Select Language

Intel Corporation stock dropped 2.7% in premarket trading after Reuters reported that Nvidia stopped testing Intel’s 18A chip manufacturing process.

Accordingly, Nvidia had been evaluating whether it could manufacture its chips using Intel’s advanced 18A production technology but decided not to move forward with the tests.

An Intel spokesperson told Reuters that the company’s 18A manufacturing technologies are "progressing well," without providing further details about Nvidia’s decision to halt testing.

The news comes just months after the two semiconductor giants announced a major collaboration in September. Under that agreement, Intel would develop custom x86 CPUs for Nvidia’s AI infrastructure platforms, while also creating x86 system-on-chips integrating Nvidia RTX GPU chiplets for personal computing devices.

As part of the partnership, Nvidia had committed to investing $5 billion in Intel’s common stock at a purchase price of $23.28 per share, subject to regulatory approvals.

The reported testing halt raises questions about the technical viability of Intel’s advanced manufacturing process, which the company has positioned as crucial to its turnaround strategy and efforts to compete with Taiwan Semiconductor Manufacturing Company in the foundry business.

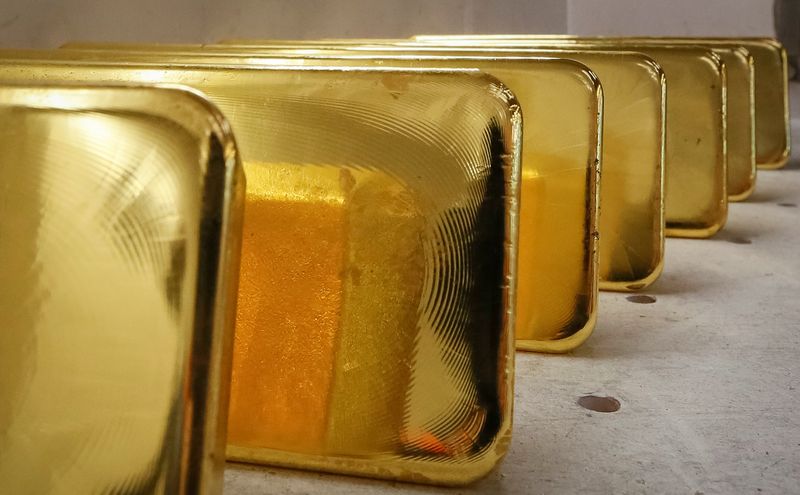

Gold prices have surged to another record high, extending its historic rally as investors balanced stabilizing moves in Japan’s bond and currency markets with a heavy slate of U.S. economic data ahead of the holidays.

Precious metals outperformed while equities showed mixed signals, with positioning data pointing to growing caution beneath the surface of year-end markets.

1.Gold and precious metals extend historic rally

Gold climbed to a fresh all-time high on Tuesday, marking the 50th session this year in which the metal has set a new record, as investors continued to favor precious metals amid easing yields, currency volatility and longer-term inflation hedging.

Gold Futures hit as high as $4,530.30/oz, marking a fresh all-time high, while gold spot prices traded as high as $4,497.82/oz.

Yardeni Research amended its outlook for gold prices following the latest surge. “When the price of an ounce of gold rose above $3,000 at the start of this year, we projected it would reach $4,000 by the end of this year and $5,000 by the end of next year,” Yardeni said.

“We are raising our year-end 2026 target to $6,000. We still expect to see $10,000 hit by the end of the decade.”

Silver Futures also rose to a new peak, while Platinum Futures and Palladium Futures also extended gains. In contrast, Brent Oil Futures and Crude Oil WTI Futures were mostly flat.

2.Japan bonds and yen find footing after BOJ volatility

In Japan, government bonds and the yen showed signs of stabilization after sharp moves following the Bank of Japan’s 25 basis-point rate hike on Friday. Yields surged initially after policymakers signaled further tightening could be ahead, but subsequent weakness in the yen raised uncertainty about how aggressively the central bank could proceed without stoking inflation.

Currency pressures began to ease after Finance Minister Satsuki Katayama said Japan had a “free hand” to act in foreign-exchange markets and described recent moves as speculative rather than fundamental. The USD/JPY pair traded about 0.7% lower on Tuesday.

