Select Language

The U.S. dollar slipped lower Tuesday, weighed by dovish Fed speak ahead of the release of key economic data that could influence the Federal Reserve’ final policy meeting of the year.

At 04:15 ET (09:15 GMT), the Dollar Index, which tracks the greenback against a basket of six other currencies, traded 0.1% lower to 99.410, resuming declines after snapping a four-day losing streak on Monday.

Dollar slips lower

The U.S. currency has retreated slightly after Federal Reserve Governor Christopher Waller spoke about the risks to the country’s jobs market, calling for another quarter-point rate cut at the upcoming policy meeting on December 9-10.

"Four to six weeks ago, we were still in this kind of no-hire, no-fire mode," Waller said in remarks to the Society of Professional Economists in London. Now, when he speaks to corporate executives, "they’re starting to talk about layoffs," he said. "They’re starting to plan for them."

"It could be AI-related. It could be a lot of other things ... It’s not just going to be ’no hire, no fire.’ At some point this is going to start happening," Waller said.

That said, other Fed officials have signalled reluctance to ease further, leaving investors unsure of the central bank’s next move.

The ending of the federal government shutdown means that this week will see the release of numerous data points, highlighted by the closely-watched September nonfarm payrolls report on Thursday.

“Our base case remains that risks are tilted to the downside for the dollar once the U.S. data cycle kicks in, and we expect a December Fed cut to become the market’s base case again,” said analysts at ING, in a note.

Markets are pricing in an approximate 40% probability of a 25-basis-point cut at the U.S. central bank’s next meeting, down from around 60% chance a week ago.

Euro still has upside - ING

In Europe, EUR/USD edged marginally higher to 1.1593, after snapping a three-day losing streak overnight.

“In our view, upside risks for EUR/USD persist,” said ING. “The pair has recently traded on the cheap side relative to its short-term fair value, but since French political risk faded, it has struggled to maintain an undervaluation greater than 1% for consecutive days.”

“Our year-end target remains 1.180. While the path higher may not resemble the one-way bullish traffic seen earlier this year, positive December seasonality could help smooth the move,” ING added.

GBP/USD traded 0.1% lower to 1.3152, with sterling under pressure ahead of Finance Minister Rachel Reeves’s upcoming budget.

Reeves is expected to need to raise tens of billions of pounds to stay on track to meet her fiscal targets on Nov. 26.

Yen gains slightly

In Asia, USD/JPY slipped 0.2% lower to 154.96, with the Japanese yen gaining after earlier hitting near nine-month lows earlier in the session.

Long-term Japanese government bond yields climbed to multi-decade highs, with the 20-year yield reaching record highs.

Investors have grown increasingly concerned that new fiscal measures under Prime Minister Sanae Takaichi’s administration could add to Japan’s already heavy debt load.

Takaichi is reportedly preparing to unveil her first economic package as early as this week. A Reuters report stated that Goushi Kataoka, a private-sector member of a key government panel, said Japan needs a stimulus package of about $149 billion to bolster the economy.

USD/CNY traded 0.1% higher to 7.1117, while AUD/USD traded largely unchanged at 0.6493.

