Select Language

The "Magnificent" tech stocks continue to dominate market attention, with recent WarrenAI rankings highlighting the strongest performers based on growth metrics, analyst sentiment, and valuation. These industry giants have demonstrated remarkable resilience and growth potential despite varying market conditions.

NVIDIA (NASDAQ:NVDA) claims the top position with a compelling combination of explosive growth and relative value. The chip giant posted a 28.1% one-year total return, but analysts see significant runway ahead with 45.7% upside potential. With revenue growth of 62.5% and forecasted EPS growth of 60.3%, NVIDIA’s forward PEG ratio of 0.66 suggests it remains undervalued relative to its growth trajectory, according to WarrenAI’s analysis.

NVIDIA (NASDAQ:NVDA): The semiconductor powerhouse continues its dominance in the AI chip market, delivering a 28.1% one-year total return. With a forward PEG ratio of 0.66 and analyst upside of 45.7%, NVIDIA combines strong historical performance with substantial growth potential, making it WarrenAI’s top pick among Magnificent stocks.

Analysts at Bernstein recently reiterated an Outperform rating on Nvidia, maintaining a positive outlook on the company.

Alphabet (NASDAQ:GOOGL): Google’s parent company recorded the highest one-year return at an impressive 90.3%, demonstrating remarkable momentum. With forecasted EPS growth of 33.2% and a PEG ratio just above 1.0, analysts still see 12.0% upside potential. WarrenAI highlights Alphabet’s strong earnings quality alongside its market-beating performance.

In recent developments, Alphabet is seeing increased interest in its custom AI chips, with reports that Meta is considering a purchase of its Tensor Processing Units (TPUs). Additionally, the Adani Group is reportedly planning a significant investment in Google’s AI data center infrastructure in India.

Microsoft (NASDAQ:MSFT): The software giant delivered a 17.0% one-year total return, with analysts projecting modest additional upside of 2.8%. Microsoft’s appeal lies in its financial stability, with a 33.3% return on equity and 55.6% EBITDA margin. WarrenAI notes its forward PEG of 1.53 reflects premium pricing for its steady, quality growth.

Microsoft received continued positive sentiment from analysts, with both Bernstein and BMO Capital reiterating Outperform ratings, citing strong demand for its Azure cloud platform.

Meta Platforms (NASDAQ:META): The social media titan posted a 13.2% one-year return with analysts forecasting similar upside potential at 12.7%. Despite a negative forward PEG ratio (-5.99) indicating forecast volatility, WarrenAI points to Meta’s attractive P/E ratio of 27.4x and improving cash flow as positive indicators of its turnaround story.

Meta Platforms has faced legal and regulatory actions, including an agreement by leadership to pay $190 million to resolve a shareholder privacy lawsuit and a Spanish court order to pay €479 million to media publishers.

These rankings reflect current market conditions and company fundamentals as assessed by WarrenAI’s analytical framework, combining traditional metrics with growth projections to identify relative strength among these market leaders.

An outage on exchange operator CME Group’s platform disrupts trading in futures in a slew of assets, leaving traders flying blind ahead of a shortened U.S. session. The U.S. dollar is on track for its worst week in four months, as wagers on a Federal Reserve interest rate cut next month grow. Meanwhile, core consumer inflation in Tokyo stays above the Bank of Japan’s target in November, bolstering the case for a near-term hike in borrowing costs in the country.

1. CME glitch impacts commodities, FX, stock futures

Commodities futures and options trading on CME Group’s popular platform was halted on Friday due to a technical issue at data centers, the world’s largest exchange operator said in a social media post.

“Due to a cooling issue at CyrusOne data centers, our markets are currently halted,” CME Group said in a statement posted on X. The company said it was working to fix the issue in the near-term.

Dallas-based CyrusOne operates more than 55 data centers in the U.S., Europe and Japan.

A host of commodities and agricultural goods contracts appeared to be disrupted by the outage. Futures prices for equity indices, including the S&P 500 and Nasdaq 100, also appeared to be impacted.

The outage contributed to already slow trading volumes across the globe following the U.S. Thanksgiving holiday on Thursday.

Futures are a key component of financial markets, used by a wide variety of participants -- from trading desks to individual speculators -- to hedge or take positions in a range of financial assets.