Bond markets responded by retracing some of their recent losses. Japan 10-Year yields fell about 4.6 basis points, while Australia 10-Year yields declined 3.1 basis points.

Adding to the calmer tone, Prime Minister Takaichi said she would not pursue “irresponsible” tax cuts, easing concerns about fiscal pressure alongside tighter monetary policy.

3. U.S. data deluge ahead of the holiday break

Attention now turns to a busy slate of U.S. economic data, the final batch before Christmas. Investors will see a delayed third-quarter GDP report later in the session, though it is backward-looking and reflects conditions prior to the government shutdown.

More focus is likely to fall on the Conference Board’s December consumer confidence reading, particularly after November’s index dropped to its lowest level since the turmoil surrounding Liberation Day in April.

Other releases include November industrial production, preliminary October durable goods orders, and the Richmond Fed’s manufacturing index.

4. Novo Nordisk jumps on Wegovy pill approval

In corporate news, Novo Nordisk A/S Class B (CSE:NOVOb) shares jumped more than 5% in Copenhagen after the company won U.S. approval to sell a pill version of its blockbuster obesity treatment Wegovy.

The decision marks a significant step in expanding access to obesity drugs beyond injections and could broaden the addressable market.

Elsewhere, shares of Oersted AS (CSE:ORSTED) have stabilized on Tuesday after the Trump administration moved to suspend leases for several offshore wind projects under construction along the U.S. East Coast, citing national security concerns.

The decision directly affects Ørsted’s Revolution Wind and Sunrise Wind developments, alongside other major projects including Vineyard Wind 1, Dominion Energy’s Coastal Virginia Offshore Wind project and Equinor’s Empire Wind 1.

The company’s stock fell more than 13% following the announcement, marking the sharpest decline among offshore wind developers, while shares of Dominion Energy (NYSE:D) falling 3.7% on Monday.

5. Positioning cools into year-end, Citi says

Positioning data suggests investors have grown more cautious into year-end. Citigroup strategists led by Chris Montagu said investors added new short positions across U.S. equity-index futures last week, leaving net positioning near neutral.

Allocation to U.S. large caps has cooled, while positioning in the Russell 2000 has turned bearish, reversing the prior week’s optimism. Net profit levels improved across most indices, with the Nasdaq the notable exception.

Gold prices are climbing again, with spot bullion up about 1.6% so far on Monday, as a mix of geopolitical risk, interest-rate expectations and strong demand continues to support the rally.

In a note to clients, UBS strategists led by Giovanni Staunovo noted that gold has recovered from a steep decline in late October and is once again reinforcing its status as one of the strongest-performing assets this year.

The bank notes that bullion is consolidating gains after a sharp advance, with prices sitting at record levels.

One key driver is rising geopolitical uncertainty. UBS points to renewed tensions after U.S. President Donald Trump ordered a “blockade” of sanctioned oil tankers linked to Venezuela, alongside reports that Washington is preparing additional sanctions on Russia’s energy sector if peace talks over Ukraine fail.

UBS says gold prices have risen over the past week “amid renewed geopolitical uncertainty,” highlighting the metal’s role as a hedge during periods of global stress.

A second factor is the outlook for U.S. interest rates. UBS notes that the U.S. real interest rate, “the opportunity cost of holding non-yielding assets like gold,” has fallen to its lowest level since mid-2022.

The bank adds that gold is “supported by the outlook for U.S. rate cuts,” which typically boosts demand for bullion.

Finally, UBS highlights persistent buying from central banks and investors.

“Demand from central banks and investors is still near record highs,” UBS wrote, adding that it expects central bank purchases of 900 to 950 metric tons this year.

“In our view, gold’s store-of-value characteristics, liquidity, and ability to hedge against shocks justify a continued place in well-diversified portfolios,” UBS declared.

Gold prices fell slightly in Asian trade on Friday and were set for a mildly positive week, while silver and platinum outperformed and remained close to record highs amid strong safe haven demand.

Broader metal prices also advanced, after softer-than-expected U.S. inflation data spurred bets on more interest rate cuts by the Federal Reserve. Metal prices rose even as the dollar recovered marginally from recent losses.

Spot gold fell 0.1% to $4,326.89 an ounce, remaining close to an October record high, while gold futures for February fell 0.2% to $4,354.70/oz by 00:48 ET (05:48 GMT). Bullion prices were trading up about 0.4% this week.