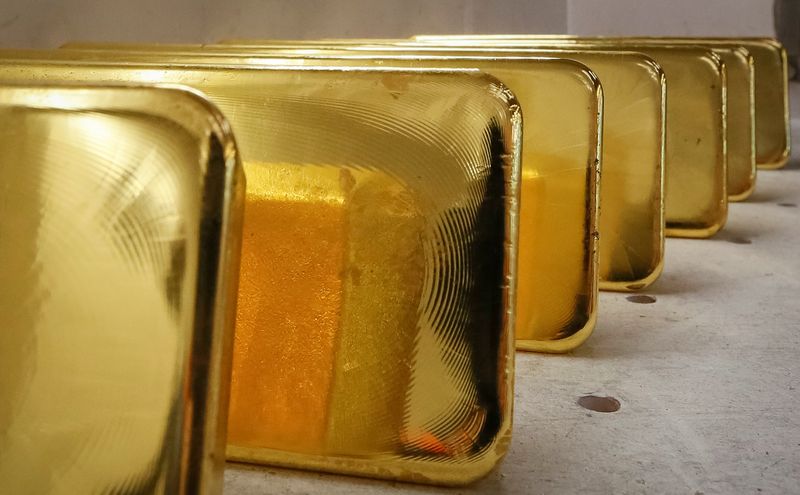

Gold prices fell in Asian trade on Monday, extending losses from the prior session as traders steadily pared back expectations that the Federal Reserve will cut interest rates next month.

The yellow metal was pressured by a stronger dollar, while increased risk-aversion, amid bets on delayed rate cuts and heightened economic uncertainty, also did little to deter gold’s losses.

Spot gold fell 0.6% to $4,053.84 an ounce by 00:33 ET (05:33 GMT), while gold futures for December fell 0.9% to $4,055.91/oz.

Gold under pressure as traders price out Dec. rate cut

Gold’s recent losses were fueled chiefly by traders steadily pricing out expectations for a Fed rate cut in December.

Markets were seen pricing in a 39.8% chance for a 25 basis point cut during the Fed’s December 10-11 meeting, down sharply from a 61.9% chance seen last week, CME Fedwatch showed.

Bets on a hold grew to 60.2% from 38.1% last week.

This was fueled chiefly by increased uncertainty over the U.S. economy, especially as the country recently emerged from its longest ever government shutdown. The shutdown is expected to have delayed or disrupted several key economic prints for October, especially inflation and employment.

A lack of insight into the two leaves the Fed flying blind into the December meeting. Market expectations for a hold were also furthered by increasing signs of sticky U.S. inflation, while Fed Chair Jerome Powell was largely non-commital towards a December rate cut.

High for longer rates bode poorly for non-yielding assets such as gold and other metals.

Among other precious metals, spot platinum rose 0.1% to $1,548.0/oz but was nursing steep losses from the prior session, while spot silver was flat at $50.5795/oz, also having tumbled from near record highs last week.

Dollar steady with Fed minutes, US econ. data due this week

The dollar firmed slightly on Monday, recovering a measure of last week’s losses. The dollar index rose 0.1%.

Focus this week will be on a host of U.S. economic cues, with the government’s nonfarm payrolls print for September due on Thursday. Purchasing managers index data for November is also due this week.

The minutes of the Fed’s October meeting are due on Wednesday, and are expected to offer more insight into the central bank going into December’s decision.

Inflation and employment are the Fed’s two biggest considerations for interest rates.

But U.S. officials recently signaled that the two prints may never be released for October, due to the shutdown.

Futures linked to major U.S. stock averages slip, following the worst day for equities in more than a month in the preceding session. Applied Materials flags that expenditures on chipmaking gear in China is anticipated to fall next year as its access to the crucial region is limited by U.S. export rules. Media reports say U.S. jobless claims eased last week, while broader risk-off sentiment sends Bitcoin below $100,000.

1. Futures drop

U.S. futures pointed lower on Friday, suggesting an extension to a dip in stock markets after equities slumped to their worst day since October 10.

By 02:49 ET (07:49 GMT), the Dow futures contract had fallen by 69 points, or 0.2%, S&P 500 futures had dropped by 17 points, or 0.3%, and Nasdaq 100 futures had decreased by 104 points, or 0.4%.

The main averages tumbled on Thursday, as a boost from the end of the U.S. government shutdown earlier this week waned. In its place emerged a slew of fresh worries denting investor sentiment, including fears over the sustainability of sky-high tech sector valuations. Artificial intelligence-affiliated darlings, such as Nvidia and Broadcom, sank, with cloud group Oracle in particular having now shed more than one-third of its value since a September spike.

"[S]tocks suffered a steep slump thanks to continued carnage in tech as investors start throwing in the towel on a year-end rally," analysts at Vital Knowledge said in a note.