2. Asian markets steady to end tough November

Asian stocks ended a difficult November on relatively steady footing, despite pressure on Chinese markets from renewed concerns over a property market meltdown in the country.

Japanese shares moved in a flat-to-low range as a swath of data showed unexpected resilience in the economy, driving up expectations for an interest rate hike by the Bank of Japan.

Regional markets received few trading cues on account of the U.S. Thanksgiving holiday. Overall losses in Asian stocks were still limited by optimism over a U.S. interest rate cut in December. But most bourses in the region were nursing losses for November, following a tumble in tech valuations through most of the month fueled partially by worries over the sustainability of massive spending on artificial intelligence.

Elsewhere, European stocks oscillated around the flatline on Friday, with a fifth straight month on gains in regional shares hanging in the balance.

3. Dollar on track for worst week in four months

The U.S. dollar strengthened slightly, but the greenback is still facing its sharpest weekly drop since July as traders assess the probability of a rate reduction by the U.S. Federal Reserve next month.

By 03:28 ET (08:28 GMT), the U.S. dollar index, which tracks the currency against a basket of its global peers, had ticked up by 0.1% to 99.70.

Traders have raised the odds of a 25-basis-point Fed cut at the December 9-10 meeting to around 85% from roughly 40% earlier this month, a swing that has knocked the dollar lower and trimmed bond yields.

The shift was driven by benign U.S. data and some dovish comments from Fed policymakers, although other officials have called for a more cautious approach to rate changes due to a lack of fresh economic data.

Speculation over a possible appointment of White House economic adviser Kevin Hassett to the Fed Chair role has added another layer to the debate. A Hassett-led policy stance could tilt toward faster and more aggressive easing, a dynamic that would typically put further pressure on the dollar.

4. Tokyo CPI in focus

Tokyo’s headline consumer price index remained unexpectedly steady at 2.7% in November amid high food prices, with underlying inflation also remaining well ahead of the Bank of Japan’s annual target.

So-called "core" CPI, which excludes volatile fresh food prices, grew 2.8% year-on-year in November, government data showed on Friday. The print was slightly above expectations of 2.7% and matched the prior month’s pace.

The core CPI reading, which is closely watched as a gauge of underlying inflation by the Bank of Japan, was above the central bank’s 2% annual target.

Sticky inflation could give the BOJ more impetus to hike interest rates. Policymakers have recently signaled they will consider raising rates at the BOJ’s December meeting.

But such increases risk putting the central bank at odds with Prime Minister Sanae Takaichi’s government, which has broadly called for looser monetary conditions and more fiscal spending to support economic growth.

5. Bitcoin hovers above $91,000

Bitcoin dipped marginally, yet floated above the $91,000 mark, as markets increasingly bet on a December interest-rate cut by the Fed and weighed the implications of the potential leadership change at the central bank.

The world’s largest cryptocurrency was down 0.4% at $91,129.7 by 03:44 ET. Last Friday, the digital asset briefly sank to near $80,000, its weakest level since April.

For the week, Bitcoin was set for a rise of nearly 8%, which would snap four straight weeks of declines.

The dollar was drifting toward its largest weekly drop in four months on Thursday as trade thinned ahead of the U.S. Thanksgiving holiday, leaving investors mulling the coming year where the U.S. is looking increasingly lonely in cutting rates.

The yen edged 0.2% higher to 156.11 per dollar in Asia trade, helped by a hawkish turn in tone from Bank of Japan officials.

U.S. markets are shut for Thanksgiving, leaving liquidity thin and amplifying moves in currency trading.

"That could be an attractive environment for Japanese authorities to intervene in dollar/yen," said Francesco Pesole, forex strategist at ING.

"However, there may still be a preference to intervene after a dollar-negative data event, and the stall in the pair may have removed some sense of urgency," he added.

The euro dropped 0.05% to $1.1590, after hitting a 1-1/2-week high earlier in the session at $1.1613.

Markets are watching negotiations over a possible Ukraine peace deal, which could lift the single currency.

U.S. envoy Steve Witkoff is expected to travel to Moscow next week for talks with Russian leaders, but a senior Russian diplomat said on Wednesday Russia will make no big concessions.

A resurgent New Zealand dollar skipped out to a three-week peak of $0.5728 and has gained about 2% since a hawkish shift at the central bank a day earlier.