Silver, platinum head for bumper weekly gains

Silver and platinum prices, however, raced past gold on Friday and the week, with both precious metals coming close to record highs.

Spot silver rose 0.5% to $65.8365/oz and was up 6% this week in its fourth consecutive week of gains. Spot platinum rose 0.6% to $1,937.50/oz, and was up 10.5% this week.

Other precious metals also rallied this week on similar trends. Spot palladium rose 1.4% to $1,709.20/oz, and was headed for a 14% spike this week.

Demand for the two largely outpaced gold in recent weeks, as investors sought more real world assets amid growing concerns over slowing economic growth in the developed world.

Silver and platinum offer stability that is comparable to gold, but at substantially lower prices when compared to the yellow metal, especially after a strong rally in gold prices through the past year.

Expectations of silver and platinum supply shortages, in the coming year, underpinned the two metals.

US CPI reads weaker than expected; analysts say Dec reading to have more bearing

Metal prices broadly advanced after U.S. consumer price index inflation data for November read softer than expected. The print spurred confidence in more interest rate cuts by the Federal Reserve.

But analysts warned that November’s reading was potentially disrupted by a long-running government shutdown in October and early-November. Goldman Sachs analysts said that December’s CPI reading was likely to provide more definitive cues on U.S. inflation and interest rates, and that the November reading was unlikely to factor into the Fed’s outlook.

Uncertainty over the U.S. economy was a major driver of haven demand this week, after an unexpected rise in unemployment sparked concerns over stagflationary risks for the U.S. economy.

Gold prices fell slightly in Asian trade on Thursday, while silver hovered close to recent record highs as markets awaited key U.S. inflation data and a host of major central bank decisions.

Metal markets faced some profit-taking after rallying sharply over the past week on increased uncertainty over the U.S. economy. Haven demand still remained high ahead of the U.S. inflation print, which is due later on Thursday.

A potential hitch in Russia-Ukraine peace talks– amid disagreements over territory concessions and Moscow’s frozen overseas assets– also lent support to safe haven assets.

Spot gold fell 0.1% to $4,334.48 an ounce, while gold futures for February fell 0.2% to $4,364.90/oz by 00:42 ET (05:42 GMT).

Spot silver rose 0.5% to $66.5095/oz, remaining close to a record high of $66.90 hit on Wednesday. Platinum outperformed, with spot prices rising as high as $1,977.80/oz and coming back in sight of their record peak of more than $2,200/oz.

Silver and platinum vastly outpaced gold this week. While bullion was up 0.7%, silver was sitting on an over 7% gain, while platinum was up 12.2%.

US economic uncertainty builds ahead of CPI data

Uncertainty over the U.S. economy rose this week, especially as official government readings provided mixed signals on the labor market. The Federal Reserve’s asset buying operations also spurred some doubts over market liquidity in the country.

Markets were now looking to upcoming consumer price index inflation data for cues on the world’s largest economy. The data is expected to show headline CPI inflation rising slightly, while core CPI is expected to remain steady at 3% annually.

The labor market and inflation are the Fed’s two biggest considerations for adjusting policy. But in addition to interest rates, markets were also concerned over a potentially stagflationary period for the U.S. economy– a scenario where unemployment increases in tandem with inflation.

Fears of such a scenario also drove outsized buying in gold and other precious metals.

BOE, ECB, and BOJ decisions on tap

Interest rate decisions from the Bank of England and the European Central Bank are due on Thursday, while the Bank of Japan is due on Friday.

The BOE is expected to cut interest rates by 25 basis points as it moves to further shore up a laggard UK economy. The ECB is expected to stand pat after slashing rates this year, amid some signs of resilience in the eurozone.

The Bank of Japan is an outlier, with markets widely pricing in a 25 basis point rate hike. This comes amid persistent yen weakness and sticky Japanese inflation, with the BOJ also having signaled it will consider a rate hike in December.

Focus will be squarely on the three banks’ outlook on their respective economies going into 2026, amid growing concerns over slowing growth in the developed world.

The U.S. dollar traded higher Wednesday, climbing away from its lowest level since the start of October as traders contemplated the Federal Reserve’s interest rate path after soft labor market data.