Concerns also swirled around whether a divided Federal Reserve will ultimately choose to cut interest rates yet again at its upcoming monetary policy meeting in December. The outcome of the gathering has been made even murkier by a dearth of economic data during the record-long federal government shutdown -- and White House officials have hinted that the release of key delayed October jobs figures may be truncated.

2. Applied Materials warns of weaker China spending

Shares of Applied Materials declined in extended hours trading after the company warned that spending on chipmaking gear in China is anticipated to fall next year due to more stringent U.S. export controls.

Around $110 million of goods were not shipped during its fiscal fourth-quarter because of restrictions which were later suspended following a face-to-face summit between U.S. President Donald Trump and Chinese President Xi Jinping last month, Applied Materials said.

The comments come after the firm flagged that its fiscal 2026 revenue faces a $600 million hit from expanded U.S. restrictions on exports of cutting-edge chip equipment to China.

Still, Applied Materials noted that a rise in business expenditures on AI is likely to drive increased sales of its semiconductor gear in the second half of next year.

Despite the after-hours drop, the stock has jumped by about 36% so far in 2025.

3. U.S. jobless claims dipped last week - reports

Applications for U.S. jobless benefits eased last week, according to media reports citing state-level filings, although the drop was not viewed as big enough to bolster the case for a Fed rate cut in December.

By one calculation from Haver Analytics, which was referenced by Reuters, first-time claims for state unemployment benefits fell to a seasonally-adjusted 227,543 in the week ended on November 8. In the prior week, the number stood at 228,899.

The figure was roughly in line with estimates provided by analysts at JPMorgan, Goldman Sachs and Nationwide, Reuters said.

A separate count carried out by Bloomberg News put the claims at about 226,000.

Weekly filings are typically released by the Bureau of Labor Statistics, but these have not been published during the data blackout caused by the more than 40-day shutdown.

The Fed slashed interest rates by 25 basis points at its previous two gatherings in October and September, as part of a bid to support a slowing U.S. labor market. But, partly given the lack of data, it is about a 50-50 toss-up if the central bank will roll out another reduction next month, CME’s FedWatch Tool has found.

4. Bitcoin slumps below $100,000

Bitcoin tumbled below the coveted $100,000 level on Friday, tracking a broader decline in risk-driven markets as sentiment was battered by Fed rate uncertainty and the fresh selloff in tech stocks.

The world’s largest cryptocurrency was on track to fall for a third consecutive week, as once-reliable flows from big investment funds, exchange-trade funds, and corporate treasuries into the digital asset showed indications of drying up.

Bitcoin slid 6.5% to $96,968.6 by 03:34 ET, after having dropped to an intraday low of $96,866.1. Since early October, the token has lost more than $450 billion in value.

5. Chinese factory output falls short of estimates

Chinese factory output grew less than expected in October, potentially heaping new pressure on Beijing to roll out out fresh measures to boost a $19 trillion economy battered by trade tensions with the United States.

Industrial production increased 4.9% year-on-year in October, government data showed on Friday. The print was below expectations of 5.5% and down from a 6.5% rise in the prior month.

Domestic demand has also been tepid. Retail sales for the month rose 2.9%, slightly above expectations, on support from increased consumer spending during the Golden Week holiday. But it was the weakest expansion since August last year.

Chinese producers have been grappling with sluggish consumer spending in recent years, as heightened uncertainty over the world’s second-largest economy has led local businesses and customers alike to pare back expenditures.

This, coupled with persistent deflation in factory gate prices, has weighed heavily on production, even as Beijing has pledged to do more to promote growth.

Gold prices rose in Asian trade on Thursday, extending recent gains as traders remained uncertain over the U.S. economy even as lawmakers voted to end the country’s longest ever government shutdown.

The yellow metal steadily rose over the past week as a swathe of weak private readings on the U.S. labor market spurred bets that the Federal Reserve will cut interest rates in December.