The Reserve Bank of New Zealand cut rates on Wednesday but said a hold was discussed and flagged that the easing cycle was likely over. Helped by some strong economic data on Thursday, markets see rates going higher and price in a hike by December 2026.

That contrasts with more than 90 basis points of cuts priced for the U.S. Federal Reserve between now and the end of next year.

Data showed New Zealand retail sales rose in the third quarter, while business confidence jumped to its highest in a year.

"Kiwi green shoots are really starting to mushroom quite quickly now," said Westpac strategist Imre Speizer.

THE AUSSIE YIELDER

The Australian dollar has also been gaining after a hotter-than-expected inflation reading on Wednesday added to the case that the easing cycle there is also finished.

Australia’s 3-year and 10-year rates of 3.86% and 4.5%, respectively, are the highest in the G10, which analysts point out makes the currency look cheap. [AUD/]

At $0.6536 the Aussie is in the middle of a channel where it has traded for about 18 months. Kit Juckes at Societe Generale, however, notes it has more closely tracked China’s yuan than interest rates lately - which could support further gains as the yuan has climbed sharply in recent sessions.

Pushback from China’s central bank fixing mechanism steadied the yuan at 7.08 per dollar on Thursday. [CNY/]

Sterling inched up to its highest since late October at $1.3265 and was on course for the largest weekly rise since August as Britain’s budget alleviated some concerns about the national finances.

DOLLAR DOWN

The U.S. dollar index was up 0.1% at 99.62, having retreated from a six-month high hit a week ago to head for its largest weekly drop since July.

"The market will soon be thinking about the big trades for 2026, and I strongly doubt that ’long USD’ will be one of them," said Spectra Markets’ President Brent Donnelly.

He said if White House economic adviser Kevin Hassett - an advocate for rate cuts - were appointed the next Federal Reserve chair it ought to be a negative catalyst for the dollar.

"Once we get past Friday, all the corporate and real money USD demand is done."

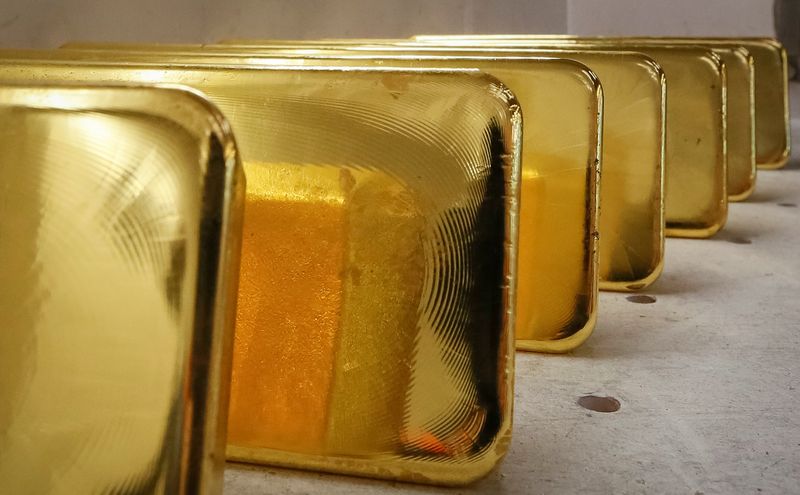

Deutsche Bank lifts its 2026 gold price forecast, citing resilient investor demand, strong central-bank buying, and limited supply response.

The bank now expects gold to average $4,450/oz in 2026, up from a previous forecast of $4,000/oz, with a projected trading range of $3,950–4,950/oz. A high of $4,950/oz would sit about 14% above current December 2026 futures, it said.

Track gold targets, commodity calls and Wall Street outlooks by upgrading to InvestingPro - get 55% off today

The upgrade reflects a combination of stabilising short-term flows, constructive technical indicators and supply-demand trends that continue to lean in gold’s favour.

“The positive structural picture shows inelastic demand from central banks and ETF investment diverting supply from the jewellery market. Also, overall growth in demand outpaces supply,” analyst Michael Hsueh said in a note.

Gold’s outperformance relative to the U.S. dollar and its unusually wide 2025 trading range—its largest since 1980—also underpin the constructive setup heading into 2026.

Hsueh expects official sector buying to rebound next year after a slight dip in 2025. He cites reserve-manager surveys showing the highest share of central banks planning to increase gold allocations in years, with one respondent calling gold the “ultimate protection against black swan tail risk events.”