At 03:55 ET (08:55 GMT), the Dollar Index, which tracks the greenback against a basket of six other currencies, traded 0.4% higher to 98.200, after hitting its lowest level since the beginning of October earlier in the week.

The index is down over 9% this year, on track for its steepest annual decline since 2017.

Cooling U.S. labor market

Data released on Tuesday showed that U.S. nonfarm payrolls rose by 64,000 jobs in November, exceeding economists’ forecasts, but this followed a sharp 105,000 job loss in October and came with the unemployment rate climbing to 4.6%, the highest since 2021.

The figures pointed to a cooling labor market and blurred the outlook for Fed policy.

That said, “the combined release yesterday of October and November jobs data did not alter the Fed’s narrative that the risk to the U.S. labor market is on the downside,” said analysts at ING, in a note.

“While Chair Powell has said that data releases will be distorted by the government shutdown, he has also spent much time positioning the unemployment rate as the best read on the supply-demand imbalance in the US labor market. The 4.6% rate is now higher than the median rate (4.5%) expected by FOMC members for the end of 2025.”

Sterling slumps after soft inflation data

In Europe, GBP/USD slumped 0.8% to 1.3322 after the release of softer than expected U.K, inflation data lifted expectations of a rate cut by the Bank of England on Thursday.

Annual U.K. consumer price inflation rose 3.2% in November, a fall from 3.6% the prior month and the lowest figure in eight months

The BoE’s Monetary Policy Committee voted 5-4 to leave rates unchanged last month, and signs of falling prices could well swing what is still likely to be a tight vote in favor of easing monetary policy.

A cut of 25 basis points would bring borrowing costs down to 3.75% from 4%, the lowest rate since the beginning of February 2023.

EUR/USD traded 0.3% lower to 1.1717, with the single currency slipping slightly but remaining close to the 12-week high it touched in the previous session ahead of the policy decision from the European Central Bank later this week.

The November eurozone CPI release is due later in the session, but is unlikely to sway central bank policymakers from keeping interest rates at 2% for a fourth straight meeting on Thursday.

“Hawkish comments from the ECB’s Isabel Schabel really reverberated through FX and rates markets last week,” said analysts at ING. “Should she be exposed as a hawkish outlier on Thursday and eurozone growth forecasts be revised insufficiently higher, then the euro could get hit.”

Yen hands back gains ahead of BOJ

In Asia, USD/JPY gained 0.5% to 155.54, with the yen retreating ahead of the Bank of Japan’s policy decision later this week.

The central bank is widely expected to raise interest rates, as policymakers respond to signs of more durable inflation and improving wage growth.

A rate hike would mark another step away from Japan’s ultra-loose monetary stance and could provide support to the yen.

USD/CNY traded 0.1% higher to 7.0457, while AUD/USD slipped 0.2% to 0.6619, with equity weakness on Wall Street hitting risk sentiment.

U.S. stock futures fell Tuesday amid caution ahead of the release of key economic data, with technology shares remaining on the backfoot.

At 06:15 ET (11:15 GMT), Dow Jones Futures fell 55 points, or 0.1%, S&P 500 Futures dropped 15 points, or 0.2%, and Nasdaq 100 Futures slid 90 points, or 0.4%.

The main averages on Wall Street declined in the previous session, with the tech sector declining the hardest on lingering concerns over the sustainability of the artificial intelligence boom after underwhelming recent quarterly reports from AI-exposed groups Broadcom (NASDAQ:AVGO) and Oracle (NYSE:ORCL).

Nonfarm payrolls due

Much of Tuesday’s attention will be on the release of nonfarm payrolls data for November, with the print being delayed due to disruptions caused by a government shutdown in October and early-November.

The print will be closely watched for more signs of immediate cooling in the labor market, which has been seen steadily deteriorating in recent months.

The payrolls print also comes just days before CPI data for November, which will also be closely scrutinized by markets.

Labor strength and inflation are the Federal Reserve’s two main considerations for cutting interest rates, with the central bank having flagged a data-driven approach to further easing after cutting interest rates last week.

Comments from New York Fed President John Williams on Monday reiterated the Fed’s data-driven stance.

Markets are also focused on who will become the Fed’s next Chair, with reports stating that U.S. President Donald Trump had narrowed his shortlist for Jerome Powell’s successor to former Fed Governor Kevin Warsh and National Economic Council Director Kevin Hassett.