But gold’s pace of gains slowed in recent sessions as markets sharply pared bets on a December cut.

Sustained central bank buying of gold, especially in China, also aided bullion prices. Recent data showed the People’s Bank purchased gold for the 12th straight month in September.

Spot gold rose 0.4% to $4,210.63 an ounce, while gold futures for December steadied at $4,214.60/oz by 00:06 ET (05:06 GMT).

Gold buoyed by economic uncertainty as US govt reopens

Gold rose this week amid growing uncertainty over the U.S. economy, even as lawmakers voted to end a nearly 43-day government shutdown.

U.S. President Donald Trump on Wednesday evening signed a bill unlocking more government funding, just shortly after the House of Representatives voted to approve the measure.

The reopening is now expected to open the door to more official economic data from the U.S. government, offering greater insight into the world’s largest economy. Readings for October and November are likely to reflect the shutdown’s impact.

Trump claimed that the shutdown cost the U.S. economy $1.5 trillion.

“The prospect of weak economic data following the US government shutdown also helped push gold higher,” ANZ analysts wrote in a note, adding that central bank buying and broader economic uncertainty was also boosting gold.

Other precious metals also advanced on Thursday and were sitting on gains this week. Spot platinum rose 0.1% to $1,620.15/oz, while spot silver surged 1.7% to $54.1665/oz.

Metal markets remained upbeat even as traders sharply pared bets on a December rate cut by the Fed. Markets are pricing in a 50.4% chance for a 25 basis point cut in December, much lower than the 62.4% chance seen a day ago, CME Fedwatch showed.

Copper up on reopening cheer, China stimulus hopes

Among industrial metals, copper prices rose on Thursday and were sitting on strong gains in recent weeks.

Benchmark copper futures on the London Metal Exchange rose 0.2% to $10,933.80 a ton, while COMEX copper futures rose 0.7% to $5.1215 a pound.

Copper prices were encouraged by the U.S. government reopening, on hopes that local business will face fewer disruptions and that demand for the red metal will pick up again.

Copper was also encouraged by pledges of more stimulus from China in recent weeks, with the country’s new five-year economic plan aimed at shoring up industrial activity and domestic production.

U.S. stock futures edged higher Wednesday as investors awaited the confirmation of a deal to end the longest-ever federal government shutdown.

At 05:30 ET (10:30 GMT), Dow Jones Futures gained 100 points, or 0.2%, S&P 500 Futures climbed 25 points, or 0.4%, and Nasdaq 100 Futures rose 165 points, or 0.7%.

The main averages on Wall Street ended in mixed fashion on Tuesday, as investors weighed the likely reopening of the U.S. government with disappointing weekly jobless claims data from payroll services firm ADP, which pointed to a downturn in labor market momentum.

The broad-based S&P 500 rose 0.2% and the blue chip Dow Jones Industrial Average gained 1.2%, while the tech heavy NASDAQ Composite dropped nearly 0.3%.

Government reopening to see data releases

Lawmakers in the U.S. House of Representatives are likely to vote this week on a compromise which would end an historically-long government shutdown.

Hopes that the government will soon reopen were bolstered earlier this week, when the U.S. Senate approved a bill to secure federal funding for most agencies until January 30.

The bill will now head to the House of Representatives, where the body’s Republican majority means the body is likely to approve the bill, before Presdident Donald Trump signs it into law.

For financial markets, reopening the government would mean the return of several official economic indicators, including a monthly jobs report, which have been delayed by the shutdown. These data points are crucial because they help investors and policymakers alike assess the state of the U.S. economy.

The data blackout has made the path ahead for Federal Reserve interest rates particularly murky, leaving the outcome of the central bank’s final monetary policy meeting in December largely uncertain.

According to the Wall Street Journal, Fed members remain divided on whether to cut rates at the gathering, after having slashed borrowing costs by 25 points at prior two meetings in October and September.