Third-quarter official demand was the third highest on record in real-dollar terms despite elevated prices.

On the investment side, exchange-traded funds (ETFs) returned to net accumulation this year after four years of outflows. Hsueh argues that the recent rapid but brief liquidation phase likely “suggests that the $3,900/oz support will hold,” supported further by seasonally strong early-year buying patterns.

Supply is expected to rise only modestly in 2026, with mined output at 3,715 tonnes. Hsueh points to lagging production responses, recycling that remains below historical peaks and conservative long-term price assumptions within the mining sector.

The analyst notes that many large mining projects still use planning price assumptions well below market levels, reinforcing a slow supply elasticity even after significant price gains. A significant supply disruption at Indonesia’s Grasberg mine is also expected to offset new project additions.

Potential risks to the outlook include a deeper equity-market correction, fewer expected Fed rate cuts, or a sharp slowdown in official buying.

Futures linked to the main U.S. stock indices inch lower, with markets gearing up for the release of closely-watched -- and delayed -- economic figures. Investors will have the chance to pour through metrics of retail sales and producer prices, among other data points, as Federal Reserve officials debate the trajectory of U.S. interest rates. Google reportedly ratchets up its drive to rival Nvidia in the artificial intelligence chip race, while server provider Dell is due to report its latest earnings.

1. Futures edge lower

U.S. stock futures pointed lower on Tuesday, indicating some investor caution ahead of a crucial batch of fresh economic data this week.

By 02:35 ET (07:35 GMT), the Dow futures contract had ticked down by 42 points, or 0.1%, S&P 500 futures had dipped 7 points, or 0.1%, and Nasdaq 100 futures had declined 46 points, or 0.2%.

The main averages on Wall Street advanced on Monday to begin a trading week due to be shortened by the Thanksgiving holiday.

Underpinning sentiment were comments from Federal Reserve policymakers which bolstered hopes for an interest rate cut at the central bank’s upcoming meeting in December.

Such expectations helped to offset ongoing concerns over a potential artificial intelligence bubble, with fears especially swirling around the sustainability of massive — and increasingly debt-fueled — spending on infrastructure for the nascent technology.

Yet, as analysts at Vital Knowledge argued, this gloomy narrative has displayed signs of “stabilizing.”

“Money isn’t exiting AI but instead shifting,”as cash pours into Google and chipmaker Broadcom to capitalize on the search giant’s new Gemini model and powerful AI-optimized processors, the analysts said.

They added that, against this backdrop, “there’s a bit more comfort in a the prospect of a year-end rally,” although investors are still wary after a recent bout of volatility.

2. Key economic data ahead

Attention now turns to the economic calendar, which is once again replete with consequential figures after the end of a record-long federal government shutdown.

The temporary closure had delayed several of these readings, depriving markets and rate-setters of crucial information needed to take decisions on everything from investments to borrowing costs.

On Tuesday, the slate of data will include gauges of retail sales and producer price growth. Consumer spending remains a crucial cog of the American economy, accounting for more than two-thirds of activity, while inflation has appeared to stay stubbornly elevated.

But, such was the length of the shutdown, the numbers only cover the month of September — and analysts have suggested that the state of the economy may have already changed compared to just two months ago.

3. Fed members on rate outlook

Given this rather murky picture of the wider economy, the Fed faces a difficult choice at its December gathering.

Officials seem to be unusually divided over whether to slash rates for the third straight meeting, or keep borrowing costs steady at their current target range of 3.75% to 4%.

San Francisco Fed President Mary Daly and Fed Governor Christopher Waller both appeared to support the former option in comments on Monday, underlining a desire to prioritize support for a weakening labor market over sticky price gains. Wagers on a 25-basis point rate reduction next month have subsequently risen.

However, other Fed members have highlighted some reticence to cut in an environment where the central bank does not have the latest economic data. At the same time, some have expressed wariness about the path ahead for rates beyond December.

According to the Wall Street Journal, the final call will ultimately fall to Fed Chair Jerome Powell — but either choice will come with significant drawbacks and risks.

4. Meta, Google discuss TPU deal - The Information

Google is sharply escalating its bid to rival Nvidia in the AI chip race, and Meta Platforms is emerging as a potential multibillion-dollar customer, The Information reported Monday evening.