Lennar headlines earnings list

The earnings season is gradually coming to a close, butresults from homebuilder Lennar Corporation (NYSE:LEN) are due after the close of U.S. markets.

The firm posted a 46% slip in profit in the third quarter, weighed down by sticky inflation which has dented the affordability of the American housing market.

Elsewhere, major exchange Nasdaq is seeking approval from U.S. securities authorities to extend trading hours on its stock venues to 23 hours during the work week, according to Bloomberg News.

In a filing with the Securities and Exchange Commission on Monday, Nasdaq asked for permission to tack on an additional trading session which would last from 9 p.m. to 4 a.m. ET.

Crude retreats further

Oil prices slumped as raised prospects for a Russia-Ukraine peace deal lifted the potential of an easing of sanctions.

Brent futures last dropped 1.6% to $59.58 a barrel, and U.S. West Texas Intermediate crude futures fell 1.8% to $55.65 a barrel.

U.S. officials have flagged some progress in the Russia-Ukraine peace talks, with Kyiv offering to drop its aspirations to join the NATO military alliance, a major point of contention for Russia, while Washington offered Ukraine security guarantees.

But a deal on territorial concessions, a highly sensitive topic for Ukraine, remained elusive.

A peace deal could result in U.S. sanctions on Russian oil companies being lifted, adding to an already well supplied market.

Gold prices rose in Asian trade on Monday, extending gains after hitting a near two-month high in the prior session as weakness in the dollar and Treasury yields, following less hawkish signals from the Federal Reserve, buoyed metal markets.

Silver prices remained close to record highs after stellar gains last week, while broader metal prices also advanced.

Focus this week is squarely on two key U.S. economic indicators– nonfarm payrolls and consumer price index inflation– which are likely to factor into the Fed’s outlook on interest rates.

Spot gold rose 1% to $4,343.62 an ounce, while gold futures for March rose 1.1% to $4,375.80/oz by 01:00 ET (06:00 GMT).

Spot silver rose 1.6% to $62.9865/oz, remaining close to a record high hit last week. Spot platinum rose 1.8% to $1,781.09/oz.

Gold, metals extend gains after dovish Fed signals hit dollar, yields

Gold and other metals largely extended gains from last week, as the sector was boosted by weakness in the dollar and Treasury yields.

This came largely following dovish signals from the Fed, after it cut interest rates last week and signaled it will immediately begin buying short-dated Treasuries from December, at a monthly pace of $40 billion.

The Fed’s asset buying activities present a dovish outlook for monetary policy, especially given that local liquidity conditions are likely to loosen further with the cash injections.

Gold stands to benefit in such an environment. But the Fed’s announcement also buoyed haven-linked demand for gold, given that it raised questions about the health of the U.S. economy.

Nonfarm payrolls, CPI data awaited

Focus this week is squarely on U.S. nonfarm payrolls and CPI data for November, due on Tuesday and Thursday, respectively.

The payrolls print, which usually lands on the first Friday of every month, was delayed due to a long-running government shutdown in October and November.

But markets will be watching closely for more signs of easing labor market growth and cooling inflation, given that the two are the Fed’s biggest considerations for cutting interest rates.

The prints will also be the most recent official economic readings available to markets after the government shutdown disrupted several key prints for October.

The U.S. dollar steadied Friday, but was on course for a third consecutive weekly fall after the Federal Reserve cut interest rates earlier this week, bringing borrowing costs to a near three-year low.

At 04:00 ET (09:00 GMT), the Dollar Index, which tracks the greenback against a basket of six other currencies, traded largely unchanged at 97.995, but was set for a weekly drop of 0.7%.

The index is down more than 9% this year, on pace for its steepest annual drop since 2017.

Dollar slips after Fed meeting

The U.S. central bank lowered rates by 25 basis points this week, as expected, but remarks from Chair Jerome Powell at his post-meeting press conference were more balanced and less hawkish than many had anticipated.

The Fed policymakers also forecast another rate cut next year, even with members of the central bank showing divisions over December’s move.

“The bearish wind is coming not only from interest rates but also from end-of-year seasonality,” said analysts at ING, in a note. “Dollar rates saw another calibration of Fed expectations lower, with the 2y falling to 3.50% and the market pricing in 3.05% as the Fed terminal rate at the end of next year, keeping pressure on the U.S. dollar.”