Markets are pricing in a 61.9% chance for a 25 basis point cut in the Fed’s December 10-11 meeting, up from 57.8% yesterday, CME Fedwatch showed.

Cisco due to report

On the earnings calendar, markets will be keeping close tabs on results from networking gear provider Cisco Systems (NASDAQ:CSCO) after the closing bell.

Cisco has faced a solid backdrop in recent months, underpinned by the surge in enthusiasm for AI, which has fueled soaring hyperscale cloud investments and driven IT infrastructure financing.

Elsewhere, Oklo (NYSE:OKLO) stock edged higher even after its third-quarter loss widened from a year ago, as the nuclear power startup works toward getting regulatory approval for its technology.

Chevron (NYSE:CVX) will also be in the spotlight, with the oil major set to reveal its latest strategy update later in the session following a massive $55 billion acquisition of smaller peer Hess.

Crude retreats

Oil prices retreated Wednesday, handing back some of the previous session’s gains brought about by expectations that an end to the longest-ever U.S. government shutdown could boost demand in the world’s biggest crude-consuming nation.

Brent futures dropped 0.9% to $64.58 a barrel, and U.S. West Texas Intermediate crude futures fell 1% to $60.46 a barrel.

Both contracts posted gains of at least 1.5% on Tuesday as traders hoped that the likely end to the U.S. government shutdown would ead to a rebound in travel ahead of the upcoming holiday season.

Gold prices could rise toward $4,700 an ounce as mounting political and financial market risks sustain demand for safe-haven assets, even if the end of the U.S. government shutdown improves investor sentiment, according to UBS.

The bank’s strategists believe that bullion’s recent pullback is just a pause in its ongoing rally.

“We think gold prices can climb further, even if the potential end to the longest government shutdown in U.S. history supports risk sentiment,” strategists led by Ulrike Hoffmann-Burchardi said in a note.

Political uncertainty remains a key driver. The team pointed to lingering questions about the timing of the Senate vote to finalize the spending bill and the possibility of another partial shutdown early next year if Congress fails to reach a longer-term agreement.

UBS also flagged uncertainty surrounding the Supreme Court’s pending ruling on the legality of tariffs imposed under the International Emergency Economic Powers Act (IEEPA), saying this should “provide ongoing support for gold.”

Elevated global government debt levels are also bolstering demand for gold amid concerns about fiscal sustainability and currency depreciation, according to UBS. The latest data from the World Gold Council showed total demand reached a record high in the September quarter, driven by investment flows and renewed central bank buying. The bank expects full-year demand to be the strongest since 2011.

Monetary policy and currency trends are also expected to favor the metal, with strategists anticipating two more Federal Reserve rate cuts by early 2026, citing weakening labor market indicators and falling consumer sentiment.

“With U.S. real interest rates likely to fall further and undermine the appeal of the US dollar, we expect gold to stay supported,” they wrote.

Overall, UBS remains bullish on the yellow metal, seeing it “as an effective portfolio diversifier and hedge.”

The bank reaffirmed its 12-month price target of $4,200 an ounce, adding that a “significant rise in political and financial market risks could push gold toward our upside target of $4,700/oz.”

European stocks surged higher Monday, following the global lead after the U.S. Senate voted in favor of a key step towards ending the country’s longest ever government shutdown.

At 03:15 ET (08:15 GMT), the DAX index in Germany gained 1.5%, the CAC 40 in France climbed 1% and the FTSE 100 in the U.K. rose 0.6%.

Sentiment boosted by U.S. shutdown news

Sentiment received a boost on Sunday with the news that the U.S. Senate voted 60-40 to advance a spending bill for consideration, after eight Democratic senators reached a deal with Republican leaders to potentially reopen the U.S. government.

The prospect of a potential breakthrough in Congress encouraged investors, as the U.S. economy struggled with its longest ever government shutdown, which entered its 40th day on Sunday.