For years, Google has limited its custom tensor processing units (TPUs) to its own cloud data centers, renting them out to companies running large-scale AI workloads. But according to The Information, Google is now pitching the chips for deployment inside customers’ own data centers, marking a major shift in strategy.

One of those customers is Meta, the owner of Facebook and Instagram. The firm is reportedly in discussions to spend billions of dollars to integrate Google’s TPUs into its data centers starting in 2027, while also planning to rent TPU capacity from Google Cloud as early as next year. Meta currently relies primarily on Nvidia GPUs for its AI infrastructure.

Shares of Google-parent Alphabet were higher in premarket U.S. trading on Tuesday, while Nvidia dropped by a little over 2%.

5. Dell to report

More corporate earnings are also due out today, as the latest quarterly reporting period ebbs to a close.

Dell Technologies will headline the slew of results after the bell on Wall Street. The company, whose customers including groups like CoreWeave and Elon Musk’s AI startup xAI, almost doubled its annual profit growth target for the next four years in October, underscoring its big bet on surging demand for its servers which help power AI models.

Annual growth in adjusted per-share profit is now tipped to be at least 15%, up from roughly 8% previously. Revenue, on an annualized basis, is seen increasing at between 7% and 9% during the period, versus a prior projection of 3% to 4%.

Soaring expenditures on Dell’s servers have cemented its position as one of the major beneficiaries of the AI boom, although analysts have flagged worries that heavy competition and the high costs related to building these products could dent income margins.

The U.S. dollar slipped marginally lower Friday, but was still set for a weekly gain as traders trimmed bets on further policy easing from the Federal Reserve next month.

At 04:20 ET (09:20 GMT), the Dollar Index, which tracks the greenback against a basket of six other currencies, traded 0.1% lower to 100.042, on course for a weekly gain of 0.8%.

Dollar set for weekly gains

The U.S. currency received a boost on Thursday after the delayed U.S. nonfarm payrolls report painted a mixed picture of the country’s labor market, reinforcing the view that the Fed is likely to hold interest rates unchanged at its December meeting.

The minutes from the Fed’s October meeting minutes showed a split among policymakers over whether to cut in December, and with the jobs report failing to offer a definitive picture a hold seems the likely result.

“This week’s events only seem to have delayed expectations for the Fed easing cycle,” said analysts at ING, in a note. “The terminal rate for the easing cycle is still priced around the 3.00% area for next year, but the market has switched to favoring the next cut in January (24bp priced) versus December (10bp priced).”

There are more economic numbers to digest Friday, with the focus likely to be on the S&P PMI readings and final readings for November consumer sentiment.

Euro helped by solid PMI data

In Europe, EUR/USD edged 0.1% higher to 1.1538, helped by data showing eurozone business activity grew steadily this month as services expanded at the quickest pace in 18 months.

The HCOB flash eurozone composite PMI, compiled by S&P Global, declined slightly to 52.4 in November from a more-than two-year high of 52.5 in October, marking its 11th consecutive month above the 50.0 mark that separates growth from contraction.

“These [PMI numbers] have been a source of comfort to the euro in that business sentiment has stayed relatively constructive, suggesting businesses are finding workarounds for the new tariff environment,” said ING.

“If EUR/USD can somehow make it back above 1.1560/65 today, it will have had a good week.”

GBP/USD traded 0.1% higher to 1.3085, with sterling edging higher even after U.K. retail sales fell 1.1% in October and a closely watched gauge of household sentiment fell this month, adding to signs of waning consumer spending ahead of finance minister Rachel Reeves’ budget next week.

Yen gains on lifted rate hike expectations

In Asia, USD/JPY dropped 0.4% to 156.76, with the yen in demand after data showed core consumer inflation stayed above the BOJ’s 2% target in October, keeping alive the possibility of a rate hike as soon as its next policy meeting on December 18 and 19.

The Bank of Japan will discuss at upcoming policy meetings the feasibility and timing of a rate hike with the focus on next year’s wage-growth impulse, governor Kazuo Ueda said, signalling the chance of a near-term rise in still-low borrowing costs.

This follows the news that Japan’s parliament on Friday approved a ¥21.3 trillion ($135 billion) stimulus package, clearing the way for one of the country’s largest spending drives since the pandemic as the government seeks to revive consumption and support key industries.

USD/CNY edged 0.1% lower to 7.1093, while AUD/USD gained 0.2% to 0.6450, but still on track for hefty losses this week as risk appetite dwindled.

