been at the forefront of a spike in popularity of new weight-loss treatments, are also expected to report.

5. Bank of England decision

The Bank of England holds its latest policy-setting meeting this week, and is widely expected to cut interest rates and hint at more reductions to come as the UK economy stagnates.

Economists anticipate the BoE will cut its benchmark rate to 4.5%, from 4.75%, on Thursday, when it will also update its economic growth and inflation forecasts.

Since the BoE published its last projections in November, the economy has stagnated and measures of inflation most closely watched by rate-setters dropped last month.

Analysts at Bank of America Securities have agreed with the consensus, expecting an 8-1 vote in favor of a reduction by the Monetary Policy Committee.

“The faster than expected drop in services inflation, weak growth and labor market loosening supports the case for a cut,” BOA analysts said, in a note dated January 31.