The shutdown sparked disruptions across the country, especially in key sectors such as air travel, prompting White House economic adviser Kevin Hassett to state in an interview that the U.S. economy, widely seen as the global economy’s main growth driver, could contract in the fourth quarter if the shutdown dragged on.

COP30 summit starts in Brazil

Elsewhere, the COP30 global climate summit kicks off on Monday in Brazil, with the gathering marking three decades since global climate negotiations began, which eventually resulted in the 1992 U.N. climate treaty.

The conference could turn out to be highly contentious, especially as the Trump government has decided not to send any high-level officials and has announced its intention to withdraw from the treaty.

Salzgitter cuts full-year guidance

There are more earnings to digest Monday as what has been a reasonably healthy quarter gradually winds down.

German steel producer Salzgitter (ETR:SZGG) lowered its full-year guidance for the second time this year, warning that business conditions have remained weak despite recent signs of firmer prices.

Reinsurer Hannover Re (OTC:HVRRY) raised its full-year earnings forecast after reporting a 7.7% increase in group net income for the first nine months of 2025.

Diageo (LON:DGE) has appointed Sir Dave Lewis as its new Chief Executive Officer, effective January 1, 2026, the company announced Monday.

Currently serving as chair of Haleon (LON:HLN), Lewis previously served as Group CEO of Tesco (LON:TSCO) from 2014 to 2020, and spent nearly three decades at Unilever (LON:ULVR) in various executive roles.

Crude trades higher

Oil prices rose Monday on optimism that the end of the U.S. government shutdown was near, potentially lifting demand in the world’s top oil consumer.

Brent futures gained 0.8% to $64.14 a barrel, and U.S. West Texas Intermediate crude futures rose 0.9% to $60.31 a barrel.

Both contracts fell about 2% last week, recording their second consecutive weekly decline, after the Organization of the Petroleum Exporting Countries and their allies, or OPEC+, agreed to increase output slightly in December, but it also paused further hikes in the first quarter, wary of a supply glut.

The U.S. dollar edged higher Friday, rebounding after dropping from multi-month highs in the previous session, as traders digested disappointing labor market data.

At 04:25 ET (09:25 GMT), the Dollar Index, which tracks the greenback against a basket of six other currencies, traded 0.1% higher to 99.700, remaining in the same trading range it has sat in since August.

Labor market data in focus

The greenback fell on Thursday after Challenger Job Cuts data showed U.S. layoffs surged to a two-decade high in October, at over 150,000 cut positions.

The print raised concerns over a rapid cooling in the labor sector, and also spurred bets that the Federal Reserve will cut interest rates again to stave off further weakness in the labor market.

“Having been bid for a week, the dollar finally softened yesterday. The catalyst appeared to be some Challenger layoff data and also some alternative data suggesting October’s NFP [nonfarm payrolls] report, which we were meant to see today, should have fallen by 9k,” said analysts at ING, in a note.

The greenback had been on the rise, buoyed by growing bets that the Federal Reserve will not cut interest rates in December after Chair Jerome Powell warned that a reduction at the final meeting of the year was not a given.

“DXY [the dollar index] has stalled at the top of the three-month trading range and we expect it to come lower. It’s not clear what will drive lower today, though,” ING added.

Sterling faces weakness

In Europe, GBP/USD slipped 0.2% to 1.3104, the day after the Bank of England held interest rates steady on a 5-4 decision, with Governor Andrew Bailey casting the deciding vote.

“It now seems Governor Andrew Bailey is the swing voter and minded for a December cut,” said ING. “That outcome is only priced with a 70% probability right now, meaning that there is scope for lower short-term rates and a weaker pound.”

EUR/USD slipped 0.1% to 1.1536, edging away from a one-week high, even after data showed that German exports rose by 1.4% in September compared with the previous month, more than the 0.5% increase expected.

“There is a chance that EUR/USD may have established an important low at 1.1470 this week,” said ING. “But for a rally to unfold, we will probably need to get more clarity on the slowing U.S. jobs market.”