Gold prices fell slightly in Asian trade, retreating from two straight days of gains as investors sharply pared bets on a December interest rate cut by the Federal Reserve.

Safe haven demand was pressured by a broad rebound in global equity markets, following positive earnings from bellwether Nvidia Corp.

Focus was now squarely on U.S. nonfarm payrolls data due later in the day, which is expected to offer more cues on the labor market.

Persistent concerns over stretched fiscal spending in the developed world offered some support to gold, especially as Japanese government bond yields continued to push higher. A growing diplomatic row between China and Japan also buoyed haven demand.

Spot gold fell 0.2% to $4,070.27 an ounce, while gold futures for December fell 0.3% to $4,069.09/oz by 00:15 ET (05:15 GMT).

Gold stalls rally as Dec rate cut bets fall further

Gold’s rally paused on Thursday after the yellow metal added over 1% in the past two sessions.

This came amid waning confidence that the Fed will cut interest rates in December. This came to a head on Wednesday, as the minutes of the Fed’s October meeting showed policymakers growing increasingly divided over whether to cut rates further.

Markets are now pricing in a 21.5% chance the Fed will cut rates by 25 basis points during its December 10-11 meeting, nearly half of the 42.4% probability seen on Wednesday, CME Fedwatch showed.

The Fed is seen going blind into December’s meeting due to delays in official economic data from a prolonged government shutdown, making a cautious hold more likely.

But high for longer U.S. interest rates tend to pressure non-yielding assets such as gold.

Other precious metals rose on Thursday after losing ground in the prior session. Spot platinum rose 0.8% to $1,560.13/oz, while spot silver steadied at $51.3415/oz.

Payrolls data awaited for more cues

Focus was now squarely on the release of long-awaited U.S. nonfarm payrolls data for September, which is due later in the day.

While the print is unlikely to factor into the Fed’s December decision, it is still expected to offer definitive cues on the labor market. Release of the print was delayed by a prolonged government shutdown, while government officials signaled that payrolls data for October was unlikely to ever be released.

A host of private readings, as well as jobless claims data released this week, showed the U.S. labor market was steadily weakening. This trend could set the Fed up for an eventual rate cut, given that preventing labor market weakness is one of the bank’s main priorities.

But sticky inflation is expected to keep the Fed from loosening monetary policy too drastically.

Futures hover around the flatline ahead of much-anticipated quarterly earnings from Nvidia which could sway the course of soaring enthusiasm around artificial intelligence. In focus will likely be the semiconductor titan’s outlook for data center infrastructure investment, especially after markets, fretting over the sustainability of heavy spending, have sold off sharply in recent session. Meanwhile, Lowe’s and Target will offer fresh insight into the health of the U.S. consumer prior to the key holiday shopping period, and minutes from the Federal Reserve’s October monetary policy meeting will be released.

1. Futures subdued

U.S. stock futures were muted on Wednesday, as investors assessed the steep decline in equities and buckled up for Nvidia’s earnings.

By 02:37 ET (07:37 GMT), the Dow futures contract, S&P 500 futures, and Nasdaq 100 futures were all mostly unchanged.

The main averages on Wall Street sank in the prior session, extending what has become a multi-day rout in stocks fueled by concerns over often debt-fueled spending on AI and lofty tech sector valuations. Chipmakers like Advanced Micro Devices, Marvell and Micron all fell, dragging down the tech-heavy Nasdaq Composite index.

Underscoring the jittery sentiment, a survey of fund managers carried out by Bank of America found that the largest "tail risk" -- or possibility of an event causing catastrophic investment losses -- for markets is that the AI industry is in a "bubble."

In individual stocks, Home Depot’s shares slumped 6% after the home improvement giant trimmed its full-year forecast, in a downbeat curtain-raiser for a slew of retail earnings due out this week.

Elsewhere, fresh data from payrolls processor ADP indicated that private-sector job losses eased in the four weeks ending on November 1, while government figures showed that the number of Americans on jobless benefits jumped between mid-September and mid-October.

2. Nvidia earnings in focus

All eyes are now on upcoming results from Nvidia, the company whose place at the center of the AI spending bonanza has made it one of the most influential players in the U.S. stock market.