The focus going forward will hinge on economic data that is still lagging from the impact of the 43-day federal government shutdown in October and November, as well as the identity of the next Fed chair.

Euro undervalued versus dollar - ING

In Europe, GBP/USD dropped 0.1% to 1.3383, falling back from its highest level since October after data showed that the U.K. economy unexpectedly contracted in October, with uncertainty ahead of the Autumn budget by Chancellor Rachel Reeves likely curtailing growth.

Data released earlier Friday by the Office for National Statistics showed that U.K. gross domestic product fell by 0.1% on a monthly basis in October, matching the drop seen during the prior month and below the 0.1% growth expected.

The Bank of England holds its final policy-setting meeting of the year next week, and is widely expected to cut interest rates by a quarter point to 3.75% as recent data has shown inflation drifting lower.

EUR/USD edged lower to 1.1736, but the single currency was poised to register weekly gains of 0.8%, on course for a third weekly gain.

German inflation rose to 2.6% in November, confirming preliminary data, while consumer prices harmonised to compare with other European Union countries, stood at 2.3% year-on-year in October.

“Following the Fed meeting this week, the market’s attention will shift to the ECB meeting next Thursday. President Christine Lagarde will present a new forecast, which should be the first test of the current pricing of no further rate cuts, in line with our view,” ING added.

BOJ looms large

In Asia, USD/JPY gained 0.1% to 155.73, with the yen slightly lower ahead of next week’s Bank of Japan meeting where the broad expectation is for a rate hike.

The market focus is on comments from the policymakers on how the Japanese rate path will look in 2026.

USD/CNY traded 0.1% lower to 7.0556, while AUD/USD gained 0.1% to 0.6673, set for a weekly gain of 0.5% as persistent inflationary pressures suggests the Reserve Bank of Australia could hike rates in the near-term.

Gold prices fell in Asian trade on Thursday as traders digested a mostly dovish outlook from the Federal Reserve, while silver prices retreated after marking a fresh record high earlier in the day.

Broader metal prices were also a mixed bag, after the Fed cut interest rates as expected and flagged a higher bar for future rate cuts. But the central bank also outlined plans to increase its asset buying operations, sending a dovish signal to markets.

Gold and other precious metals were hit with some profit-taking after logging strong gains in the run-up to Wednesday’s Fed meeting.

Spot gold fell 0.5% to $4,207.49 an ounce, while gold futures for March rose 0.3% to $4,235.50/oz by 00:39 ET (05:39 GMT).

Silver dips from fresh record high

Spot silver fell slightly to $61.8095/oz, after hitting a record high of $62.8895/oz earlier in the session.

The white metal had rallied over the past week on growing expectations of tighter supplies and improving demand in the coming year. Traders also bought into the metal’s safe haven appeal, which is comparable to gold but at a much lower price point.

Silver prices more than doubled so far in 2025, outpacing gold amid renewed optimism over the white metal’s prospects. Its designation as a critical mineral by the U.S. government also boosted silver’s appeal.

Gold pulls back after Fed rate cut

Gold and broader metal prices moved in a flat-to-low range on Thursday, giving up some recent gains after the Fed’s decision on Wednesday.

The central bank cut interest rates by a widely expected 25 basis points, with Chair Jerome Powell signalling a higher bar for future rate cuts.

But in a move widely viewed as dovish by markets, the Fed said it will resume buying Treasury bills to increase market liquidity, at an initial pace of $40 billion per month.

The Fed’s asset buying operation, termed by many as “quantitative easing,” is expected to increase market liquidity in the coming months, and points to a dovish outlook for monetary policy. Treasury yields fell after the Fed’s announcement.

“Overall, the decision did not come as “hawkish” as some market participants had worried about. In consideration of the updated economic projections, Powell’s comments on the neutral rate, and the unchanged median dots, we maintain our base-case for one 25bp cut in 2026,” analysts at OCBC wrote in a note.

Gold had largely risen in the run-up to the Fed’s meeting, as had other metal prices. They faced some profit-taking after the central bank’s decision.

Spot platinum rose 0.2% to $1,661.18/oz after logging some overnight losses. Among industrial metals, benchmark copper futures on the London Metal Exchange rose 0.4% to $11,608.45 a ton.