Yen slips slightly

In Asia, USD/JPY traded 0.3% higher to 153.44, after data, released earlier Friday, showed household spending grew less than expected in September.

That said, the pair is on track for a weekly loss after the release of strong wage growth data earlier in the week provided the Bank of Japan with more impetus to hike interest rates.

USD/CNY traded 0.1% higher to 7.1222 after data showed China’s trade surplus unexpectedly shrank in October. China’s exports contracted for the first time since March 2024.

China’s imports also grew at a much slower rate than expected, signaling that domestic demand in Asia’s largest economy remained weak.

AUD/USD gained 0.1% to 0.6482.

U.S. stock futures edge down after solid corporate earnings and economic data helped to soothe concerns around high stock valuations. Some members of the U.S. Supreme Court’s conservative supermajority express skepticism about the White House’s use of emergency economic powers to impose aggressive tariffs. Qualcomm warns that it could lose some business from a major customer, while Tesla shareholders are set to hold a vote on a $1 trillion pay package for CEO Elon Musk.

1. Futures inch lower

U.S. stock futures pointed lower on Thursday, following a rebound in the prior session after worries around elevated stock valuations hit equities earlier in the week.

By 02:27 ET (07:27 GMT), the Dow futures contract had slipped by 42 points, or 0.1%, S&P 500 futures had fallen by 7 points, or 0.1%, and Nasdaq 100 futures had declined by 47 points, or 0.2%.

The main averages on Wall Street climbed on Wednesday, with mega-cap technology stocks in particular notching gains. The uptick helped to tamp down emerging fears over the sustainability of heightened stock valuations, especially in the artificial intelligence-driven tech sector.

Bolstering sentiment as well were alternative data sources which suggested that U.S. economic conditions remained solid in October. Officials and policymakers alike have been starved of official figures during an ongoing government shutdown that has dragged on for more than a month.

Media reports suggested that lawmakers in Washington could forge an agreement to end the shutdown by this weekend. Should it linger on, Transportation Secretary Sean Duffy has warned, air travel capacity at 40 major American airports will be reduced by 10% from Friday.

2. Supreme Court shows skepticism on IEEPA tariffs

Meanwhile, markets were highlighting a note of skepticism among members of the U.S. Supreme Court’s conservative supermajority toward President Donald Trump’s use of emergency economic powers to impose sweeping tariffs.

On Wednesday, the high court began hearing oral arguments on Trump’s usage of the 1977 International Emergency Economic Powers Act, or IEEPA, as legal backing for the levies. The matter has been brought before the Supreme Court after lower courts ruled that the president had surpassed his authority by employing the measures.

Some debate has swirled around whether the court’s 6-3 conservative supermajority, which includes three Trump picks, will ultimately choose to strike down or uphold the IEEPA tariffs. For much of Trump’s second term in office, the Supreme Court have broadly supported the White House’s efforts to centralize decision-making powers in the executive branch.

For that reason, sharp questioning of IEEPA’s application to the duties by Chief Justice John Roberts was met with some surprise. The tariffs represented a tax on Americans, Roberts argued, adding "that has always been the core power of Congress."

Bets that the tariffs will survive the fall dropped in prediction markets, although analysts at Vital Knowledge flagged that, if the levies are not upheld, investors could be looking at a more uncertain economic landscape. Trump officials have also hinted that they could take advantage of other legal means to keep the president’s trade war going.

3. Qualcomm flags possible loss of Samsung business

Shares of Qualcomm sank by more than 3% in extended hours trading after the chip designer unveiled that it may lose some business from top customer Samsung Electronics next year.

The announcement overshadowed current-quarter sales and profit forecasts from the chip designer that surpassed Wall Street expectations thanks in large part to demand for premium smartphones. Qualcomm is a major global supplier of the modem chips which help connect these devices with wireless data networks.

Partially fueling these sales has been Samsung, which uses the chips in its Galaxy S25 model phones. However, CEO Cristiano Amon said Qualcomm is now preparing for the chips to make up a lower share of Samsung’s next-generation versions of the handset, Reuters reported.