With a market capitalization that stands at $4.41 trillion, Nvidia currently makes up more than 7% of the weighting of the benchmark S&P 500. As a result, its returns and outlook could heavily sway market sentiment in the final weeks of 2025.

What is more, analysts at Capital Economics flagged, AI is not only powering the stock market, but also boosting U.S. economic growth -- meaning that the implications of Nvidia’s latest numbers may extend well beyond Wall Street.

Nvidia, whose graphics processing units have become the gold standard for both training and running AI models, is tipped to post third-quarter revenue of $55.19 billion and adjusted operating income of $36.46 billion, Bloomberg consensus forecasts showed.

"[W]e expect the near-term investor debate to remain centered on the sustainability of infrastructure investment," despite another round of hyperscaler capital expenditure increases and commentary on continued investment, analysts at Stifel said in a note.

They added that worries around a crush of circular dealmaking in the AI sector, much of it revolving around Nvidia, have "increased as well," although the firm is still "best positioned" to benefit from an expected uptick in AI compute demand.

Shares of Nvidia were under pressure prior to the earnings, falling by 2.8% on Tuesday.

3. Lowe’s, Target to report

Retail chains Lowe’s and Target are also scheduled to report their own earnings prior to the start of U.S. trading.

Off-price brand TJX Companies will unveil earnings before the opening bell today too, while Walmart will report on Thursday.

Apart from Nvidia, retailers have been in focus for investors this week, especially after a prolonged government shutdown left markets without a raft of official data needed to gauge the state of the American consumer and broader economy.

Home Depot offered a decidedly gloomy view of the topic on Tuesday.

Executives at the firm had been hoping that a combination of lower interest and mortgage rates would underpin a spike in demand, but the uptick failed to materialize. The results painted a picture of consumer caution prior to the crucial holiday season, with Americans opting to shy away from pricier home renovations and installations in the face of uncertainty sparked by elevated U.S. tariffs.

4. FOMC minutes ahead

Meanwhile, minutes from the Federal Reserve’s October meeting are set to be released on Wednesday.

The central bank slashed rates by 25 basis points to a range of 3.75% to 4% at the gathering last month, following an equally-sized reduction in September.

However, Fed Chair Jerome Powell later stressed that, despite expectations for another drawdown at the final policy meeting in December, a cut next month is not a foregone conclusion.

The dearth of fresh official economic indicators during the federal government shutdown has also led some members to call for caution before rolling out another reduction, although Fed Governor Christopher Waller backed such a move earlier this week.

Subsequently, how the December meeting will turn out essentially remains a 50-50 coin-flip, CME’s FedWatch Tool has shown.

5. Bitcoin bounces

Bitcoin rebounded on Wednesday, indicating that there were some buyers of the world’s largest cryptocurrency after a decline that has wiped out all of its gains logged in 2025.

Risk sentiment, one of the central drivers of the digital token, has been dented by the broader market wariness surrounding the trajectory of the AI industry. Market participants have also highlighted the impact of murkiness clouding the Fed’s December rate decision.

Some $3.7 billion has flowed out of U.S. Bitcoin-linked exchange-traded funds since October 10, when wider stock markets were hit by fears over renewed trade tensions between the U.S. and China, Reuters reported.

According to data from market tracker CoinGecko cited by the news agency, the total market value of all cryptocurrencies over the past six weeks has fallen by $1.2 trillion.

Get more stock picks by Wall Street analysts by upgrading to InvestingPro - get 55% off today

The U.S. dollar slipped lower Tuesday, weighed by dovish Fed speak ahead of the release of key economic data that could influence the Federal Reserve’ final policy meeting of the year.

At 04:15 ET (09:15 GMT), the Dollar Index, which tracks the greenback against a basket of six other currencies, traded 0.1% lower to 99.410, resuming declines after snapping a four-day losing streak on Monday.

Dollar slips lower

The U.S. currency has retreated slightly after Federal Reserve Governor Christopher Waller spoke about the risks to the country’s jobs market, calling for another quarter-point rate cut at the upcoming policy meeting on December 9-10.

"Four to six weeks ago, we were still in this kind of no-hire, no-fire mode," Waller said in remarks to the Society of Professional Economists in London. Now, when he speaks to corporate executives, "they’re starting to talk about layoffs," he said. "They’re starting to plan for them."

"It could be AI-related. It could be a lot of other things ... It’s not just going to be ’no hire, no fire.’ At some point this is going to start happening," Waller said.

That said, other Fed officials have signalled reluctance to ease further, leaving investors unsure of the central bank’s next move.

The ending of the federal government shutdown means that this week will see the release of numerous data points, highlighted by the closely-watched September nonfarm payrolls report on Thursday.

“Our base case remains that risks are tilted to the downside for the dollar once the U.S. data cycle kicks in, and we expect a December Fed cut to become the market’s base case again,” said analysts at ING, in a note.

Markets are pricing in an approximate 40% probability of a 25-basis-point cut at the U.S. central bank’s next meeting, down from around 60% chance a week ago.

Euro still has upside - ING

In Europe, EUR/USD edged marginally higher to 1.1593, after snapping a three-day losing streak overnight.

“In our view, upside risks for EUR/USD persist,” said ING. “The pair has recently traded on the cheap side relative to its short-term fair value, but since French political risk faded, it has struggled to maintain an undervaluation greater than 1% for consecutive days.”

“Our year-end target remains 1.180. While the path higher may not resemble the one-way bullish traffic seen earlier this year, positive December seasonality could help smooth the move,” ING added.

GBP/USD traded 0.1% lower to 1.3152, with sterling under pressure ahead of Finance Minister Rachel Reeves’s upcoming budget.

Reeves is expected to need to raise tens of billions of pounds to stay on track to meet her fiscal targets on Nov. 26.

Yen gains slightly

In Asia, USD/JPY slipped 0.2% lower to 154.96, with the Japanese yen gaining after earlier hitting near nine-month lows earlier in the session.

Long-term Japanese government bond yields climbed to multi-decade highs, with the 20-year yield reaching record highs.

Investors have grown increasingly concerned that new fiscal measures under Prime Minister Sanae Takaichi’s administration could add to Japan’s already heavy debt load.

Takaichi is reportedly preparing to unveil her first economic package as early as this week. A Reuters report stated that Goushi Kataoka, a private-sector member of a key government panel, said Japan needs a stimulus package of about $149 billion to bolster the economy.

USD/CNY traded 0.1% higher to 7.1117, while AUD/USD traded largely unchanged at 0.6493.

Gold prices fell in Asian trade on Monday, extending losses from the prior session as traders steadily pared back expectations that the Federal Reserve will cut interest rates next month.

The yellow metal was pressured by a stronger dollar, while increased risk-aversion, amid bets on delayed rate cuts and heightened economic uncertainty, also did little to deter gold’s losses.

Spot gold fell 0.6% to $4,053.84 an ounce by 00:33 ET (05:33 GMT), while gold futures for December fell 0.9% to $4,055.91/oz.

Gold under pressure as traders price out Dec. rate cut

Gold’s recent losses were fueled chiefly by traders steadily pricing out expectations for a Fed rate cut in December.

Markets were seen pricing in a 39.8% chance for a 25 basis point cut during the Fed’s December 10-11 meeting, down sharply from a 61.9% chance seen last week, CME Fedwatch showed.

Bets on a hold grew to 60.2% from 38.1% last week.

This was fueled chiefly by increased uncertainty over the U.S. economy, especially as the country recently emerged from its longest ever government shutdown. The shutdown is expected to have delayed or disrupted several key economic prints for October, especially inflation and employment.

A lack of insight into the two leaves the Fed flying blind into the December meeting. Market expectations for a hold were also furthered by increasing signs of sticky U.S. inflation, while Fed Chair Jerome Powell was largely non-commital towards a December rate cut.

High for longer rates bode poorly for non-yielding assets such as gold and other metals.

Among other precious metals, spot platinum rose 0.1% to $1,548.0/oz but was nursing steep losses from the prior session, while spot silver was flat at $50.5795/oz, also having tumbled from near record highs last week.

Dollar steady with Fed minutes, US econ. data due this week

The dollar firmed slightly on Monday, recovering a measure of last week’s losses. The dollar index rose 0.1%.

Focus this week will be on a host of U.S. economic cues, with the government’s nonfarm payrolls print for September due on Thursday. Purchasing managers index data for November is also due this week.

The minutes of the Fed’s October meeting are due on Wednesday, and are expected to offer more insight into the central bank going into December’s decision.

Inflation and employment are the Fed’s two biggest considerations for interest rates.

But U.S. officials recently signaled that the two prints may never be released for October, due to the shutdown.