Elsewhere, fellow chip technology provider Arm Holdings’ fiscal third-quarter outlook surpassed estimates as well, buoyed by heavy recent AI spending throughout the tech industry. Shares of the U.K.-based group rose after-hours.

4. Tesla shareholder vote ahead

Tesla shareholders are expected to decide today on a massive compensation package for CEO Elon Musk, with at least one major stakeholder having already outlined plans to vote against the measure.

Earlier this week, Norway’s sovereign wealth fund -- and the world’s largest -- said it would reject the roughly $1 trillion pay package Tesla has put forward for Musk, citing concerns over the scope and effect of the award.

Norges Bank Investment Management, which manages the $1.9 trillion fund, said that while it "appreciate[s] the significant value created under Mr. Musk’s visionary role" at the helm of the electric carmaker, "we are concerned about the total size of the award, dilution, and lack of mitigation of key person risk."

But Tesla’s board has flagged that should shareholders say no to the compensation, there is a risk that Musk -- the world’s richest man -- will leave the company, potentially pushing down its stock price.

5. BoE decision

While last week’s Federal Reserve interest rate cut, as well as policy holds by the European Central Bank and Bank of Japan, were widely anticipated, the Bank of England’s announcement later today is far from certain.

Markets are projecting that the BoE will keep rates steady, although there was still a roughly one-in-three chance that the central bank will ease borrowing costs by a quarter of a percentage point.

Leaving rates unchanged would be the first slowing in a cycle of policy loosening which began last year, but some analysts now expect a possible drawdown because of recently softer-than-expected -- albeit relatively elevated -- consumer price inflation and wage data.

The BoE has consistently slashed rates every three months since August last year, yet it is now unclear if it will maintain this pace, with Governor Andrew Bailey saying in September that the path ahead is "more uncertain."

Gold prices rebounded in Asian trading on Wednesday as a broader risk-off mood across global financial markets lifted bullion’s safe-haven demand, while traders await U.S. private payroll data for cues on future interest rate cuts.

Spot gold rose 0.9% to $3,966.56 per ounce by 00:47 ET (05:47 GMT), while U.S. Gold Futures edged up 0.3% to $3,974.10.

The metal declined nearly 2% in the previous session, hitting a one-week low.

Market bubble fears boost gold’s haven demand

Investor nerves were rattled after the CEOs of Morgan Stanley and Goldman Sachs flagged the possibility of a sharp equity market drawdown, pointing to richly valued stocks and “bubble” like dynamics in the tech-led rally.

Their remarks led to steep overnight losses on Wall Street, also dragging Asian equities lower on Wednesday.

Market jitters revived demand for gold, traditionally viewed as a safe store of value during times of financial stress.

Despite Wednesday’s uptick, bullion remains under pressure from waning bets on another U.S. Federal Reserve rate cut this year. Traders have scaled back expectations for a December cut after Chair Jerome Powell signaled last week that policymakers may pause further easing.

A resilient U.S. dollar, which hovered near a three-month high, has also weighed on gold by making it more expensive for overseas buyers.

At the same time, easing U.S.-China tensions have reduced safe-haven inflows, limiting gold’s upside momentum in recent sessions.

Investors are now turning their attention to the U.S. ADP National Employment Report due later on Wednesday for fresh clues on the labor market and future Fed policy moves. With official economic releases delayed due to a partial U.S. government shutdown, the ADP data is expected to take on added significance.

Metal markets edge up

Other precious and industrial metals edged higher on Wednesday, as a slight fall in the U.S. dollar aided gains.

Silver Futures rose 0.4% to $47.49 per ounce, while Platinum Futures edged up 0.2% to $1,542.75/oz.

Benchmark Copper Futures on the London Metal Exchange gained 0.4% to $10,6980.20 a ton, while U.S. Copper Futures climbed 0.9% to $4.97 a pound.